U.S - Cracks in the Foundation?

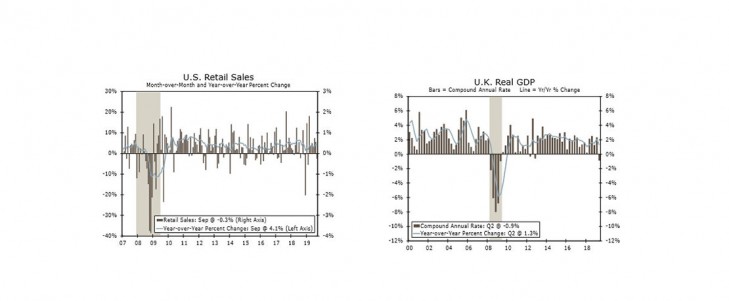

- Personal consumption is still on track for a solid Q3, but retail sales declined in September for the first time in seven months.

- Manufacturing data were certainly influenced by the GM strike, but output has now fallen in six months this year, and survey evidence has yet to point to a meaningful pickup.

- Single-family housing starts rose for the fourth consecutive month. Housing should positively contribute to GDP growth in Q3 for the first time in almost two years.

- The lack of a pushback on market expectations from the Fed speakers gives us increasing confidence that the FOMC will cut the fed funds rate by 25 bps at its October 29-30 meeting.

Global - A Breakthrough on Brexit, or Another False Start?

- UK PM Boris Johnson and EU leaders announced they had struck a Brexit deal, an encouraging development ahead of the October 31 deadline by which the UK must either leave the EU or once again request an extension.

- The path forward is precarious, however, as the UK Parliament is set to vote on the deal in an emergency session on Saturday. The prospects for the deal's passage remain far from assured.

- Chinese Q3 GDP growth slowed further to 6.0% year-over-year, although September retail and industrial activity suggest the quarter ended on a firmer note. However, given a measured policy response, the overall growth slowdown should continue.

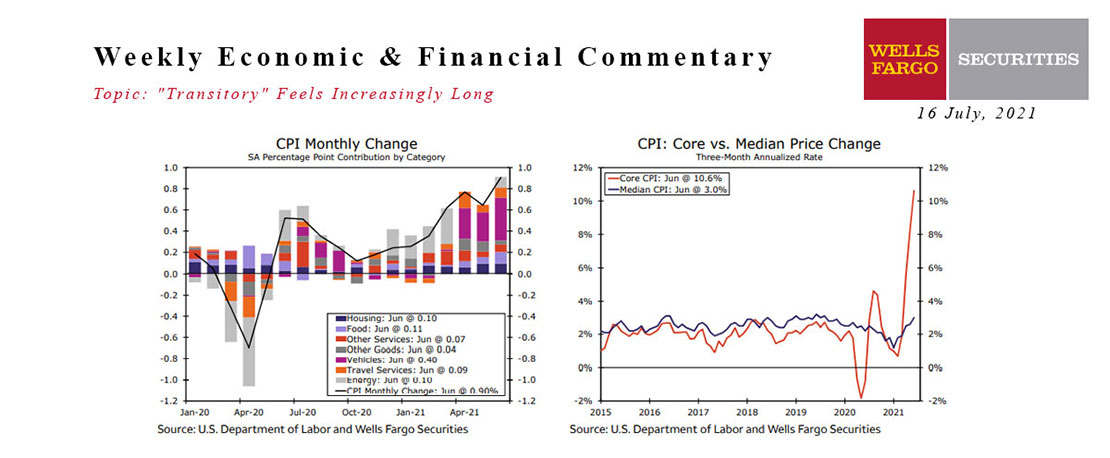

This Week's State Of The Economy - What Is Ahead? - 16 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

Visiting from Texas, it felt more like fall, which like the Texas cold-snap last February just goes to show that it’s a case of what you’re used to.

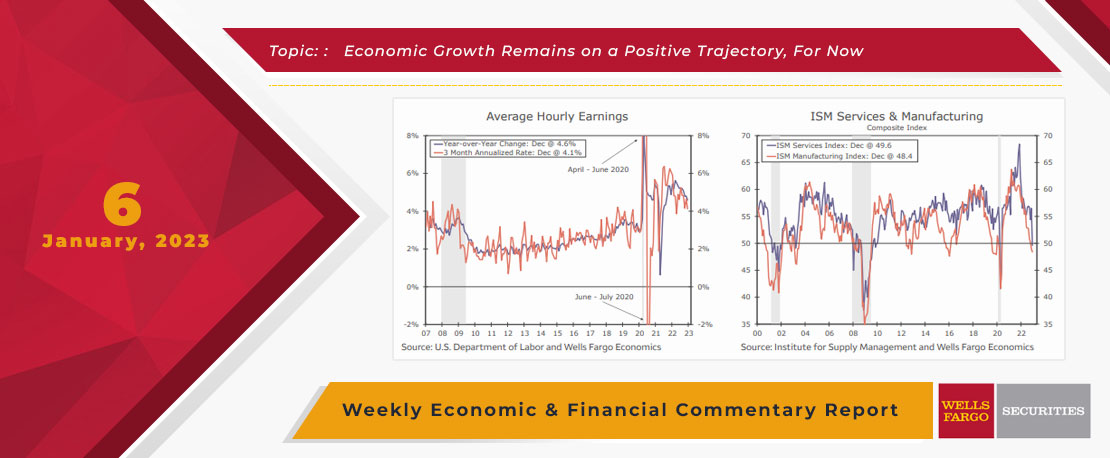

This Week's State Of The Economy - What Is Ahead? - 06 January 2023

Wells Fargo Economics & Financial Report / Jan 12, 2023

During December, payrolls rose by 223K while the unemployment rate fell to 3.5% and average hourly earnings eased 0.3%. Job openings (JOLTS) edged down to 10.46 million in November.

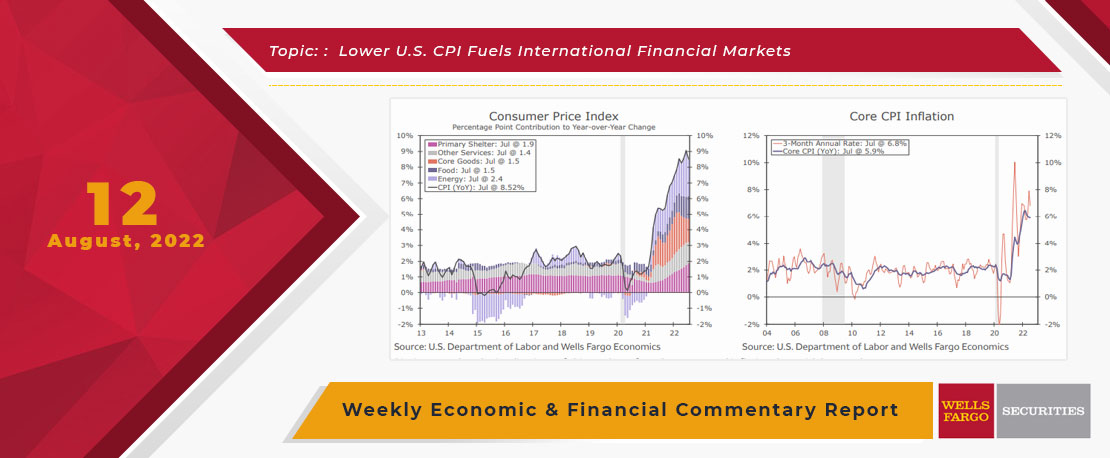

This Week's State Of The Economy - What Is Ahead? - 12 August 2022

Wells Fargo Economics & Financial Report / Aug 13, 2022

The FOMC has made it clear that it needs to see inflation slowing on a sustained basis before pivoting from its current stance. The data seems to be going in multiple directions all at once.

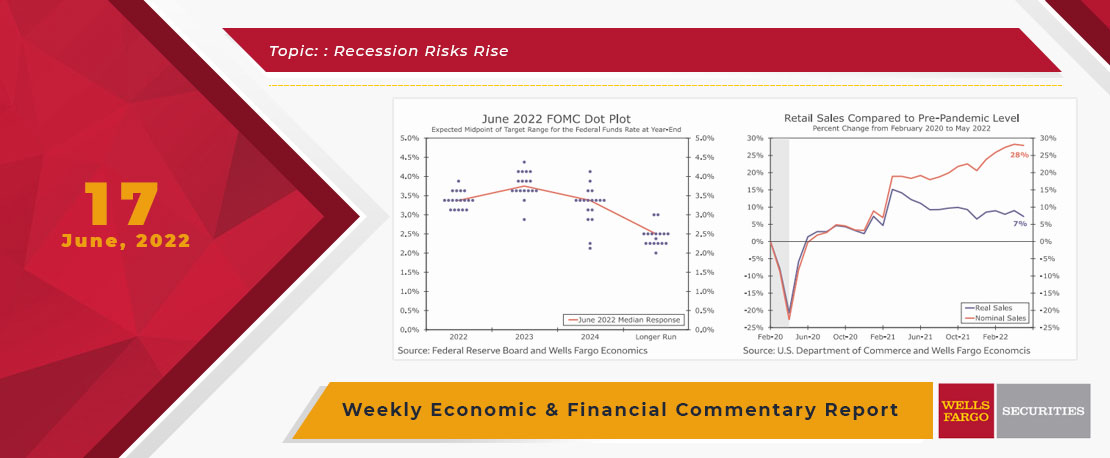

This Week's State Of The Economy - What Is Ahead? - 17 June 2022

Wells Fargo Economics & Financial Report / Jun 20, 2022

After last week\'s stronger-than-expected CPI, less surprising was the 75 point rate increase put forth by the Fed.

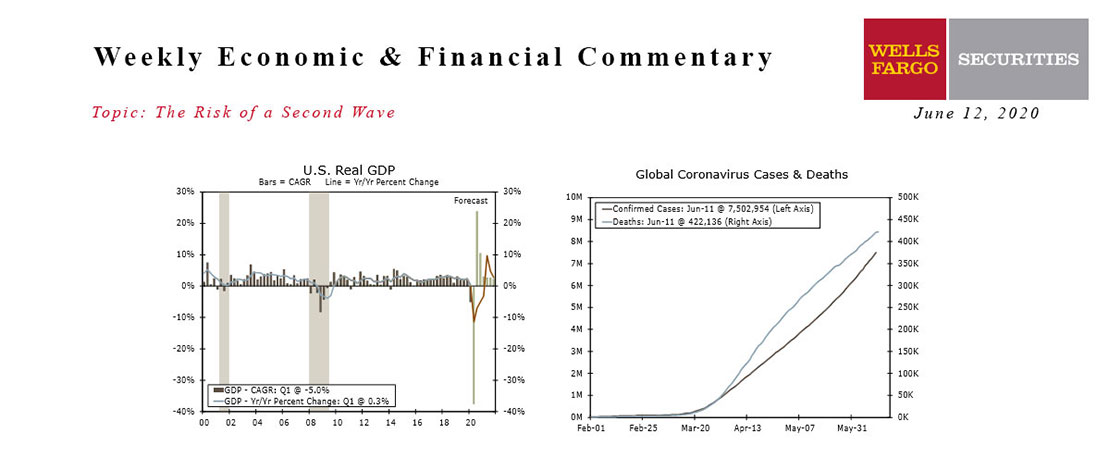

This Week's State Of The Economy - What Is Ahead? - 12 June 2020

Wells Fargo Economics & Financial Report / Jun 13, 2020

Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.

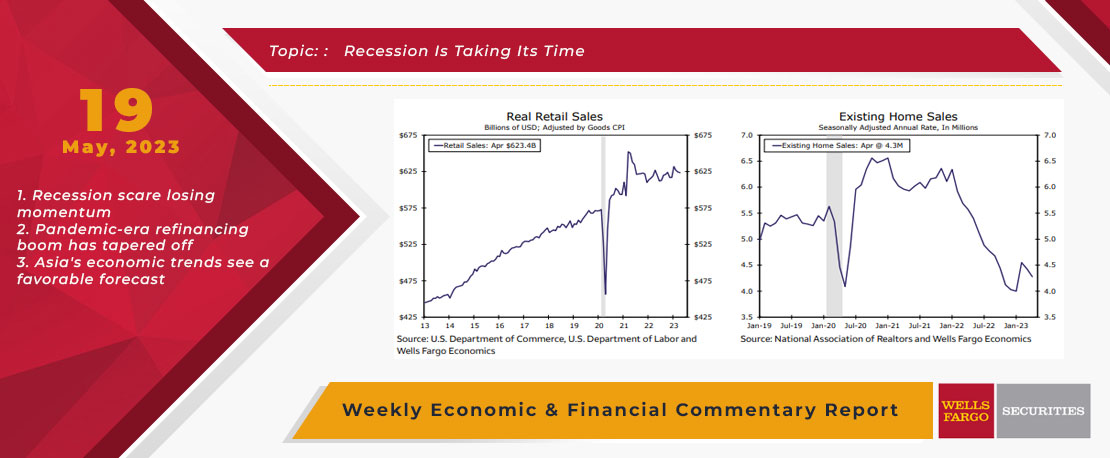

This Week's State Of The Economy - What Is Ahead? - 19 May 2023

Wells Fargo Economics & Financial Report / May 23, 2023

Economic data continue to suggest the U.S. economy is only gradually losing momentum. Consumers continue to spend, and industrial and housing activity are seeing some stabilization.

September 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Sep 19, 2020

A March survey by the Federal Reserve Bank of Dallas found most exploration firms need West Texas Inter-mediate (WTI) at $49 per barrel or higher to profitably drill a well.

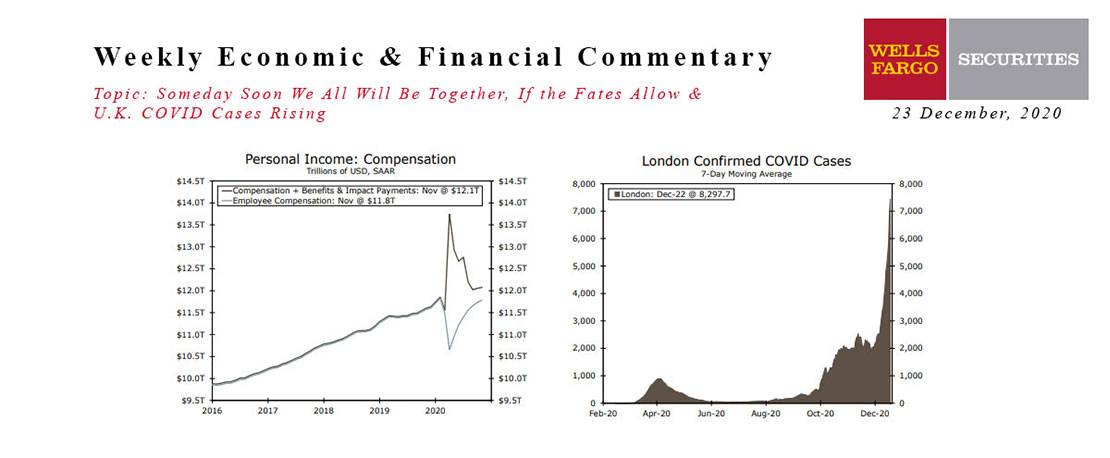

This Week's State Of The Economy - What Is Ahead? - 23 December 2020

Wells Fargo Economics & Financial Report / Dec 26, 2020

Vaccines are here, but they are not yet widely available in a way that can stem the spread of a disease that grows by 200K a day.

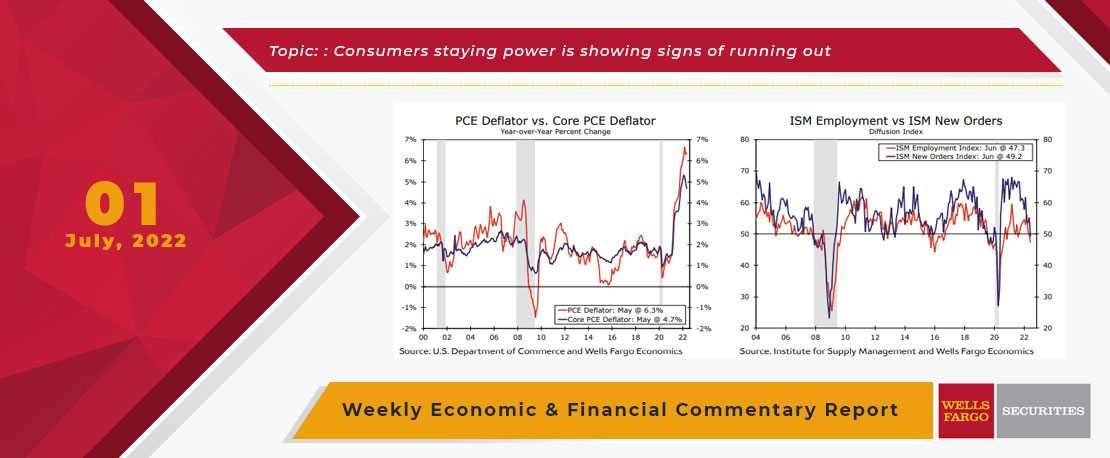

This Week's State Of The Economy - What Is Ahead? - 01 July 2022

Wells Fargo Economics & Financial Report / Jul 14, 2022

As with the Mets and Yankees when they ran into the Astros over the last couple days, consumers staying power is showing signs of running out as inflation persists and confidence moves sharply lower.

This Week's State Of The Economy - What Is Ahead? - 27 November 2019

Wells Fargo Economics & Financial Report / Nov 28, 2019

A series of U.K. general election polls released this week continue to show Boris Johnson’s Conservative Party with a significant lead over the opposition Labor Party.