U.S - Survey Says

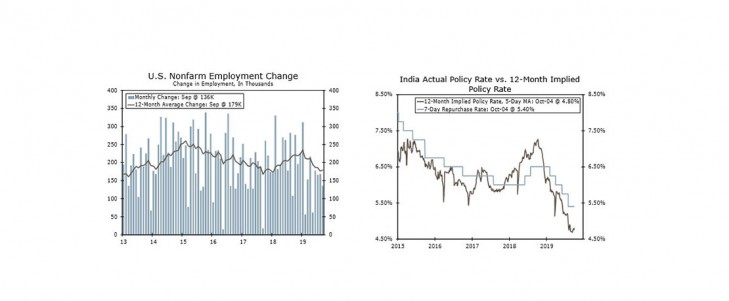

- Survey evidence flashed signs of contraction in the manufacturing sector and indicated weakness spreading to the services side of the economy, while employers added a less-than-expected 136K jobs in September.

- While hiring is likely to continue to slow, there is evidence the labor market remains right. Squaring the September hiring data with the weak survey evidence, the Fed looks set to cut rates another 25 bps, as early as October.

- The GM worker strike didn't impact the September jobs report, but for our take on how it may impact economic data, please see Topic of the Week on Page 9.

Global - Disappointing Data and More Central Bank Cuts

- The Reserve Bank of Australia (RBA) reduced its Cash Rate another 25 bps to 0.75%, marking the third interest rate cut from the Australian central bank this year and bringing the policy rate to its lowest point on record.

- The latest data from the Eurozone has been concerning, and while we do not think a full-scale recession is imminent, we acknowledge that the risks of a recession are growing.

- The Reserve Bank of India cut its repurchase rate 25 bps to 5.15%, after already reducing its main policy rate nearly 100 bps this year to give the economy a boost.

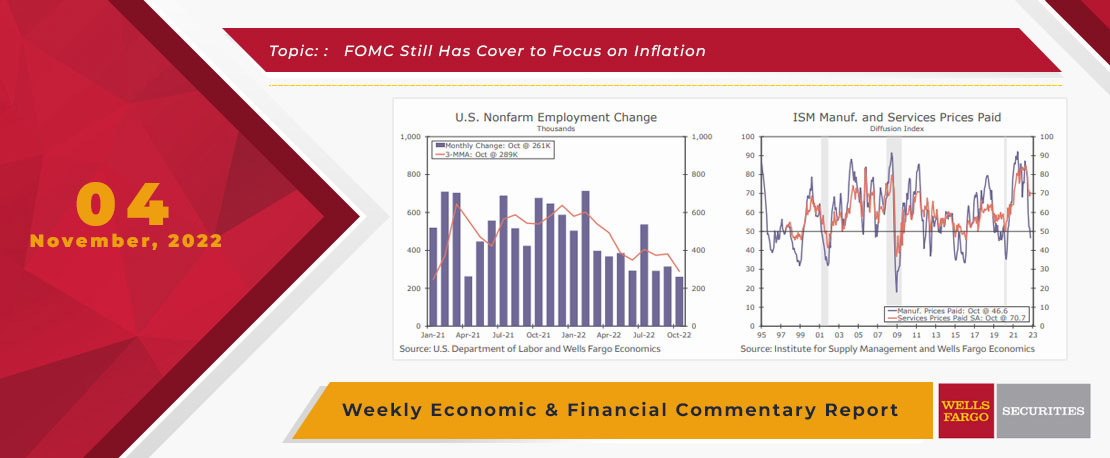

This Week's State Of The Economy - What Is Ahead? - 04 November 2022

Wells Fargo Economics & Financial Report / Nov 07, 2022

Employers continued to add jobs at a steady clip in October, demonstrating the labor market remains tight and the FOMC will continue to tighten policy.

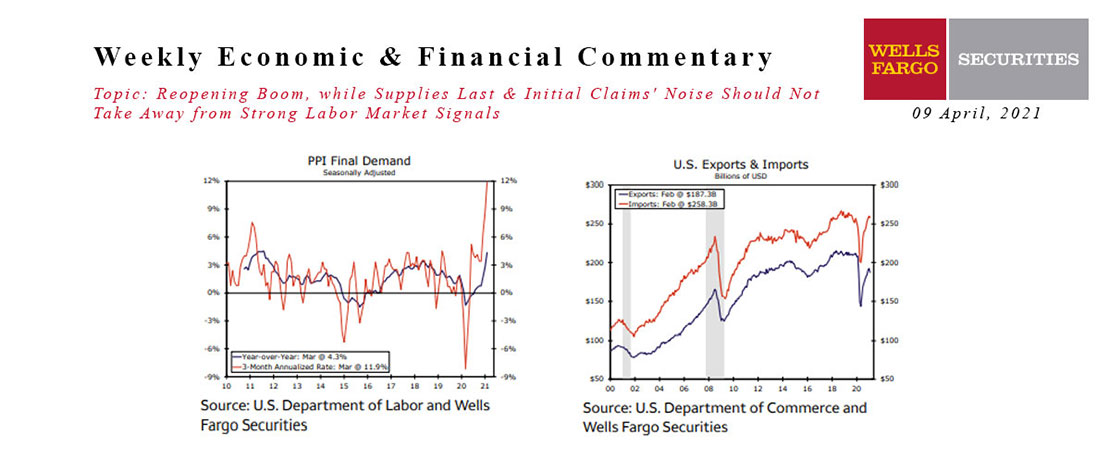

This Week's State Of The Economy - What Is Ahead? - 09 April 2021

Wells Fargo Economics & Financial Report / Apr 10, 2021

This week\'s economic data kicked of with a bang. The ISM Services Index jumped more than eight points to 63.7, signaling the fastest pace of expansion in the index\'s 24-year history.

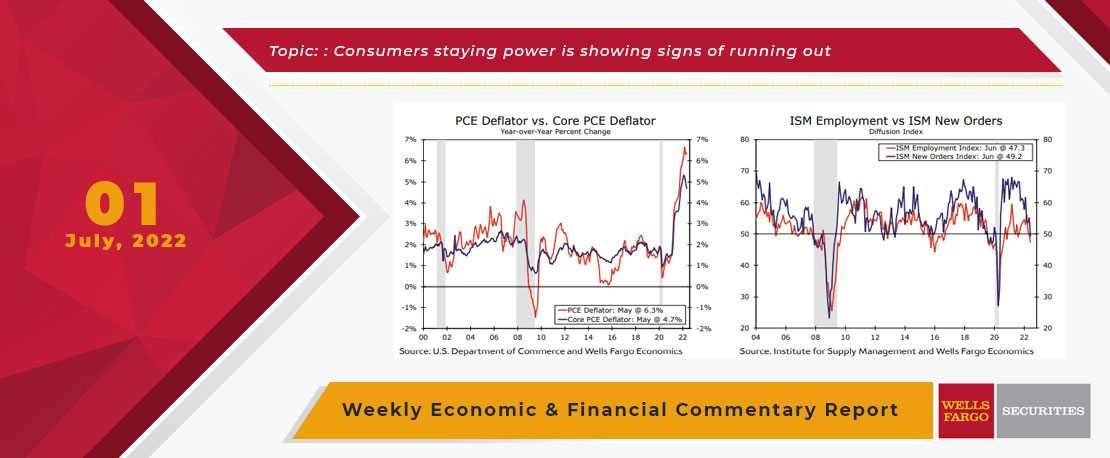

This Week's State Of The Economy - What Is Ahead? - 01 July 2022

Wells Fargo Economics & Financial Report / Jul 14, 2022

As with the Mets and Yankees when they ran into the Astros over the last couple days, consumers staying power is showing signs of running out as inflation persists and confidence moves sharply lower.

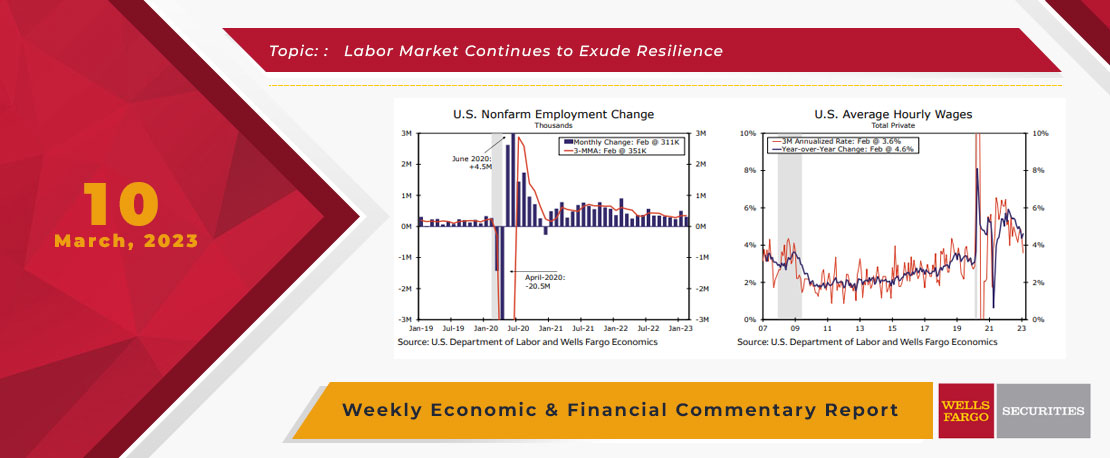

This Week's State Of The Economy - What Is Ahead? - 10 March 2023

Wells Fargo Economics & Financial Report / Mar 14, 2023

Financial markets were looking for validation that January\'s unexpected strength was not a fluke and that the downward slide in economic momentum experienced late last year had stabilized.

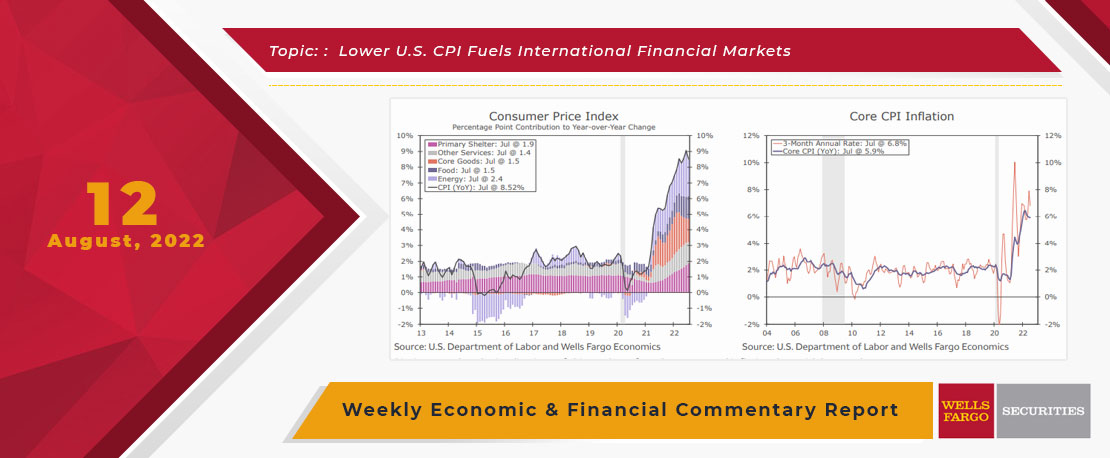

This Week's State Of The Economy - What Is Ahead? - 12 August 2022

Wells Fargo Economics & Financial Report / Aug 13, 2022

The FOMC has made it clear that it needs to see inflation slowing on a sustained basis before pivoting from its current stance. The data seems to be going in multiple directions all at once.

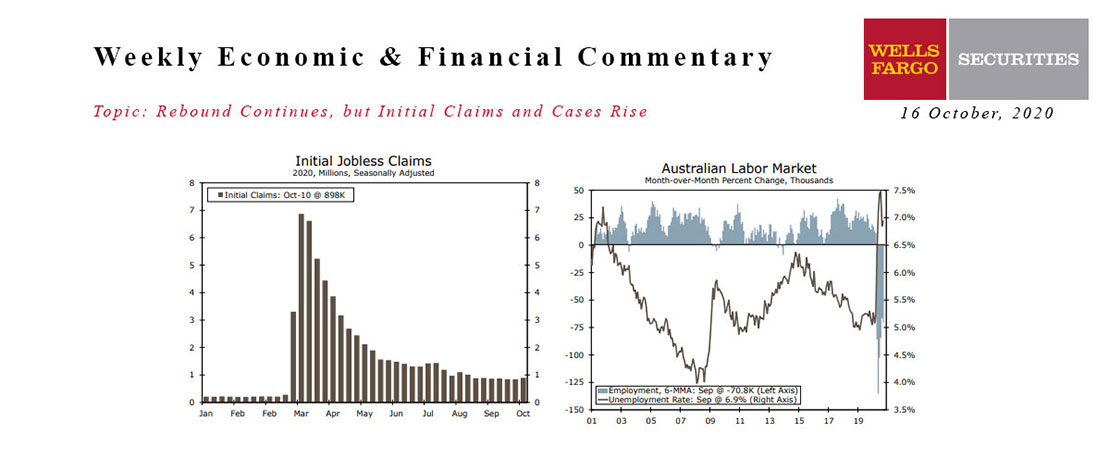

This Week's State Of The Economy - What Is Ahead? - 16 October 2020

Wells Fargo Economics & Financial Report / Oct 20, 2020

Data continue to reflect an economy digging itself out of the lockdown-induced slump.

This Week's State Of The Economy - What Is Ahead? - 03 September 2021

Wells Fargo Economics & Financial Report / Sep 10, 2021

e move into the Labor Day weekend celebrating the 235K jobs added in August, while simultaneously lamenting that it was about half a million jobs short of expectations.

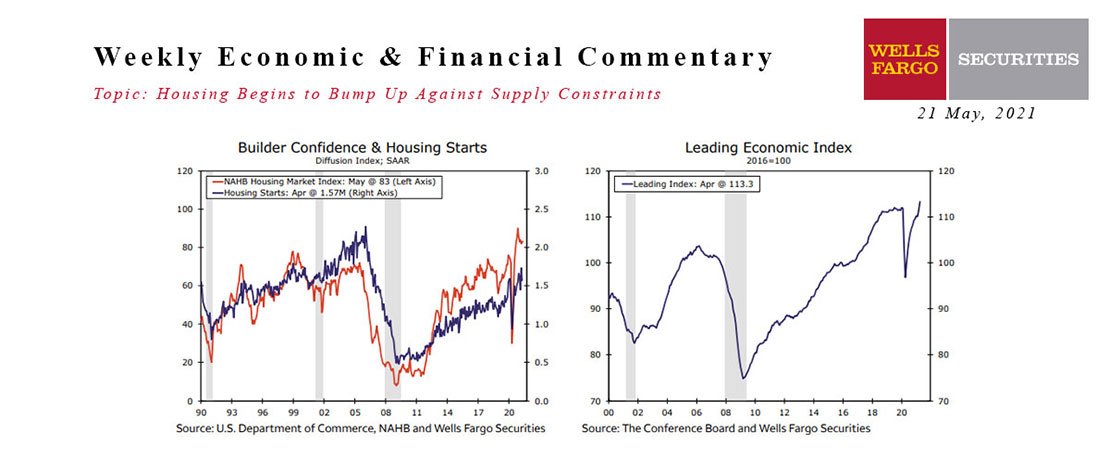

This Week's State Of The Economy - What Is Ahead? - 21 May 2021

Wells Fargo Economics & Financial Report / May 25, 2021

Over the past year, the housing market has become white-hot.

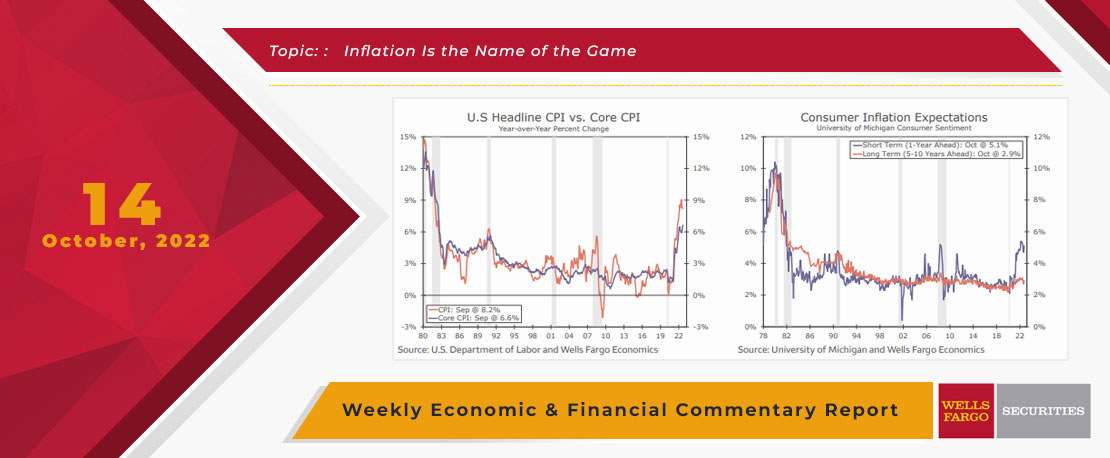

This Week's State Of The Economy - What Is Ahead? - 14 October 2022

Wells Fargo Economics & Financial Report / Oct 18, 2022

Highly anticipated Consumer Price Index report surprised to the upside. Headline CPI rose 0.4% in September, and core CPI increased 0.6%.

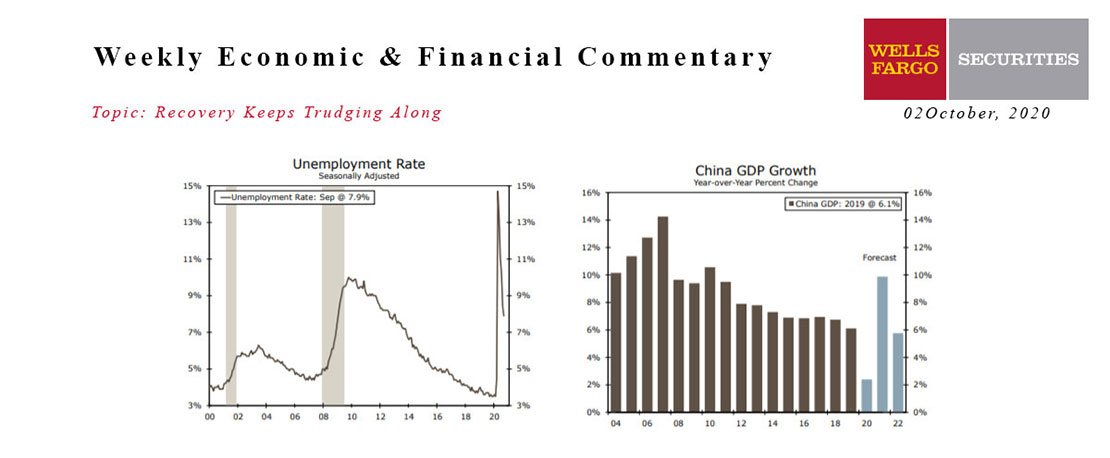

This Week's State Of The Economy - What Is Ahead? - 02 October 2020

Wells Fargo Economics & Financial Report / Sep 29, 2020

In what was a jam-packed week of economic data, the jobs report, prospects of additional fiscal stimulus and the president’s positive COVID-19 test result commanded markets’ attention.