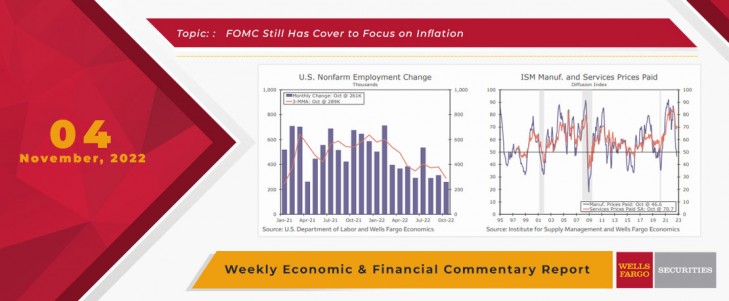

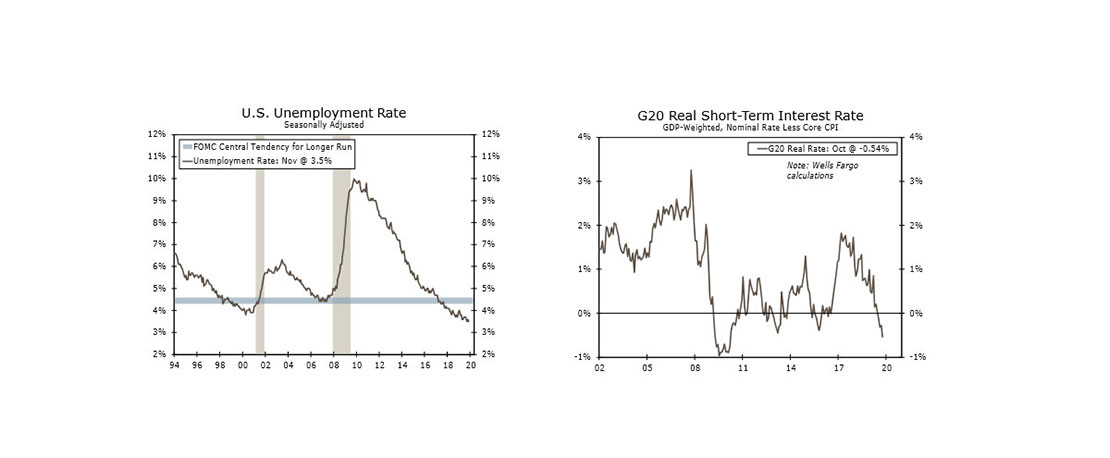

In what was a widely anticipated decision, the FOMC elected to lift the target range for the federal funds rate 75 bps at the conclusion of its November policy meeting this week to a range of 3.75%-4.00%. We analyze the meeting in more detail in this week's Interest Rate Watch section. In short, we think the FOMC is prepared to slow the pace of tightening at future meetings, though it is not done tightening yet. The risk of not tightening enough and inflation becoming entrenched outweighs the risk of over-tightening. We still anticipate the FOMC will deliver a 50 bps rate hike in December, though the size of the hike depends largely on the incoming data. Specifically, the November employment report and two CPI reports released before the next policy meeting on December 14.

The October employment report closed out the week and showed employers continued to add workers at a rapid clip. Employers added 261K net new jobs in October, beating the consensus expectation for a 195K gain (chart). This also came on top of some upward revisions to past data, but the fever still looks to be breaking on hiring with the three-month average pace of hiring falling to the slowest pace since the start of 2021. Job gains were fairly broad-based across sectors, and the report is still consistent with a tight labor market, which we think reinforces the idea the FOMC will keep tightening policy.

We look for job growth to moderate further over the coming months. Job openings pressed higher in September, though month-to-month movements tend to be volatile. Most measures, including the job opening rate, hiring plans and the PMI employment sub-components, indicate demand for labor is topping out. But with hiring still solid to date, the FOMC continues to largely have cover to focus primarily on inflation. We'll get the consumer price data for October next Thursday and expect prices rose 0.6% over the month. Please see our Domestic Outlook section for more detail on our expectations for next week's release.

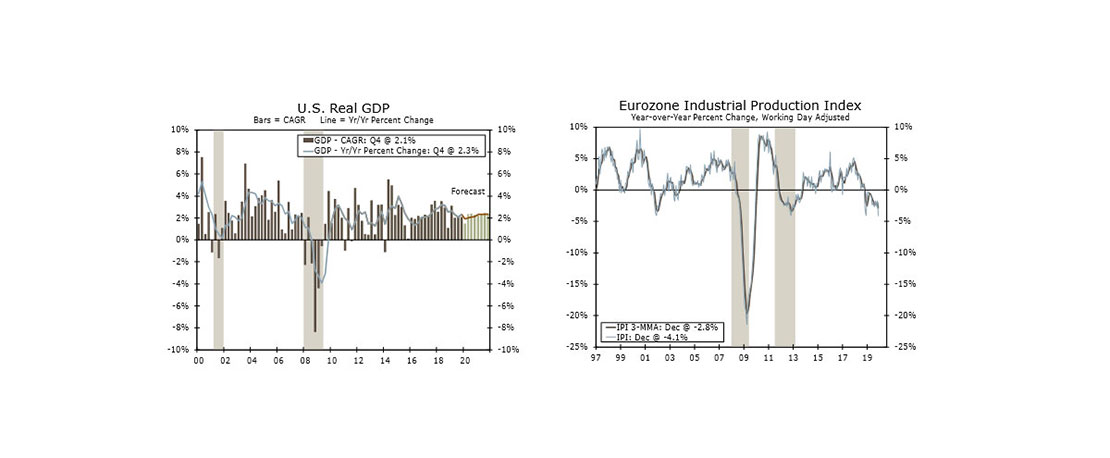

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

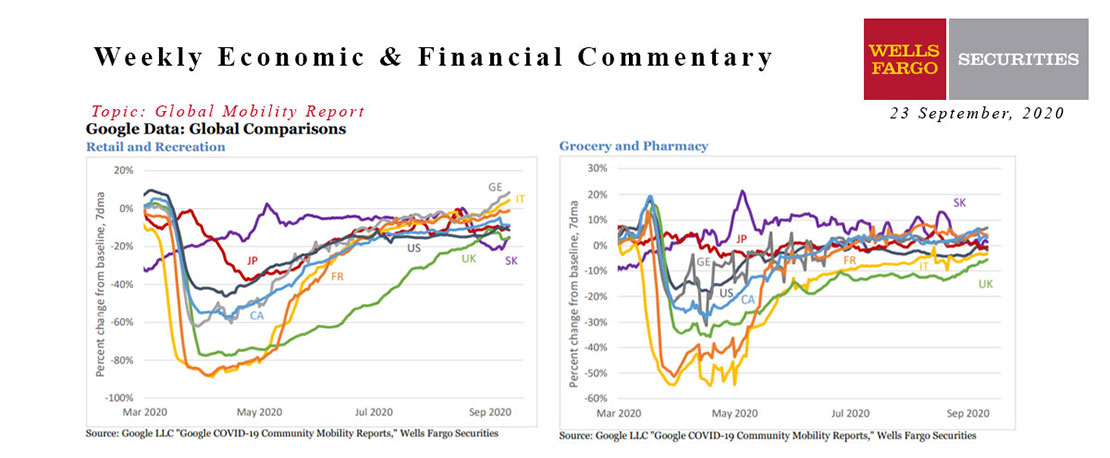

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

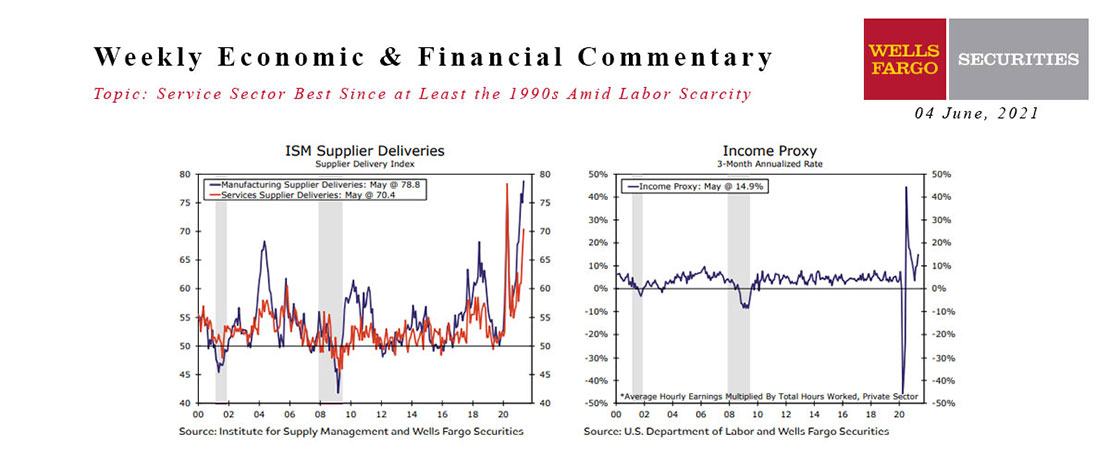

This Week's State Of The Economy - What Is Ahead? - 04 June 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

The CDC\'s relaxation of its mask mandate occurred mid-May, and as data for that month begins rolling in this week, it is evident there is no lack of demand. Supplies, on the other hand, are a worsening problem.

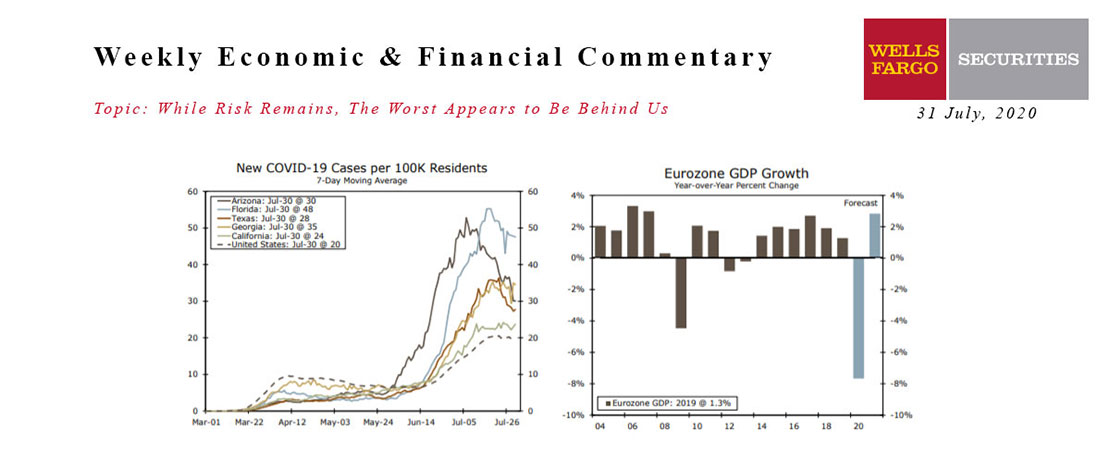

This Week's State Of The Economy - What Is Ahead? - 31 July 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

The resurgence in COVID-19 in much of the Sun Belt appears to have topped out, although cases are rising faster in some smaller mid-Atlantic states and in parts of Europe, Asia and Australia.

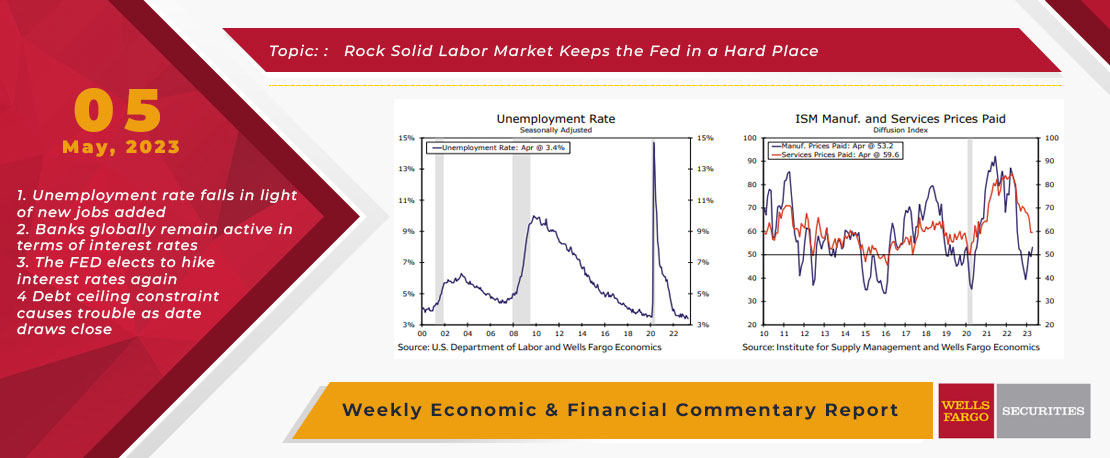

This Week's State Of The Economy - What Is Ahead? - 05 May 2023

Wells Fargo Economics & Financial Report / May 11, 2023

In April, employers added 253K jobs and the unemployment rate fell to 3.4%. During the same month, the ISM services index edged up to 51.9, while the ISM manufacturing index improved to 47.1.

This Week's State Of The Economy - What Is Ahead? - 06 December 2019

Wells Fargo Economics & Financial Report / Dec 07, 2019

The latest hiring data are an encouraging sign that the U.S. economy is withstanding the global slowdown and continued trade-related uncertainty.

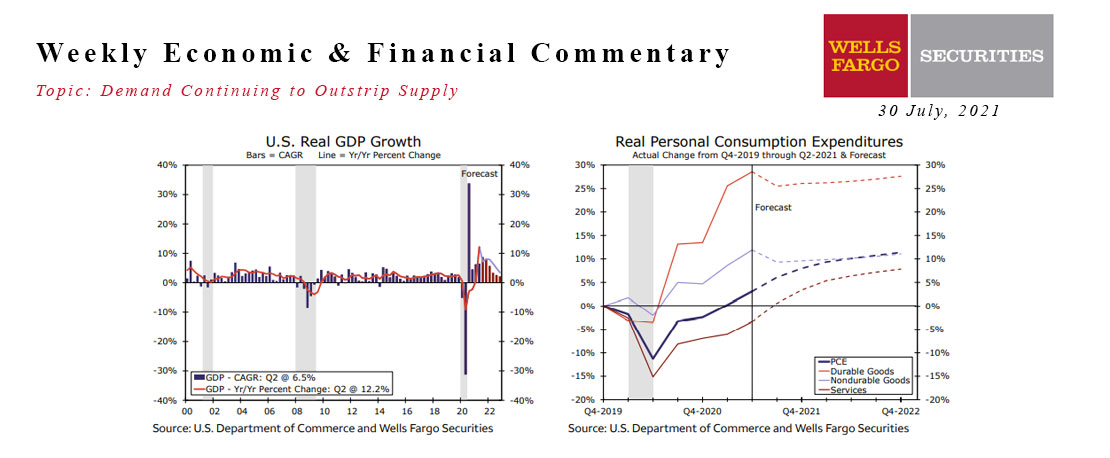

This Week's State Of The Economy - What Is Ahead? - 30 July 2021

Wells Fargo Economics & Financial Report / Aug 11, 2021

Despite a few misses on the headline numbers, economic data this week highlighted a theme of demand continuing to outstrip supply and ongoing slack in the labor market.

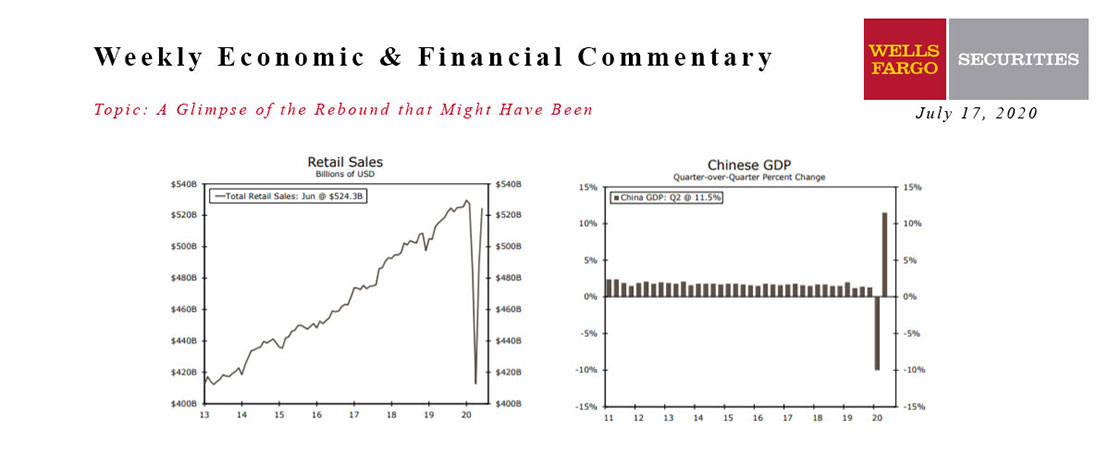

This Week's State Of The Economy - What Is Ahead? - 17 July 2020

Wells Fargo Economics & Financial Report / Jul 18, 2020

Two countervailing themes competed for attention this week in financial markets. The first is that for the most part, economic data continue to surprise to the upside and do not yet rule out prospects for that elusive V-shaped recovery.

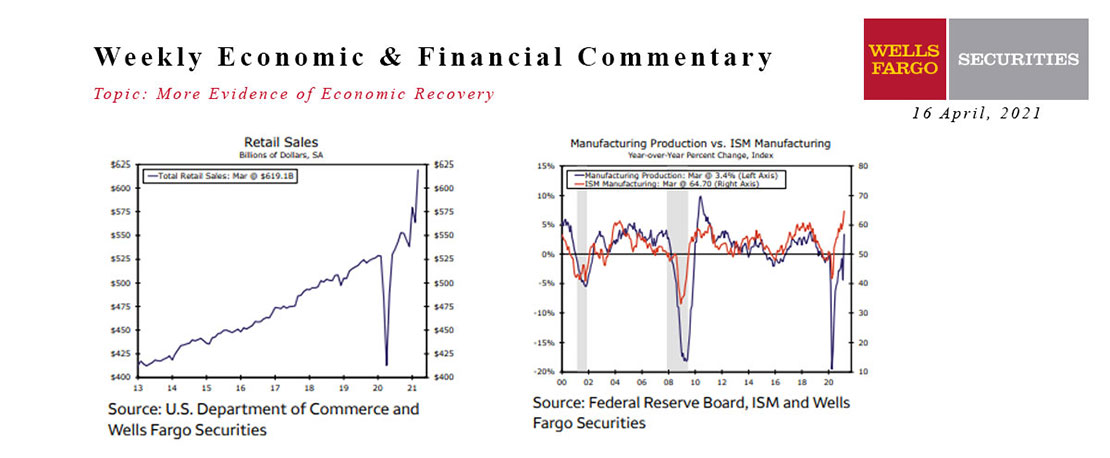

This Week's State Of The Economy - What Is Ahead? - 16 April 2021

Wells Fargo Economics & Financial Report / Apr 17, 2021

Data released this week continue to show that the economic recovery has gained momentum in March. The much anticipated consumer boom has arrived.

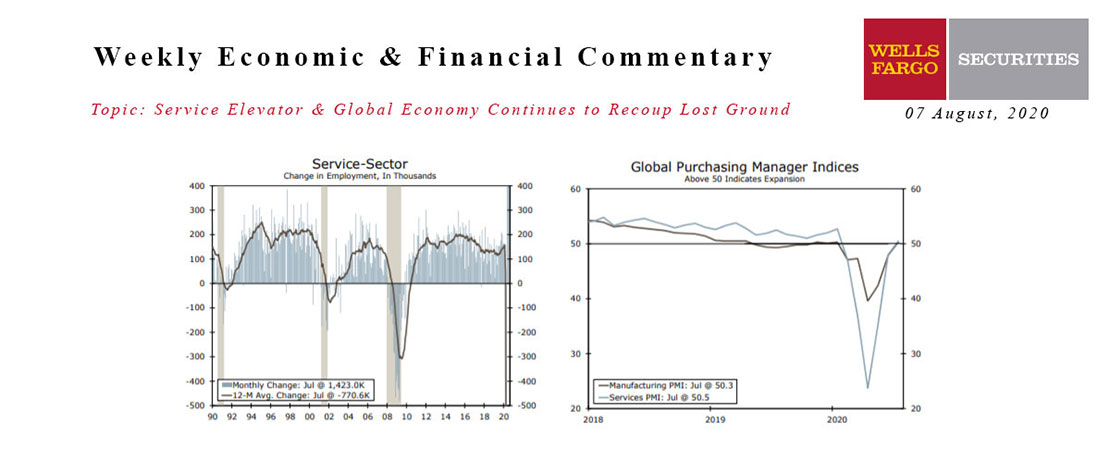

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

There were more signs of global recovery this week and PMI surveys improved further across the world.