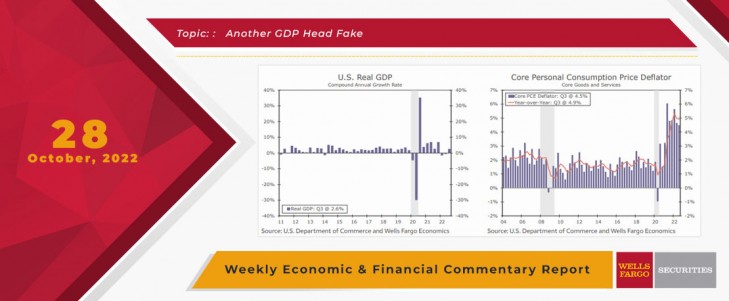

Headline GDP continues to send mixed signals on the direction of the U.S. economy. During Q3, real GDP rose at a 2.6% annualized rate, ending the recent string of quarterly declines in growth registered in the first half of 2022. At first look, the expansion in real GDP is a welcome sign that the economy is busting out of its recent slump. The underlying details, however, paint an entirely different picture. The top-line real GDP figure was boosted by a 2.8 percentage point contribution from real net exports. Real exports of goods and services rose solidly during the quarter. Considering the current strength of the U.S. dollar and the economic struggles of America's trading partners, the strong growth in exports is unlikely to be sustained. On the other hand, real imports pulled back in Q3 as supply chains continue to normalize, businesses slow inventory builds and consumer demand wanes.

Taken together, consumer spending and business fixed investment, which are a better measure of the underlying trend in economic activity, were essentially flat during Q3. A sharp drop in structures spending dragged down overall business fixed investment, which fell 4.9% during the quarter. New nonresidential development continues to be hampered by uncertain demand and rising building material prices. Equipment and intellectual property spending both expanded solidly. The impacts of higher interest rates as well as the return to more typical consumer behavior were evident in the consumer spending data. Real personal consumption expenditures (PCE) registered a relatively soft 1.4% annualized rise. The quarterly gain was mostly the result of a solid increase in services spending, which is still benefiting from unleashed pent-up demand from the pandemic. Spending on goods, which is more sensitive to interest rates, declined for the third straight quarter.

Housing is another sector that is highly responsive to financing costs. Residential fixed investment plummeted 26.4% during Q3, a sharp decline brought on by this year's spike in mortgage rates. Since the start of the year, mortgage rates have moved up rapidly and are currently hovering above 7.0%. The climb in borrowing costs has significantly reduced affordability and pushed buyers to the sidelines. If October's drop in mortgage demand is any indication, residential fixed investment is likely to remain a drag on overall GDP. Mortgage applications for purchase have slipped in every week so far in October and are down almost 42% over the year. Pending home sales and new home sales are also on a steep downward trend, with both retreating markedly in September. Home prices are now declining on a monthly basis. The S&P Case-Schiller National Home Price Index dropped 1.3%, the second straight monthly decline.

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

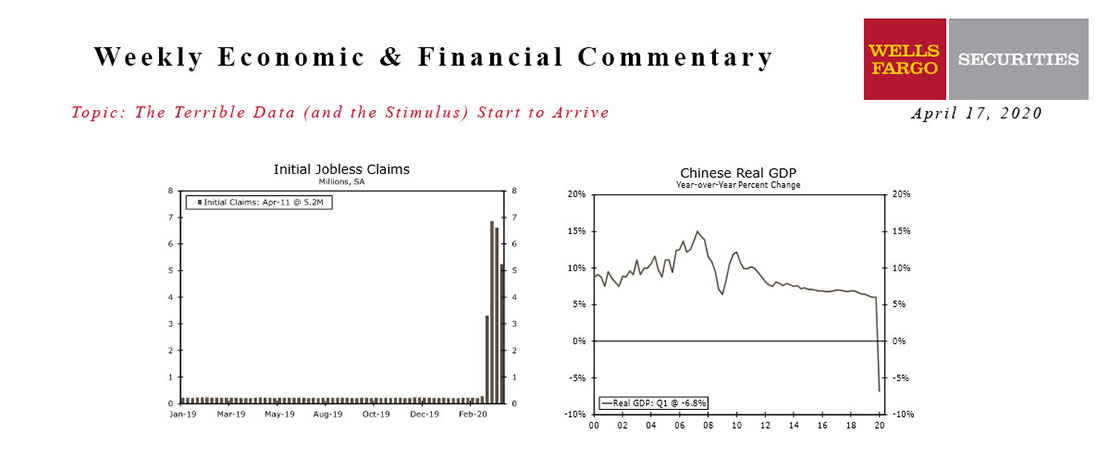

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

This Week's State Of The Economy - What Is Ahead? - 10 November 2022

Wells Fargo Economics & Financial Report / Nov 11, 2022

Relief in October inflation gives the FOMC the ability to slow the pace of rate hikes ahead. But make no mistake, the Fed\'s job of taming inflation remains far from over.

This Week's State Of The Economy - What Is Ahead? - 14 October 2020

Wells Fargo Economics & Financial Report / Oct 14, 2020

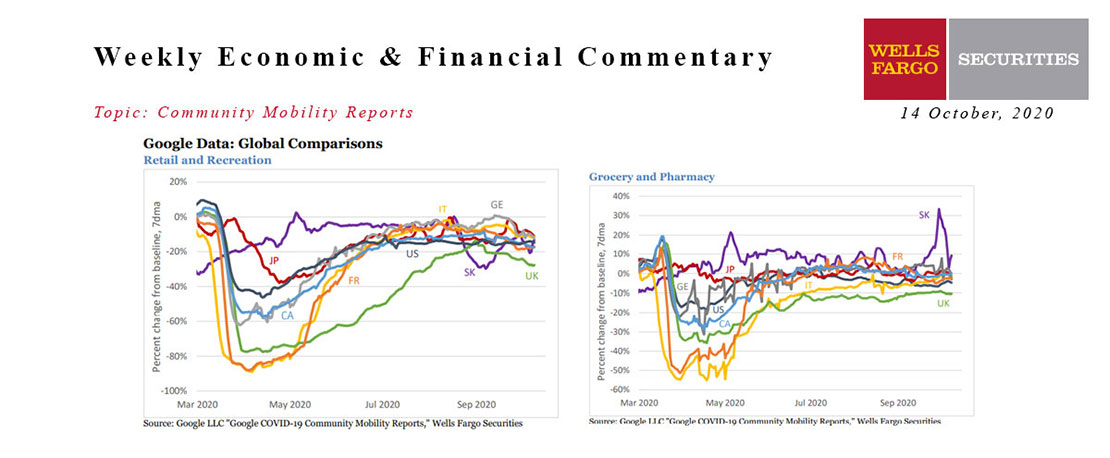

The global mobility playing field is equalizing. Major European countries such as Germany and France have seen a slowdown in recent weeks, leaving them right in line with the United States relative to the January baseline.

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

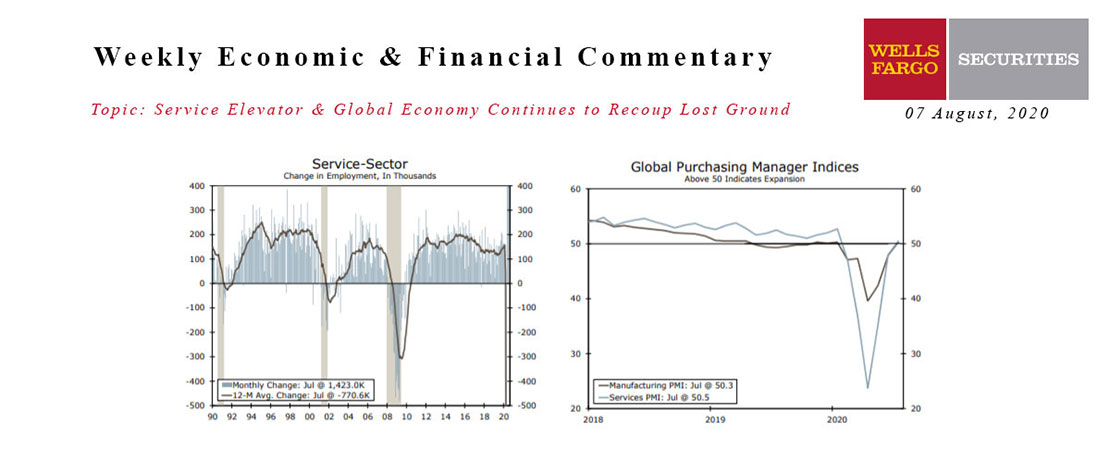

There were more signs of global recovery this week and PMI surveys improved further across the world.

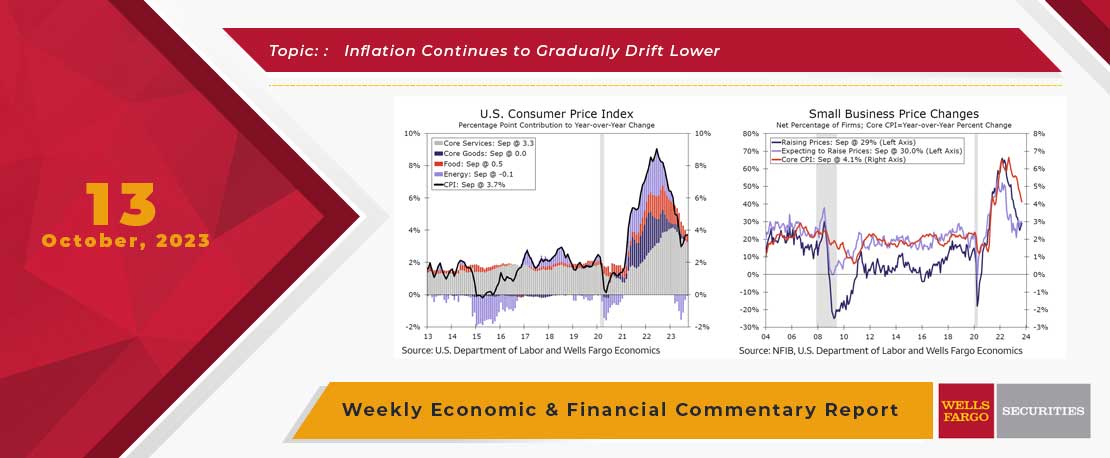

This Week's State Of The Economy - What Is Ahead? - 13 October 2023

Wells Fargo Economics & Financial Report / Oct 13, 2023

The Consumer Price Index (CPI) rose 0.4% in September, a monthly change that was a bit softer than the 0.6% increase registered in August. The core CPI rose 0.3% during the month, a pace unchanged from the month prior.

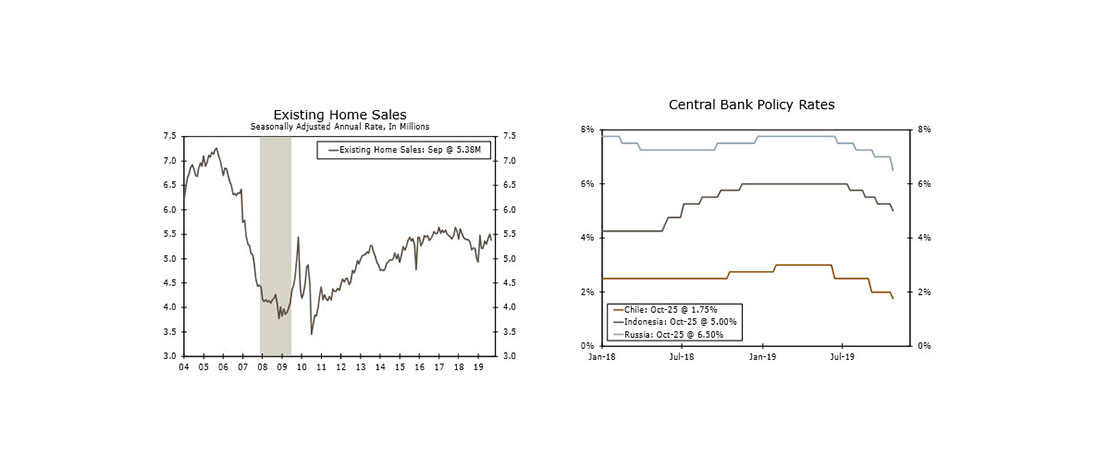

This Week's State Of The Economy - What Is Ahead? - 25 October 2019

Wells Fargo Economics & Financial Report / Oct 26, 2019

Sales of existing homes fell 2.2% to a 5.38 million-unit pace in September, but sales and prices were still up enough in the quarter that they will add solidly to Q3 GDP growth.

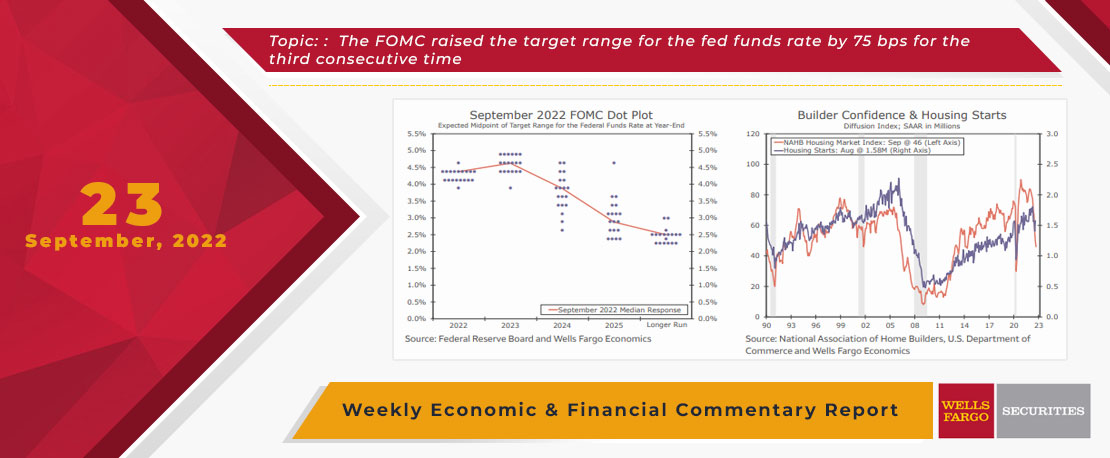

This Week's State Of The Economy - What Is Ahead? - 23 September 2022

Wells Fargo Economics & Financial Report / Sep 27, 2022

The FOMC raised the target range for the fed funds rate by 75 bps for the third consecutive time. The housing market continues to buckle under the pressure of higher mortgage rates.

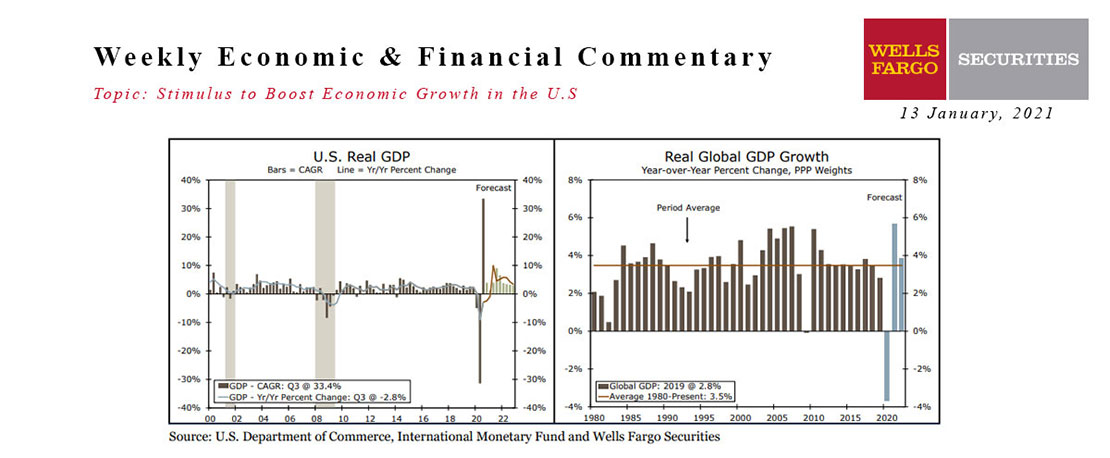

13 January 2021 Monthly Outlook Report

Wells Fargo Economics & Financial Report / Jan 19, 2021

The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate.

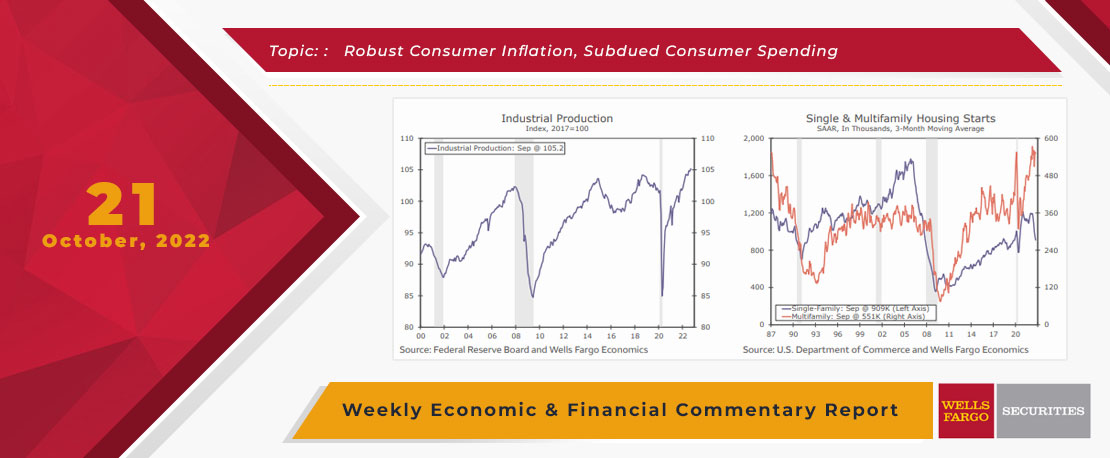

This Week's State Of The Economy - What Is Ahead? - 21 October 2022

Wells Fargo Economics & Financial Report / Oct 25, 2022

The real estate sector has been significantly affected by rising interest rates, with total housing starts falling 8.1% in September. Peering ahead, the forward-looking Leading Economic Index points to a recession in the coming year.

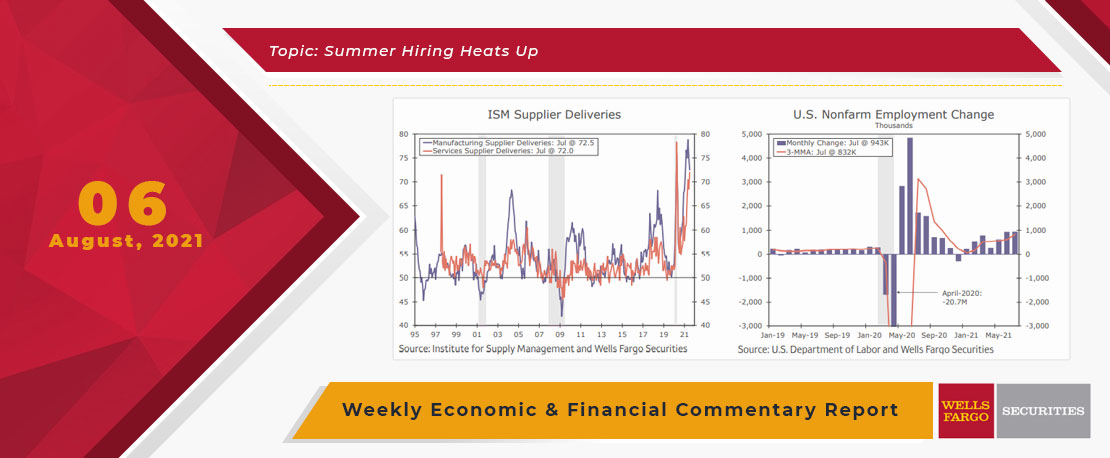

This Week's State Of The Economy - What Is Ahead? - 06 August 2021

Wells Fargo Economics & Financial Report / Aug 16, 2021

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy\'s resilience in spite of those continuing problems.