Olympic trivia for the day…Eddie Alvarez is about to become just the third American, and sixth Olympic athlete overall, to win medals in both the Summer and Winter Olympics. Alvarez won a silver medal as a member of the 5,000-meter ice skating relay team at the 2014 Sochi Olympics. He then transitioned to baseball, which he noted has absolutely nothing in common with speed skating other than requiring a series of left turns. He is now a shortstop in the Miami Marlins system with their AAA minor league affiliate in Jacksonville, FL. With yesterday’s 7 – 2 victory over South Korea, the USA Baseball team is assured of nothing worse than a silver medal depending upon the outcome of tomorrow’s gold medal game against Japan. That has nothing to do with the economy, but I thought it was neat.

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy's resilience in spite of those continuing problems. Meanwhile financial markets weighed the impact of the Delta variant wave on the outlook for the economy and Fed policy. ISM surveys for the manufacturing and service sectors continued to show businesses' ability to operate in this supply-strained world, with the latter hitting a new record high. Finally, this morning's virtually blemish-free employment report marked a big step down the road of "substantial further progress."

This Week's State Of The Economy - What Is Ahead? - 23 October 2020

Wells Fargo Economics & Financial Report / Oct 24, 2020

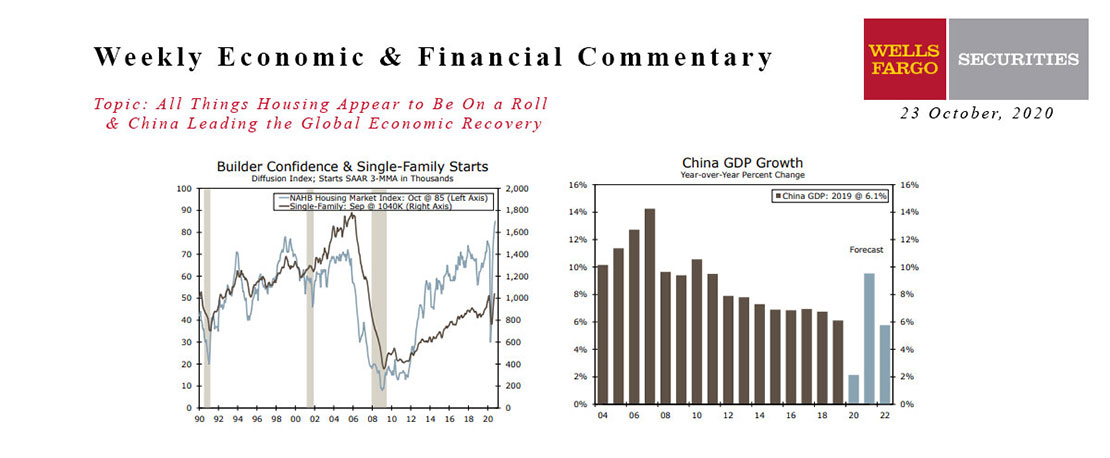

A recent strong report from the National Association of Homebuilders set the tone for another round of strong housing data. The NAHB index rose two points to a record high 85.

This Week's State Of The Economy - What Is Ahead? - 05 February 2021

Wells Fargo Economics & Financial Report / Feb 10, 2021

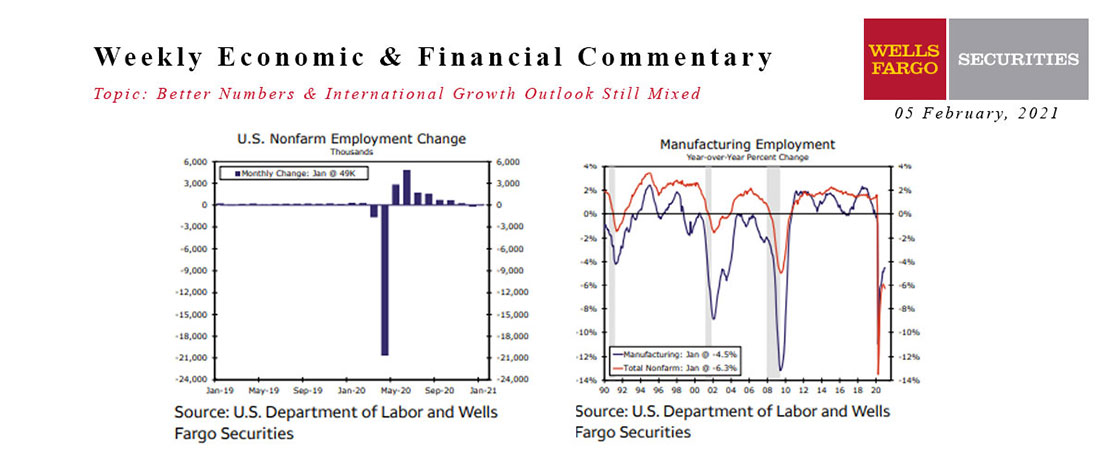

Nonfarm employment rebounded in January, with employers adding 49,000 jobs following the prior month\'s 227,000-job drop.

This Week's State Of The Economy - What Is Ahead? - 05 June 2020

Wells Fargo Economics & Financial Report / Jun 09, 2020

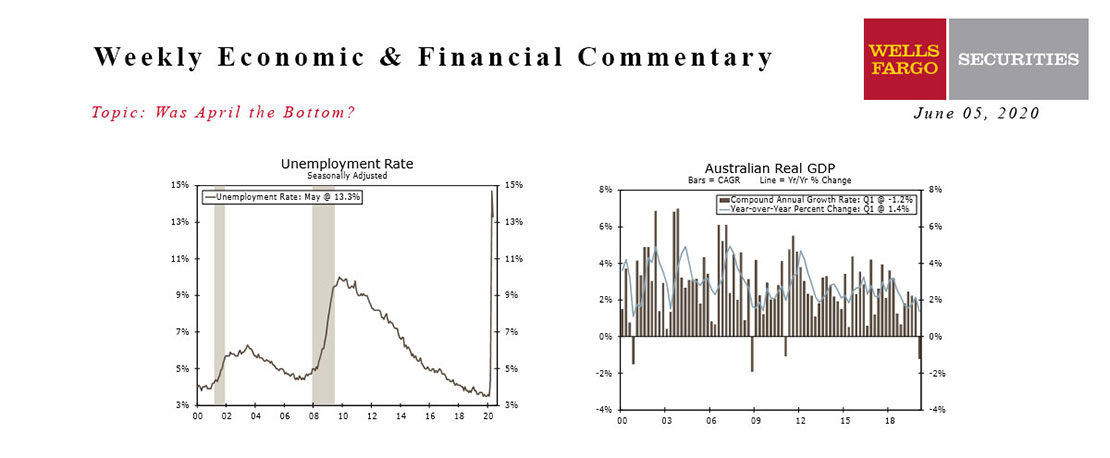

Data this week continued to suggest the U.S. economy hit rock bottom in April. Still, it is a long road to recovery and the pickup in economic activity will be gradual.

This Week's State Of The Economy - What Is Ahead? - 15 April 2022

Wells Fargo Economics & Financial Report / Apr 18, 2022

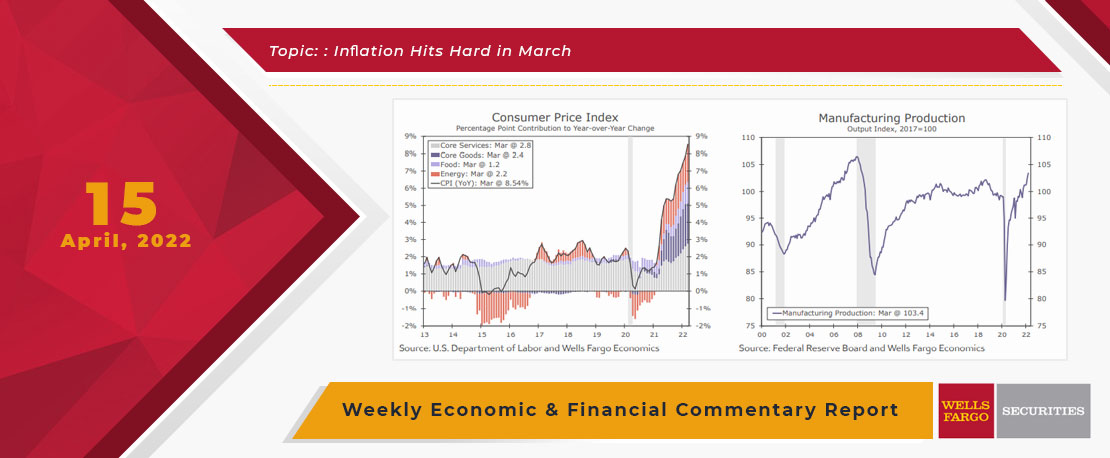

What do pollen and the Consumer Price Index (CPI) have in common? Answer; both are hitting new highs. This week’s U.S. economic data was led by the largest month monthly increase in the Consumer Price Index (CPI) since September 2005.

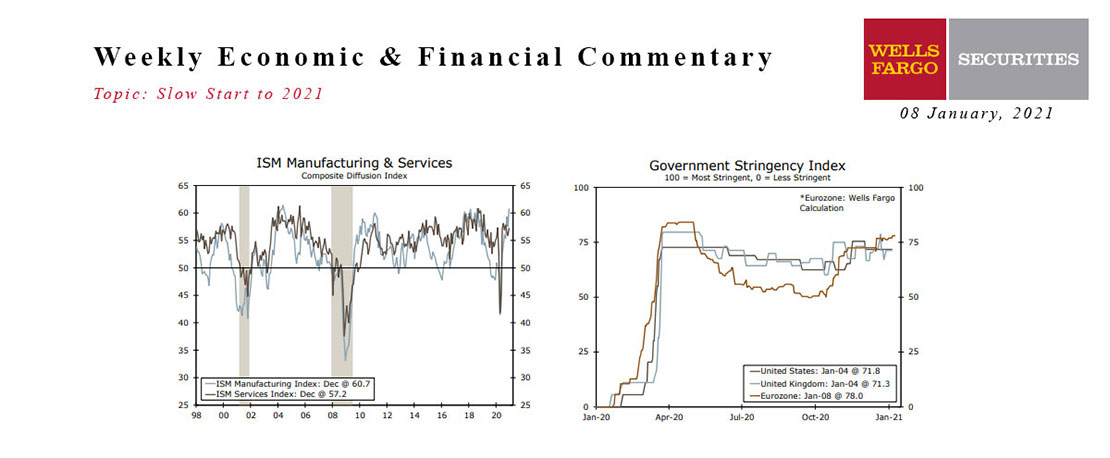

This Week's State Of The Economy - What Is Ahead? - 08 January 2021

Wells Fargo Economics & Financial Report / Jan 12, 2021

The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

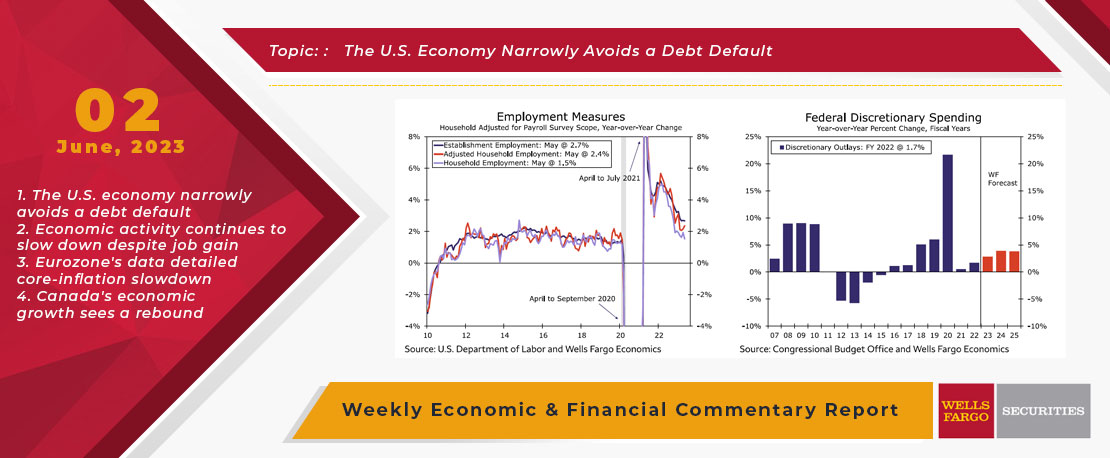

This Week's State Of The Economy - What Is Ahead? - 02 June 2023

Wells Fargo Economics & Financial Report / Jun 06, 2023

This week, Congress and the president prevented what would have been the first default in U.S. history by agreeing to suspend the debt ceiling through the end of 2024.

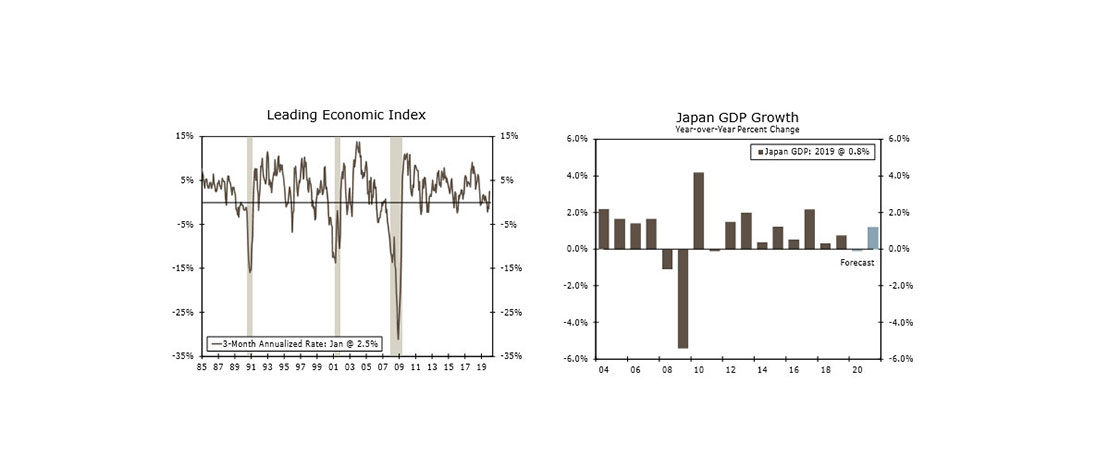

This Week's State Of The Economy - What Is Ahead? - 21 February 2020

Wells Fargo Economics & Financial Report / Feb 22, 2020

Minutes from the January 28-29 FOMC meeting indicate the coronavirus will not push the Fed to cut interest rates, and for the most part housing and manufacturing survey data this week supported that view.

This Week's State Of The Economy - What Is Ahead? - 21 June 2024

Wells Fargo Economics & Financial Report / Jun 25, 2024

Retail sales rose just 0.1% over the month, falling short of consensus and suggesting that consumers may finally be feeling some spending fatigue.

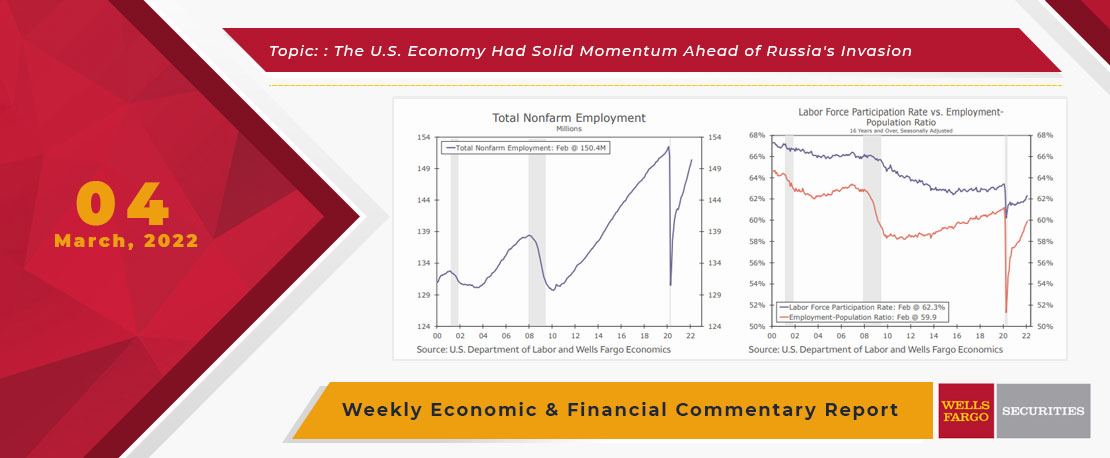

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

This Week's State Of The Economy - What Is Ahead? - 31 May 2024

Wells Fargo Economics & Financial Report / Jun 04, 2024

Markets digested a light lineup of economic data on the holiday-shortened week. The second look at first quarter GDP revealed an economy increasingly pressured by high interest rates as headline growth was revised lower.