Census numbers dropped this week, and although Houston was the second fastest growing major city in the U.S. the last decade, at 9.8% (Phoenix was first at 11.2%), we didn’t quite catch Chicago to officially take over as the 3rd largest city in the U.S. We’ll get ’em next time. Meanwhile, the CPI data this week showed that the sharpest monthly consumer price hikes may be behind us, but inflation is not about to quietly fade away.

Ongoing supply constraints for products and labor, rising costs and renewed risks around COVID weighed on small business optimism in July and on the Wells Fargo Economics team’s outlook for growth, which includes an expectation for a 7.3% annual rate rise in Personal Consumption Expenditures (“PCE”) for Q3, down from 8.3% before the COVID Delta variant began its current run.

That is expected to pull PCE back to 8.7% for the year, versus the prior 9.0% expectation. The general outlook remains positive as households have accumulated over $2T in excess savings on their balance sheets and net worth has risen across all income groups.

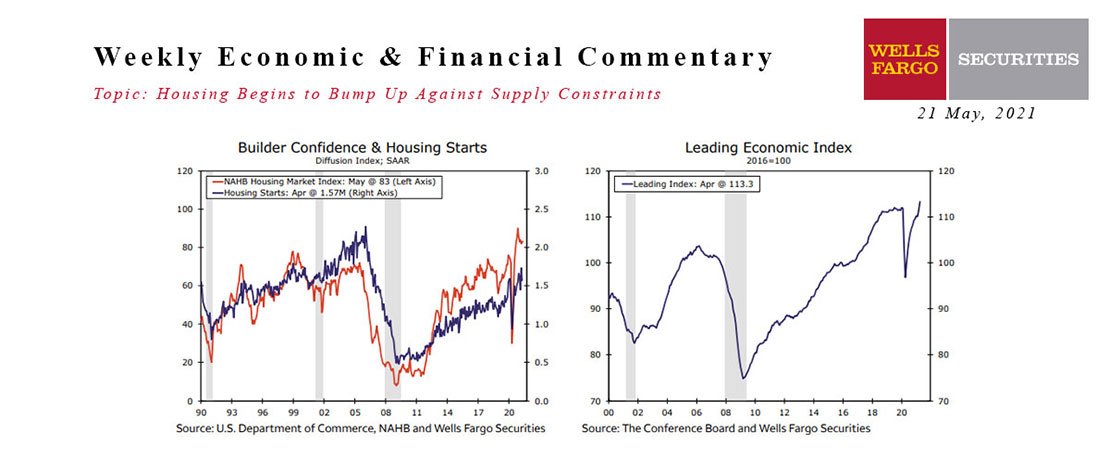

This Week's State Of The Economy - What Is Ahead? - 21 May 2021

Wells Fargo Economics & Financial Report / May 25, 2021

Over the past year, the housing market has become white-hot.

This Week's State Of The Economy - What Is Ahead? - 21 January 2022

Wells Fargo Economics & Financial Report / Jan 24, 2022

The Texans have earned a top draft position yet again, the Cowboys are home again for the remainder of the playoffs, and inflation concerns that continue to mount, along with ongoing supply chain disruptions, are weighing on homebuilder confidence.

Where Will That $2 Trillion Come From Anyway?

Wells Fargo Economics & Financial Report / Apr 01, 2020

Net Treasury issuance is set to surge in the coming weeks and months. At present, we look for the federal budget deficit to be $2.4 trillion in FY 2020 and $1.7 trillion in FY 2021.

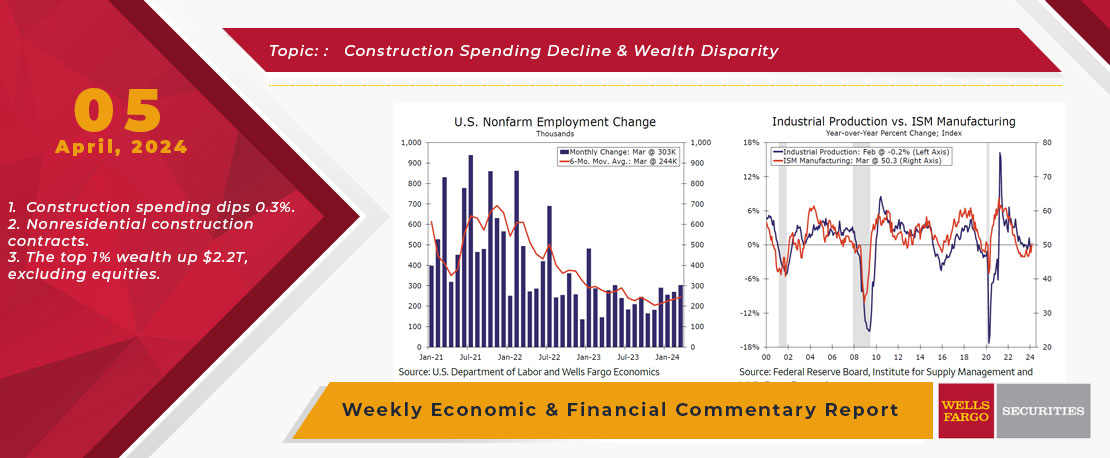

This Week's State Of The Economy - What Is Ahead? - 05 April 2024

Wells Fargo Economics & Financial Report / Apr 09, 2024

Nonfarm payrolls expanded 303K in March, surpassing all estimates submitted to Bloomberg. The continued strength in hiring suggests less urgency for policymakers at the Federal Reserve to lower the target range of the fed funds rate.

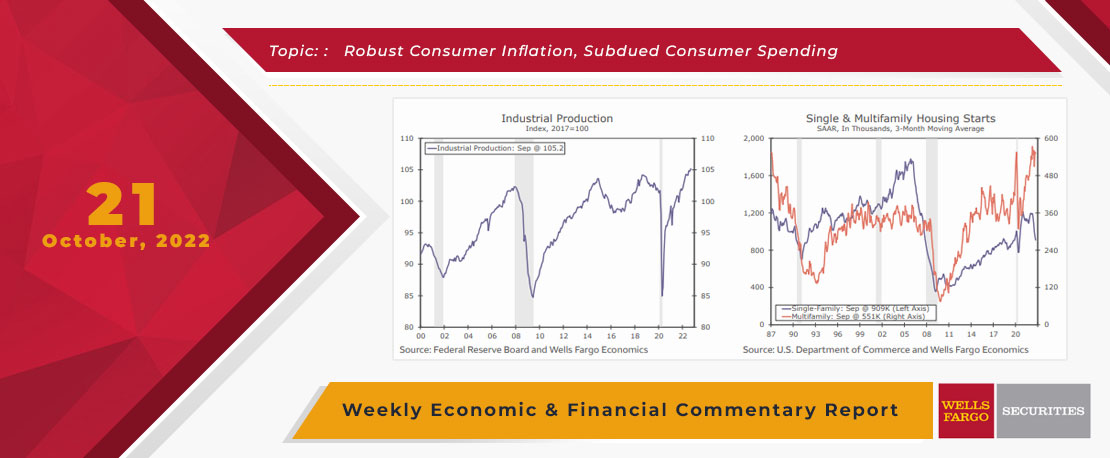

This Week's State Of The Economy - What Is Ahead? - 21 October 2022

Wells Fargo Economics & Financial Report / Oct 25, 2022

The real estate sector has been significantly affected by rising interest rates, with total housing starts falling 8.1% in September. Peering ahead, the forward-looking Leading Economic Index points to a recession in the coming year.

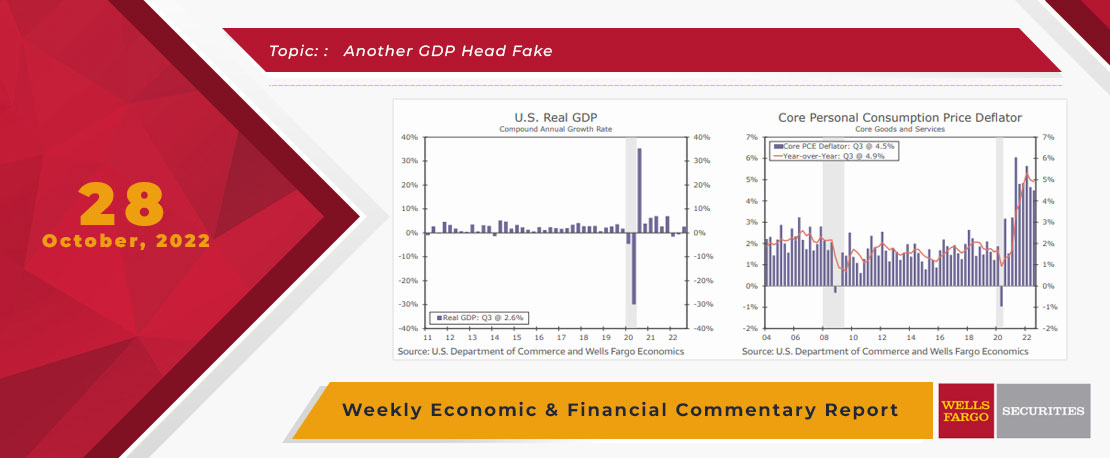

This Week's State Of The Economy - What Is Ahead? - 28 October 2022

Wells Fargo Economics & Financial Report / Oct 31, 2022

Headline GDP continues to send mixed signals on the direction of the U.S. economy. During Q3, real GDP rose at a 2.6% annualized rate, ending the recent string of quarterly declines in growth registered in the first half of 2022.

This Week's State Of The Economy - What Is Ahead? - 24 September 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

While fears of an Evergrande default in China were rattling financial markets, for those of us in Southeast Texas who have survived the typically very hot months of July, August and September, this week brought the very welcome first early fall-like

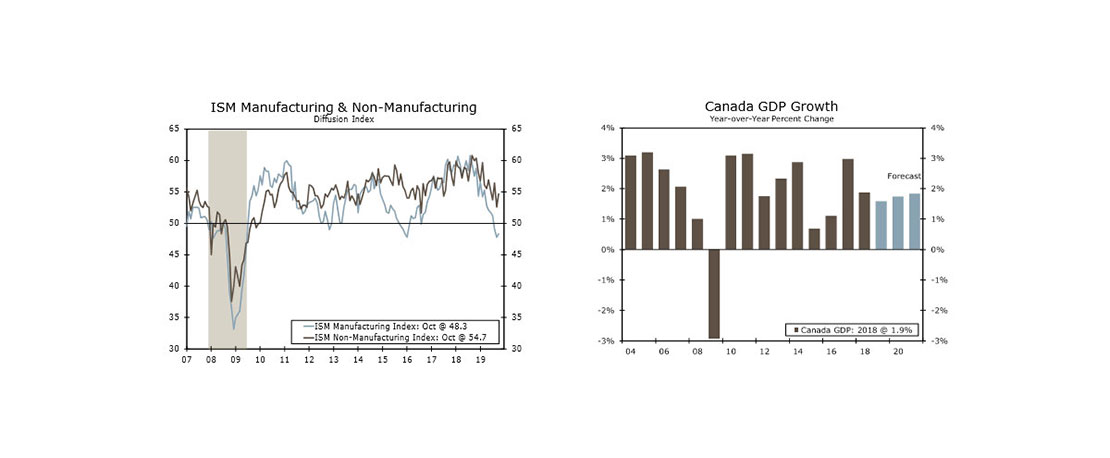

This Week's State Of The Economy - What Is Ahead? - 08 November 2019

Wells Fargo Economics & Financial Report / Nov 09, 2019

Optimism soared this week on hopes of a forthcoming trade deal, as equity markets hit all-time highs and the yield curve steepened.

This Week's State Of The Economy - What Is Ahead? - 12 August 2020

Wells Fargo Economics & Financial Report / Aug 15, 2020

The consumer has been a bright spot in the recovery so far, but with jobless benefits in flux and no clear path for the long-awaited stimulus bill, the support here could fade.

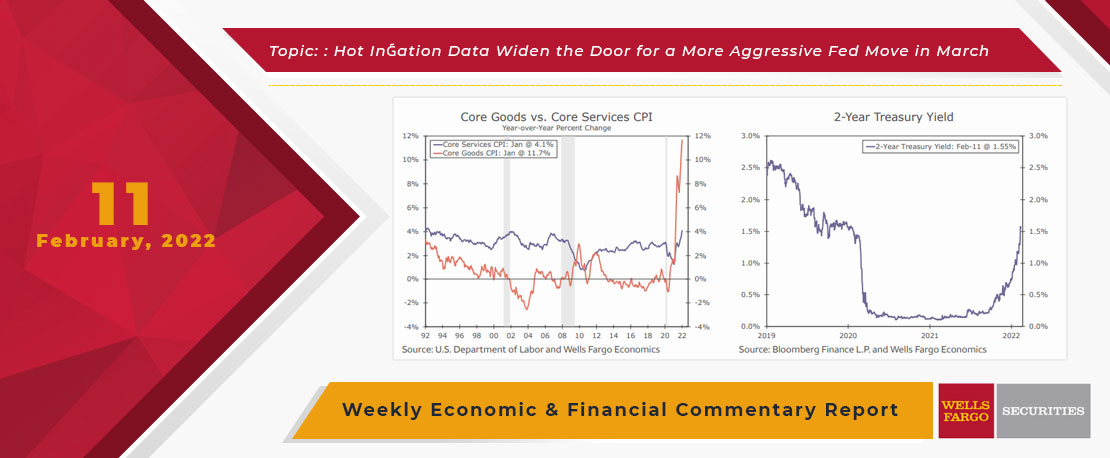

This Week's State Of The Economy - What Is Ahead? - 11 February 2022

Wells Fargo Economics & Financial Report / Feb 14, 2022

Deep thought for the week, if a tree falls in the forest, or an Olympics occurs, and no one is there to hear it or see it, did it really occur?