This week's indicator performance presented mixed evidence of strength of the U.S. economy and the impact tightening monetary policy is having on key sectors.

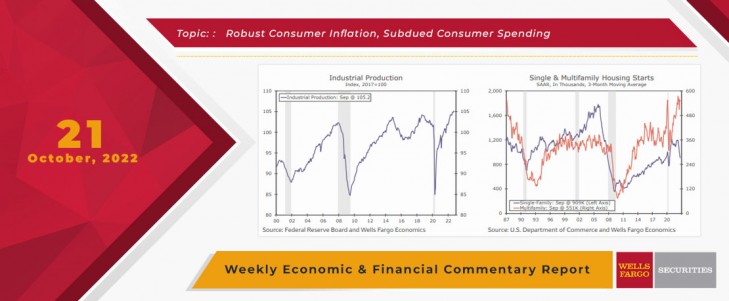

Signaling slower growth rather than outright recession, industrial production regained its footing in September after declining in three of the prior four months. Total production rose 0.4% last month, as a matching gain in manufacturing and a 0.6% rise in mining more than offset a 0.3% slide in utilities. On broad-based strength, manufacturing output extended its growth streak to three months underpinned by solid business investment and demand for consumer goods. That said, the manufacturing sector is losing momentum. Manufacturing production increased at just a 1.9% annual rate in the third quarter after rising 3.6% in the second quarter.

Regional manufacturing surveys released this week support this loss of momentum. The Empire State and Philadelphia Fed surveys continued to signal contraction in early October as both headline indices remained in negative territory. Encouragingly, the surveys have been signaling less strain from supplier deliveries, reflecting, in part, softer demand, yet consistent with less upward pressure on prices. Expectations are high for manufacturing activity to start contracting in coming months as rising interest rates, consumers' spending changes from goods to services, and downturns in Europe and China collectively take a toll. Business surveys are picking up on this pessimism, as evidenced by the six-month ahead Empire State business conditions index falling to its second weakest reading since 2009 and the Philly Fed's future general activity index posting its fifth consecutive negative reading.

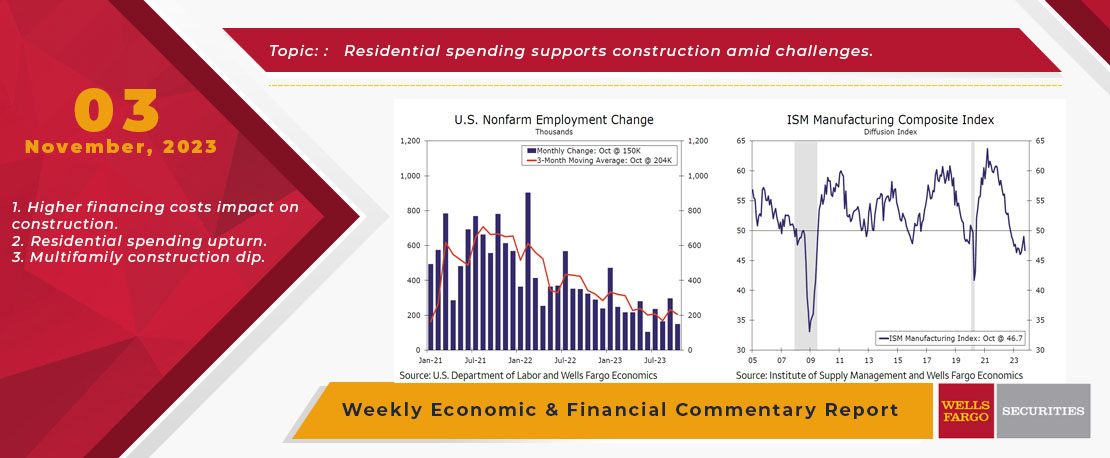

This Week's State Of The Economy - What Is Ahead? - 03 November 2023

Wells Fargo Economics & Financial Report / Nov 08, 2023

Although payroll growth is easing, the labor market remains relatively tight. The unemployment rate inched up to 3.9% in October, slightly higher than the cycle low of 3.4% first hit in January 2023, but still low compared to historical averages.

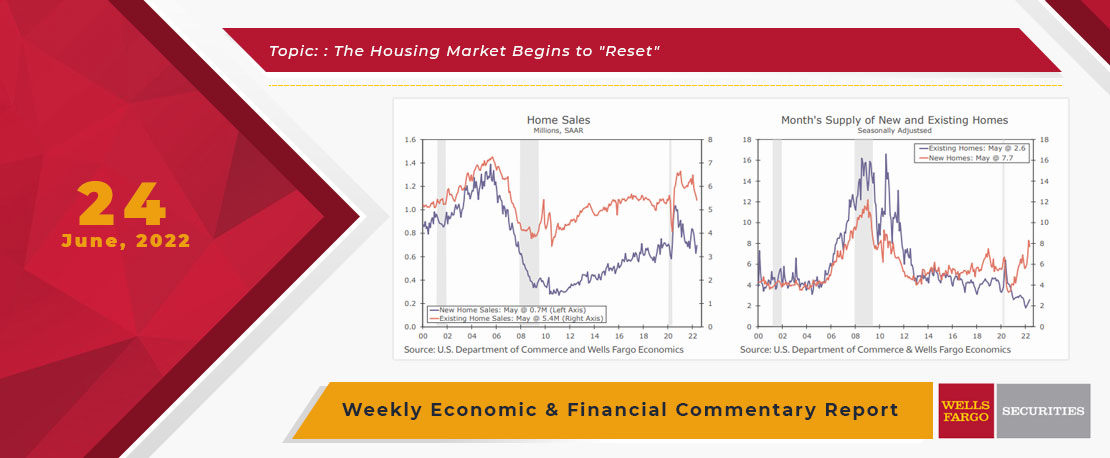

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

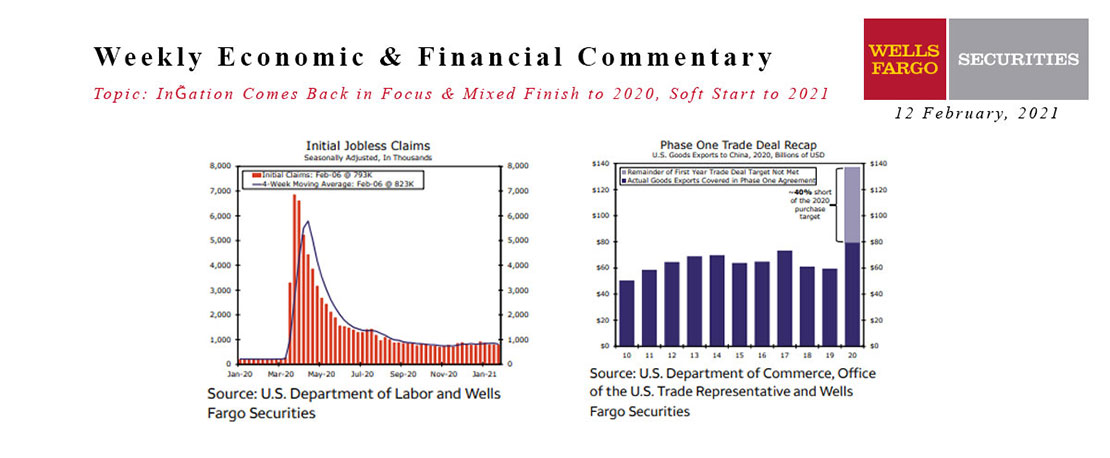

This Week's State Of The Economy - What Is Ahead? - 12 February 2021

Wells Fargo Economics & Financial Report / Feb 19, 2021

Market attention was concentrated on the January consumer price data, as inflation has come back into focus.

This Week's State Of The Economy - What Is Ahead? - 09 June 2023

Wells Fargo Economics & Financial Report / Jun 14, 2023

An unexpected spike in jobless claims is a sign that cracks are forming in the labor market. Higher mortgage rates look to be hindering a housing market rebound.

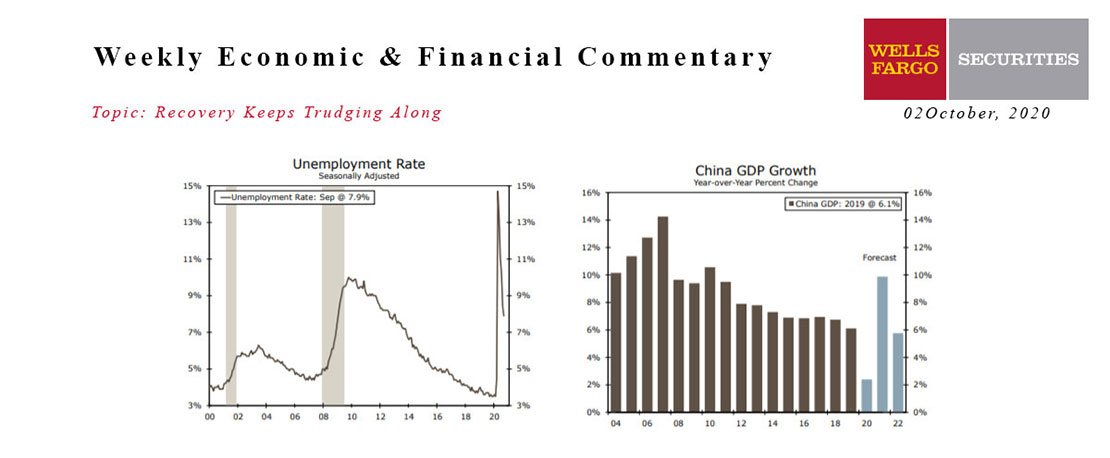

This Week's State Of The Economy - What Is Ahead? - 02 October 2020

Wells Fargo Economics & Financial Report / Sep 29, 2020

In what was a jam-packed week of economic data, the jobs report, prospects of additional fiscal stimulus and the president’s positive COVID-19 test result commanded markets’ attention.

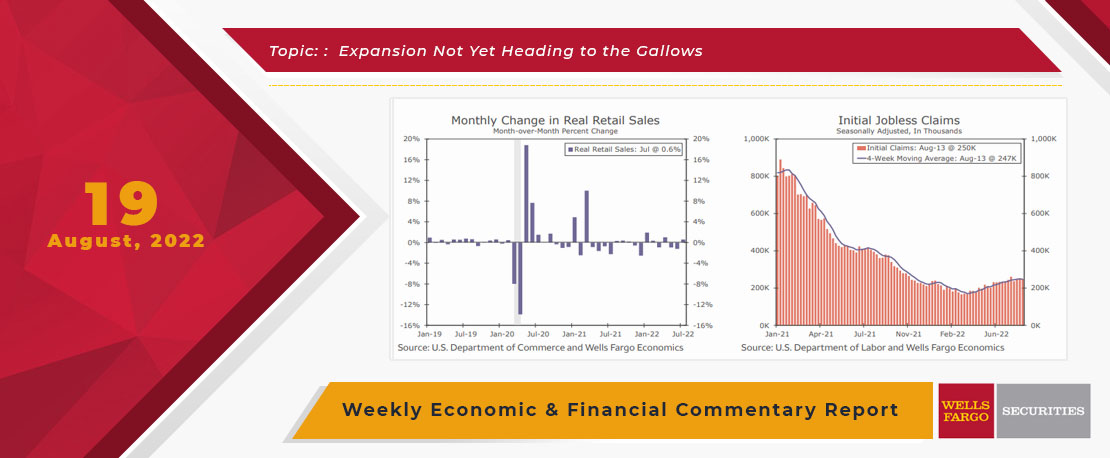

This Week's State Of The Economy - What Is Ahead? - 19August 2022

Wells Fargo Economics & Financial Report / Aug 23, 2022

July data indicates that we celebrated a decline in gas prices by going shopping, boosting retail sales figures. I’m not sure I get the connection...

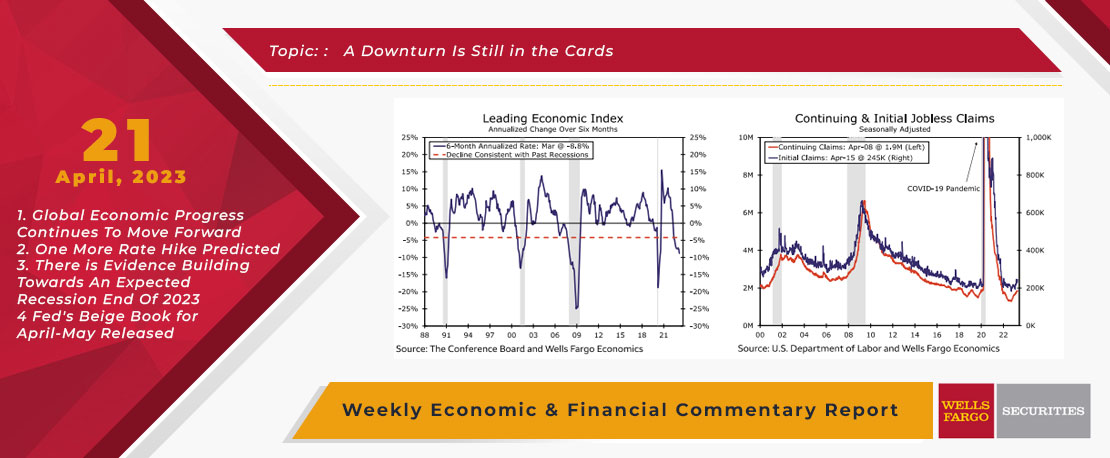

This Week's State Of The Economy - What Is Ahead? - 21 April 2023

Wells Fargo Economics & Financial Report / Apr 26, 2023

The Leading Economic Index (“LEI”) continued to flash contraction as early signs of labor market weakening are starting to emerge. Meanwhile, a batch of housing data confirmed that a full-fledged housing market recovery is still far off.

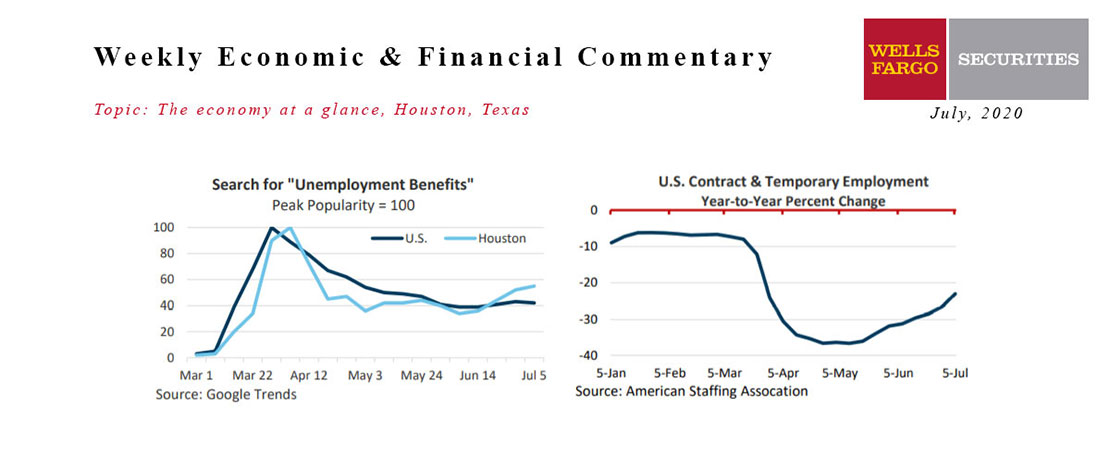

July 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jul 30, 2020

The recent surge in COVID-19 cases indicates that elected officials re-opened the economy too soon, that too many Americans are flaunting social distancing guidelines, and that the virus is likely to be around longer than we’d hoped.

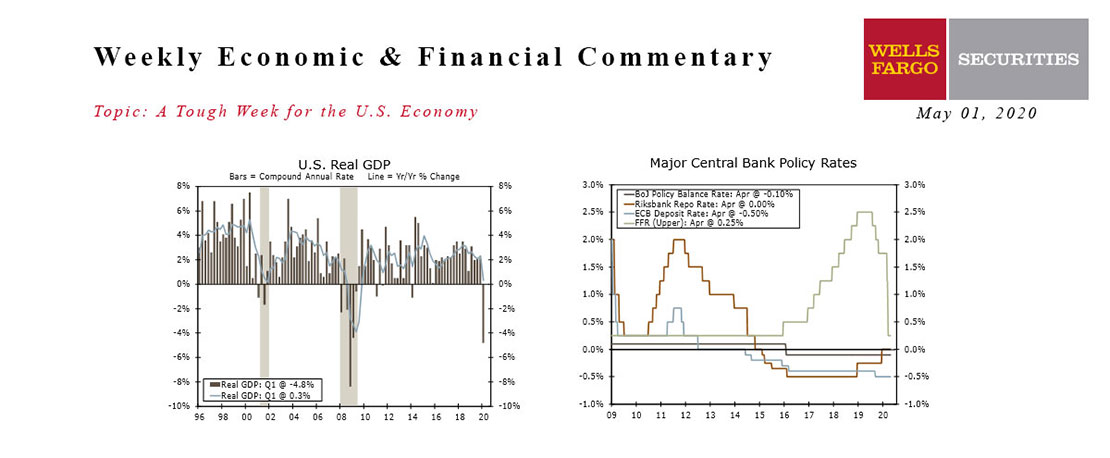

This Week's State Of The Economy - What Is Ahead? - 01 May 2020

Wells Fargo Economics & Financial Report / May 04, 2020

U.S. GDP declined at an annualized rate of 4.8% in the first quarter, only a hint of what is to come in the second quarter.

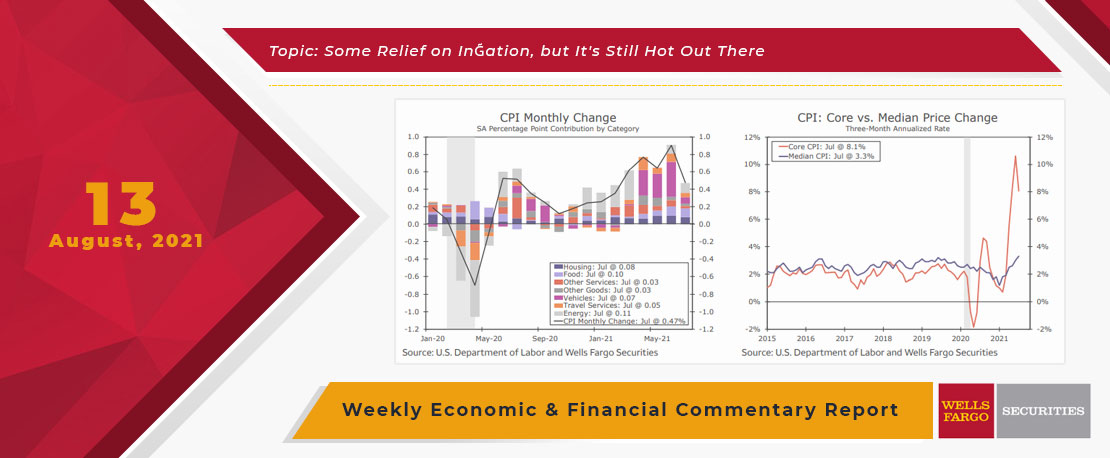

This Week's State Of The Economy - What Is Ahead? - 13 August 2021

Wells Fargo Economics & Financial Report / Aug 19, 2021

The general outlook remains positive as households have accumulated over $2T in excess savings on their balance sheets and net worth has risen across all income groups.