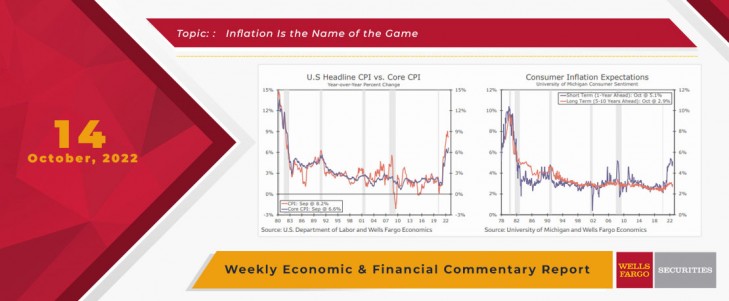

Thursday's highly anticipated Consumer Price Index (CPI) report surprised to the upside. Headline CPI rose 0.4% in September, 0.2 percentage points higher than expected by the Bloomberg consensus. Over the year, the CPI is up 8.2%, a slight step down from August's 8.3% reading. Even with some easing on a year-ago basis, the details of the report suggest inflation still has plenty of momentum and remains broad-based.

Gas prices slid 4.9% last month, helping to offset some solid increases seen elsewhere in the consumption basket. Food price growth remains a major pressure point. The food CPI rose 0.8% in September, trailing only modestly behind the 1.0% average pace over the prior three months. On the bright side, we suspect food inflation will not worsen from here. Food-related commodity prices have rolled over, and in the separately-reported Producer Price Index, transportation and warehousing costs slid for the third consecutive month in September, providing scope for disinflation in food, and goods prices more broadly, in the coming months.

Excluding food and energy, the core CPI rose 0.6% in September, matching August's pace and pushing the year-ago rate up to a fresh 40-year high of 6.6%. Core goods prices were flat over the month, with notable declines in used vehicles (-1.1%), education & communication goods (-0.6%) and apparel (-0.3%). Core services, on the other hand, rose a blistering 0.8%. Strength was broad-based, with sturdy increases in transportation services (1.9%), medical care (1.0%) and owners equivalent rent (0.8%). In short, services inflation continues to gain traction, while goods inflation is showing signs of slowing. For insight on what the latest consumer price data mean for the FOMC's thinking, please see this week's Interest Rate Watch.

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

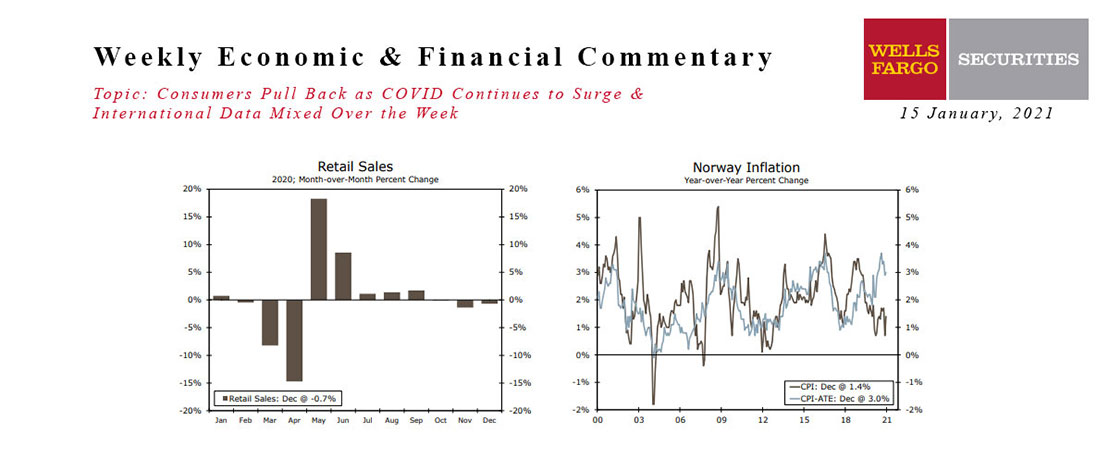

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

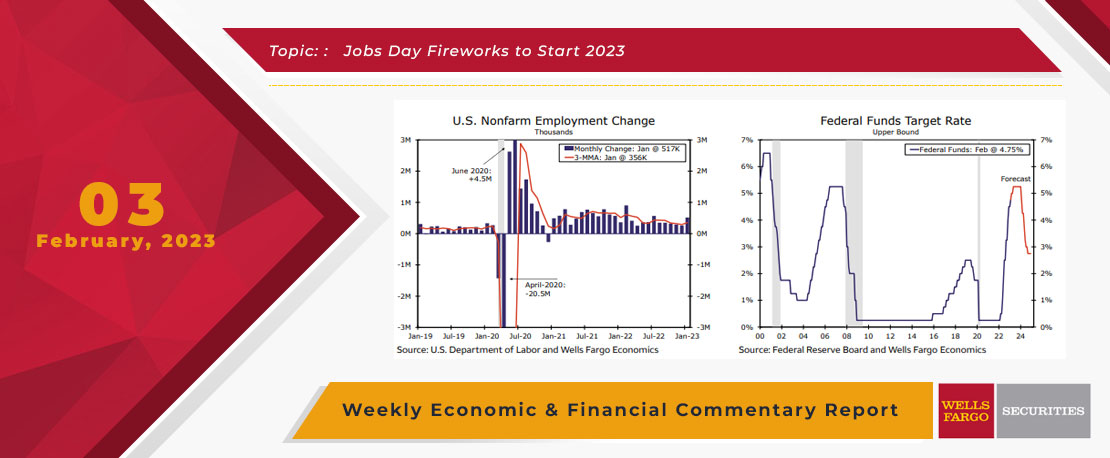

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

This Week's State Of The Economy - What Is Ahead? - 13 October 2023

Wells Fargo Economics & Financial Report / Oct 13, 2023

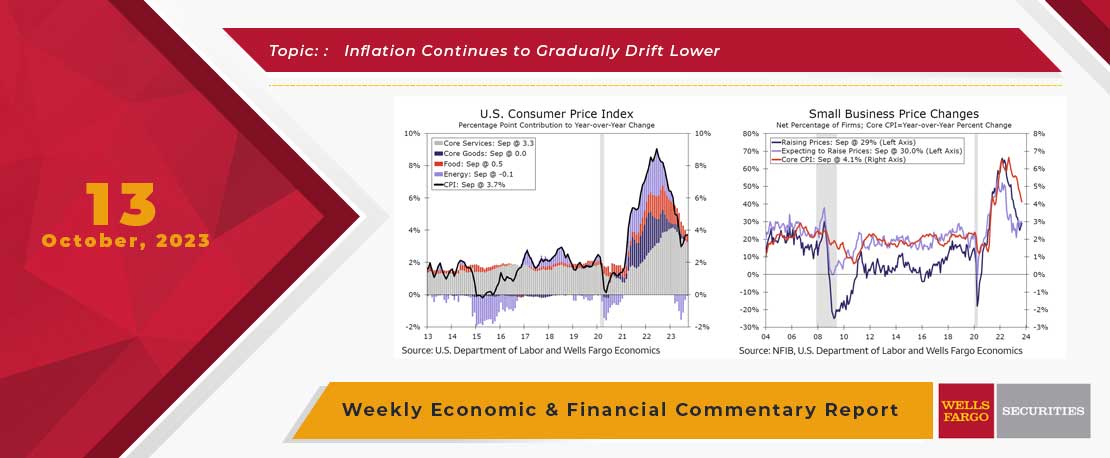

The Consumer Price Index (CPI) rose 0.4% in September, a monthly change that was a bit softer than the 0.6% increase registered in August. The core CPI rose 0.3% during the month, a pace unchanged from the month prior.

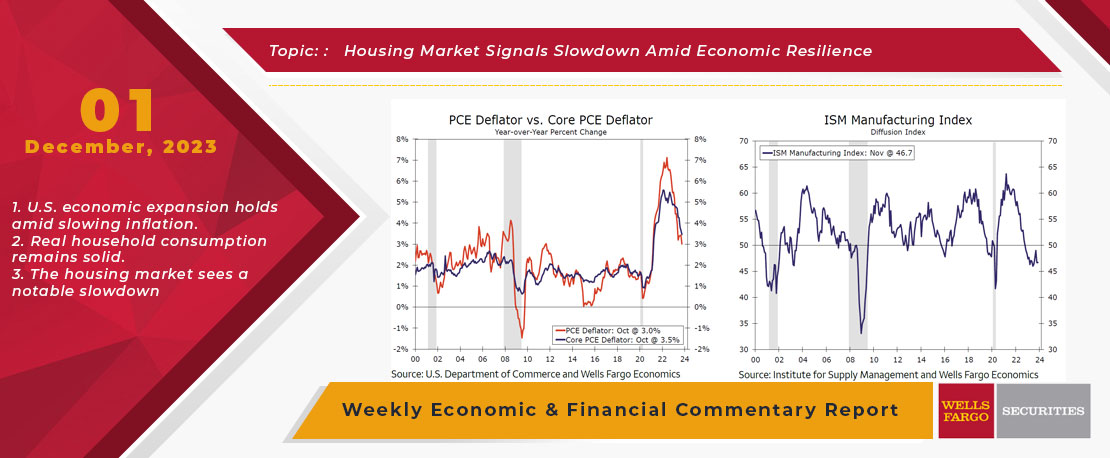

This Week's State Of The Economy - What Is Ahead? - 01 December 2023

Wells Fargo Economics & Financial Report / Dec 05, 2023

U.S. data released this week indicates the economic expansion remains alive even as inflation continues to slow. The year-ago rates of headline and core PCE inflation were the lowest since March 2021 and April 2021, respectively.

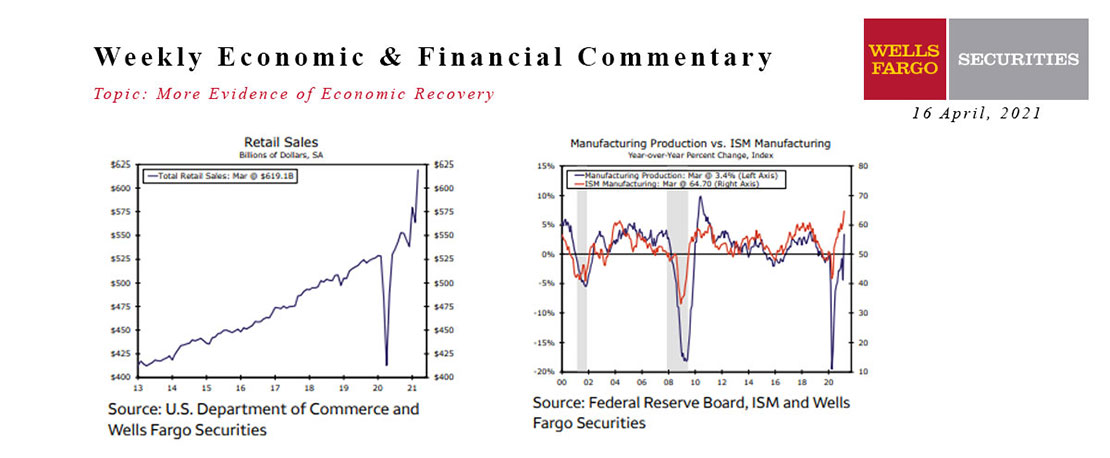

This Week's State Of The Economy - What Is Ahead? - 16 April 2021

Wells Fargo Economics & Financial Report / Apr 17, 2021

Data released this week continue to show that the economic recovery has gained momentum in March. The much anticipated consumer boom has arrived.

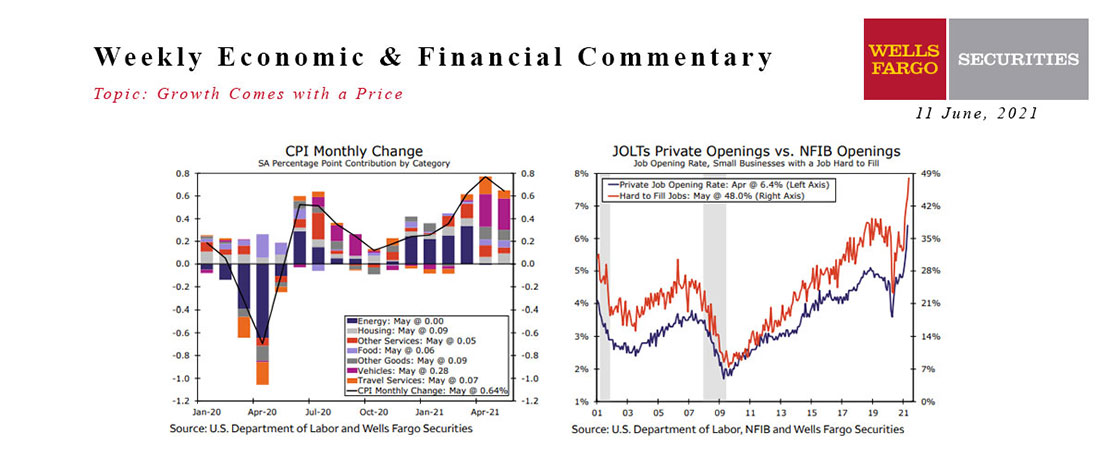

This Week's State Of The Economy - What Is Ahead? - 11 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Okay, so I’ve gotten about half a dozen calls since Wednesday asking if I saw the May CPI numbers that came out this week.

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

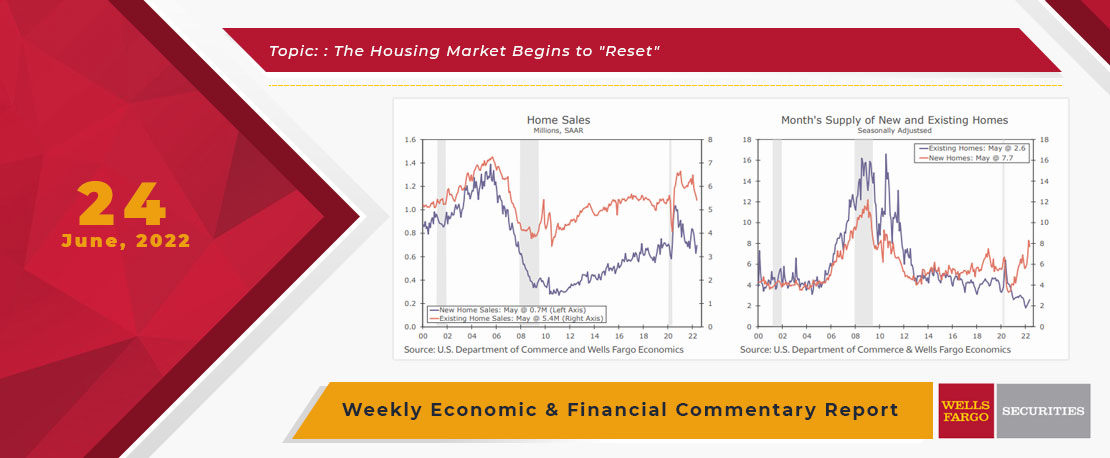

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

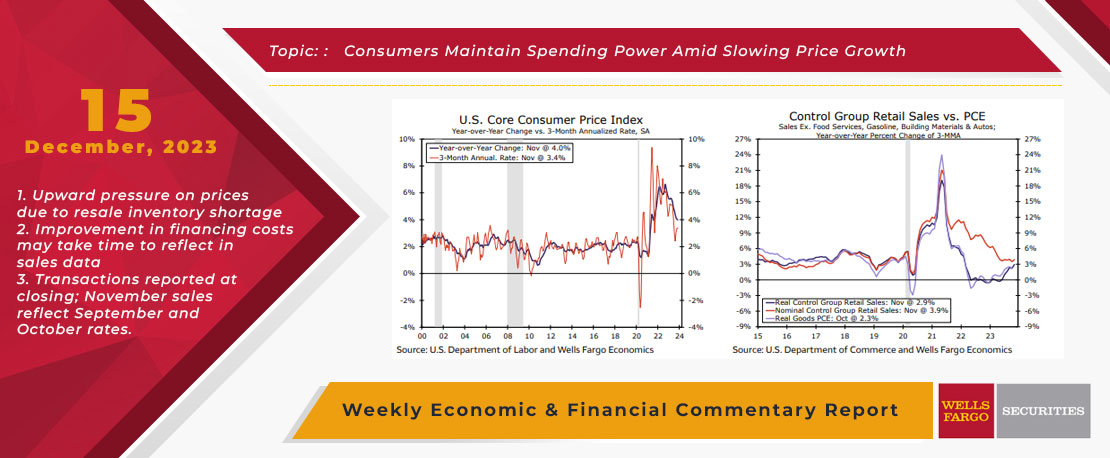

This Week's State Of The Economy - What Is Ahead? - 15 December 2023

Wells Fargo Economics & Financial Report / Dec 21, 2023

core CPI remained elevated in November at a 4.0% annual rate, a string of slower monthly prints suggests that disinflation has more room to run.

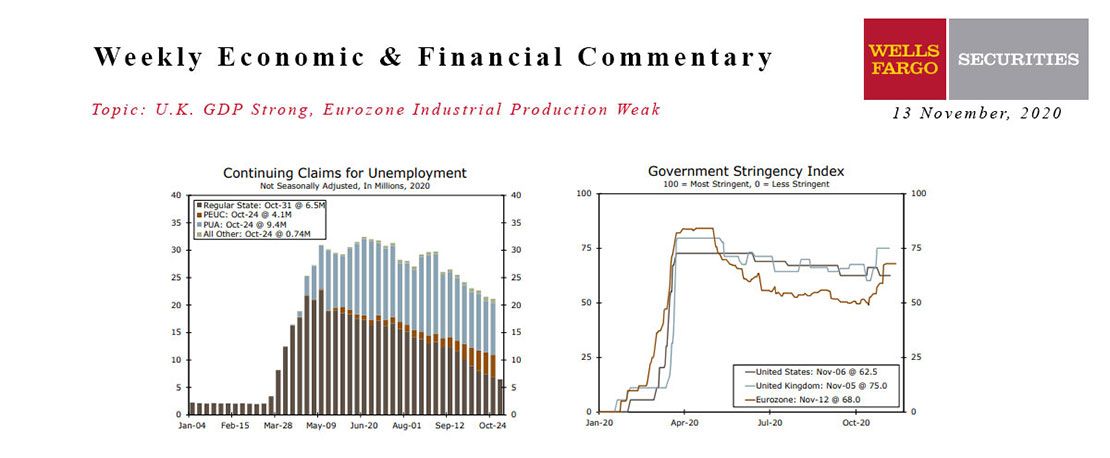

This Week's State Of The Economy - What Is Ahead? - 13 November 2020

Wells Fargo Economics & Financial Report / Nov 14, 2020

The combination of the election outcome and a workable vaccine boosted financial markets and set the background music for this week’s short list of indicators.