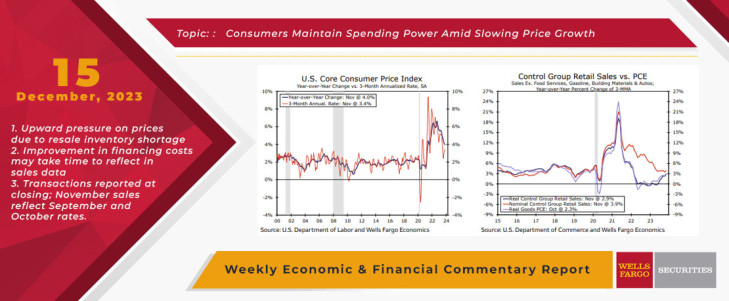

Macroeconomic data released this week reveal that gradually easing price pressures are promoting consumer resilience, while high financing costs continue to bite producers. The Consumer Price Index (CPI) rose just 0.1% in November, amounting to a 3.1% year-to-year upswing. The headline print was muted by a downdraft in gasoline prices and ongoing moderation in food costs. In contrast, firmer services prices continue to prop up core inflation. A 0.3% monthly uptick in core prices translated to a 4.0% annual gain in November, unchanged from October’s rate.

Despite core CPI seemingly stuck at double the Fed’s inflation target, there are encouraging signs of more progress to come. A recent streak of softer prints brought the three-month annualized core rate to 3.4% through November, suggesting that disinflation has more room to run in the coming months. Gradually cooling labor costs should also help to keep a lid on services inflation, while stalling wholesale prices reduce the risk of price reacceleration. That said, price pressures have not completely abated. This week, we also received the latest NFIB Small Business Economic Trends Survey. In November, the net share of small businesses expecting to raise prices in the coming months reached its highest reading in one year (34%), consistent with a bump in plans to raise compensation.

Nevertheless, inflation expectations are adjusting lower. A survey from the New York Fed found that consumers anticipate a 3.4% annual increase in prices over the next year, the softest expectation since April 2021. A solid string of slower inflation readings also led FOMC members to take down their own forecasts, supporting their decision to hold rates steady for the third straight meeting in December. In the latest Summary of Economic Projections (SEP), the median FOMC participant expected core PCE inflation to print at 3.2% this year, down from 3.7% in the September SEP. These adjustments give a nod to ongoing progress on inflation, while acknowledging that price growth is likely to proceed above target. See Interest Rate Watch for more insight into how these developments affect our outlook for Federal Reserve policy.

Receding inflation appears to be bolstering consumer staying power. Retail sales rose 0.3% in November, outshining expectations of a slight decline. Based on our estimates, sales mounted a more impressive 0.9% increase on an inflation-adjusted basis, the fastest pace since last January. In addition to demonstrating enduring consumer resilience, November’s print also signals a solid holiday shopping season this year. Holiday sales are now on track to grow just under 5.0% on an annual basis. If realized, this spending pace would be a downshift from post-pandemic norms while still remaining above the longer-term average. Finally, a 0.9% real increase in control group sales in November set up GDP to advance a touch faster than we currently expect in Q4.

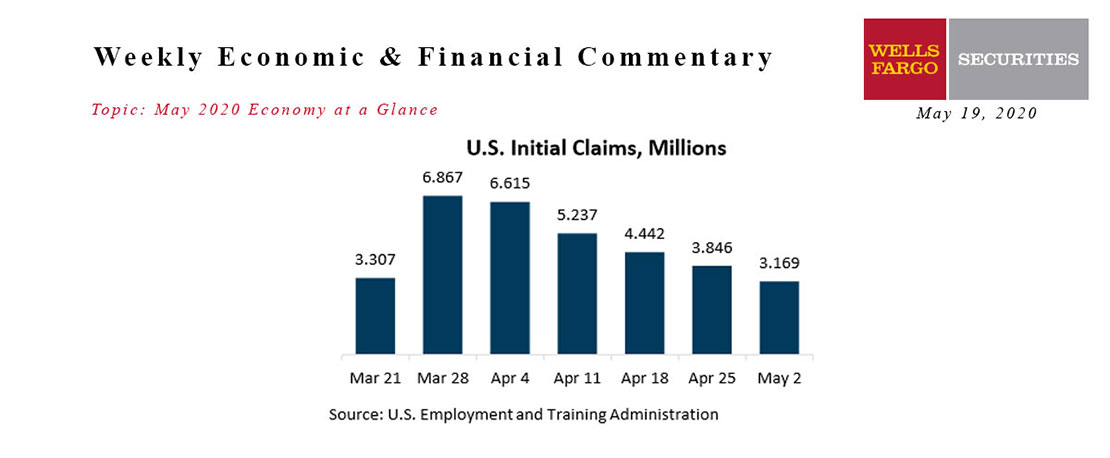

May 2020 Economy at a Glance

Wells Fargo Economics & Financial Report / May 19, 2020

The U.S. is in a severe recession caused by the sudden shutdown due to the COVID-19 pandemic. Since the lock down began, the nation has lost 21.4 million jobs.

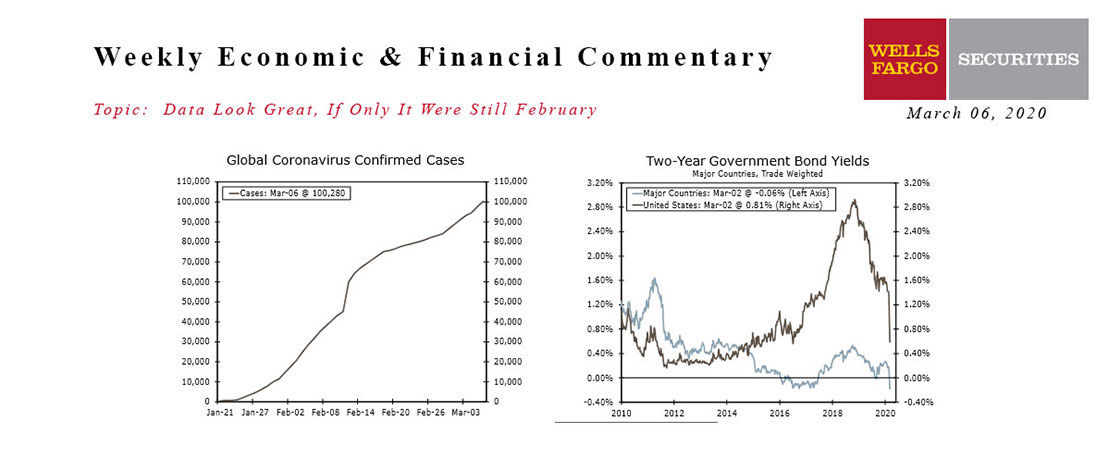

This Week's State Of The Economy - What Is Ahead? - 06 March 2020

Wells Fargo Economics & Financial Report / Mar 07, 2020

An inter-meeting rate cut by the FOMC did little to stem financial market volatility, as the number of confirmed COVID-19 cases continued to climb.

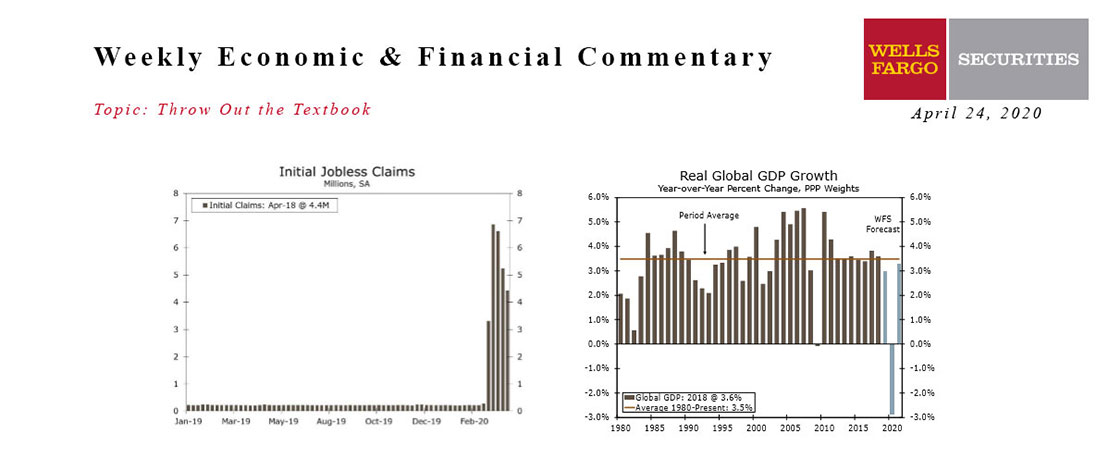

This Week's State Of The Economy - What Is Ahead? - 24 April 2020

Wells Fargo Economics & Financial Report / Apr 27, 2020

Oil prices went negative for the first time in history on Monday as the evaporation of demand collided with a supply glut. In the past five weeks, 26.5 million people have filed for unemployment insurance, or more than one out of every seven workers.

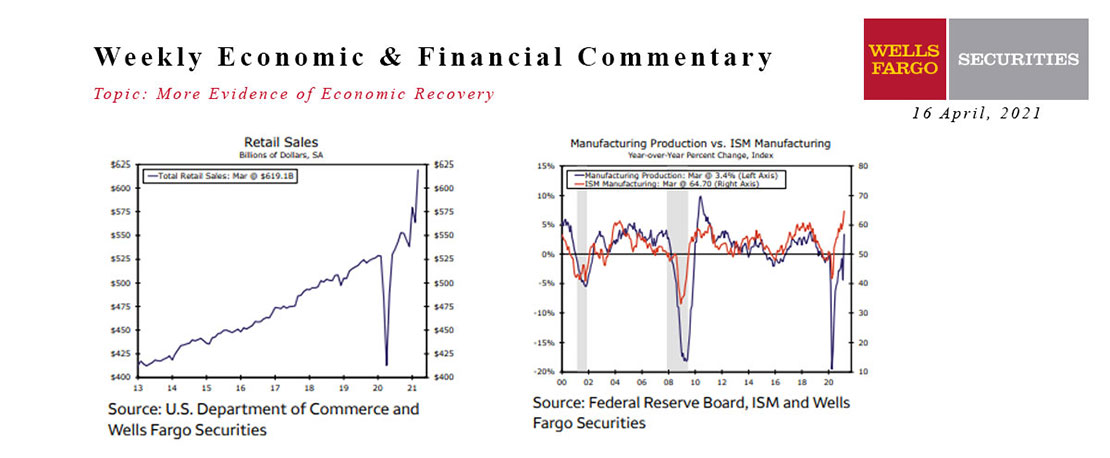

This Week's State Of The Economy - What Is Ahead? - 16 April 2021

Wells Fargo Economics & Financial Report / Apr 17, 2021

Data released this week continue to show that the economic recovery has gained momentum in March. The much anticipated consumer boom has arrived.

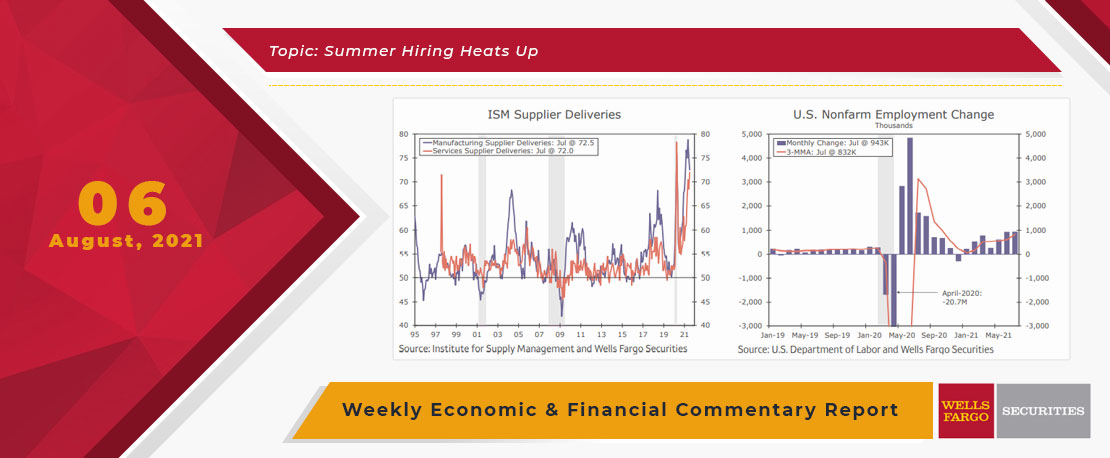

This Week's State Of The Economy - What Is Ahead? - 06 August 2021

Wells Fargo Economics & Financial Report / Aug 16, 2021

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy\'s resilience in spite of those continuing problems.

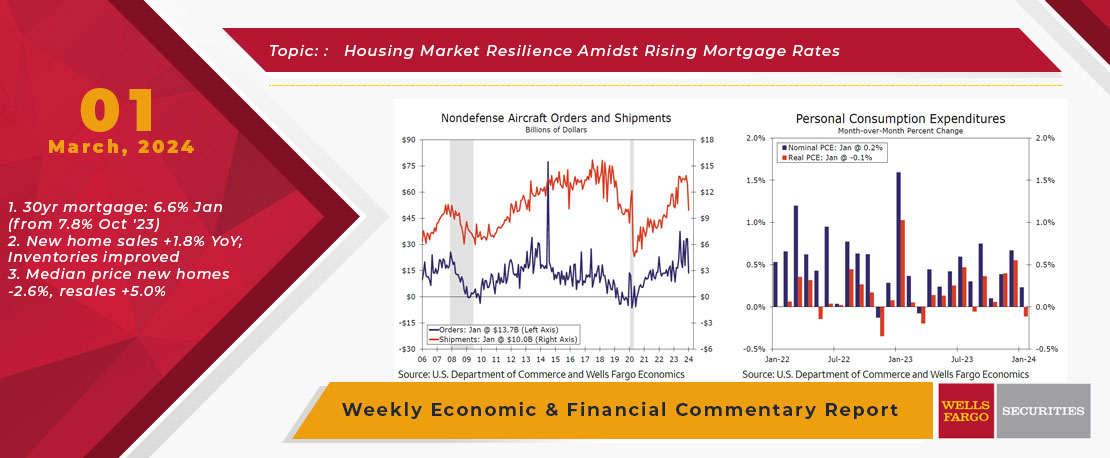

This Week's State Of The Economy - What Is Ahead? - 01 March 2024

Wells Fargo Economics & Financial Report / Mar 05, 2024

Economic data were downbeat this week, as downward revisions took some of the shine out of the marquee headline numbers. Despite the somewhat weak start to Q1, economic growth continues to trek along.

This Week's State Of The Economy - What Is Ahead? - 24 January 2020

Wells Fargo Economics & Financial Report / Jan 25, 2020

Fears of an escalating coronavirus outbreak reached the United States this week, as a Washington state man became the first confirmed domestic case and the international total reached more than 800.

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

This Week's State Of The Economy - What Is Ahead? - 11 August 2023

Wells Fargo Economics & Financial Report / Aug 15, 2023

During July, both the headline and core Consumer Price Index (CPI) rose 0.2%. On a year-over-year basis, the core CPI was up 4.7% in July. Recent signs have been more encouraging, with core CPI running at a 3.1% three-month annualized pace.

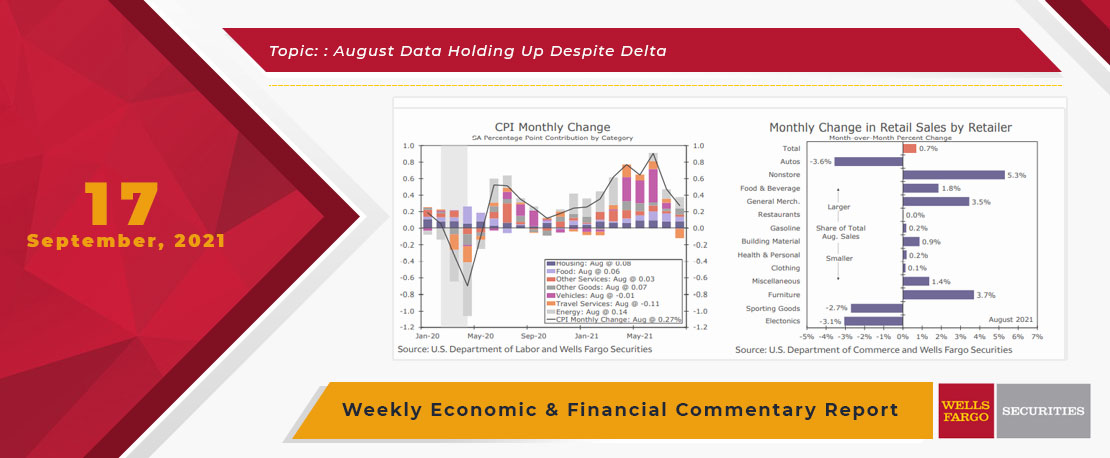

This Week's State Of The Economy - What Is Ahead? - 17 September 2021

Wells Fargo Economics & Financial Report / Sep 23, 2021

While we were picking up tree limbs from the yard, data released this week generally showed a stronger economy in August than many expected in the wake of surging COVID cases.