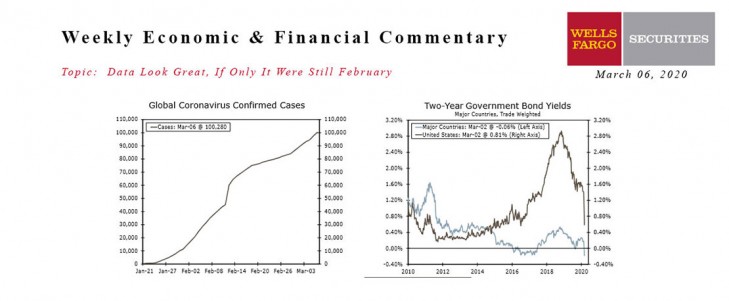

U.S - Data Look Great, If Only It Were Still February

- An inter-meeting rate cut by the FOMC did little to stem financial market volatility, as the number of confirmed COVID-19 cases continued to climb.

- The ISM manufacturing index narrowly remained in expansion territory, despite some early signs of virus-related supply disruptions, while survey data for the service sector provided conflicting signals.

- Friday’s jobs report reiterated the health of the economy in February, with employers adding 273K jobs. The report, however, seems almost stale in the face of the ongoing outbreak.

Global - Tumultuous Week for the Global Economy

- It was a tumultuous week for the global economy, as concerns continued to grow about the economic and human impact from the spread of COVID-19.

- On Tuesday, finance ministers and central bankers from the G-7 group of nations held a conference call to discuss possible economic policy responses to disruptions caused by the virus.

- Outside of the Federal Reserve, only two major developed market central banks took action this week. Both the Reserve Bank of Australia and the Bank of Canada cut their policy rates, by 25 and 50 bps, respectively.

This Week's State Of The Economy - What Is Ahead? - 24 January 2020

Wells Fargo Economics & Financial Report / Jan 25, 2020

Fears of an escalating coronavirus outbreak reached the United States this week, as a Washington state man became the first confirmed domestic case and the international total reached more than 800.

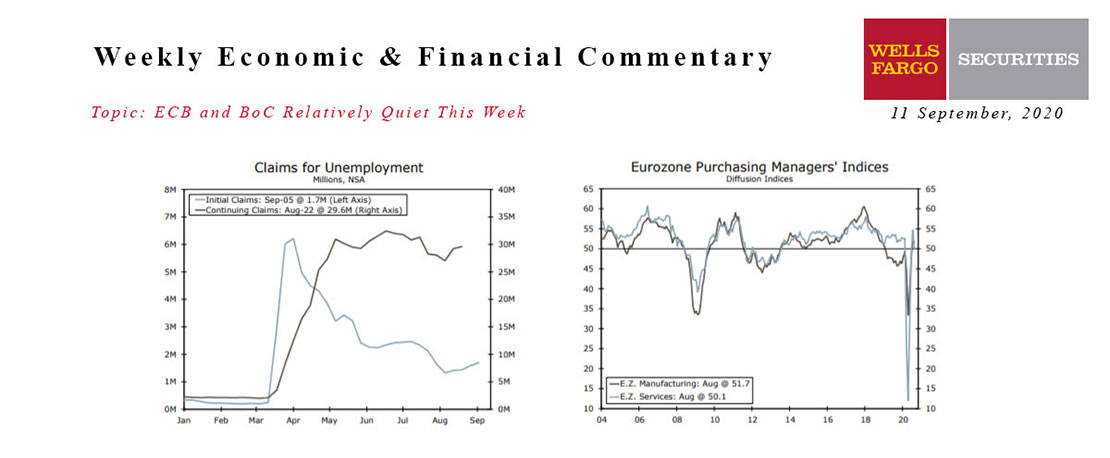

This Week's State Of The Economy - What Is Ahead? - 11 September 2020

Wells Fargo Economics & Financial Report / Sep 14, 2020

In the holiday-shortened week, analysts’ attention remained on the progress of the labor market. Recent jobless claims data remain stubbornly high and point to a slowing jobs rebound.

This Week's State Of The Economy - What Is Ahead? - 27 August 2021

Wells Fargo Economics & Financial Report / Aug 30, 2021

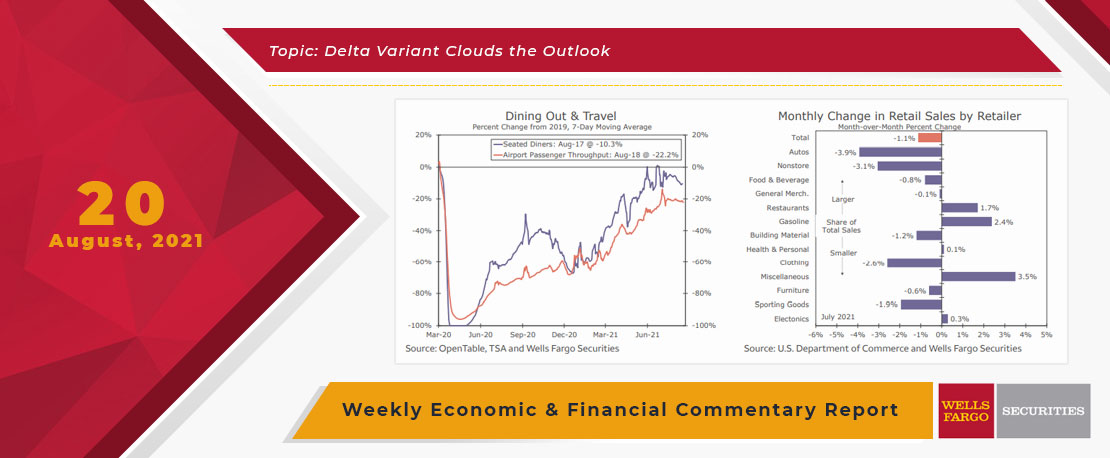

In other economic news, output continues to ramp up across the U.S., even as the resurgence in COVID cases is leading to some pullback in consumer engagement.

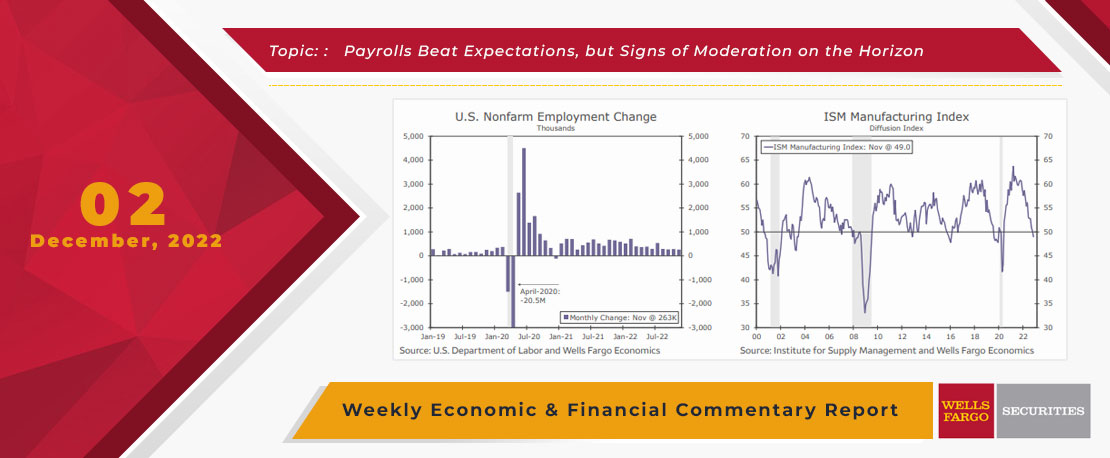

This Week's State Of The Economy - What Is Ahead? - 02 December 2022

Wells Fargo Economics & Financial Report / Dec 08, 2022

Total payrolls rose by 263K in November, with the unemployment rate holding steady at 3.7% and average hourly earning rising by 0.6%.

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

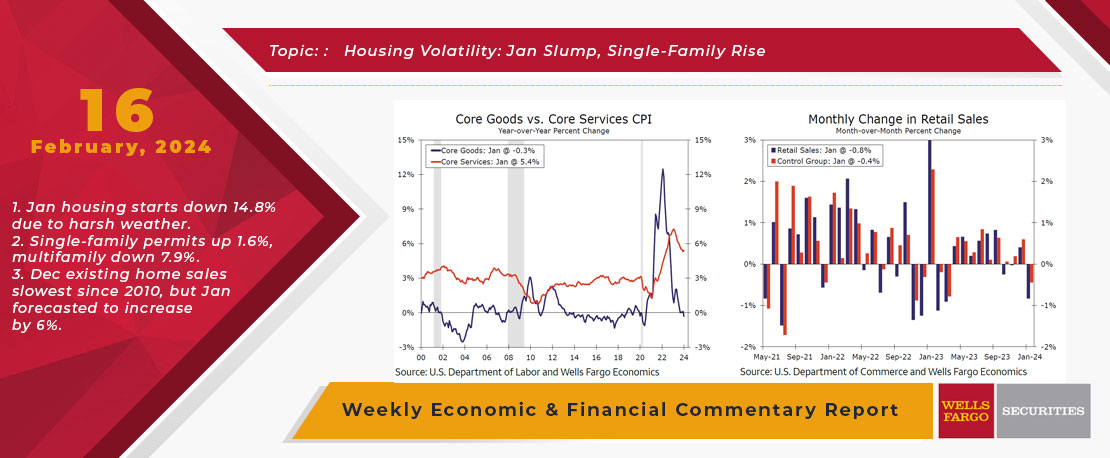

This Week's State Of The Economy - What Is Ahead? - 16 February 2024

Wells Fargo Economics & Financial Report / Feb 20, 2024

The out-of-consensus start to the year for economic data continued with a slip in retail sales and industrial production followed by a startling 14.8% drop in housing starts during January.

This Week's State Of The Economy - What Is Ahead? - 16 September 2022

Wells Fargo Economics & Financial Report / Sep 20, 2022

Financial markets reacted in a zig-zag pattern to this week\'s economic data ahead of the next FOMC meeting. Price pressure is still not showing the sustained slowdown the Fed needs before it takes its foot off the throttle of tighter policy.

This Week's State Of The Economy - What Is Ahead? - 29 September 2023

Wells Fargo Economics & Financial Report / Oct 02, 2023

On the housing front, new home sales dropped more than expected in August, though an upward revision to July results left us about where everyone expected us to be year-to-date.

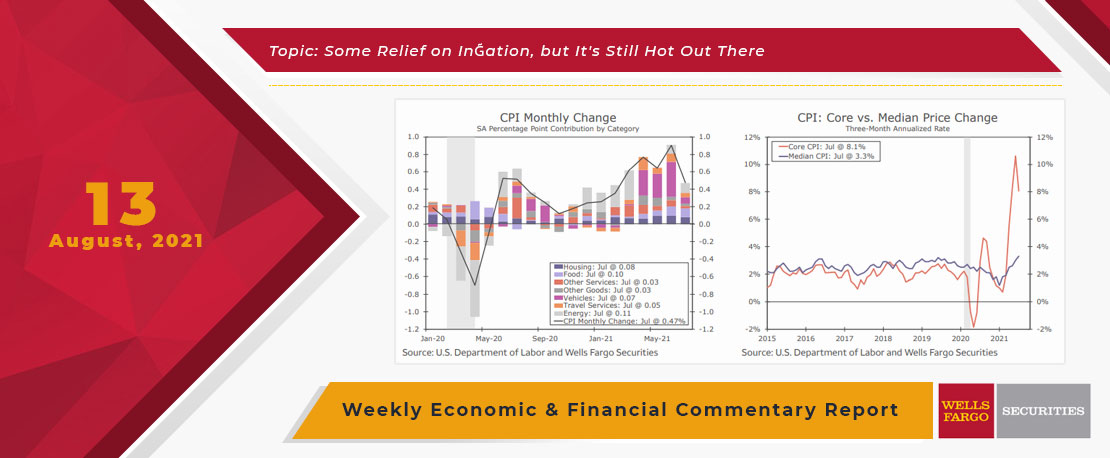

This Week's State Of The Economy - What Is Ahead? - 13 August 2021

Wells Fargo Economics & Financial Report / Aug 19, 2021

The general outlook remains positive as households have accumulated over $2T in excess savings on their balance sheets and net worth has risen across all income groups.

This Week's State Of The Economy - What Is Ahead? - 03 September 2021

Wells Fargo Economics & Financial Report / Sep 10, 2021

e move into the Labor Day weekend celebrating the 235K jobs added in August, while simultaneously lamenting that it was about half a million jobs short of expectations.