U.S. - Labor Focus

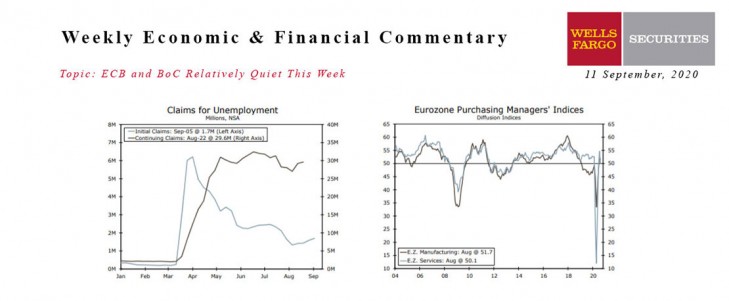

- In the holiday-shortened week, analysts’ attention remained on the progress of the labor market. Recent jobless claims data remain stubbornly high and point to a slowing jobs rebound.

- Aside from claims, inflation data were also a highlight this week. Prices continued to pick up in August, but we expect it will be quite some time before inflation consistently exceeds 2%, preventing the Fed from lifting interest rates anytime soon.

- In our updated forecast this week, we released our initial estimates for 2022. At a high level, we expect the U.S. economy to grow above trend at 2.7% in 2022. For further details on our latest forecast, please see attached our Monthly Economic Outlook.

Global - ECB and BoC Relatively Quiet This Week

- It was a relatively quiet meeting for policymakers at the European Central Bank (ECB) this week. The policy statement was almost a verbatim copy of July’s and President Lagarde mainly toed the line in her comments.

- We remain constructive on the Euro zone recovery, but we will be watching the recent COVID-19 outbreak and the government responses very closely in the weeks ahead.

- The Bank of Canada (BoC) also met this week, and like the ECB it mostly left monetary policy unchanged. The central bank noted that the “bounce-back in activity in the third quarter looks to be faster than anticipated in July.”

This Week's State Of The Economy - What Is Ahead? - 09 June 2023

Wells Fargo Economics & Financial Report / Jun 14, 2023

An unexpected spike in jobless claims is a sign that cracks are forming in the labor market. Higher mortgage rates look to be hindering a housing market rebound.

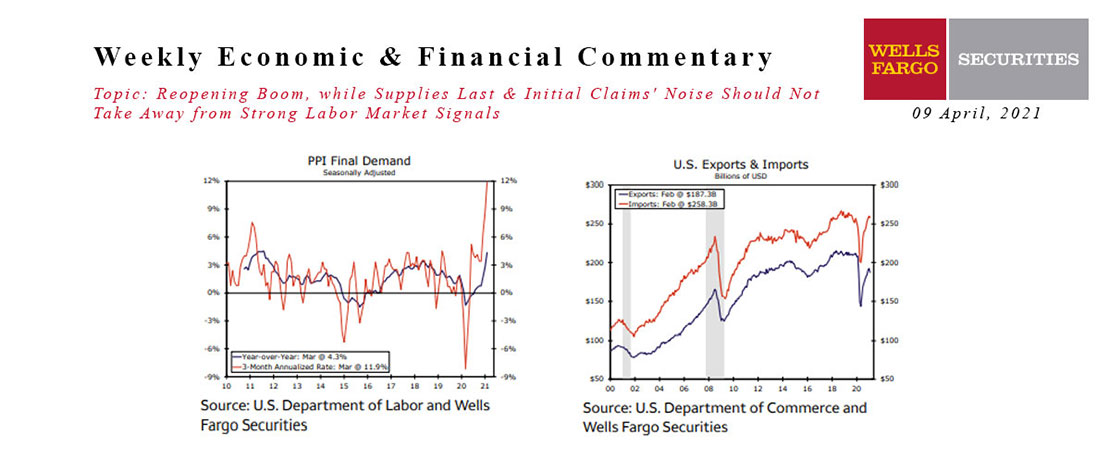

This Week's State Of The Economy - What Is Ahead? - 09 April 2021

Wells Fargo Economics & Financial Report / Apr 10, 2021

This week\'s economic data kicked of with a bang. The ISM Services Index jumped more than eight points to 63.7, signaling the fastest pace of expansion in the index\'s 24-year history.

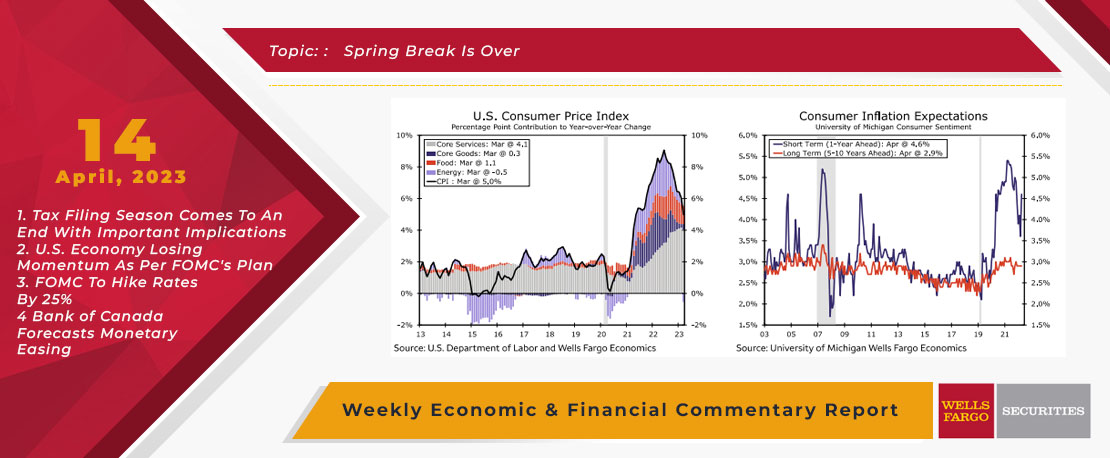

This Week's State Of The Economy - What Is Ahead? - 14 April 2023

Wells Fargo Economics & Financial Report / Apr 20, 2023

In March retail sales fell 1.0%, manufacturing production slipped 0.5% and the consumer price index rose a modest 0.1%.

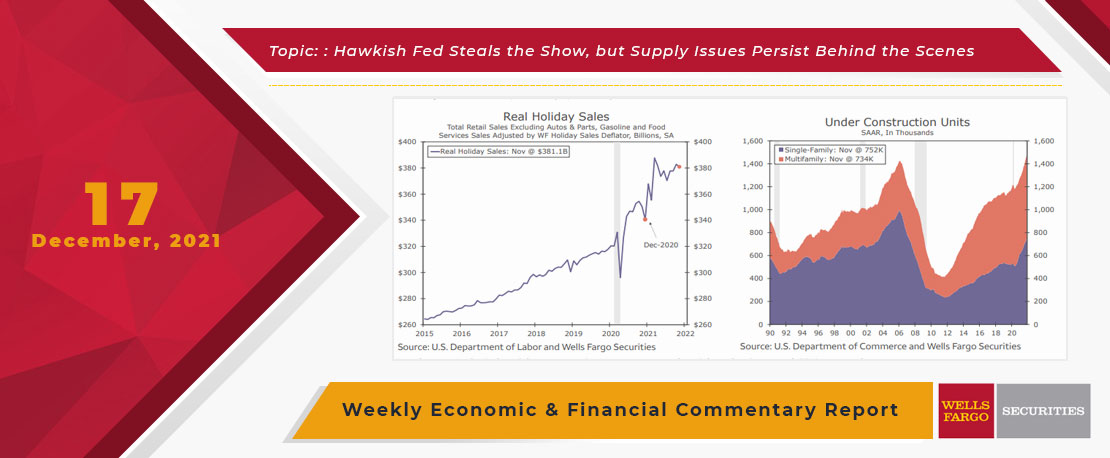

This Week's State Of The Economy - What Is Ahead? - 17 December 2021

Wells Fargo Economics & Financial Report / Dec 21, 2021

7 Interest Rate Watch for more detail. In other news, retail sales data disappointed as higher prices factor into spending and industrial activity continued to recover but remains beset by supply issues.

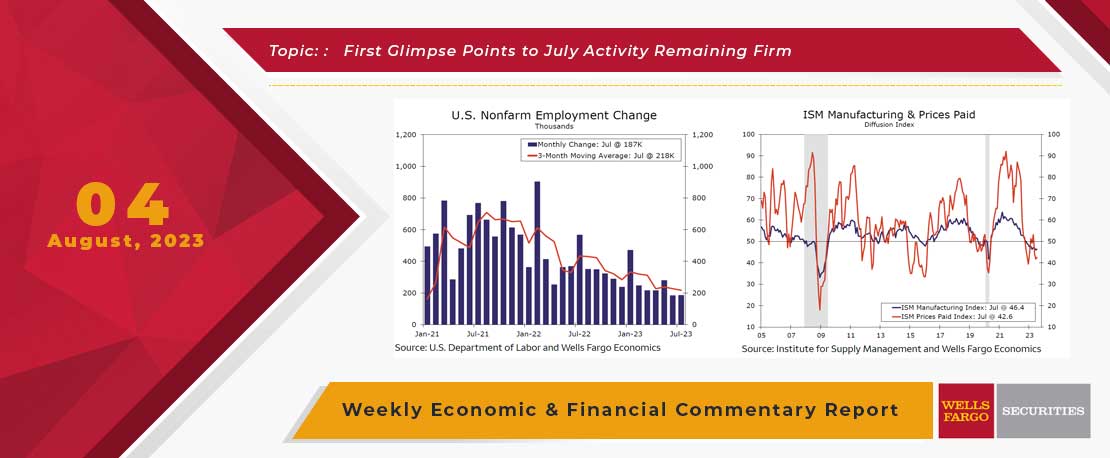

This Week's State Of The Economy - What Is Ahead? - 04 August 2023

Wells Fargo Economics & Financial Report / Aug 09, 2023

Employment growth was broad-based, though reliant on a 87K gain in health care & social assistance. Modest gains from construction, financial activities and hospitality also contributed to private sector job growth.

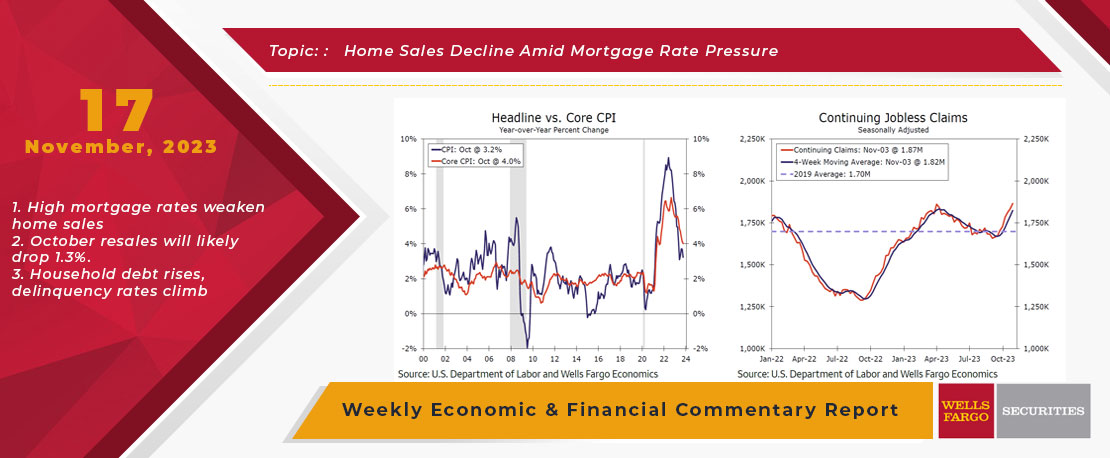

This Week's State Of The Economy - What Is Ahead? - 17 November 2023

Wells Fargo Economics & Financial Report / Nov 23, 2023

Retail and Industrial activity were stronger than the headline data suggest, there are also some signs of weakening.

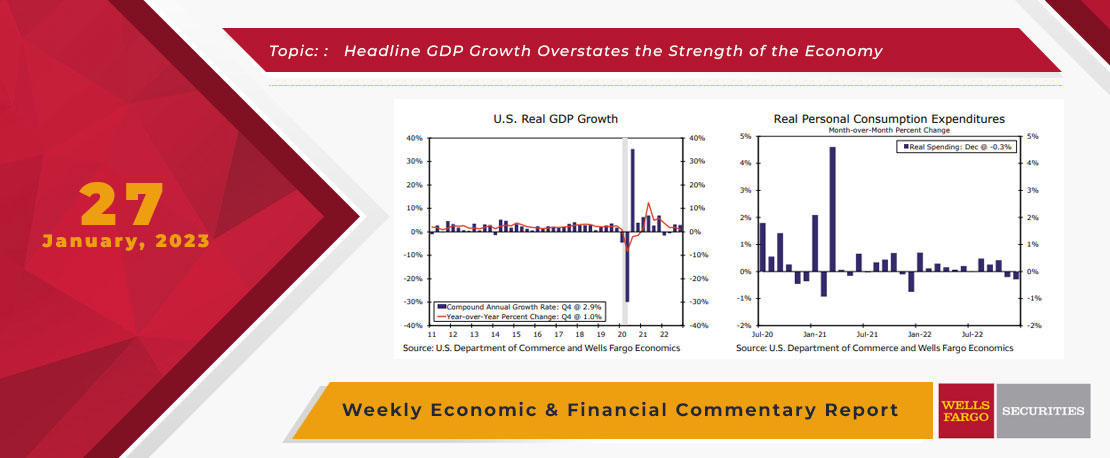

This Week's State Of The Economy - What Is Ahead? - 27 January 2023

Wells Fargo Economics & Financial Report / Jan 28, 2023

Real GDP expanded at a 2.9% annualized pace in Q4. While beating expectations, the underlying details were not as encouraging. Moreover, the weakening monthly indicator performances to end the year suggest the decelerating trend will continue in Q1.

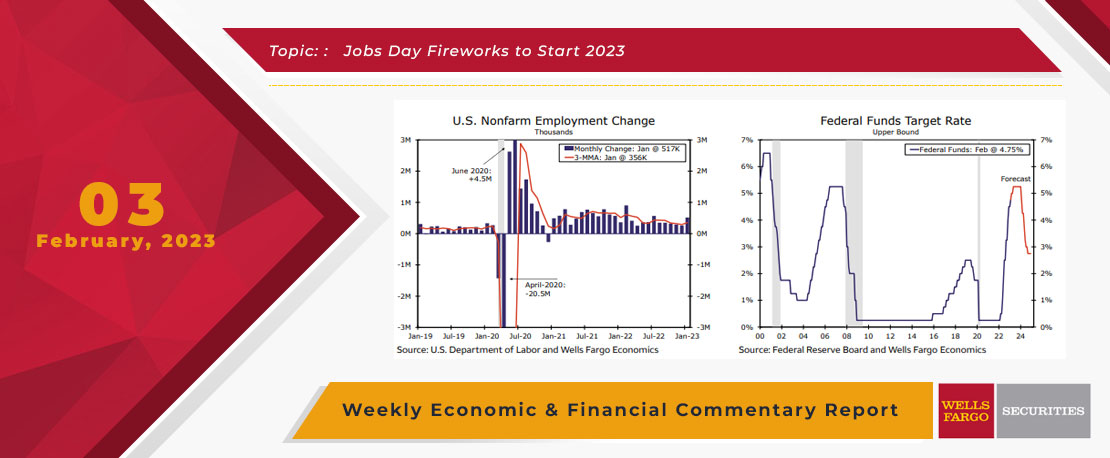

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

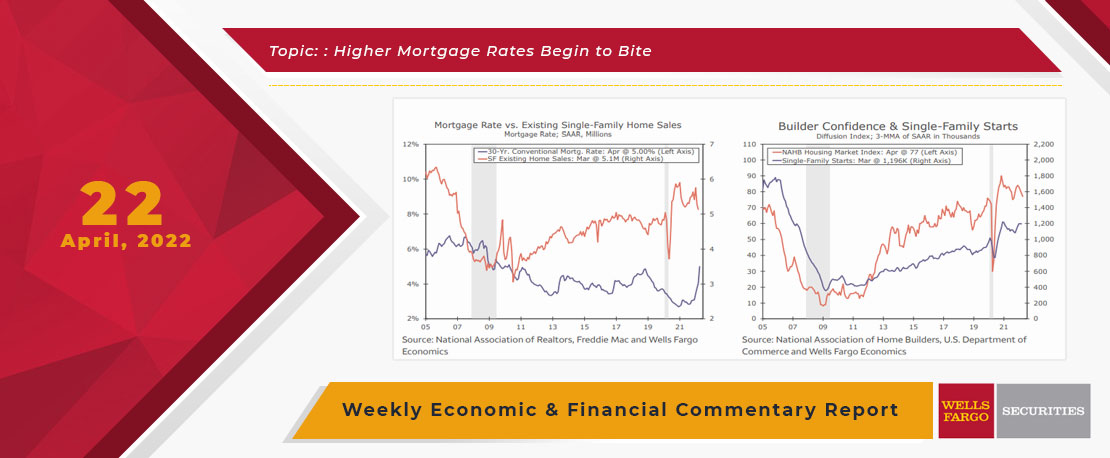

This Week's State Of The Economy - What Is Ahead? - 22 April 2022

Wells Fargo Economics & Financial Report / Apr 27, 2022

I’ll wish you a Happy Earth Day anyway. Don’t expect a card this year. While the Earth continues to thankfully revolve at a steady rate, rising mortgage rates appear to be slowing residential activity

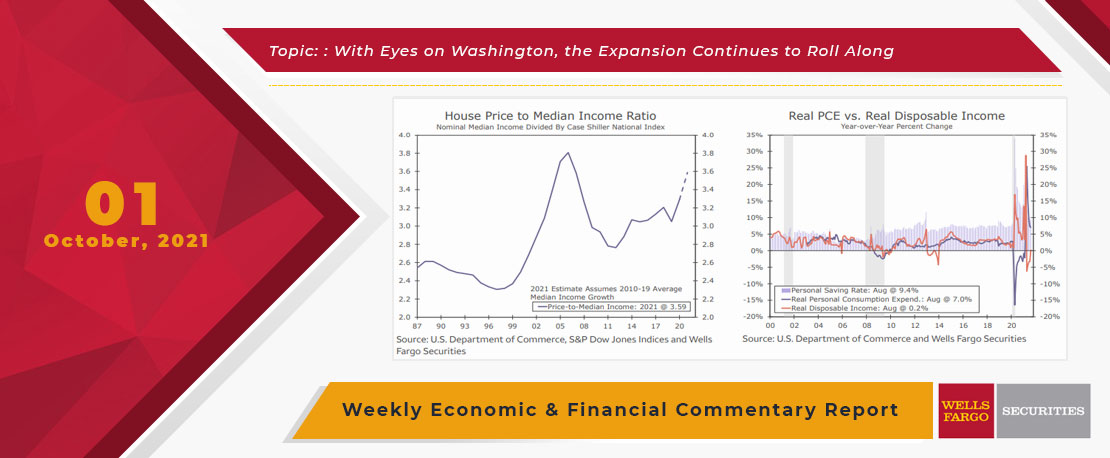

This Week's State Of The Economy - What Is Ahead? - 01 October 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

Economic data this week indicated that the ongoing expansion still has some momentum despite some familiar headwinds, though this week\'s releases were largely overshadowed by a busy week on Capitol Hill.