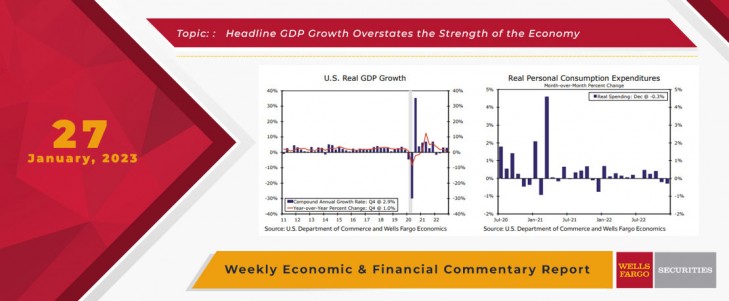

Despite the Beat, Q4 GDP Conceals Slowing Economic Momentum

At first glance, this week's GDP report revealed that the U.S. economy expanded at an above-trend pace in the fourth quarter. Underlying details, however, were less encouraging than the stronger-than-expected headline gain. When combined with the waning performance of recently monthly data, the Q4 GDP report suggests that the U.S. economy ended last year with a distinct loss of momentum that is likely to carry through into 2023.

Real GDP expanded at an annualized pace of 2.9% in the fourth quarter relative to the third quarter. This marks the second straight quarter of above-trend growth, as real GDP increased at a 3.2% pace in Q3. On a year-over-year basis, however, real GDP growth moderated to a 1.0% pace, down substantially from the 5.7% rate registered in Q4 2021.

The composition of fourth quarter growth was not nearly as strong as the headline figure would suggest. As businesses added nearly $130 billion to their stocks, the inventory build contributed a stronger-than-expected 1.5 percentage points to top-line growth, reflecting, in part, strength in manufacturing, mining and utilities. We are mindful that this inventory build could be unintended and, therefore, presents downside risk in Q1. Another surprise was net exports, which added 0.6 percentage points to headline GDP. Exports fell 1.3% reflecting deteriorating external demand, while imports declined 4.6% amid the ongoing deterioration in domestic demand for goods from abroad. Government outlays registered another solid performance in Q4, up 3.7%, with gains in both federal and local spending.

A better measure of underlying demand is real final sales to private domestic purchasers. Comprised of consumer spending and business fixed investment, this component represents the core part of the economy that is targeted by monetary policy. Real personal consumption expenditures increased at a healthy 2.1% annualized pace, with the strongest gains coming in services. Spending on "other" services (notably international travel), restaurant dining and health care led the way, suggesting consumers are not done yet making up for experiences held off during the pandemic. Unfortunately, consumer spending's pace was front-loaded in the quarter and does not truly reflect the underlying trend. On a monthly basis, real consumer spending contracted in December (-0.3%) and November (-0.2%), following a solid gain in October (0.4%) (chart). This weakening performance suggests that higher interest rates are taking a bigger toll on the all-important U.S. consumer. Moreover, the weakness exhibited at the end of 2022 places consumer spending growth on an uphill battle in Q1.

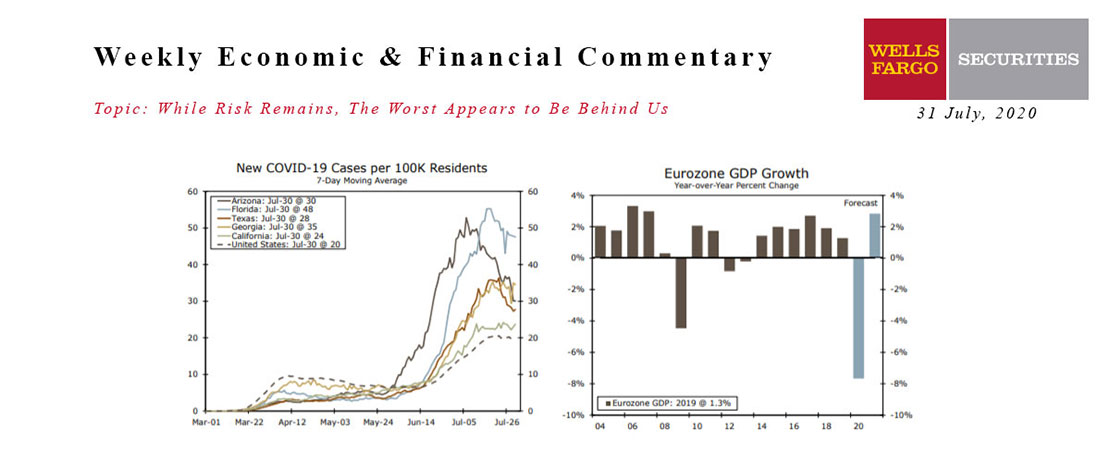

This Week's State Of The Economy - What Is Ahead? - 31 July 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

The resurgence in COVID-19 in much of the Sun Belt appears to have topped out, although cases are rising faster in some smaller mid-Atlantic states and in parts of Europe, Asia and Australia.

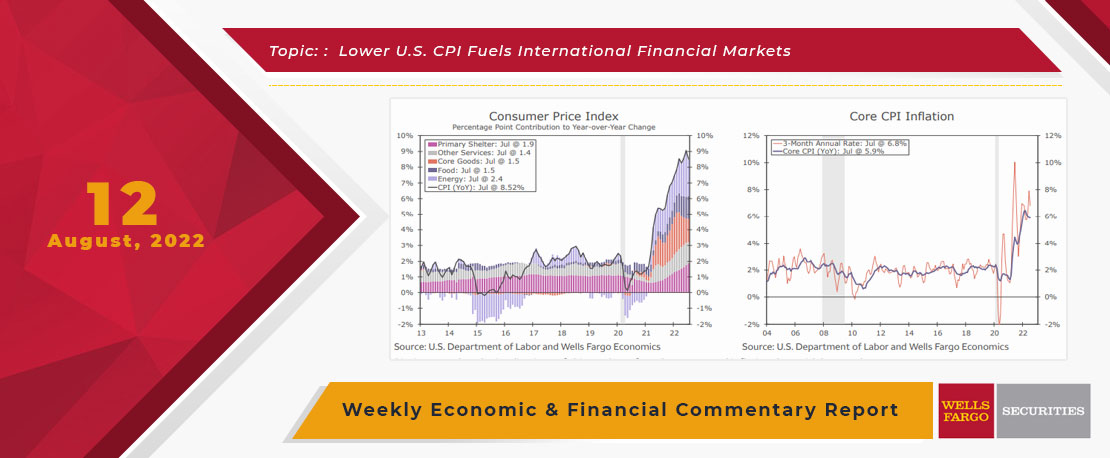

This Week's State Of The Economy - What Is Ahead? - 12 August 2022

Wells Fargo Economics & Financial Report / Aug 13, 2022

The FOMC has made it clear that it needs to see inflation slowing on a sustained basis before pivoting from its current stance. The data seems to be going in multiple directions all at once.

This Week's State Of The Economy - What Is Ahead? - 17 May 2024

Wells Fargo Economics & Financial Report / May 23, 2024

The Producer Price Index (PPI) was a bit firm in April, rising 0.5% amid higher services prices, though it did come with slight downward revisions to prior month\'s data.

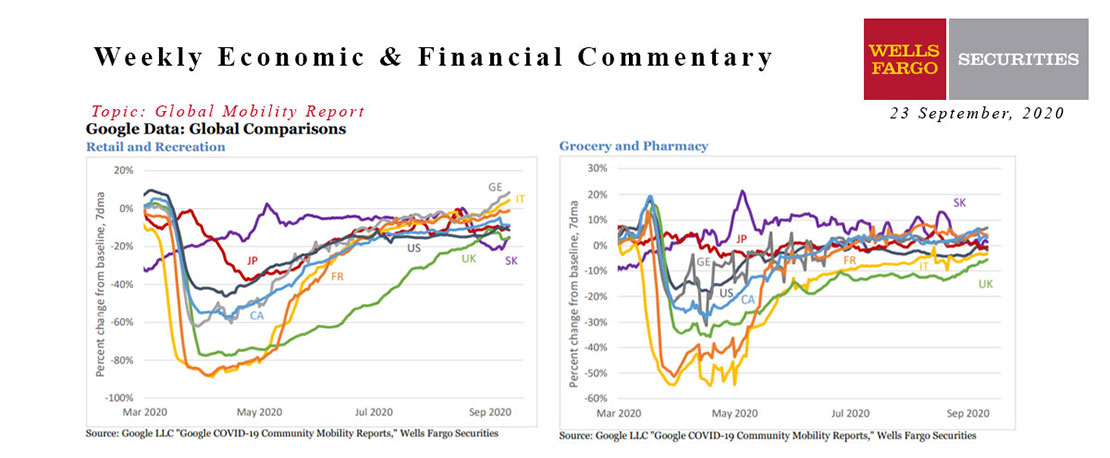

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

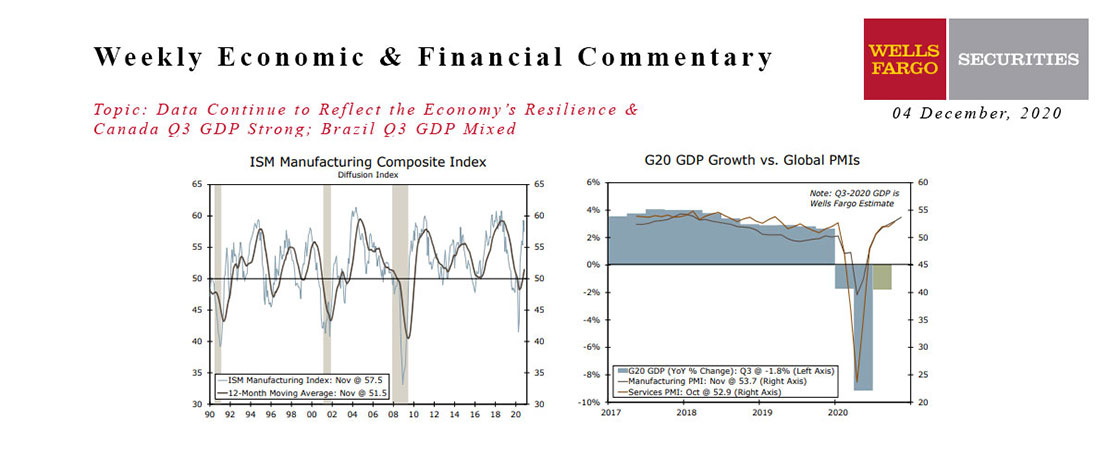

This Week's State Of The Economy - What Is Ahead? - 04 December 2020

Wells Fargo Economics & Financial Report / Dec 09, 2020

Manufacturing held up relatively well in November, despite a larger-than-expected dip in the ISM manufacturing survey. The nonfarm manufacturing survey rose slightly.

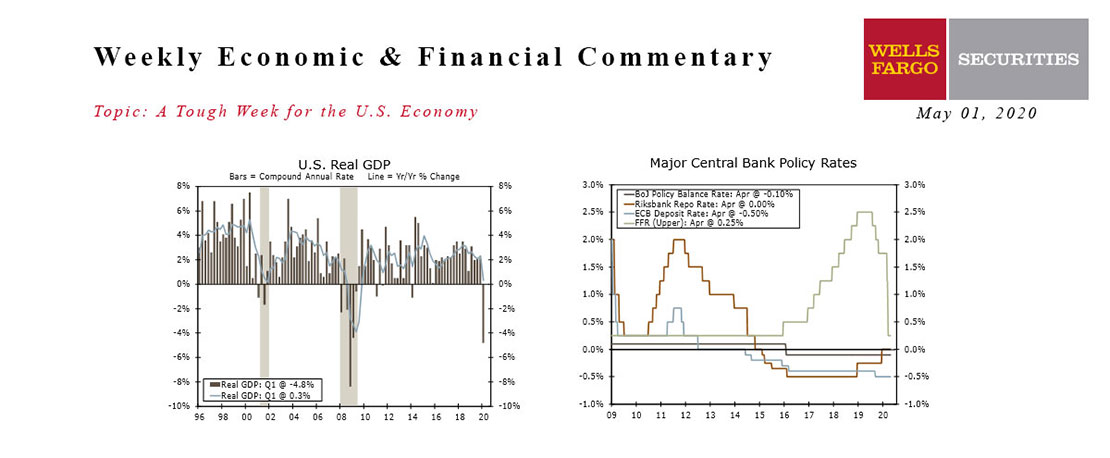

This Week's State Of The Economy - What Is Ahead? - 01 May 2020

Wells Fargo Economics & Financial Report / May 04, 2020

U.S. GDP declined at an annualized rate of 4.8% in the first quarter, only a hint of what is to come in the second quarter.

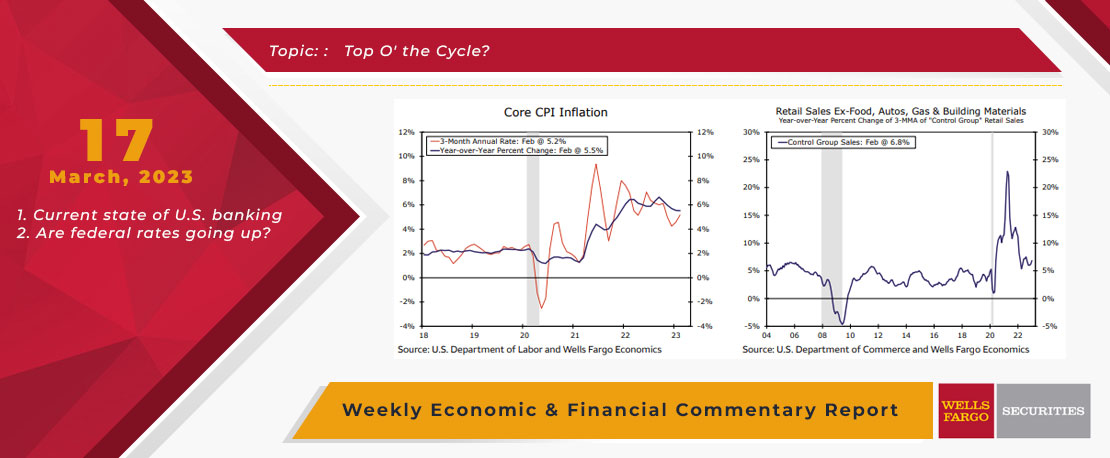

This Week's State Of The Economy - What Is Ahead? - 17 March 2023

Wells Fargo Economics & Financial Report / Mar 21, 2023

Retail sales declined 0.4% during February, while industrial production was flat (0.0%). Housing starts and permits jumped 9.8% and 13.8%, respectively.

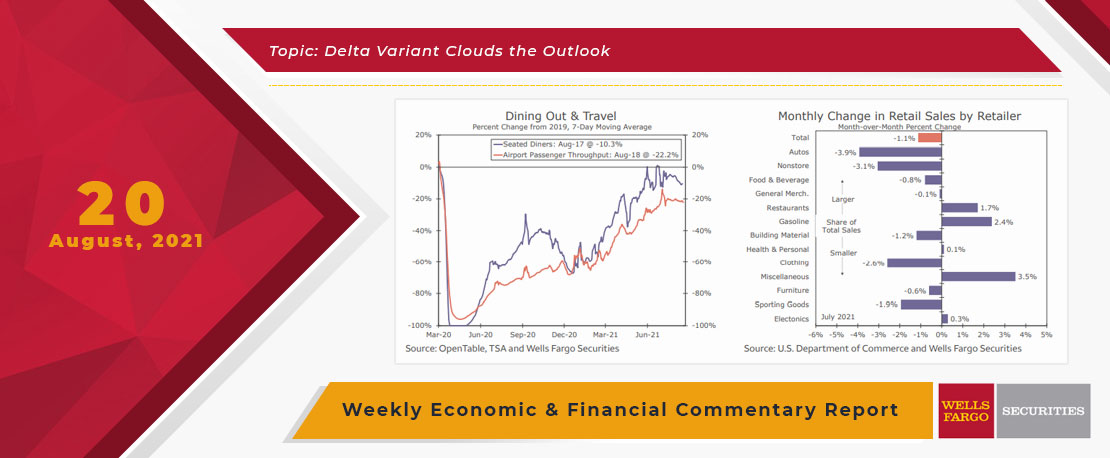

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

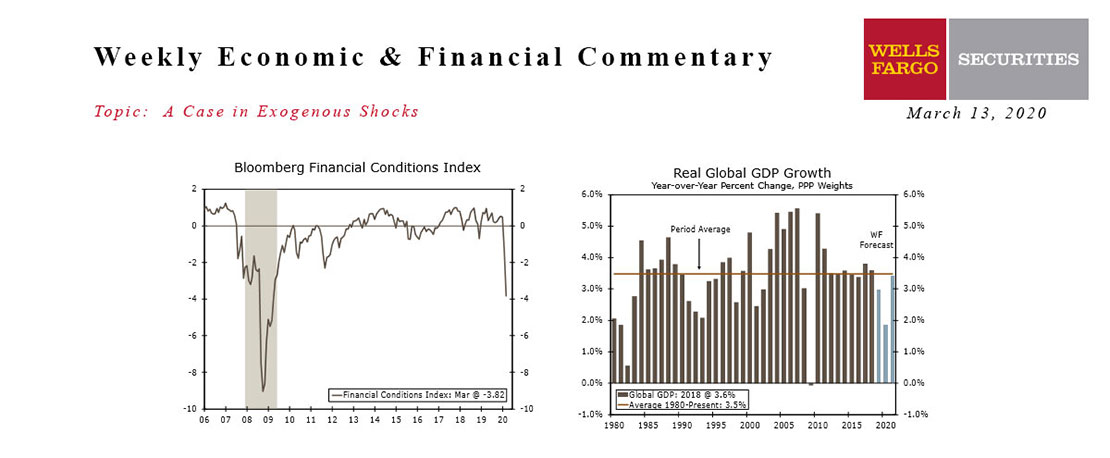

This Week's State Of The Economy - What Is Ahead? - 13 March 2020

Wells Fargo Economics & Financial Report / Mar 14, 2020

Financial conditions tightened sharply this week as concerns over the coronavirus and the economic fallout of containment efforts mounted.

This Week's State Of The Economy - What Is Ahead? - 31 May 2024

Wells Fargo Economics & Financial Report / Jun 04, 2024

Markets digested a light lineup of economic data on the holiday-shortened week. The second look at first quarter GDP revealed an economy increasingly pressured by high interest rates as headline growth was revised lower.