There was no shortage of economic data this week, but little did much to change the macro landscape. We got a fresh report on producer and consumer prices for April, which showed a step in the right direction for inflation after a hot first quarter of price growth. Retail sales came in a touch soft, but we anticipate that was more monthly noise than the start of the end of consumer momentum. And April industrial production and housing starts data both showed sectors constrained by elevated rates. The economic data continue to be broadly consistent with an economy that is growing at a modest clip despite still-elevated price pressures and tighter policy.

The inflation data received increased attention as analysts try and pinpoint when and if the Fed will begin to ease policy later this year. The Producer Price Index (PPI) was a bit firm in April, rising 0.5% amid higher services prices, though it did come with slight downward revisions to prior month's data. In terms of consumer prices, both the headline and core (excluding food and energy) Consumer Price Index (CPI) rose 0.3% in April, which drove the year-ago rates lower to 3.4% and 3.6%, respectively (chart). The year-over-year Core CPI now sits at a three-year low. The composition of inflation was also more favorable last month amid an easing in “super core” (services excluding primary shelter) inflation. Even as the slowdown in services inflation remains painfully slow, it resumed in April with core services prices up 0.4%, matching the Q4-2023 pace.

This week's data suggest a more modest reading (~0.25%) from the Fed's preferred consumer inflation metric (the PCE deflator). On balance, we expect the April inflation data should help restore some confidence that price growth is continuing to moderate through the month-to-month noise. But we believe we'll need to see a string of solid inflation reports to help induce the first rate cut.

Inflation may be softening, but price growth compounds for households and the inflationary environment is one of many reasons to be skeptical about the sustainability of consumer spending. Retail sales came in flat in April and the control group measure, which excludes key components and feeds into the BEA's measure of goods spending in the GDP accounting, slid 0.3% (chart). But this weak outturn came after an unusually-strong spending environment in March, and while retail is our first indication of spending in a given month, it's less comprehensive in that it mostly covers goods spending, while it has rather been services consumption that has accounted for most of the growth lately. We are not reading too much into this weaker retail print.

While the consumer sector continues to hold on, the industrial sector can't find its legs. Industrial production also came in flat in April, but that was due to a weather-related pop in utilities. The three-tenths drop in manufacturing output is more telling of current conditions. Demand remains constrained amid elevated borrowing costs and tighter credit conditions, which we expect to keep manufacturing in its narrow range for some time. There's a similar dynamic happening in the residential housing market. While underlying demand isn't necessarily the problem here, elevated rates are discouraging builders from new construction and eroding affordability. Housing starts rose 5.7% in April, but that gain was due entirely to a spurt of new multifamily development, which is highly volatile on a month-to-month basis and remains set on a downward trend.

We still look for the first cut from the FOMC to come at its September meeting, though the timing of easing is highly dependent on the incoming data. Any additional bumps on the inflation road would likely push that timing back, absent a marked deterioration in the labor market. But if the Fed begins to gradually lower rates later this year, we expect that to be supportive of manufacturing activity and new home construction. We'll just have to wait and see how the data evolve.

This Week's State Of The Economy - What Is Ahead? - 21 January 2022

Wells Fargo Economics & Financial Report / Jan 24, 2022

The Texans have earned a top draft position yet again, the Cowboys are home again for the remainder of the playoffs, and inflation concerns that continue to mount, along with ongoing supply chain disruptions, are weighing on homebuilder confidence.

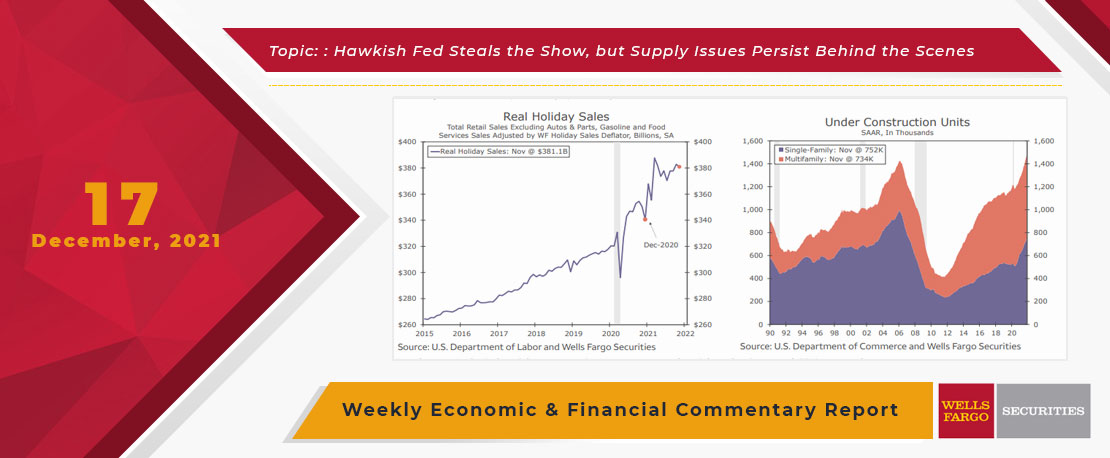

This Week's State Of The Economy - What Is Ahead? - 17 December 2021

Wells Fargo Economics & Financial Report / Dec 21, 2021

7 Interest Rate Watch for more detail. In other news, retail sales data disappointed as higher prices factor into spending and industrial activity continued to recover but remains beset by supply issues.

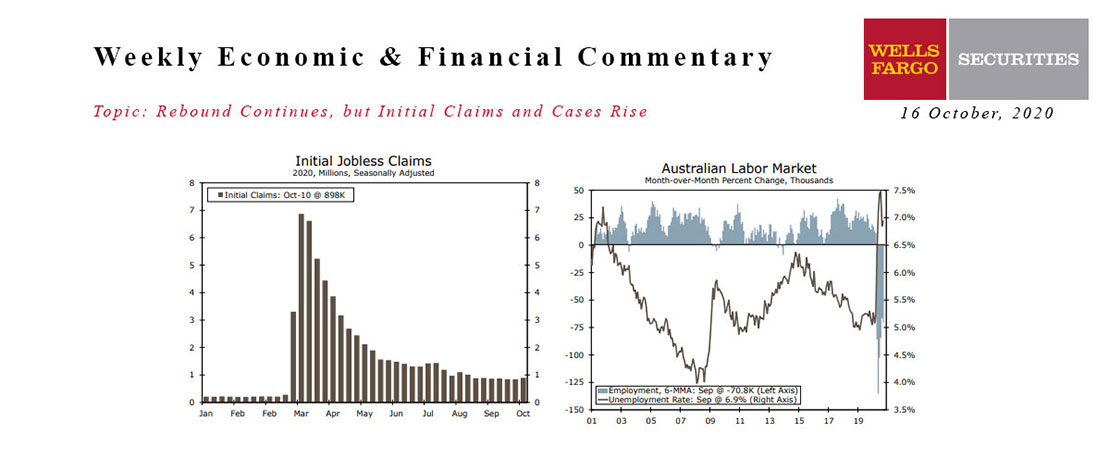

This Week's State Of The Economy - What Is Ahead? - 16 October 2020

Wells Fargo Economics & Financial Report / Oct 20, 2020

Data continue to reflect an economy digging itself out of the lockdown-induced slump.

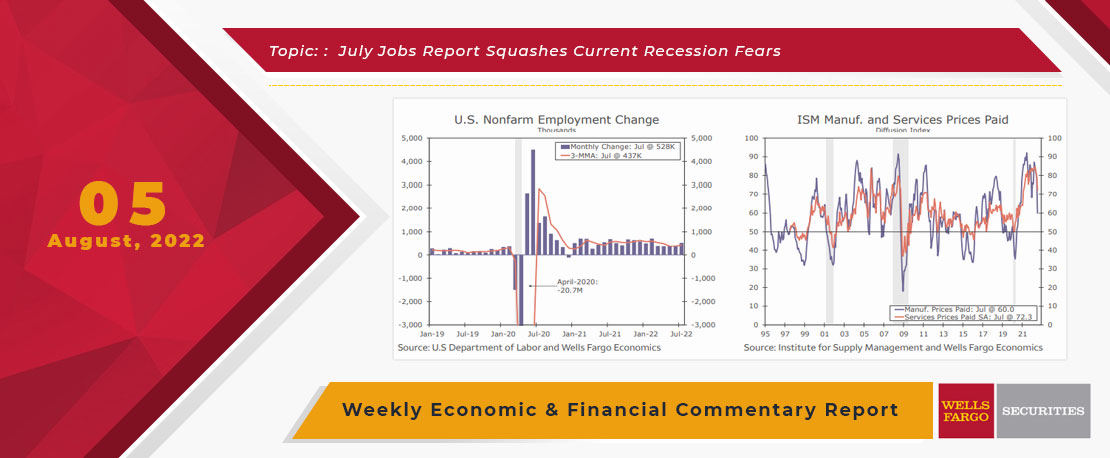

This Week's State Of The Economy - What Is Ahead? - 05 August 2022

Wells Fargo Economics & Financial Report / Aug 08, 2022

The Bureau of Labor Statistics reported this morning that nonfarm payrolls increased 528,000 for the month of July, easily topping estimates, lowering the unemployment rate to 3.5%.

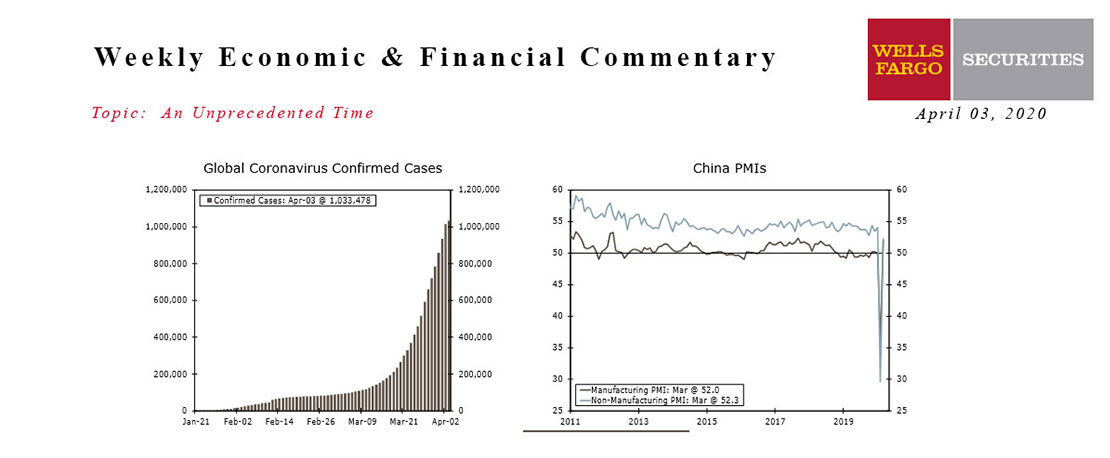

This Week's State Of The Economy - What Is Ahead? - 03 April 2020

Wells Fargo Economics & Financial Report / Apr 04, 2020

Efforts to contain the virus are leading to millions of job losses and it’s likely only a matter of time before a majority of economic data reveal unprecedented declines.

This Week's State Of The Economy - What Is Ahead? - 03 September 2021

Wells Fargo Economics & Financial Report / Sep 10, 2021

e move into the Labor Day weekend celebrating the 235K jobs added in August, while simultaneously lamenting that it was about half a million jobs short of expectations.

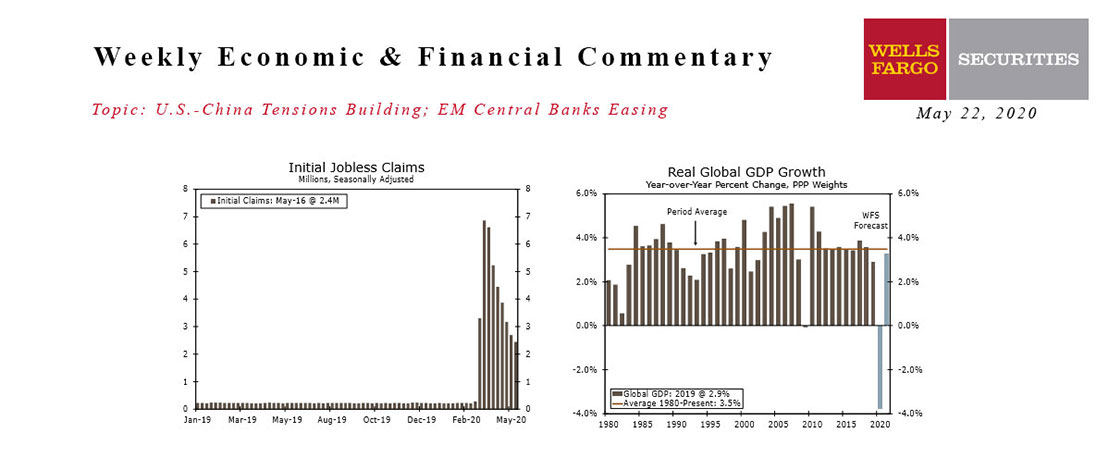

This Week's State Of The Economy - What Is Ahead? - 22 May 2020

Wells Fargo Economics & Financial Report / May 25, 2020

The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions.

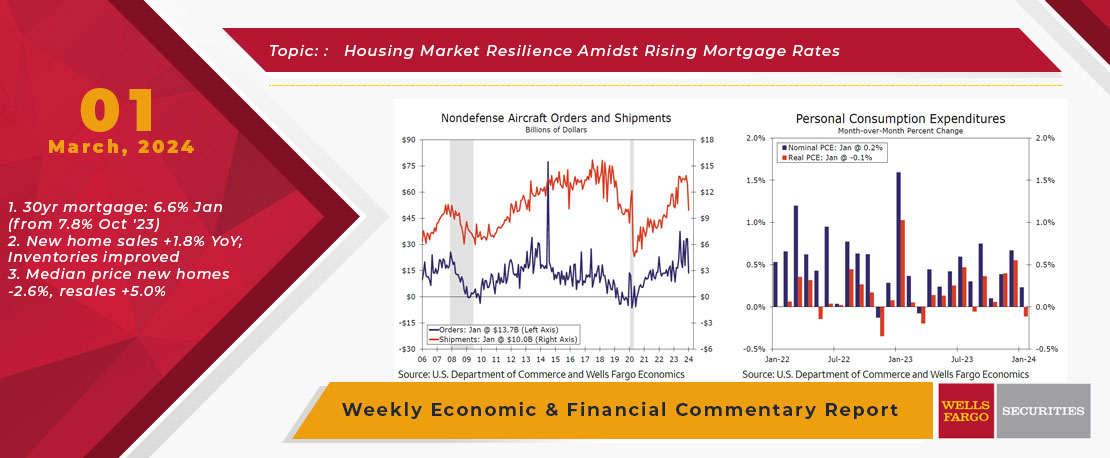

This Week's State Of The Economy - What Is Ahead? - 01 March 2024

Wells Fargo Economics & Financial Report / Mar 05, 2024

Economic data were downbeat this week, as downward revisions took some of the shine out of the marquee headline numbers. Despite the somewhat weak start to Q1, economic growth continues to trek along.

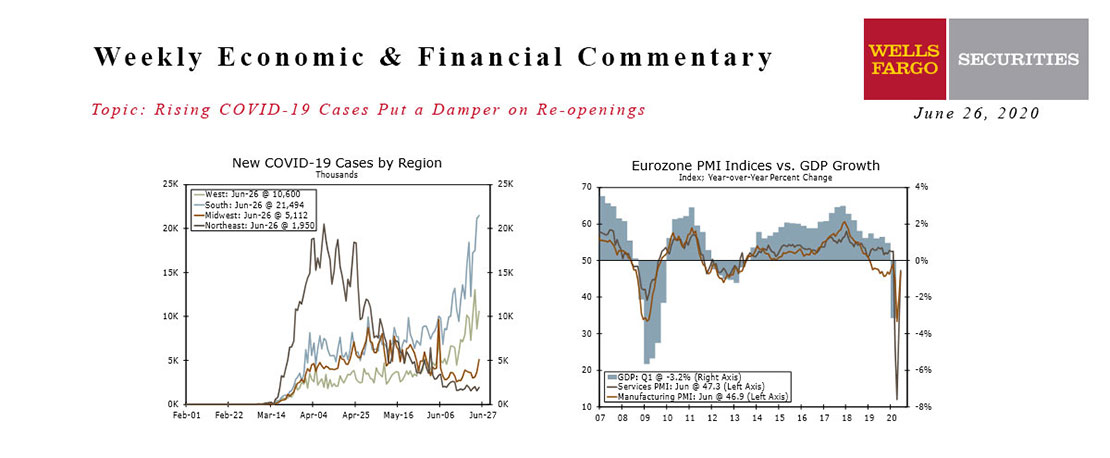

Rising COVID-19 Cases Put A Damper On Re-openings

Wells Fargo Economics & Financial Report / Jun 27, 2020

The rising number of COVID-19 infections gained momentum this week, with most of the rise occurring in the South and West. The rise in infections is larger than can be explained by increased testing alone and is slowing re-openings.

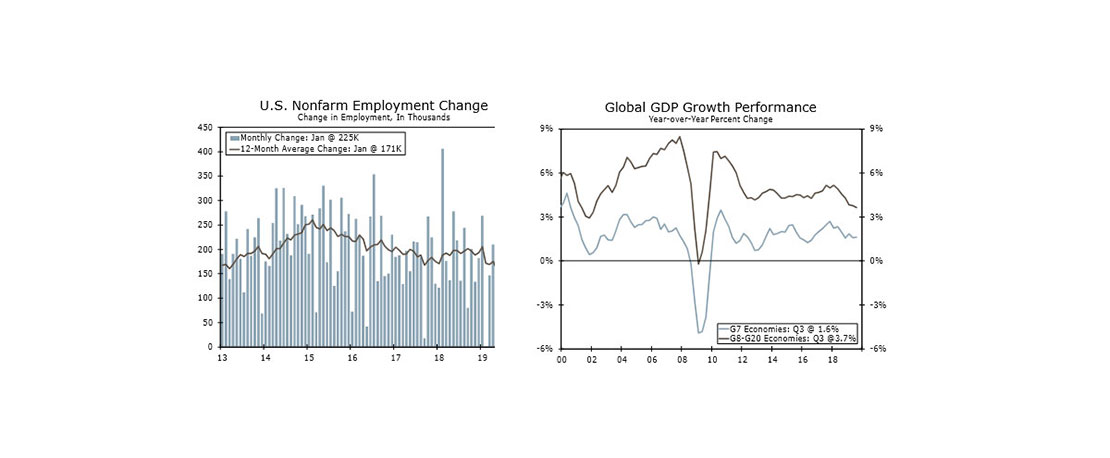

This Week's State Of The Economy - What Is Ahead? - 07 February 2020

Wells Fargo Economics & Financial Report / Feb 08, 2020

U.S. employers added 225K new workers to their payrolls in January, which handily beat expectations. But the factory sector shed jobs for the third time in four months, and net layoffs were reported for finance and retail as well.