It’s been a really quiet week for economic data, which leaves free time to ponder other things, like an article I saw this week speculating on whether it’s better to be a fan of a football organization that models consistency, like the Houston Texans (as in consistently bad), or one like the Dallas Cowboys that teases success only to rip away that hope from its fans at the last moment. Hmmm…. On the other hand, we could ponder the state of the housing market. Neither scenario is particularly original. The Texans have earned a top draft position yet again, the Cowboys are home again for the remainder of the playoffs, and inflation concerns that continue to mount, along with ongoing supply chain disruptions, are weighing on homebuilder confidence in January. In spite of that, new home construction continues to run at a robust pace. The overall shortfall of housing inventories constrained buying activity in December and pulled existing median home prices higher. See this week’s attached Commentary for more insightful analysis of domestic and international economic trends and the ever-popular Federal Reserve watch.

If you’re one of the three people who have somehow avoided COVID Omicron so far, wow, that’s impressive. For everyone else, have some chicken soup, Nyquil and get plenty of rest.

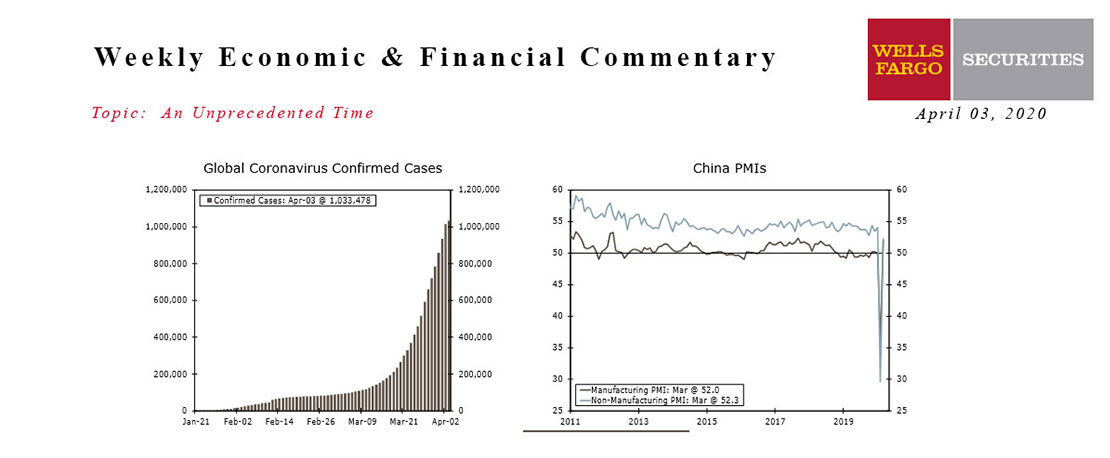

This Week's State Of The Economy - What Is Ahead? - 03 April 2020

Wells Fargo Economics & Financial Report / Apr 04, 2020

Efforts to contain the virus are leading to millions of job losses and it’s likely only a matter of time before a majority of economic data reveal unprecedented declines.

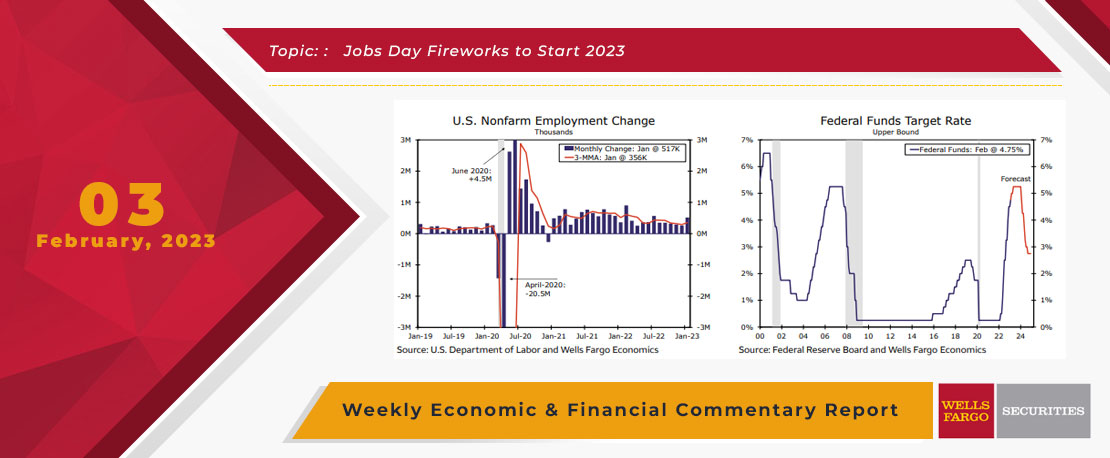

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

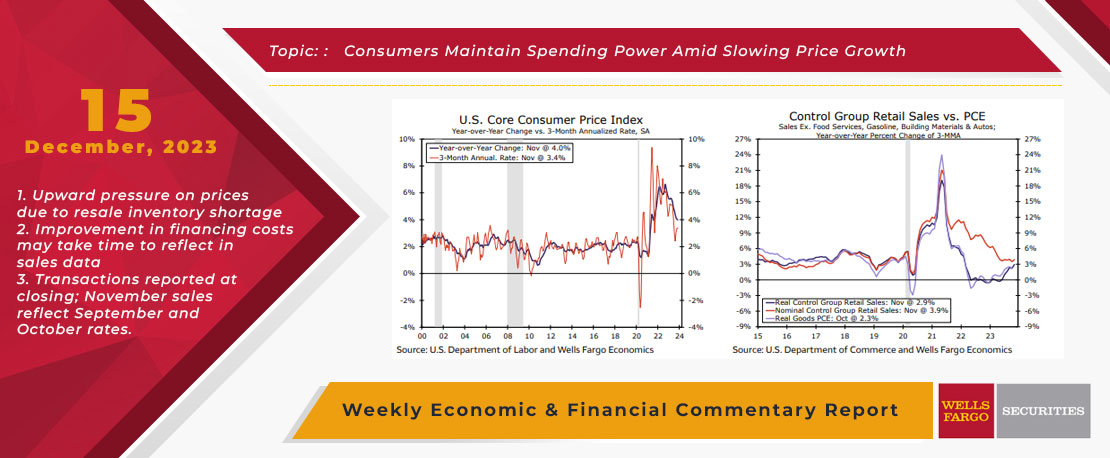

This Week's State Of The Economy - What Is Ahead? - 15 December 2023

Wells Fargo Economics & Financial Report / Dec 21, 2023

core CPI remained elevated in November at a 4.0% annual rate, a string of slower monthly prints suggests that disinflation has more room to run.

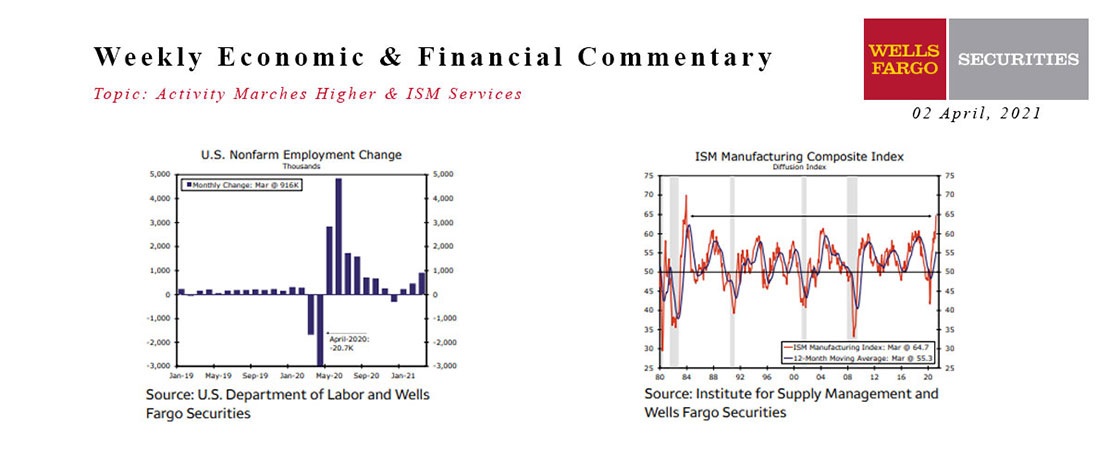

This Week's State Of The Economy - What Is Ahead? - 02 April 2021

Wells Fargo Economics & Financial Report / Apr 08, 2021

Increased vaccinations and an improving public health position led to an easing of restrictions and pickup in activity across the country in March.

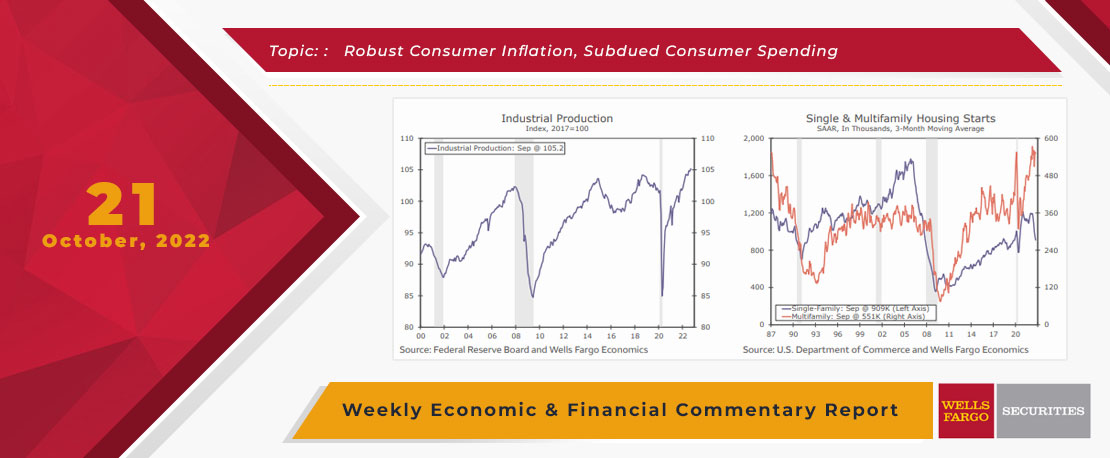

This Week's State Of The Economy - What Is Ahead? - 21 October 2022

Wells Fargo Economics & Financial Report / Oct 25, 2022

The real estate sector has been significantly affected by rising interest rates, with total housing starts falling 8.1% in September. Peering ahead, the forward-looking Leading Economic Index points to a recession in the coming year.

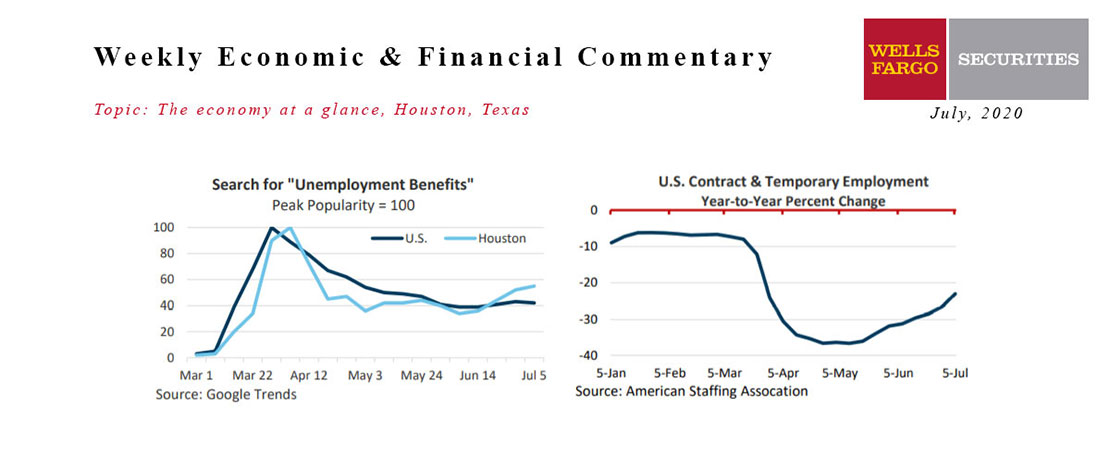

July 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jul 30, 2020

The recent surge in COVID-19 cases indicates that elected officials re-opened the economy too soon, that too many Americans are flaunting social distancing guidelines, and that the virus is likely to be around longer than we’d hoped.

This Week's State Of The Economy - What Is Ahead? - 24 January 2020

Wells Fargo Economics & Financial Report / Jan 25, 2020

Fears of an escalating coronavirus outbreak reached the United States this week, as a Washington state man became the first confirmed domestic case and the international total reached more than 800.

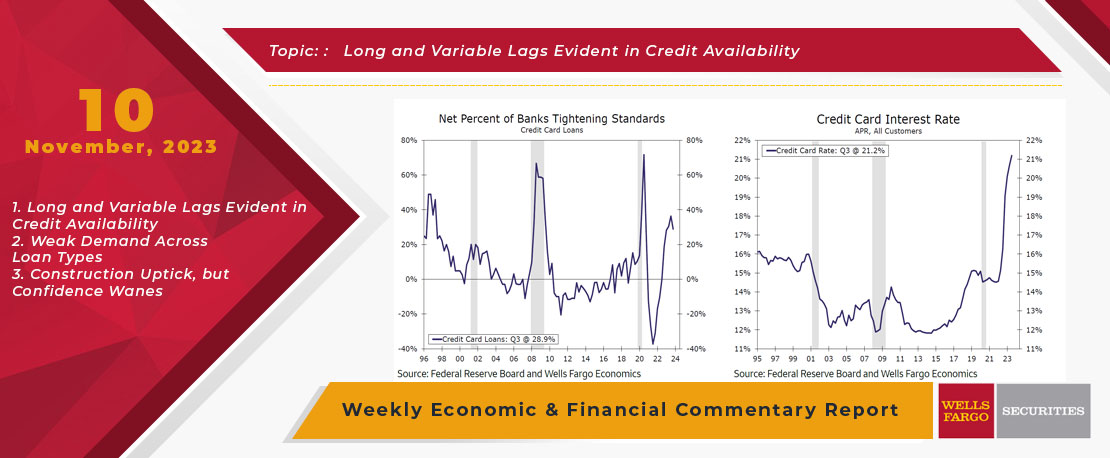

This Week's State Of The Economy - What Is Ahead? - 10 November 2023

Wells Fargo Economics & Financial Report / Nov 16, 2023

Sometimes, the impact of higher rates is quite obvious, such as the series of bank failures that occurred earlier this year.

This Week's State Of The Economy - What Is Ahead? - 24 September 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

While fears of an Evergrande default in China were rattling financial markets, for those of us in Southeast Texas who have survived the typically very hot months of July, August and September, this week brought the very welcome first early fall-like

This Week's State Of The Economy - What Is Ahead? - 21 June 2024

Wells Fargo Economics & Financial Report / Jun 25, 2024

Retail sales rose just 0.1% over the month, falling short of consensus and suggesting that consumers may finally be feeling some spending fatigue.