The phrase “long and variable lags” coined by Milton Friedman refers to the difficulty of gauging precisely when higher interest rates will negatively affect economic growth. It is a maddeningly difficult thing to measure. During a press conference following the November 2022 FOMC meeting, Federal Reserve Chair Jay Powell used the word “lag” or some variation of it a combined 17 times as he pledged policymakers’ vigilance to monitoring it.

Sometimes, the impact of higher rates is quite obvious, such as the series of bank failures that occurred earlier this year. Other times, the impact of higher rates is harder to tease out and is not measured in an objective, quantifiable way like some bellwether indicators, such as the monthly jobs number or the core rate of PCE inflation. As it weighs policy decisions, the Federal Reserve seeks to better understand these more subtle ways that higher rates can creep into the economy. One of the more widely overlooked monitoring tools is a survey, conducted by the Fed, of up to 80 large domestic banks and 24 U.S. branches and agencies of foreign banks. Because this survey is a vital input for the FOMC meetings, it is conducted quarterly so that results are available for the January/February, April/May, August and October/November FOMC meetings.

Sometimes, a performance is so electrifying it demands an encore. Known at the FOMC and among its fan base of econ enthusiasts as the Senior Loan Office Opinion Survey (or SLOOS, for short), this indicator has the rare characteristic of additional, off-cycle releases. The Federal Reserve is known to occasionally conduct one or two additional surveys throughout any given year. Questions are intended to turn over every stone in an attempt to identify those variable lags influencing policy. These include changes in the standards and terms of the banks' lending as well as the state of business and household demand for loans. The survey can, and often does, include questions on one or two other topics of current interest.

This Week's State Of The Economy - What Is Ahead? - 07 October 2020

Wells Fargo Economics & Financial Report / Oct 10, 2020

In the immediate fallout after the lockdowns in the early stages of this pandemic, there was a lot of discussion about the shape of the recovery.

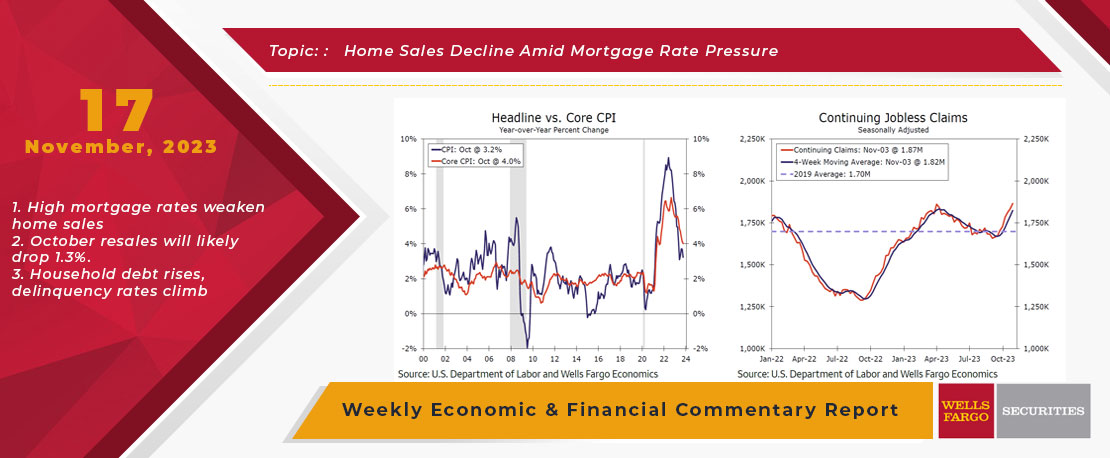

This Week's State Of The Economy - What Is Ahead? - 17 November 2023

Wells Fargo Economics & Financial Report / Nov 23, 2023

Retail and Industrial activity were stronger than the headline data suggest, there are also some signs of weakening.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

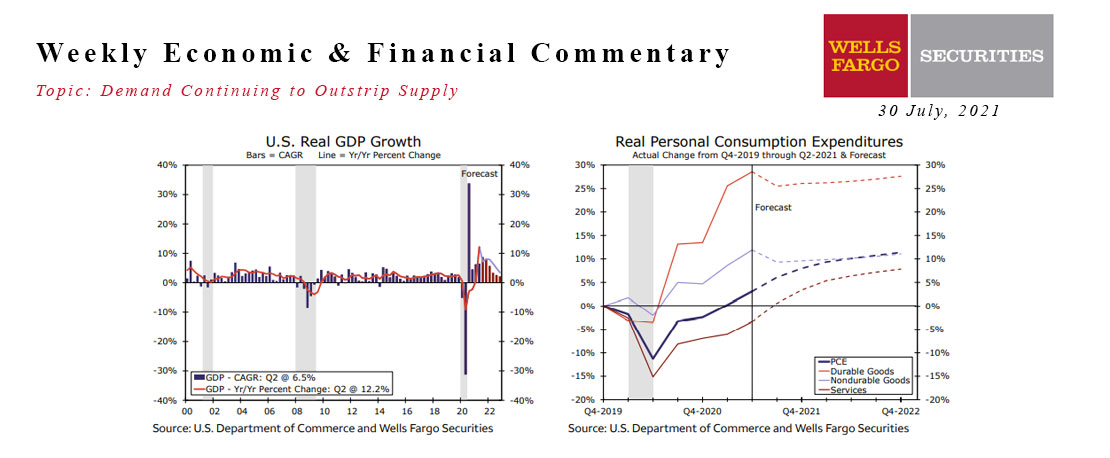

This Week's State Of The Economy - What Is Ahead? - 30 July 2021

Wells Fargo Economics & Financial Report / Aug 11, 2021

Despite a few misses on the headline numbers, economic data this week highlighted a theme of demand continuing to outstrip supply and ongoing slack in the labor market.

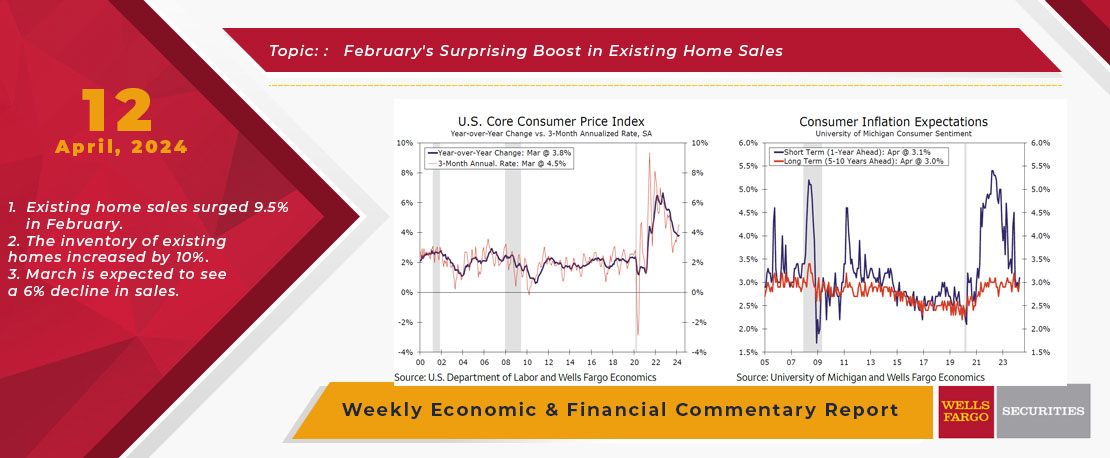

This Week's State Of The Economy - What Is Ahead? - 12 April 2024

Wells Fargo Economics & Financial Report / Apr 18, 2024

The March consumer price data dominated the economic discussion this week and are the latest to support that the timing and degree of Fed easing will be later and smaller than many of us previously expected.

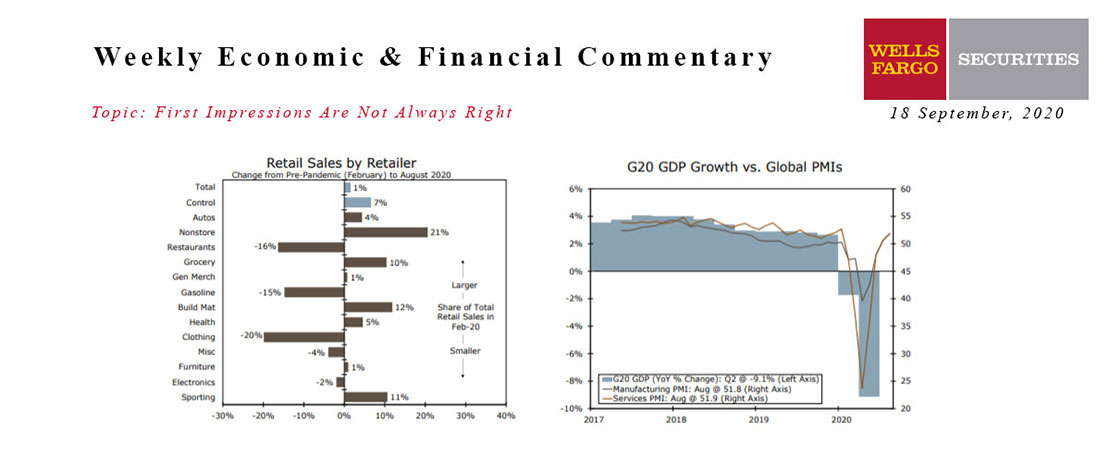

This Week's State Of The Economy - What Is Ahead? - 18 September 2020

Wells Fargo Economics & Financial Report / Sep 15, 2020

The details were generally more favorable. The retail sectors hurt most by the pandemic saw gains in August, factory output is growing and soaring homebuilder confidence suggests soft construction data this week may be transitory.

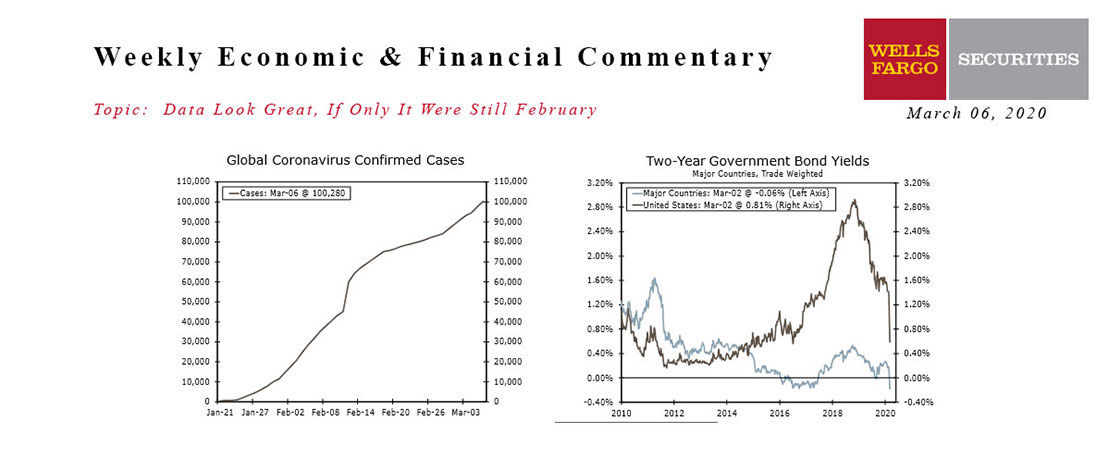

This Week's State Of The Economy - What Is Ahead? - 06 March 2020

Wells Fargo Economics & Financial Report / Mar 07, 2020

An inter-meeting rate cut by the FOMC did little to stem financial market volatility, as the number of confirmed COVID-19 cases continued to climb.

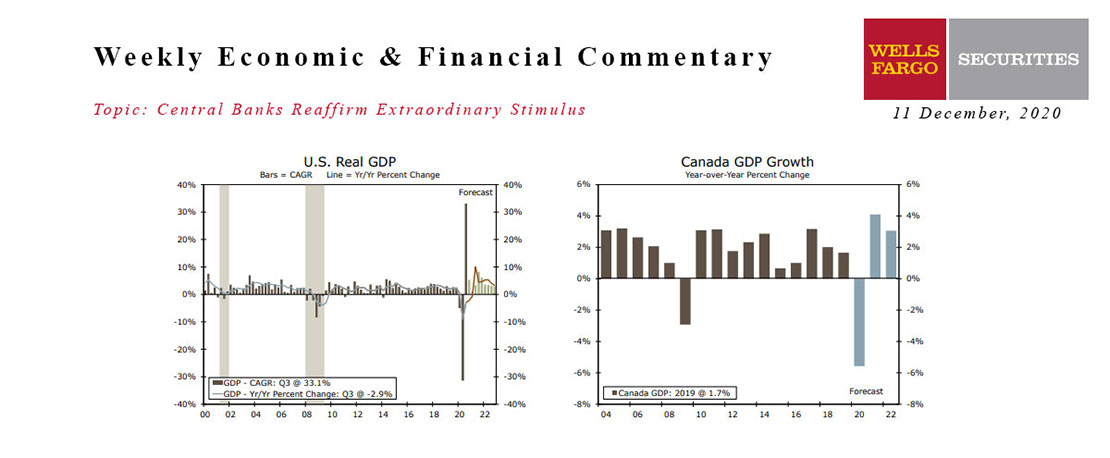

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.

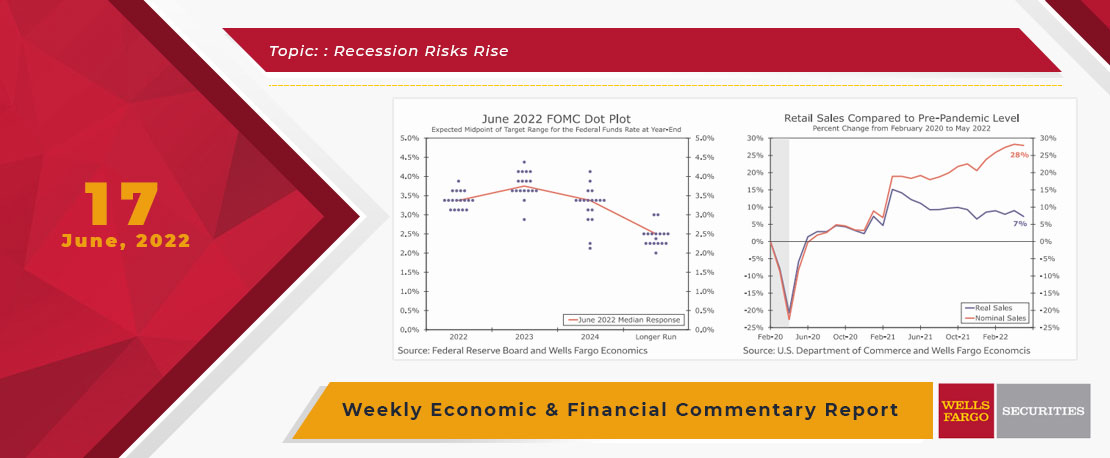

This Week's State Of The Economy - What Is Ahead? - 17 June 2022

Wells Fargo Economics & Financial Report / Jun 20, 2022

After last week\'s stronger-than-expected CPI, less surprising was the 75 point rate increase put forth by the Fed.

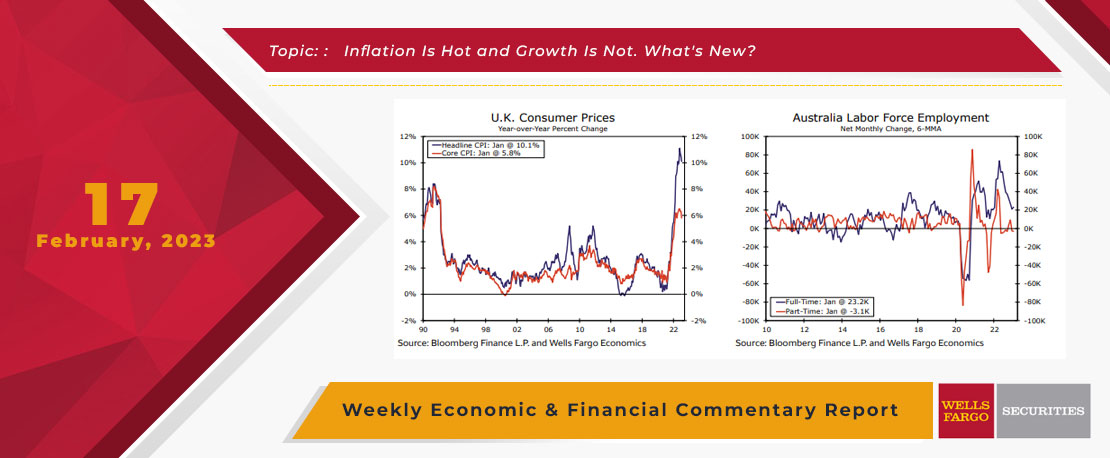

This Week's State Of The Economy - What Is Ahead? - 17 February 2023

Wells Fargo Economics & Financial Report / Feb 20, 2023

Inflation in the U.K. receded for the third straight month in January, with the headline rate coming in at 10.1% year-over-year. In bad news, this is still five times the Bank of England\'s 2% target.