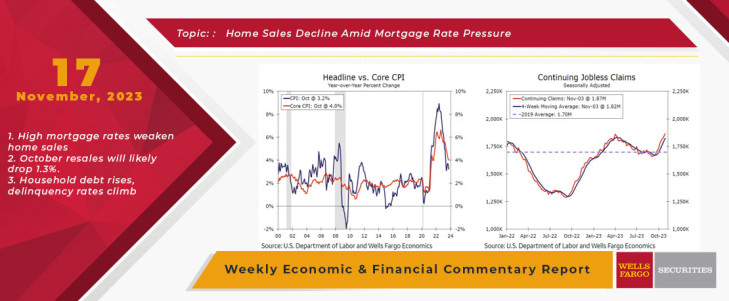

There was a slew of economic data to parse through this week. While the data came in somewhat different from anticipated, the underlying details continue to paint a picture of an economy that is gradually losing momentum. The consumer price data showed a continued deceleration in inflation with the annual growth rate on the headline index slipping by a half a percentage point to 3.2% after a 3.7% year-ago increase in September. The softening in the core index (excluding food and energy) was a bit more modest, but at a 4% annual rate in October, signals a continued slowing in inflation (chart). The softer-than-expected CPI print was an encouraging development for the Fed and reinforces our view that the FOMC has ended its hiking cycle, but is still likely a ways away from outright easing policy. Market participants had a similar reaction as the yield on the 10-year Treasury security slid by about 20 bps on the CPI release and market pricing for eventual FOMC easing was pulled forward.

Some caution was baked back into expectations, however, on Tuesday amid a solid retail sales report. While overall sales slipped 0.1% in October, the control group measure, which excludes volatile categories and aligns well with consumer spending in the GDP report, rose 0.2%, signaling a still-resilient consumer. The weak portions of retail sales were tied to categories that did well earlier in this cycle when consumers were embracing their inner home-body, but which have since languished as people have returned to experiences outside the home. Furniture & home furnishing store sales, for example, slipped 2% and sporting goods & hobby stores fell 0.8%. Consumer spending may be losing momentum after a robust first half of the year, but the fire is not yet out.

That said, we still anticipate further moderation in spending. Not only are pandemic-era support factors of excess liquidity and easy access to credit fading, but real income growth has started to come under renewed pressure amid some softening in the labor market. Initial claims for unemployment insurance ticked up to 231K in the week ending November 10. While that marked the largest weekly gain (+13K) since early August, it's not meaningfully above the year-to-date weekly average of 227K. Yet, continuing claims rose to 1,865K the week ending November 4, marking the highest number of people continuing to claim unemployment insurance since the end of 2021, which signals less ease among recently laid off workers in finding new employment than in recent months.

This Week's State Of The Economy - What Is Ahead? - 29 September 2023

Wells Fargo Economics & Financial Report / Oct 02, 2023

On the housing front, new home sales dropped more than expected in August, though an upward revision to July results left us about where everyone expected us to be year-to-date.

This Week's State Of The Economy - What Is Ahead? - 25 September 2020

Wells Fargo Economics & Financial Report / Sep 28, 2020

Existing home sales rose 2.4% to a 6.0-million unit annual pace. The surge in sales further depleted inventories and pushed prices sharply higher.

This Week's State Of The Economy - What Is Ahead? - 20 September 2019

Wells Fargo Economics & Financial Report / Sep 21, 2019

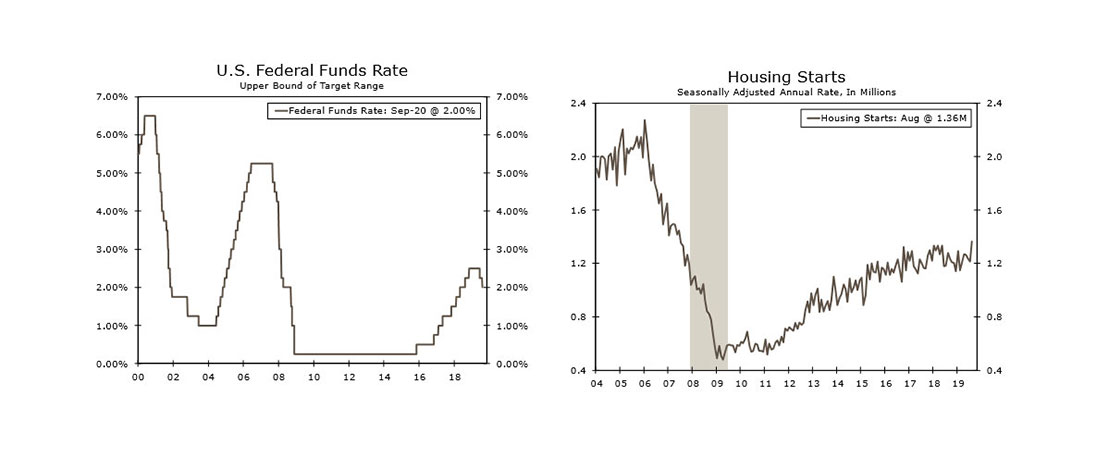

The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.

This Week's State Of The Economy - What Is Ahead? - 13 May 2022

Wells Fargo Economics & Financial Report / May 18, 2022

While small business enthusiasm appears to have stalled, as owners are concerned about their ability to continue to pass on higher costs to consumers, cautious enthusiasm around rookie Jeremy Pena’s start persists.

This Week's State Of The Economy - What Is Ahead? - 20 January 2023

Wells Fargo Economics & Financial Report / Jan 20, 2023

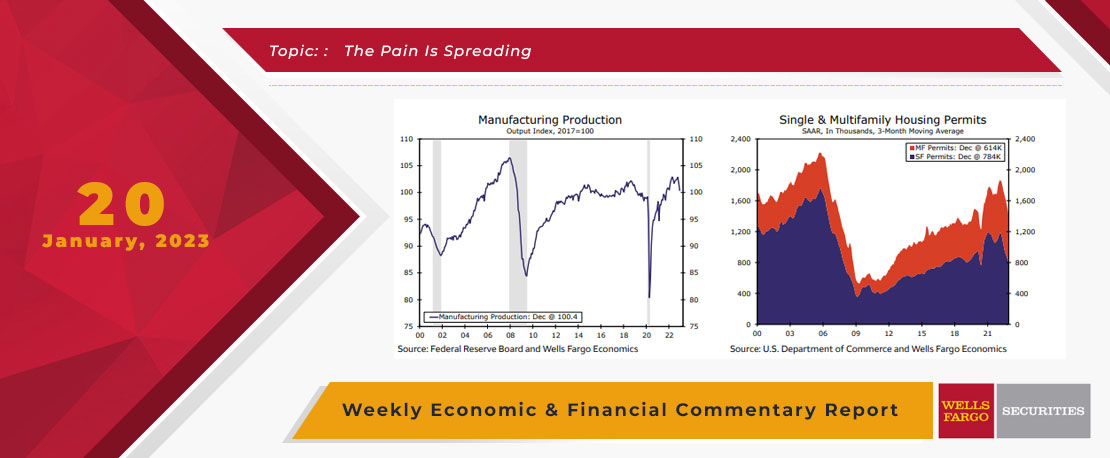

The housing sector has borne the brunt of the Fed\'s efforts to slow the economy, and this week\'s data showed the industry continues to reel.

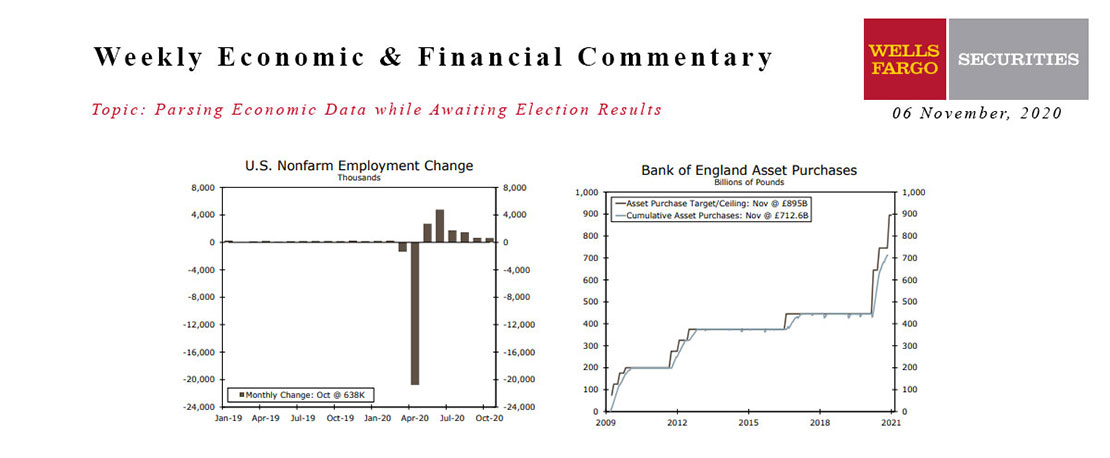

This Week's State Of The Economy - What Is Ahead? - 06 November 2020

Wells Fargo Economics & Financial Report / Nov 10, 2020

As of this writing, the outcome of the U.S. presidential election is undecided. Joe Biden, however, appears likely to become president based off of his growing lead in several key states.

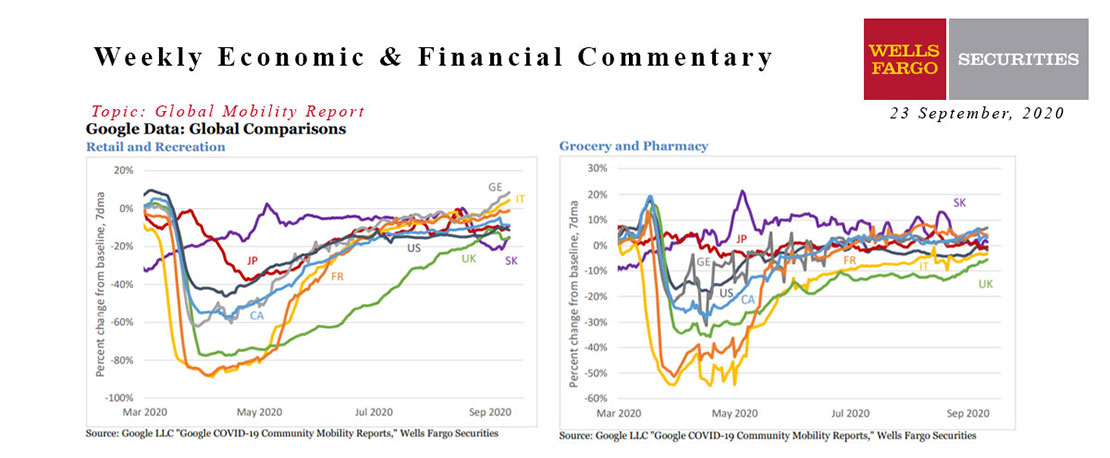

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

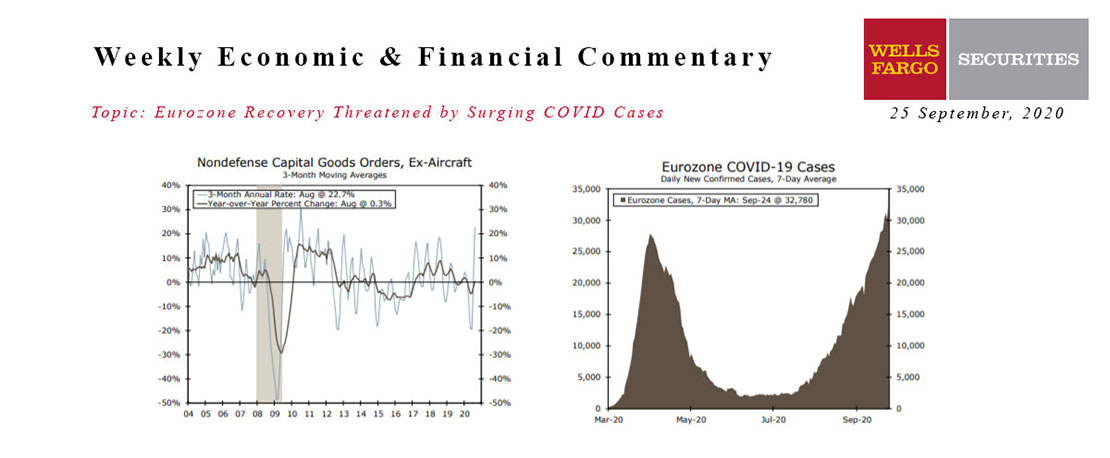

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

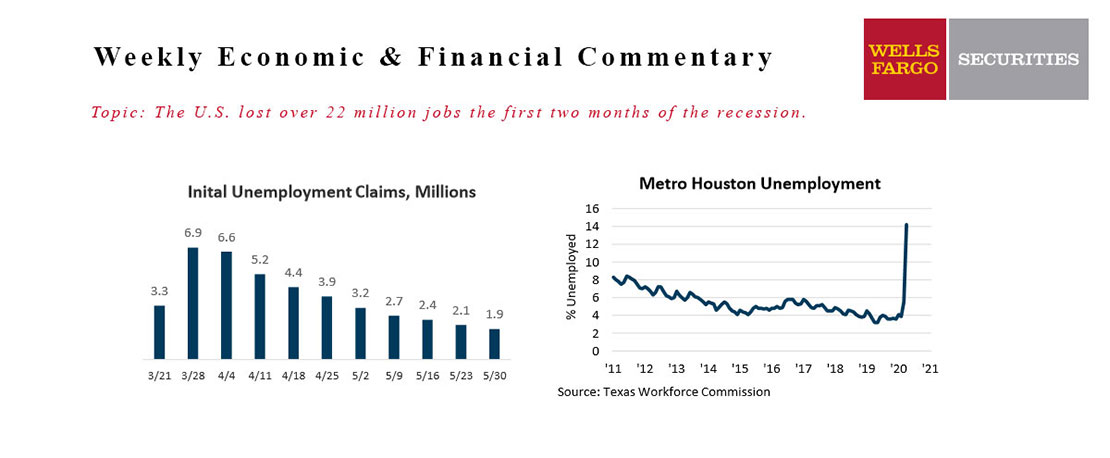

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

This Week's State Of The Economy - What Is Ahead? - 31 May 2024

Wells Fargo Economics & Financial Report / Jun 04, 2024

Markets digested a light lineup of economic data on the holiday-shortened week. The second look at first quarter GDP revealed an economy increasingly pressured by high interest rates as headline growth was revised lower.

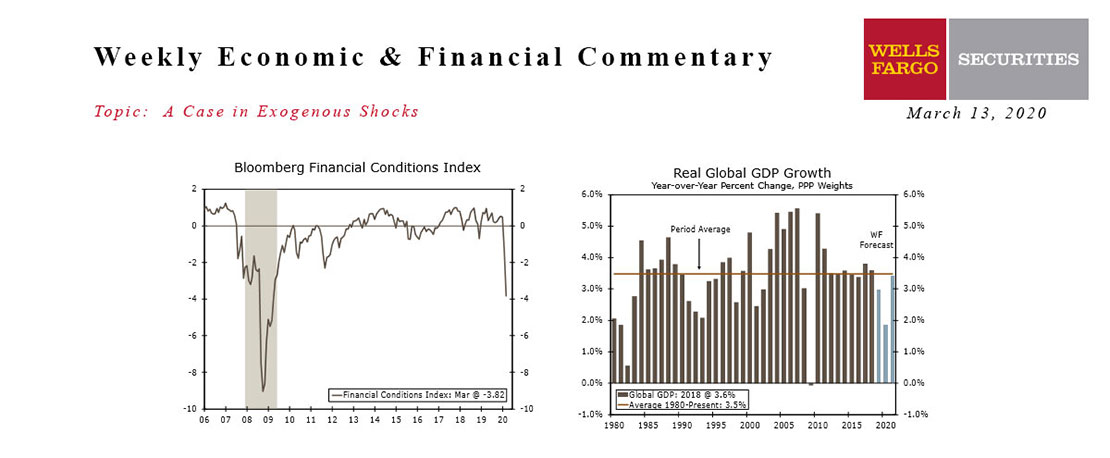

This Week's State Of The Economy - What Is Ahead? - 13 March 2020

Wells Fargo Economics & Financial Report / Mar 14, 2020

Financial conditions tightened sharply this week as concerns over the coronavirus and the economic fallout of containment efforts mounted.