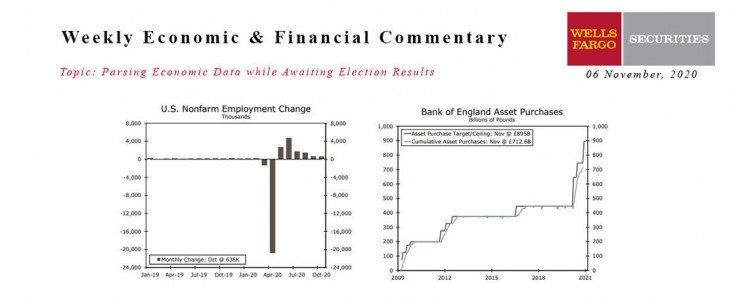

U.S. - Parsing Economic Data while Awaiting Election Results

- As of this writing, the outcome of the U.S. presidential election is undecided. Joe Biden, however, appears likely to become president based off of his growing lead in several key states.

- Total payrolls rose by 638K in October. Growth continues to slow, however. The unemployment rate fell to 6.9%.

- The FOMC made no major changes to monetary policy, although did acknowledge the downside risk of rising COVID cases throughout the country.

- The ISM manufacturing index soared to 59.3 in October. By contrast, the ISM services index declined to 56.6.

Global - Global Focus Turns to Central Bank Announcements

- Global central banks were back in the spotlight this week, with several central banks easing monetary policy. The Reserve Bank of Australia lowered its Cash Rate and three-year yield target to 0.10%, and increased bond purchases by A$100B of five-to-ten year government bonds over the next six months.

- The Bank of England eased monetary policy further, expanding its asset purchase program by a larger-than-expected £150B. Separately, U.K. Chancellor Sunak announced an extension of the government’s salary support program until the end of March 2021. Elsewhere, the Norges Bank also announced policy this week, leaving its key rate unchanged at zero.

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

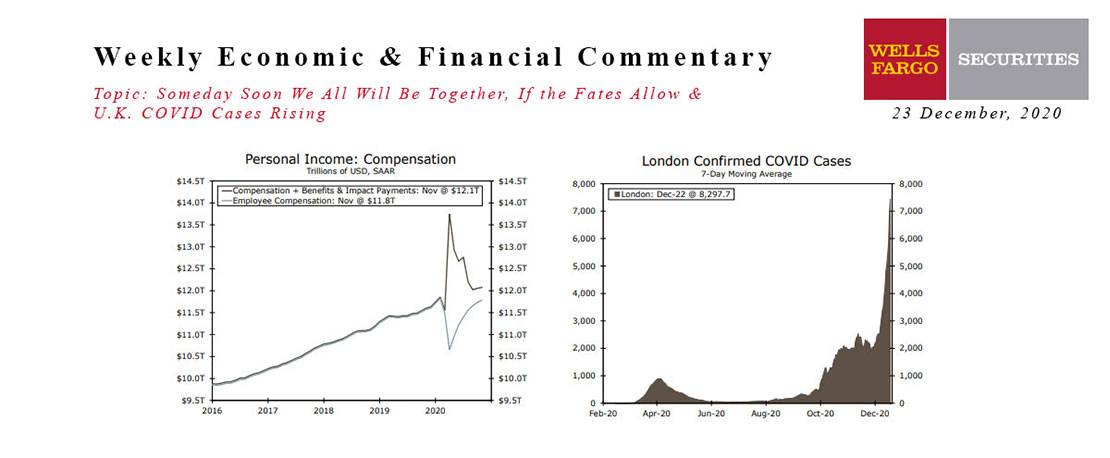

This Week's State Of The Economy - What Is Ahead? - 23 December 2020

Wells Fargo Economics & Financial Report / Dec 26, 2020

Vaccines are here, but they are not yet widely available in a way that can stem the spread of a disease that grows by 200K a day.

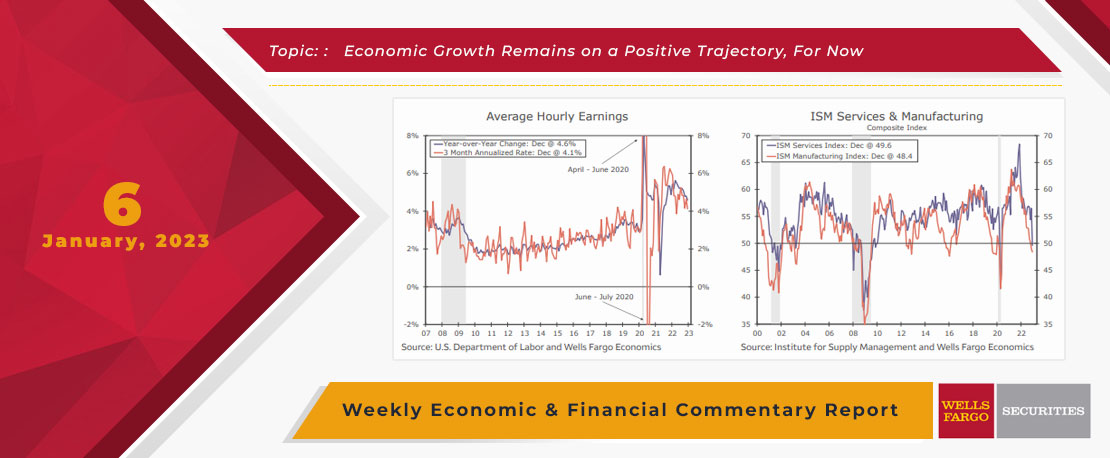

This Week's State Of The Economy - What Is Ahead? - 06 January 2023

Wells Fargo Economics & Financial Report / Jan 12, 2023

During December, payrolls rose by 223K while the unemployment rate fell to 3.5% and average hourly earnings eased 0.3%. Job openings (JOLTS) edged down to 10.46 million in November.

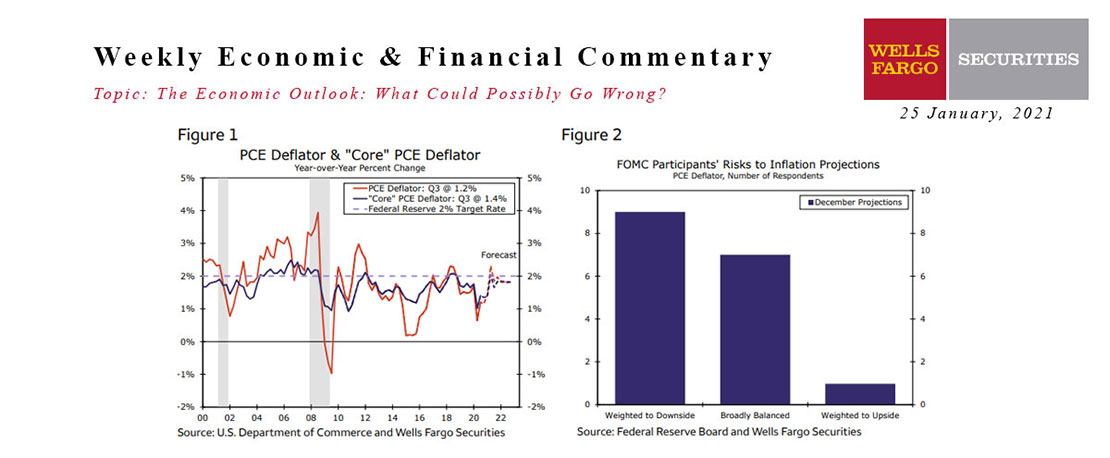

25 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Jan 30, 2021

In the second installment of our series on economic risks in the foreseeable future, we analyze the potential for higher inflation in coming years stemming from excess demand.

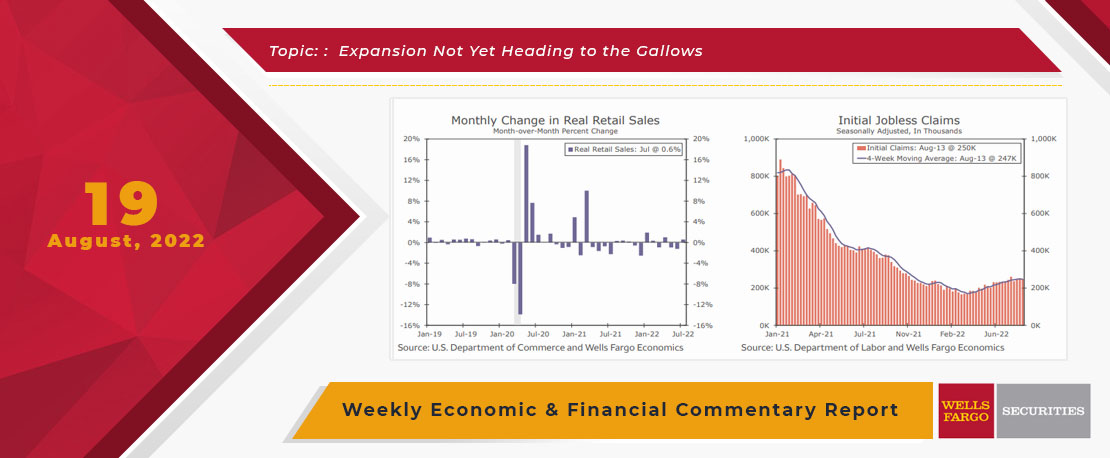

This Week's State Of The Economy - What Is Ahead? - 19August 2022

Wells Fargo Economics & Financial Report / Aug 23, 2022

July data indicates that we celebrated a decline in gas prices by going shopping, boosting retail sales figures. I’m not sure I get the connection...

This Week's State Of The Economy - What Is Ahead? - 14 January 2022

Wells Fargo Economics & Financial Report / Jan 18, 2022

As you may have already seen, inflation is running almost as hot as the stock of our favorite bank. The Consumer Price Index (CPI) rose 7.0% year-over-year in December, the fastest increase in nearly 40 years.

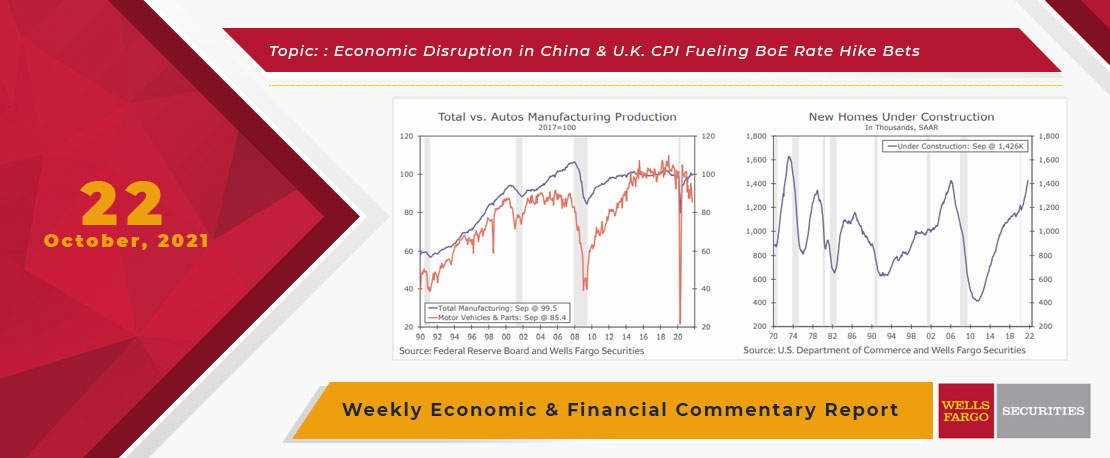

This Week's State Of The Economy - What Is Ahead? - 22 October 2021

Wells Fargo Economics & Financial Report / Oct 25, 2021

Restrictions from a renewed COVID outbreak in China, regulatory changes weighing on local financial markets and a potential collapse of Evergrande have all contributed to a slowdown in Chinese economic activity.

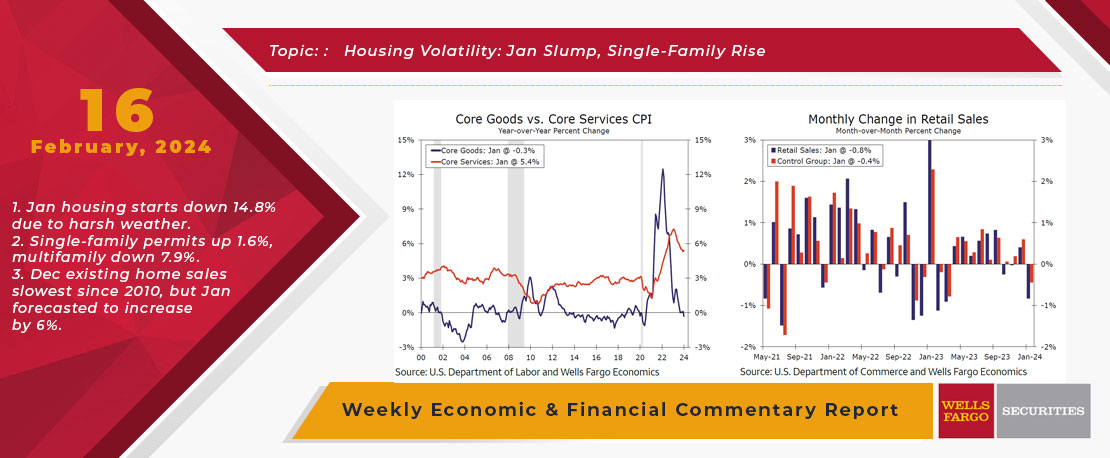

This Week's State Of The Economy - What Is Ahead? - 16 February 2024

Wells Fargo Economics & Financial Report / Feb 20, 2024

The out-of-consensus start to the year for economic data continued with a slip in retail sales and industrial production followed by a startling 14.8% drop in housing starts during January.

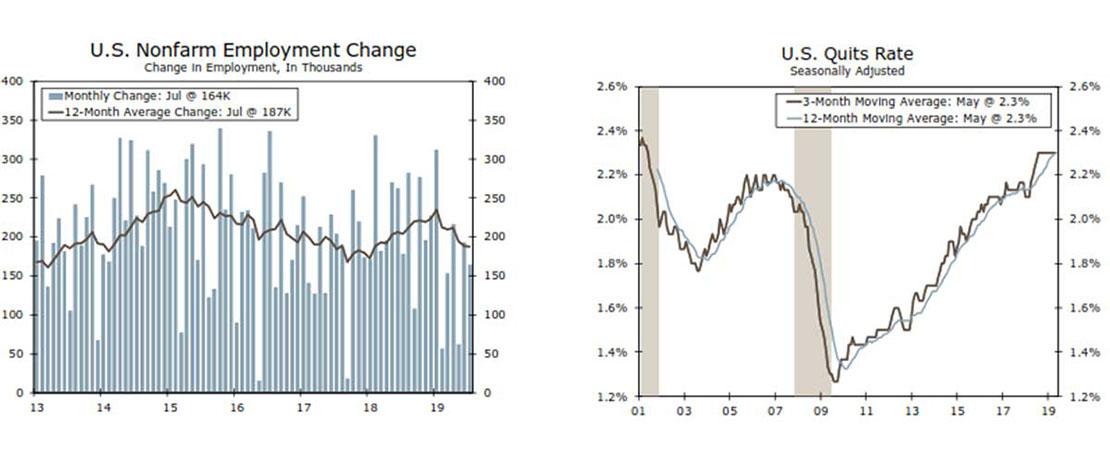

This Week's State Of The Economy-What Is Ahead?

Wells Fargo Economics & Financial Report / Aug 03, 2019

How will Fed rates-cut and Trump 10% tariff on $300 Billion Chinese Goods countered by Chinese currency devaluation against Dollar, affect inflation and economic slowdown in US economy?

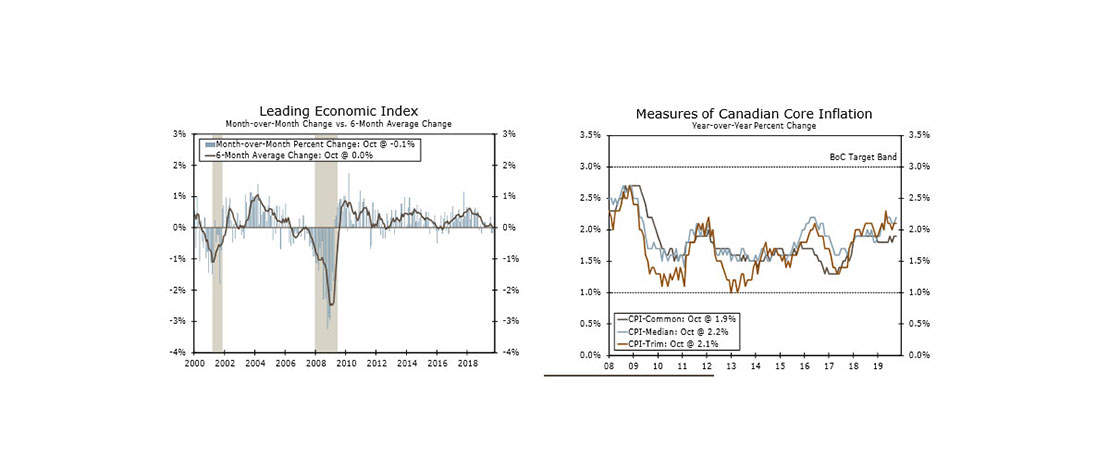

This Week's State Of The Economy - What Is Ahead? - 22 November 2019

Wells Fargo Economics & Financial Report / Nov 23, 2019

Minutes from the October FOMC meeting indicated the Fed is content to remain on the sidelines for the rest of this year as the looser financial conditions resulting from rate cuts at three consecutive meetings feed through to the economy.