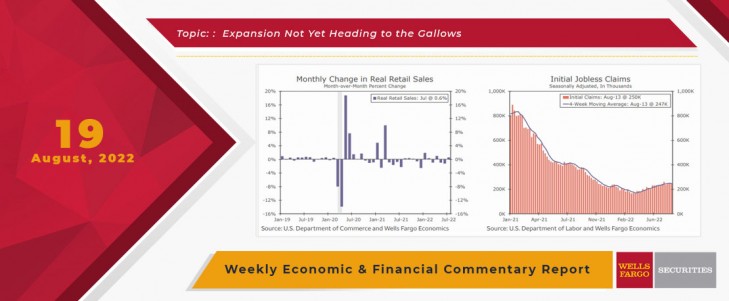

July data indicates that we celebrated a decline in gas prices by going shopping, boosting retail sales figures. I’m not sure I get the connection…maybe we bought more souvenir trinkets while on vacation or felt better doing a little early “back-to-school” shopping? In any case, the data indicates we’re probably not quiet yet in a recession, so don’t look for the Fed to back off on rate increases. The Wells Fargo Economics Group is looking for 75bp next month, 50bp in November and another 25bp in December. Merry Christmas borrowers.

That said, with new orders in the manufacturing sector slowing sharply and housing activity continuing to tumble, data this week did little to change the view of the Wells Fargo Economics Group that a downturn in the coming quarters will be hard to avoid.

There is a chance you may see something strange falling from the sky this weekend into next week. In case you’ve forgotten, it’s called “rain”. Don’t panic…it’s a good thing. Your yard needs it.

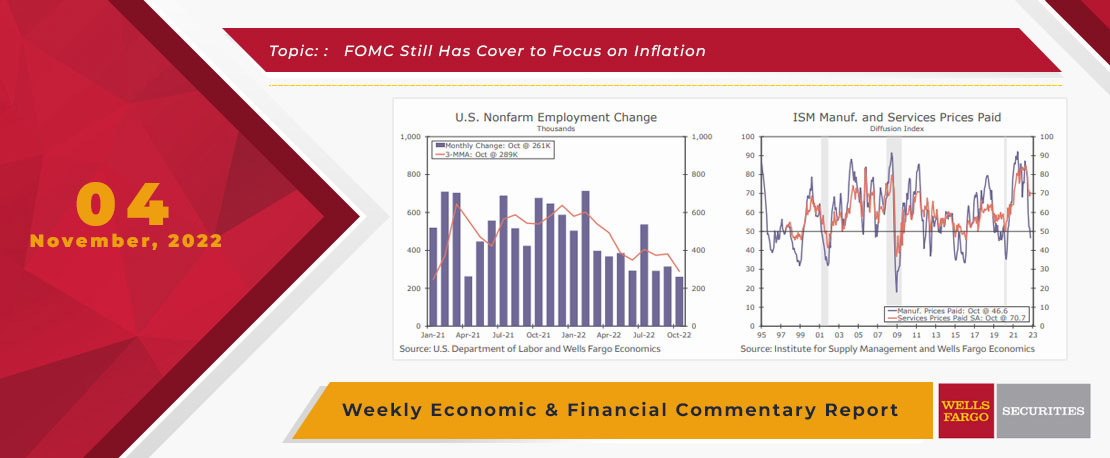

This Week's State Of The Economy - What Is Ahead? - 04 November 2022

Wells Fargo Economics & Financial Report / Nov 07, 2022

Employers continued to add jobs at a steady clip in October, demonstrating the labor market remains tight and the FOMC will continue to tighten policy.

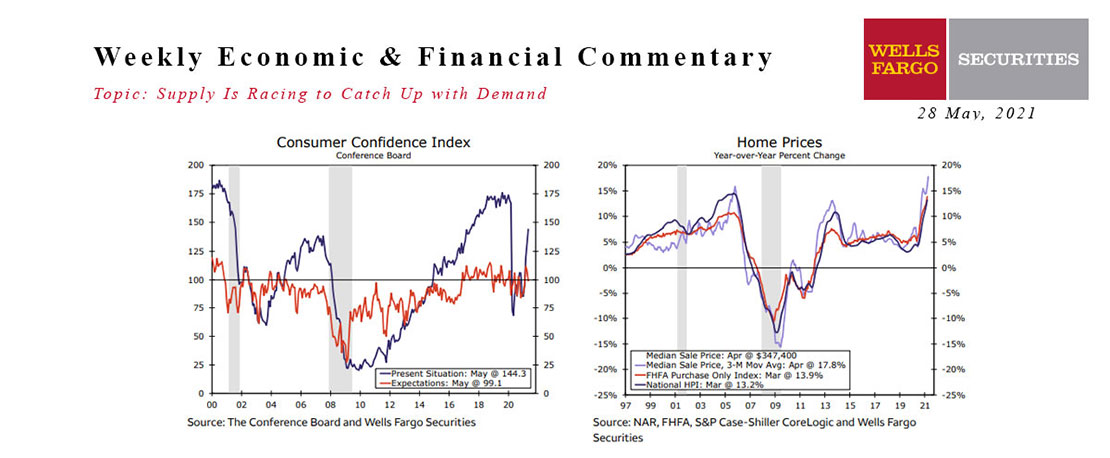

This Week's State Of The Economy - What Is Ahead? - 28 May 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

This week\'s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth.

This Week's State Of The Economy - What Is Ahead? - 09 June 2023

Wells Fargo Economics & Financial Report / Jun 14, 2023

An unexpected spike in jobless claims is a sign that cracks are forming in the labor market. Higher mortgage rates look to be hindering a housing market rebound.

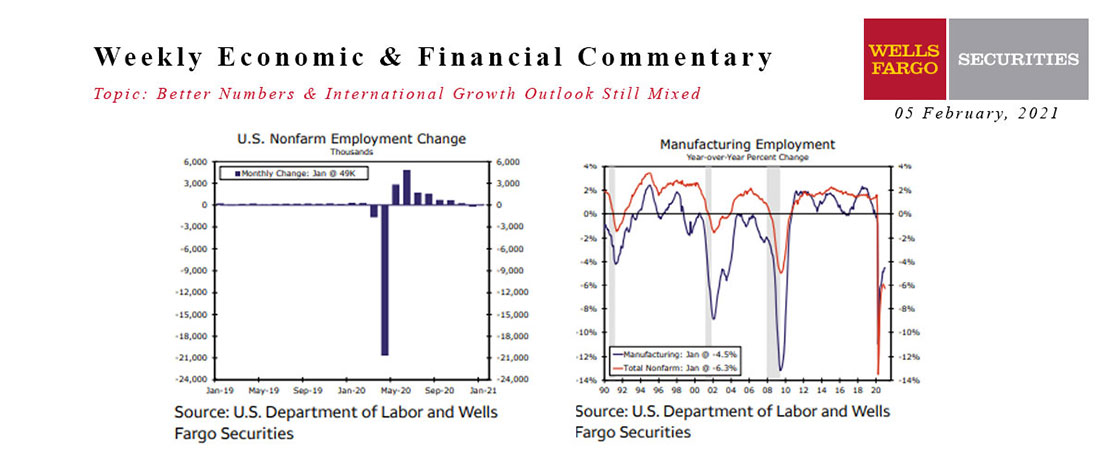

This Week's State Of The Economy - What Is Ahead? - 05 February 2021

Wells Fargo Economics & Financial Report / Feb 10, 2021

Nonfarm employment rebounded in January, with employers adding 49,000 jobs following the prior month\'s 227,000-job drop.

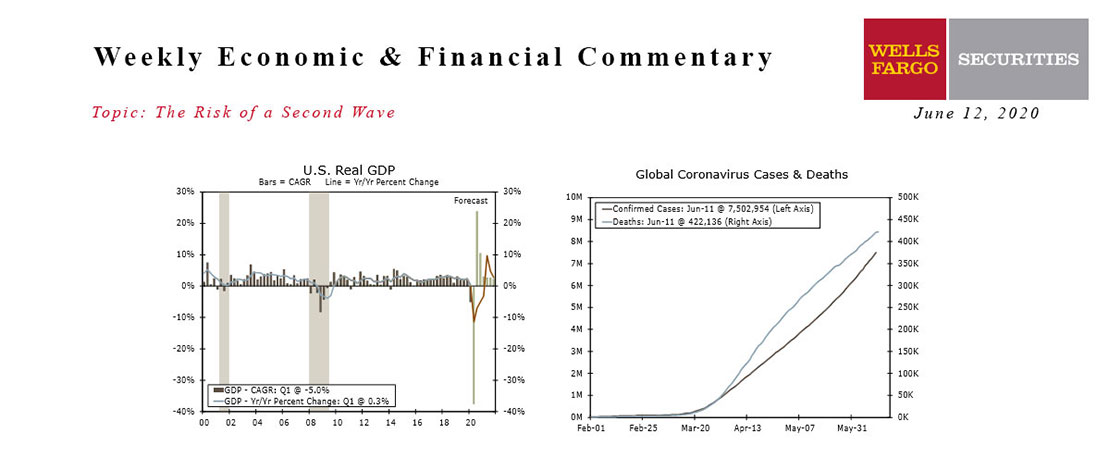

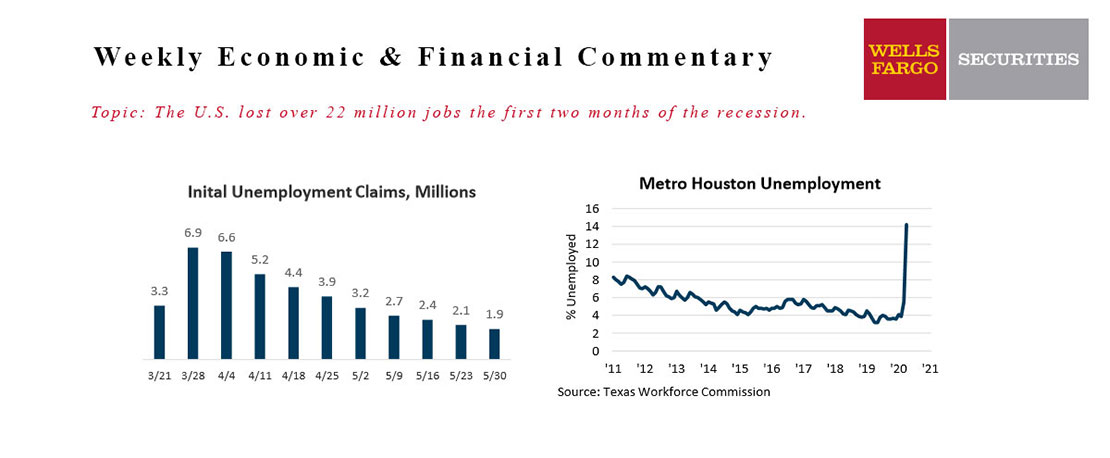

This Week's State Of The Economy - What Is Ahead? - 12 June 2020

Wells Fargo Economics & Financial Report / Jun 13, 2020

Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.

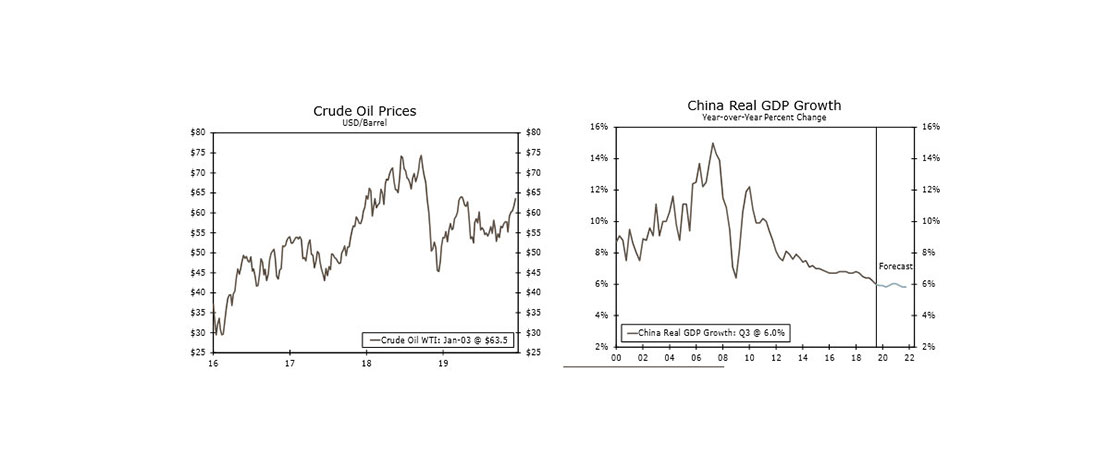

This Week's State Of The Economy - What Is Ahead? - 03 January 2020

Wells Fargo Economics & Financial Report / Jan 04, 2020

Markets were also pressured from the latest ISM manufacturing report, which signaled further deterioration in the sector with the index falling to its lowest level since 2009.

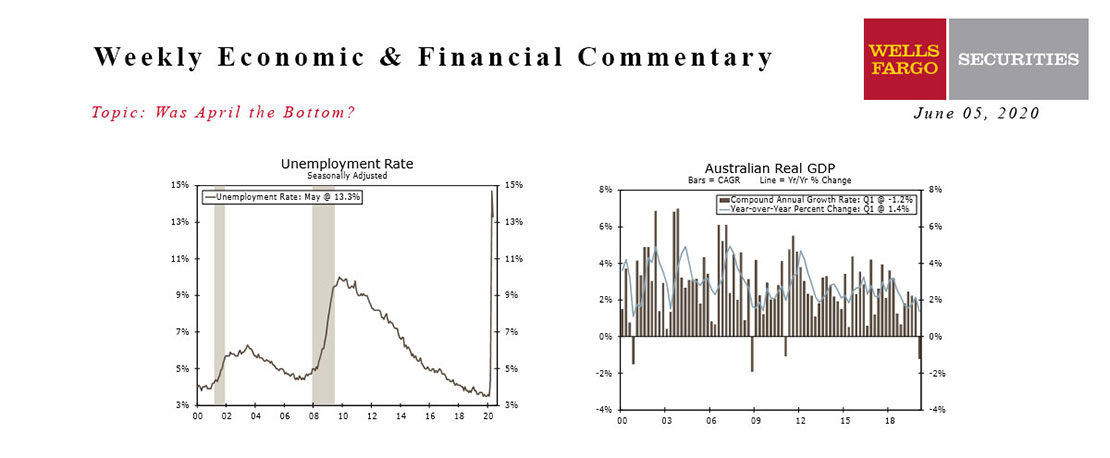

This Week's State Of The Economy - What Is Ahead? - 05 June 2020

Wells Fargo Economics & Financial Report / Jun 09, 2020

Data this week continued to suggest the U.S. economy hit rock bottom in April. Still, it is a long road to recovery and the pickup in economic activity will be gradual.

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

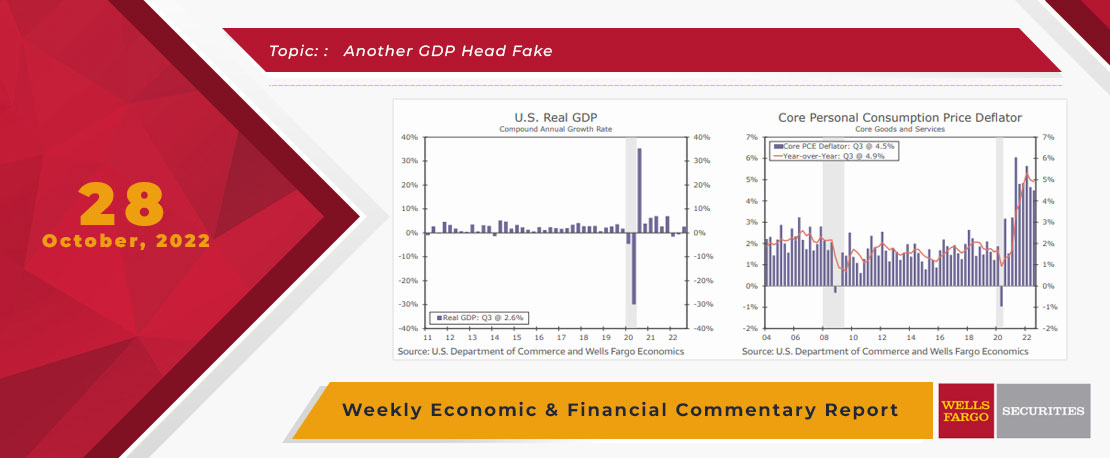

This Week's State Of The Economy - What Is Ahead? - 28 October 2022

Wells Fargo Economics & Financial Report / Oct 31, 2022

Headline GDP continues to send mixed signals on the direction of the U.S. economy. During Q3, real GDP rose at a 2.6% annualized rate, ending the recent string of quarterly declines in growth registered in the first half of 2022.

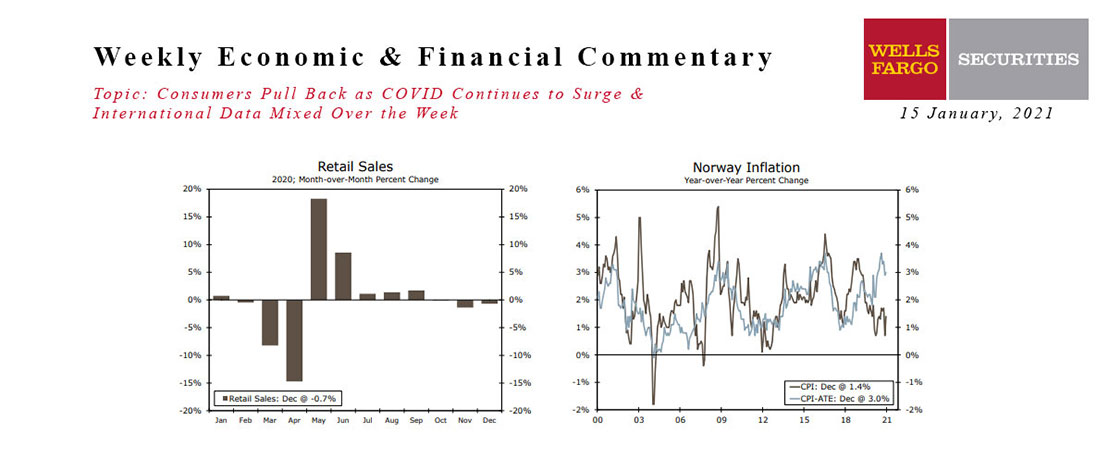

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.