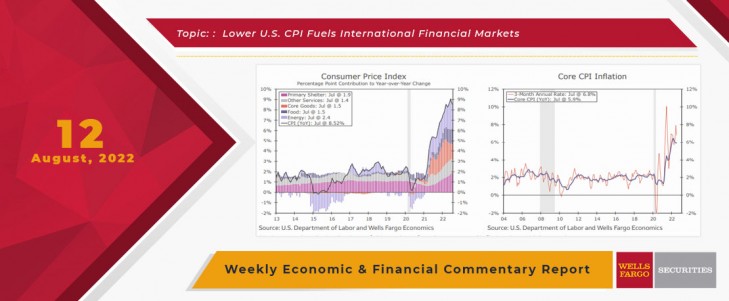

Piecing together the implications of this week's softer-than-expected inflation data (so is inflation tapering?) with last week's blowout nonfarm payroll report (maybe not?) for the Fed's policy path is top of mind for many. The FOMC has made it clear that it needs to see inflation slowing on a sustained basis before pivoting from its current stance. The data seems to be going in multiple directions all at once. My take is that anyone who says they’ve got this all figured out is either deceiving themselves or trying to convince you to buy the book they just wrote. Save your book money.

I know that those with school-age kids are likely sending them back to school pretty soon (if not already). I’ll be off to the Llano Estacado home of Texas Tech (Lubbock) this weekend with kid #2 before sending kid #1 back to UT Austin the following weekend. Safe travels to all who are making similar treks, whether across the country or just across the neighborhood.

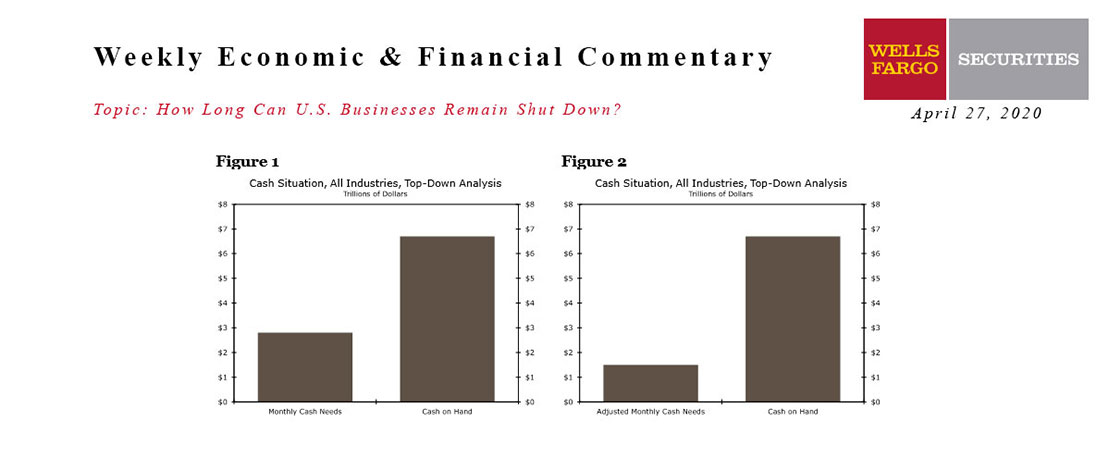

How Long Can US Businesses Remain Shut Down?

Wells Fargo Economics & Financial Report / Apr 29, 2020

The sudden stop in economic activity caused by the COVID-19 pandemic means that many businesses will need to rely on their cash reserves to survive the next few months.

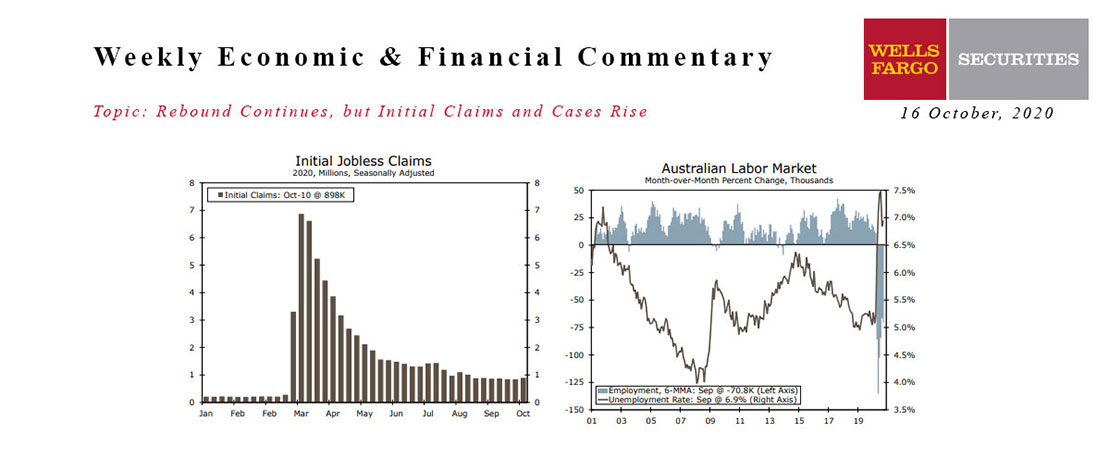

This Week's State Of The Economy - What Is Ahead? - 16 October 2020

Wells Fargo Economics & Financial Report / Oct 20, 2020

Data continue to reflect an economy digging itself out of the lockdown-induced slump.

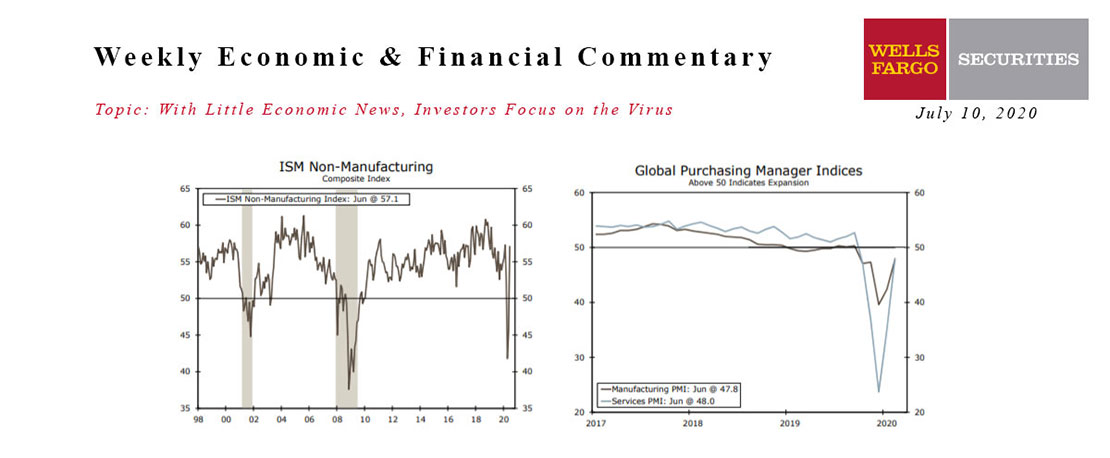

This Week's State Of The Economy - What Is Ahead? - 10 July 2020

Wells Fargo Economics & Financial Report / Jul 13, 2020

The ISM non-manufacturing index jumped 11.7 points to 57.1, reflecting the broadening re-opening of the economy.

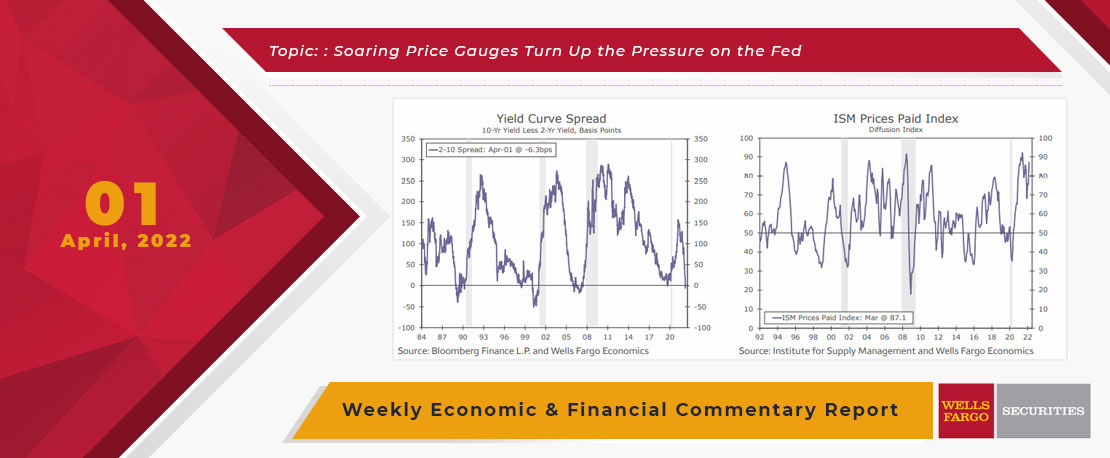

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

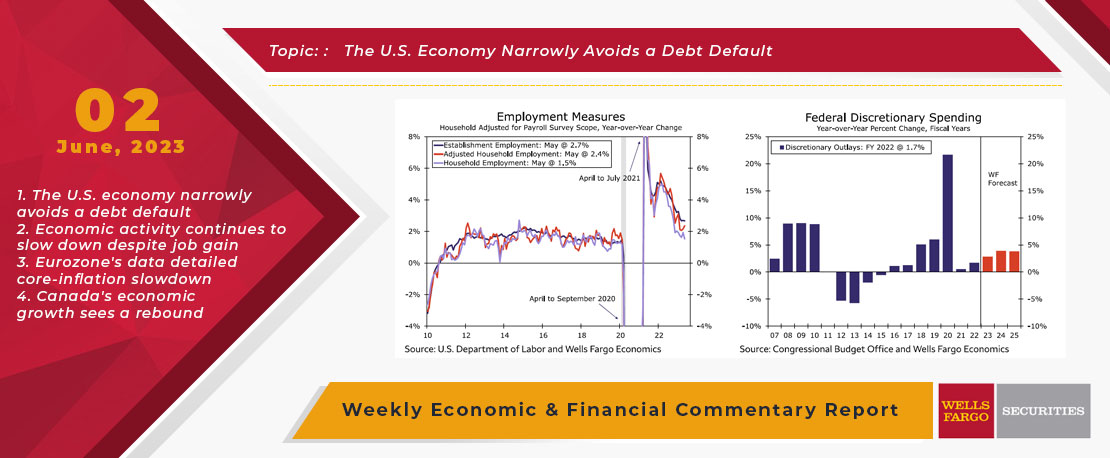

This Week's State Of The Economy - What Is Ahead? - 02 June 2023

Wells Fargo Economics & Financial Report / Jun 06, 2023

This week, Congress and the president prevented what would have been the first default in U.S. history by agreeing to suspend the debt ceiling through the end of 2024.

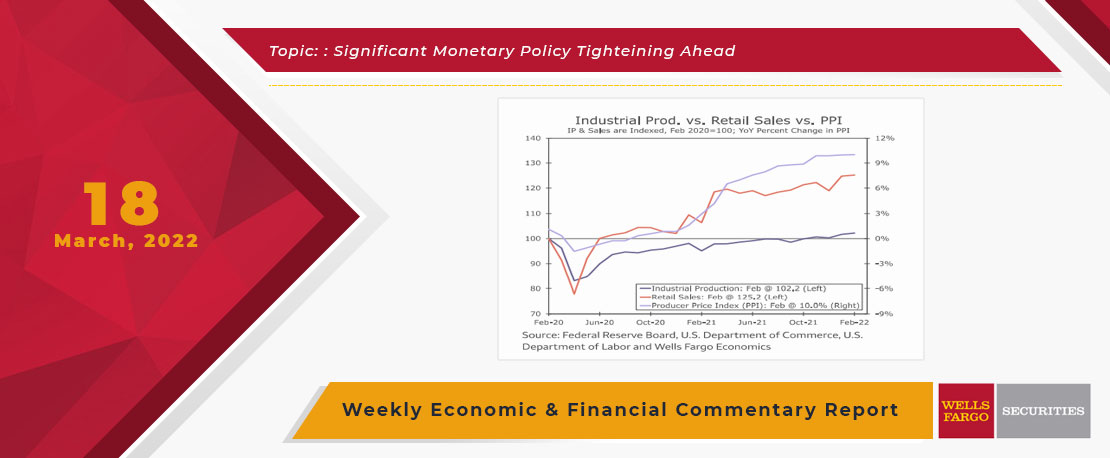

This Week's State Of The Economy - What Is Ahead? - 18 March 2022

Wells Fargo Economics & Financial Report / Mar 21, 2022

it was a big week for economic news as the Astros allowed the TWINS of all teams to sign Carlos Correa to the type of short-term deal that the Astros have historically been open to.

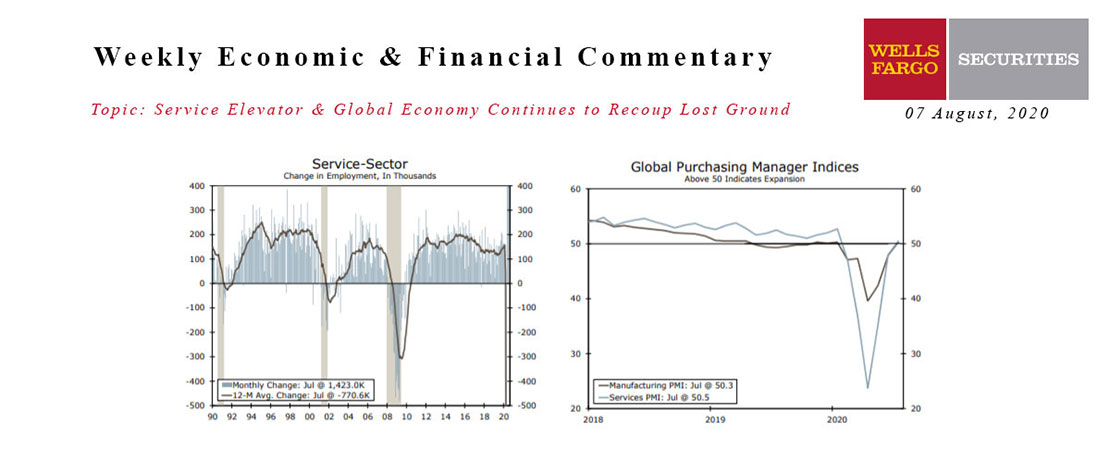

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

There were more signs of global recovery this week and PMI surveys improved further across the world.

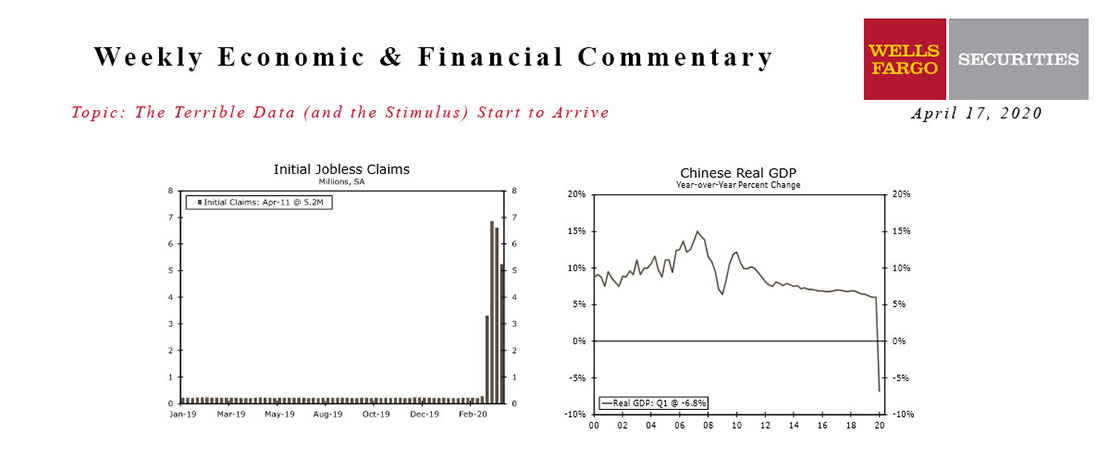

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

Economic Uncertainty Seems Removed Going Into The New Year 2020

Wells Fargo Economics & Financial Report / Dec 28, 2019

The U.S. economy continues to expand, albeit at a moderate pace. The U.S. Bureau of Economic Analysis reports U.S. gross domestic product (GDP) grew 2.1 percent in Q3/19.

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).