Interesting factoid I’ve seen noted several places recently is that the Millennial generation (1981 – 1996) surpassed the Baby Boom as the largest generation in U.S. history. That is relevant because after a delay caused by factors such as student debt, and possibly some other factors as well, more Millennials will reach the age of 32, the median age for first-time home buyers, over the next two years than ever before. That seems like a strong indicator for continued strong home sales for the next two years at least, unless of course interest rates escalate to a level that forces them to remain renters.

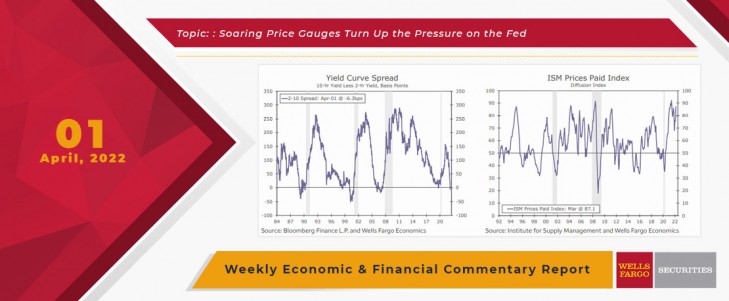

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation. The Fed's difficult job got harder this week. Its preferred inflation gauge set another fresh 40-year record high while the ISM prices paid measure shot up 11.5 points to 87.1. Payrolls increased 431K in March with steep upward revisions that lifted last month's gain, but personal income is not quite keeping pace with price gains. Small wonder, the yield curve temporarily inverted, a sign the bond market is losing faith in a soft landing.

This Week's State Of The Economy - What Is Ahead? - 20 March 2020

Wells Fargo Economics & Financial Report / Mar 21, 2020

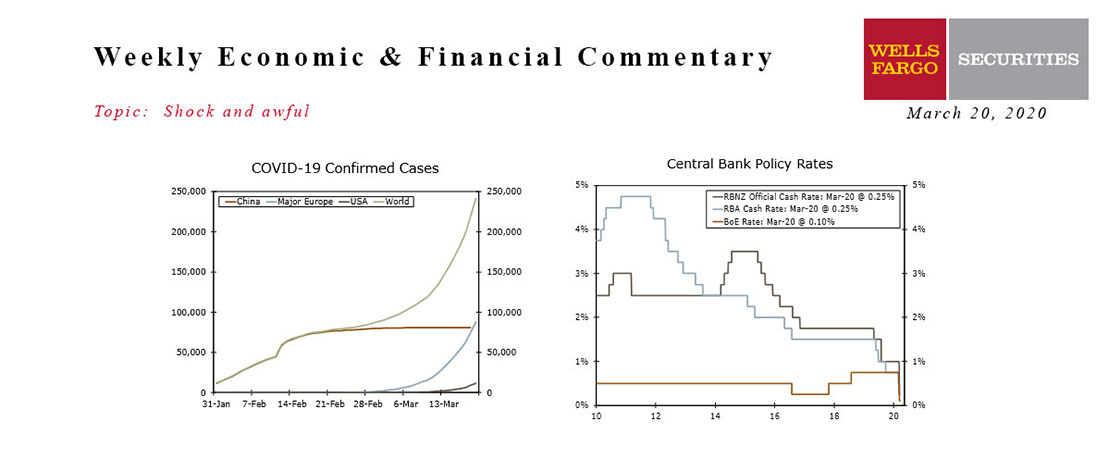

Daily life came to a screeching halt this week as governments, businesses and consumers took drastic steps to halt the COVID-19 pandemic.

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

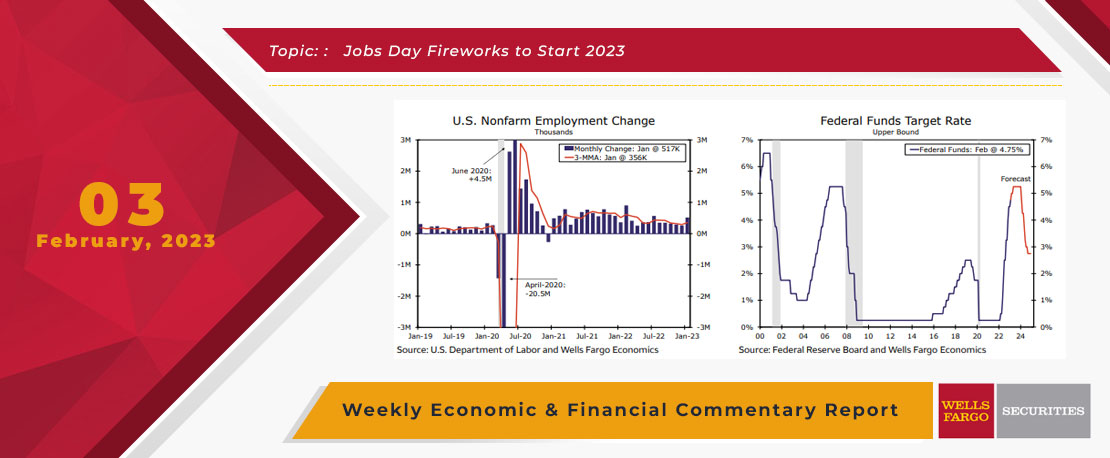

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

This Week's State Of The Economy - What Is Ahead? - 28 February 2020

Wells Fargo Economics & Financial Report / Feb 29, 2020

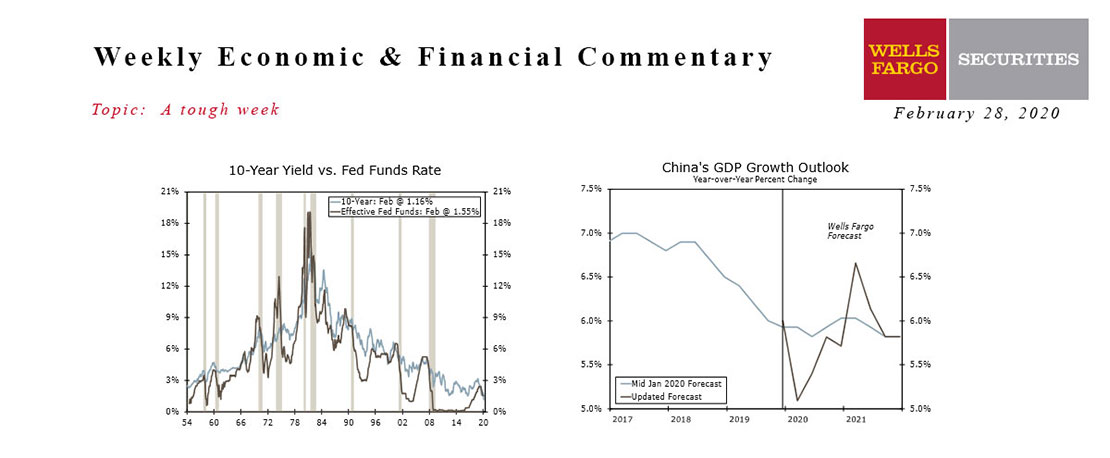

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

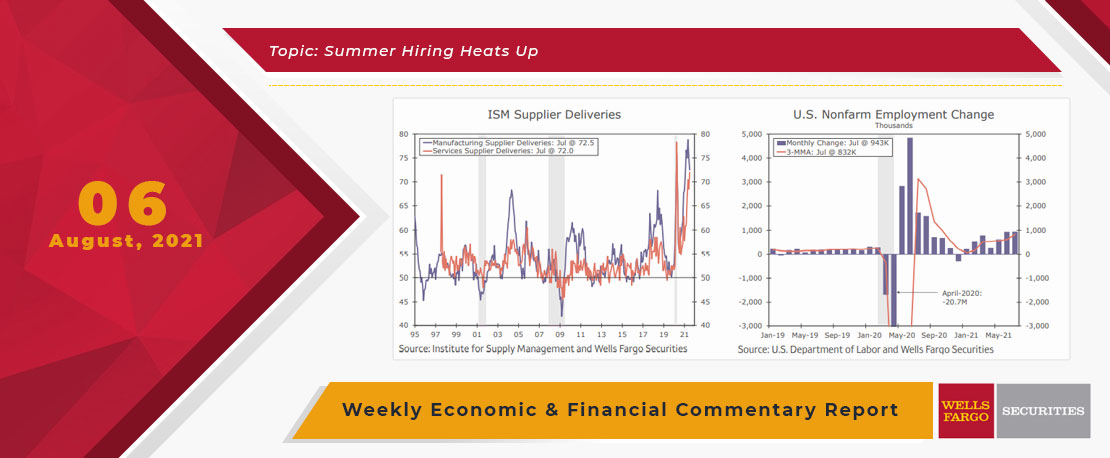

This Week's State Of The Economy - What Is Ahead? - 06 August 2021

Wells Fargo Economics & Financial Report / Aug 16, 2021

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy\'s resilience in spite of those continuing problems.

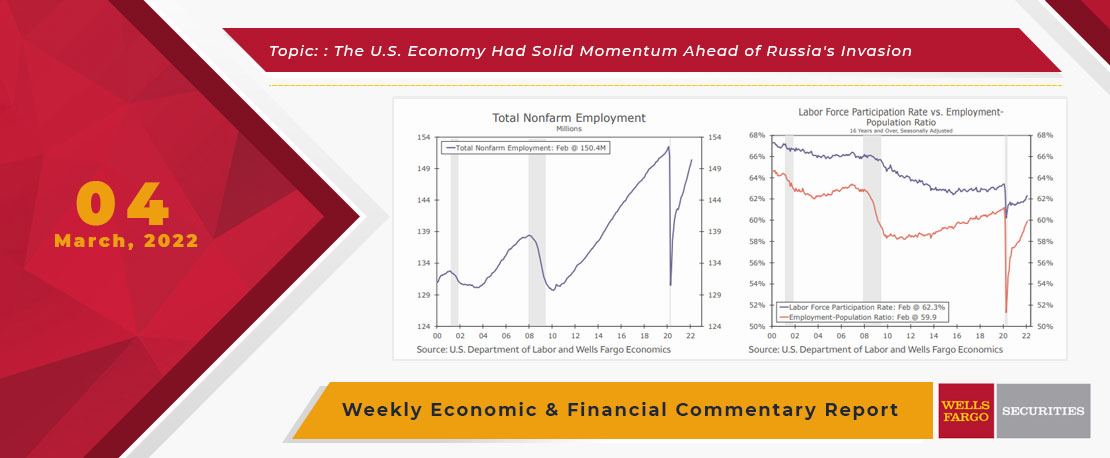

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

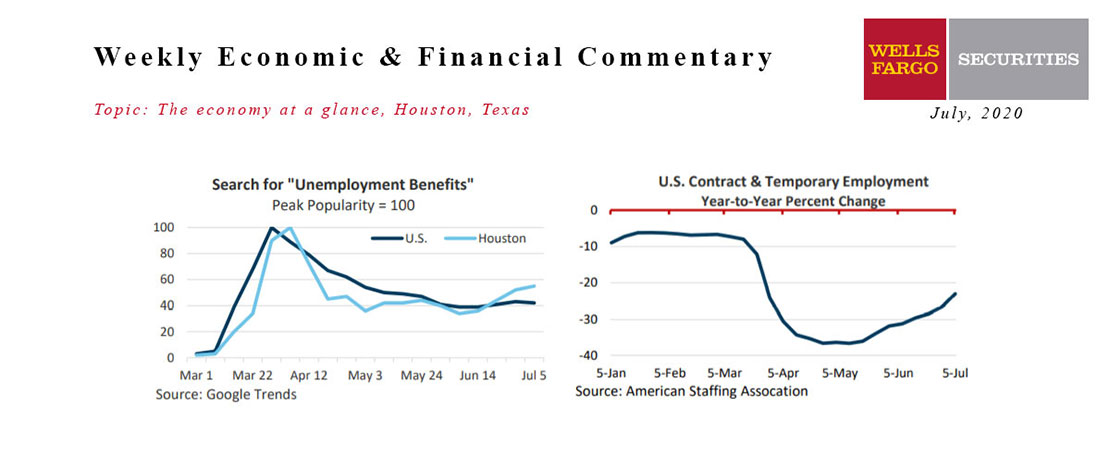

July 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jul 30, 2020

The recent surge in COVID-19 cases indicates that elected officials re-opened the economy too soon, that too many Americans are flaunting social distancing guidelines, and that the virus is likely to be around longer than we’d hoped.

This Week's State Of The Economy - What Is Ahead? - 24 September 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

While fears of an Evergrande default in China were rattling financial markets, for those of us in Southeast Texas who have survived the typically very hot months of July, August and September, this week brought the very welcome first early fall-like

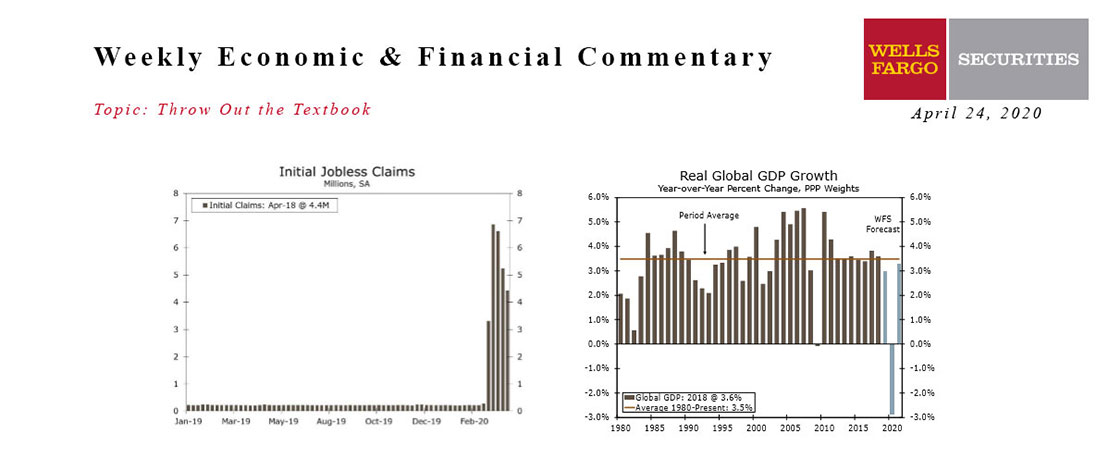

This Week's State Of The Economy - What Is Ahead? - 24 April 2020

Wells Fargo Economics & Financial Report / Apr 27, 2020

Oil prices went negative for the first time in history on Monday as the evaporation of demand collided with a supply glut. In the past five weeks, 26.5 million people have filed for unemployment insurance, or more than one out of every seven workers.

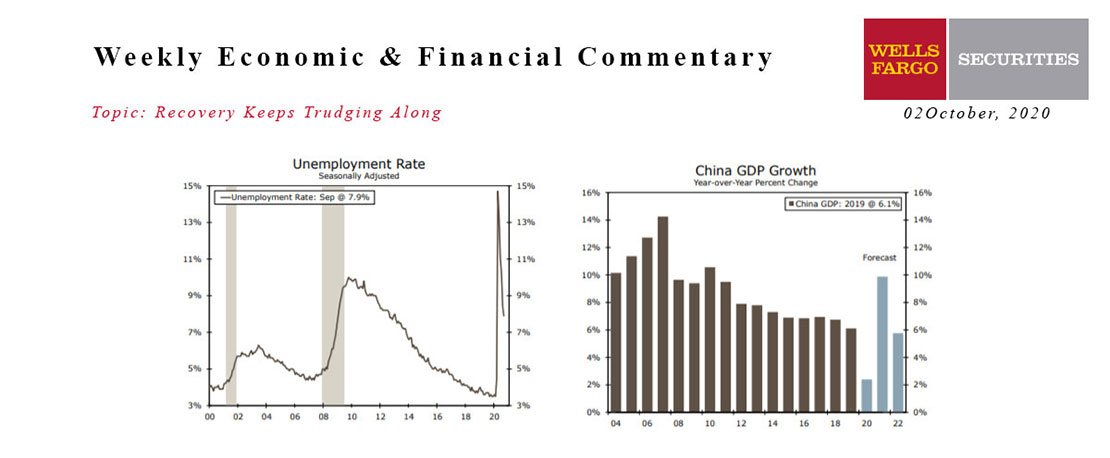

This Week's State Of The Economy - What Is Ahead? - 02 October 2020

Wells Fargo Economics & Financial Report / Sep 29, 2020

In what was a jam-packed week of economic data, the jobs report, prospects of additional fiscal stimulus and the president’s positive COVID-19 test result commanded markets’ attention.

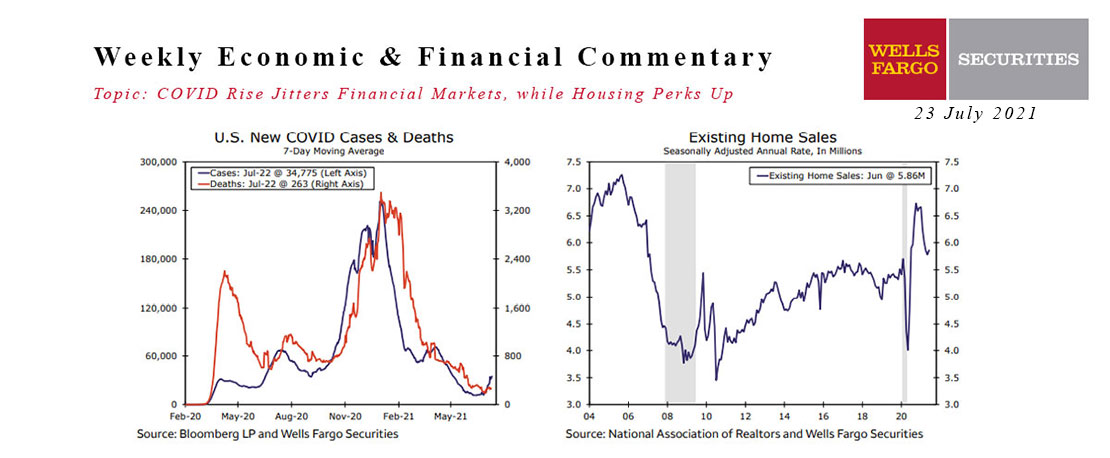

This Week's State Of The Economy - What Is Ahead? - 23 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

In the biggest financial news this week not connected to college football conference realignment, July\'s NAHB Housing Market Index slipped one point to 80.