U.S - A Tough Week

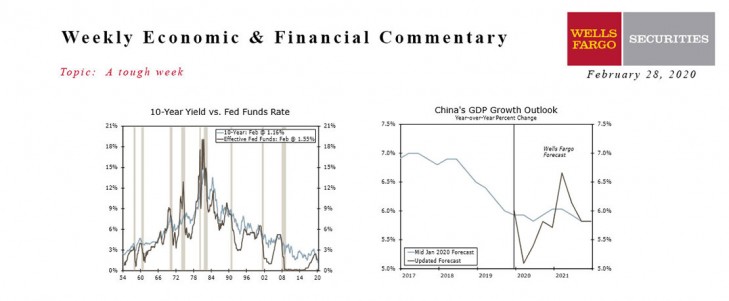

- The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

- The bond market now expects almost four Fed rate cuts by the end of the year, but one might rightly wonder how lower short-term rates would alleviate supply chain disruptions.

- We believe the Fed will try to remain patient, and look for a “material” change in the outlook, but if and when the committee decides it needs to ease again, it most likely won’t be just once.

Global - Virus Spreads to Broader Global Economy

- A surge in new cases of coronavirus in Italy and Korea led to further concerns over the impact of the outbreak on global growth, while seemingly ongoing disruptions to Chinese economic activity suggest even further downside to our current forecast for Q1 Chinese GDP growth of 5.1% year-over-year.

- Elsewhere, Canada’s Q4 growth figures were soft as GDP barely grew during the quarter, although the details were more mixed. Perhaps the most important global economic data point of the week is still to come, with China’s official PMIs for February due later today, the first significant release from China that should capture the virus’ economic impact.

This Week's State Of The Economy - What Is Ahead? - 21 June 2024

Wells Fargo Economics & Financial Report / Jun 25, 2024

Retail sales rose just 0.1% over the month, falling short of consensus and suggesting that consumers may finally be feeling some spending fatigue.

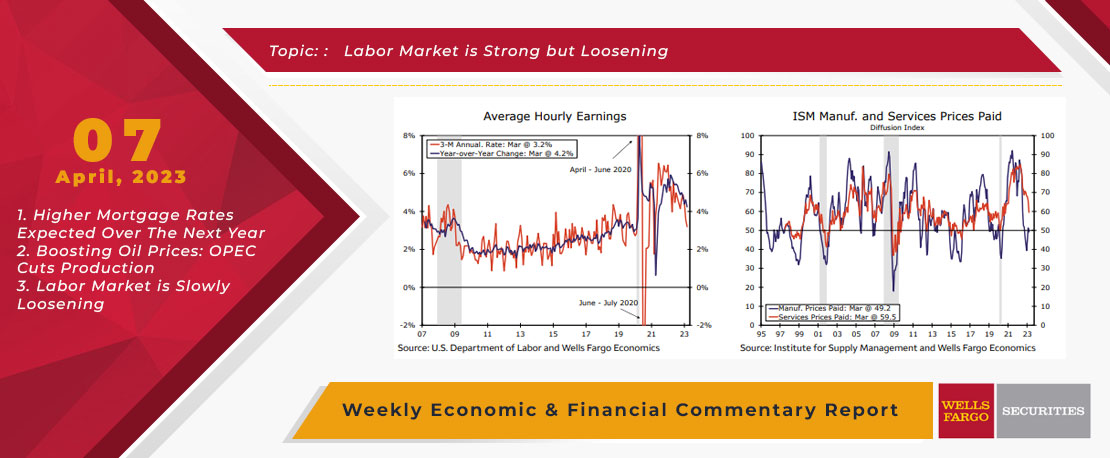

This Week's State Of The Economy - What Is Ahead? - 07 April 2023

Wells Fargo Economics & Financial Report / Apr 10, 2023

Employers added jobs at the slowest pace since 2020 in March, job openings fell and an upward trend in initial jobless claims has emerged.

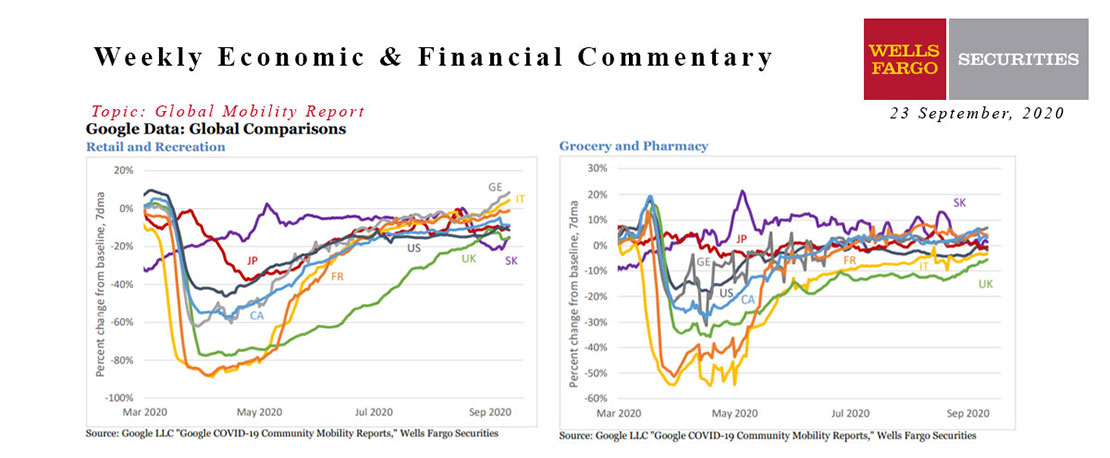

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

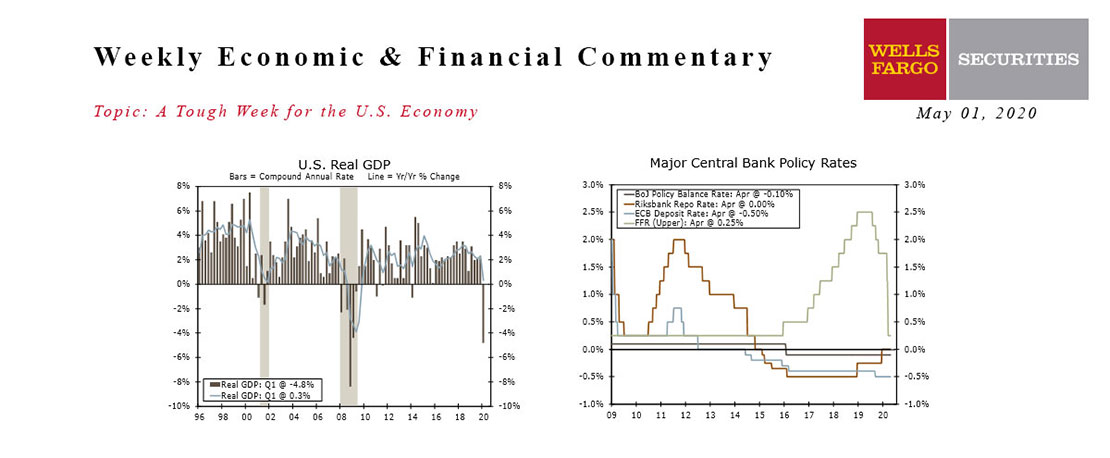

This Week's State Of The Economy - What Is Ahead? - 01 May 2020

Wells Fargo Economics & Financial Report / May 04, 2020

U.S. GDP declined at an annualized rate of 4.8% in the first quarter, only a hint of what is to come in the second quarter.

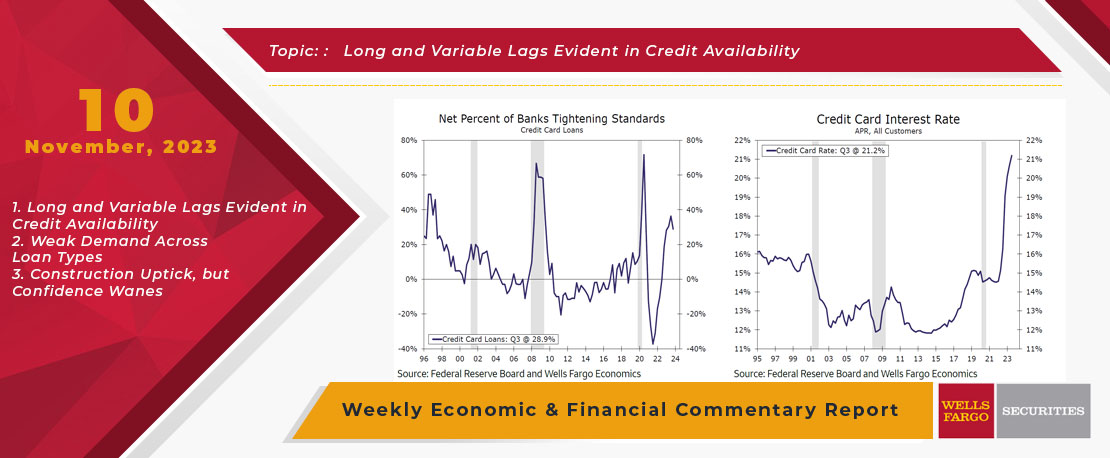

This Week's State Of The Economy - What Is Ahead? - 10 November 2023

Wells Fargo Economics & Financial Report / Nov 16, 2023

Sometimes, the impact of higher rates is quite obvious, such as the series of bank failures that occurred earlier this year.

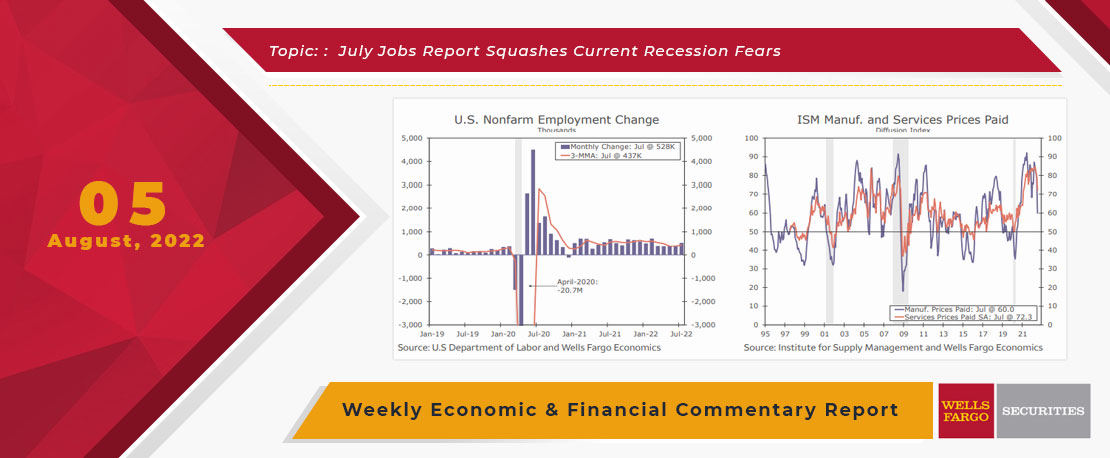

This Week's State Of The Economy - What Is Ahead? - 05 August 2022

Wells Fargo Economics & Financial Report / Aug 08, 2022

The Bureau of Labor Statistics reported this morning that nonfarm payrolls increased 528,000 for the month of July, easily topping estimates, lowering the unemployment rate to 3.5%.

This Week's State Of The Economy - What Is Ahead? - 16 September 2022

Wells Fargo Economics & Financial Report / Sep 20, 2022

Financial markets reacted in a zig-zag pattern to this week\'s economic data ahead of the next FOMC meeting. Price pressure is still not showing the sustained slowdown the Fed needs before it takes its foot off the throttle of tighter policy.

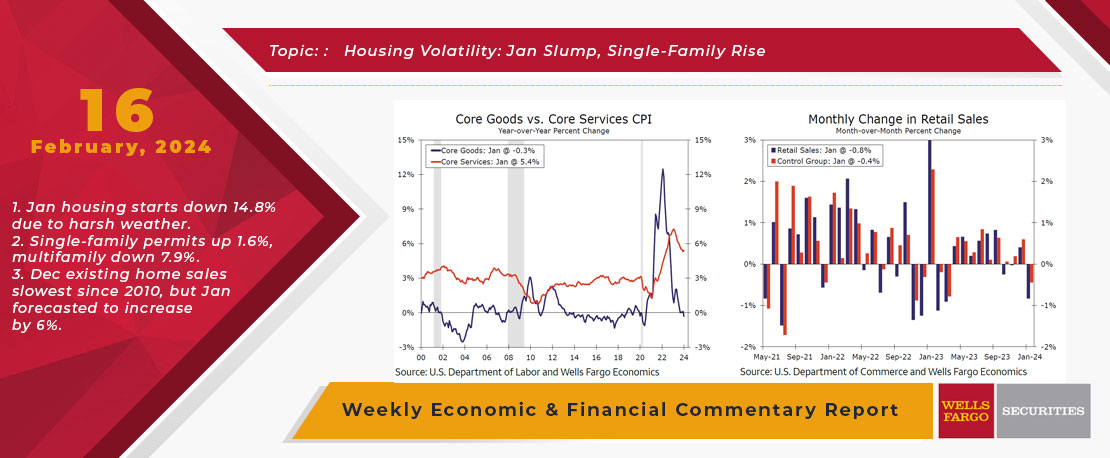

This Week's State Of The Economy - What Is Ahead? - 16 February 2024

Wells Fargo Economics & Financial Report / Feb 20, 2024

The out-of-consensus start to the year for economic data continued with a slip in retail sales and industrial production followed by a startling 14.8% drop in housing starts during January.

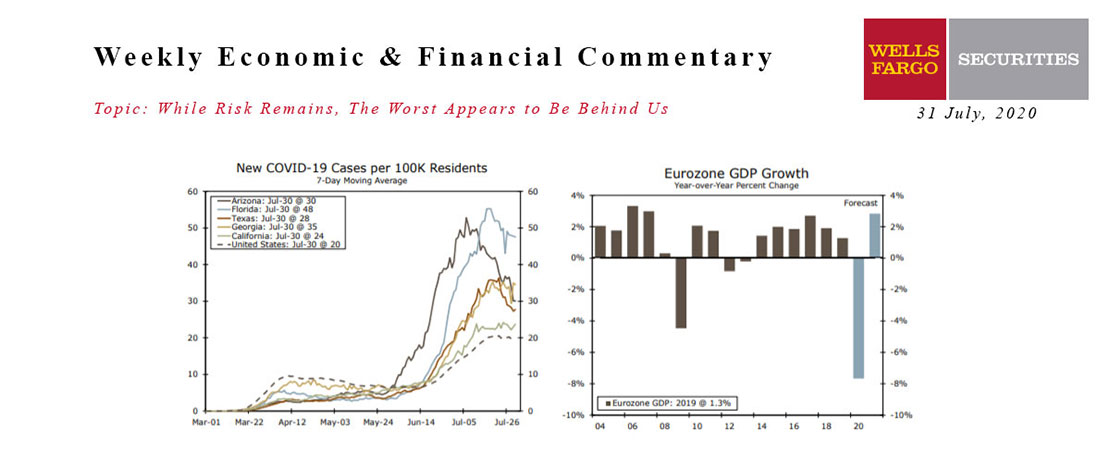

This Week's State Of The Economy - What Is Ahead? - 31 July 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

The resurgence in COVID-19 in much of the Sun Belt appears to have topped out, although cases are rising faster in some smaller mid-Atlantic states and in parts of Europe, Asia and Australia.

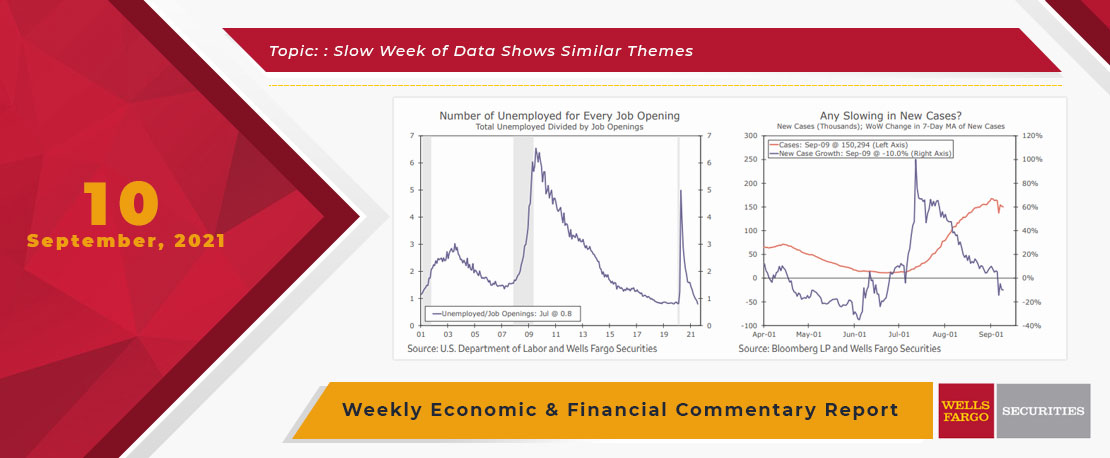

This Week's State Of The Economy - What Is Ahead? - 10 September 2021

Wells Fargo Economics & Financial Report / Sep 13, 2021

Data from the opening weekend of College Football indicates that we will have to endure another season of Nick Saban deification.