Labor Market is Strong but Loosenin

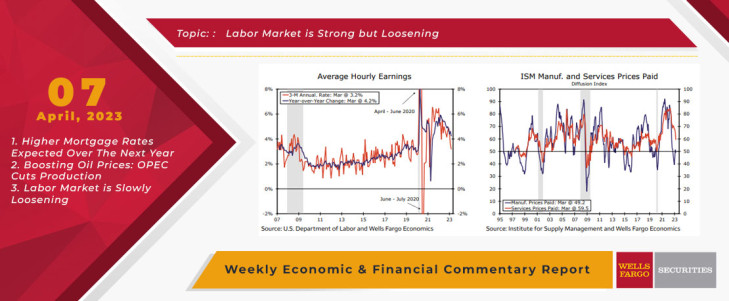

This week's data broadly added to evidence that the labor market is loosening. The big release of the week was the nonfarm payrolls report on Friday morning, which showed employers added 236K net new jobs in March. This is still above the pre-pandemic run rate, but marks the lowest pace of job growth since late 2020 and is a marked move lower from the near 350K jobs added on average over the past three months. The unemployment rate ticked lower to 3.5% and labor force participation rose for the fourth straight month. Improved supply has helped soften the trend in earnings growth. Average hourly earnings are up just 3.2% at a three-month annualized rate, which is more consistent with the Fed's 2% inflation target (chart). This is very much what the Fed is looking for in terms of curing the labor market imbalance with more workers returning to the labor force.

Labor weakness was evident in other data as well. The March ISM reports showed a softening in hiring, consistent with layoffs in manufacturing and a slower pace of hiring in services. Job openings fell below 10 million, registering the lowest level since May 2021. The number of openings per unemployed worker also fell to 1.67. This remains above the 1.2 pre-pandemic ratio, but marks a 15-month low and is consistent with a topping out in labor demand—as is the fact that the lowest share of small businesses since May 2020 now plan to add workers in coming months. Finally, past revisions to initial jobless claims, which was one of the key data points stubbornly demonstrating strength, also now show a clear uptrend in recent months. All these data signal the labor market is weakening, albeit from a very strong starting point.

Beyond labor, there are growing signs of weakness elsewhere in the economy. Both ISM reports demonstrated economic slowdown last month. The ISM manufacturing index slid to its lowest level since 2020 and is consistent with a sector that has now been in correction for five straight months. Every sub-component was in contraction (below the breakeven 50) for the first time since 2009. At the same time, the services report called service sector resilience into question. The services index slid sharply to 51.2 from 55.1, but most major components remain consistent with expansion. This was not a great development for the services sector, but it's too soon to call off expansion, particularly in light of a solid gain in private service-providing industries employment in March (+196K).

The good news is that there are signs of slower activity bringing reprieve to prices. The prices paid components of both ISMs declined in March, though as shown in the nearby chart the gap between the two remains large, demonstrating how integral services prices are to returning inflation to the Fed's 2% target. At 59.5, service sector price pressure remains firm, but this is the first time it has slipped below 60 since late 2020. Overall it appears we have reached the point where a broadening group of indicators is suggesting the slowdown is in train and the end of the Fed's tightening cycle is in sight.

This Week's State Of The Economy - What Is Ahead? - 01 October 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

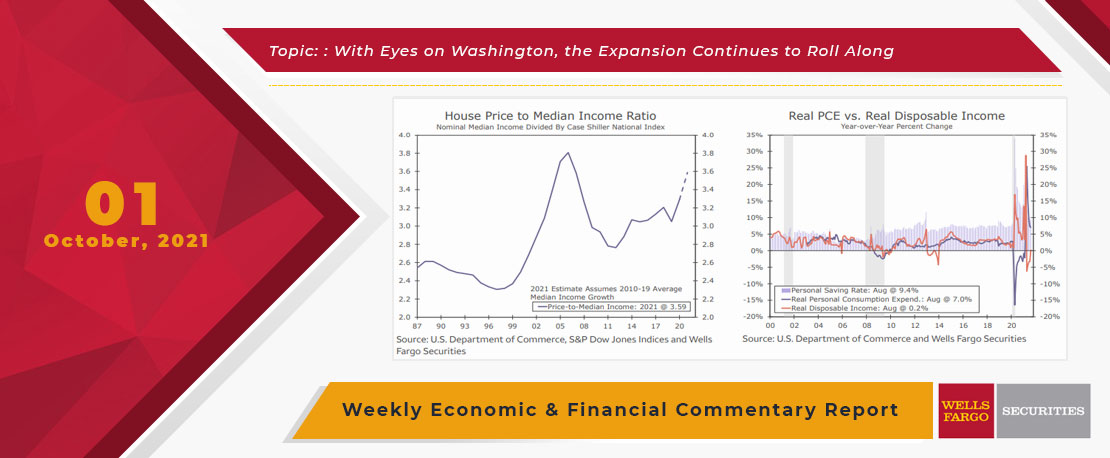

Economic data this week indicated that the ongoing expansion still has some momentum despite some familiar headwinds, though this week\'s releases were largely overshadowed by a busy week on Capitol Hill.

This Week's State Of The Economy - What Is Ahead? - 05 May 2023

Wells Fargo Economics & Financial Report / May 11, 2023

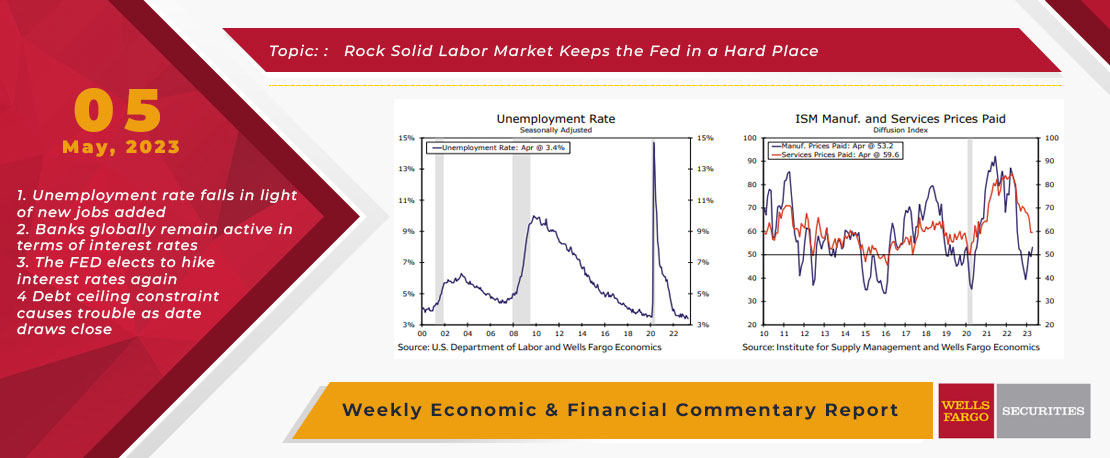

In April, employers added 253K jobs and the unemployment rate fell to 3.4%. During the same month, the ISM services index edged up to 51.9, while the ISM manufacturing index improved to 47.1.

This Week's State Of The Economy - What Is Ahead? - 16 October 2021

Wells Fargo Economics & Financial Report / Oct 22, 2021

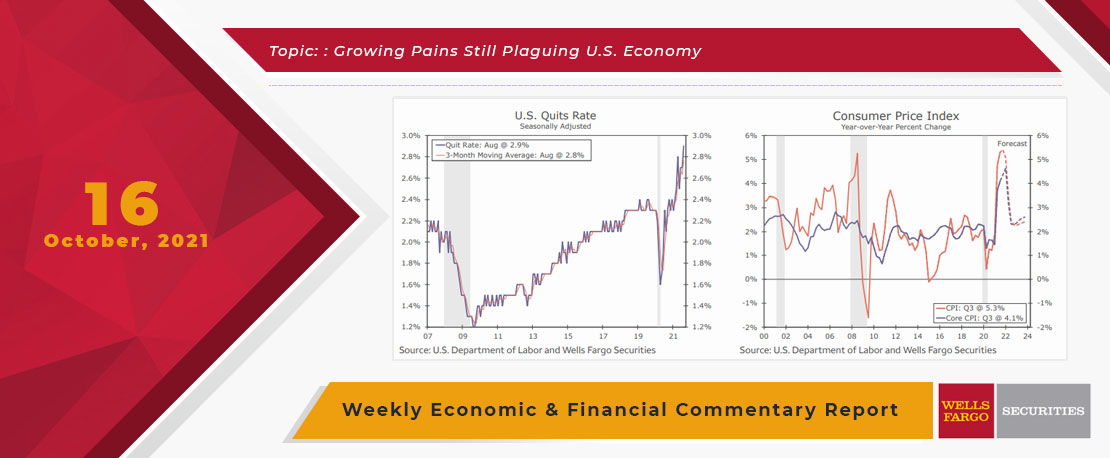

The first economic data released this week in the United States reinforced the theme that labor supply and demand are struggling to come into balance.

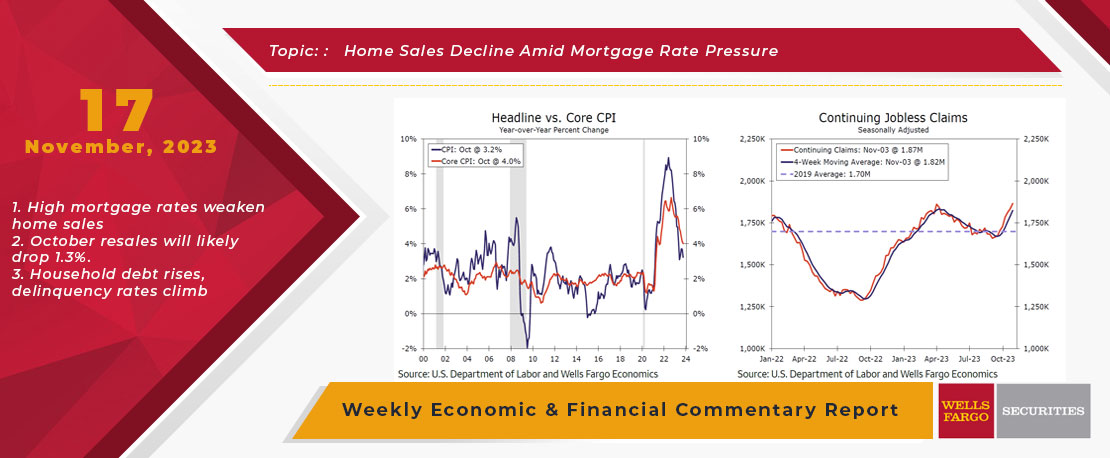

This Week's State Of The Economy - What Is Ahead? - 17 November 2023

Wells Fargo Economics & Financial Report / Nov 23, 2023

Retail and Industrial activity were stronger than the headline data suggest, there are also some signs of weakening.

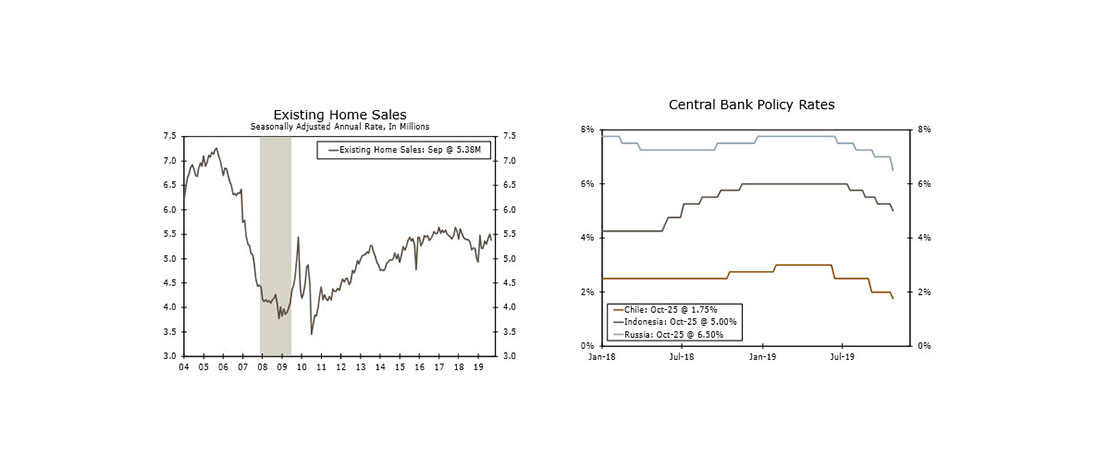

This Week's State Of The Economy - What Is Ahead? - 25 October 2019

Wells Fargo Economics & Financial Report / Oct 26, 2019

Sales of existing homes fell 2.2% to a 5.38 million-unit pace in September, but sales and prices were still up enough in the quarter that they will add solidly to Q3 GDP growth.

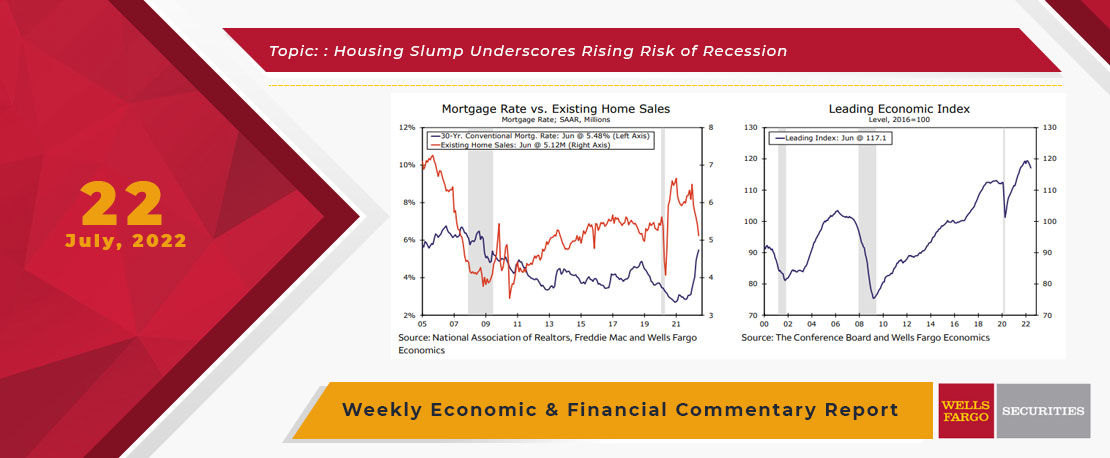

This Week's State Of The Economy - What Is Ahead? - 22 July 2022

Wells Fargo Economics & Financial Report / Jul 27, 2022

July\'s NAHB Housing Market Index dropped 12 points to 55, the second largest monthly decline on record behind April 2020\'s pandemic-induced collapse.

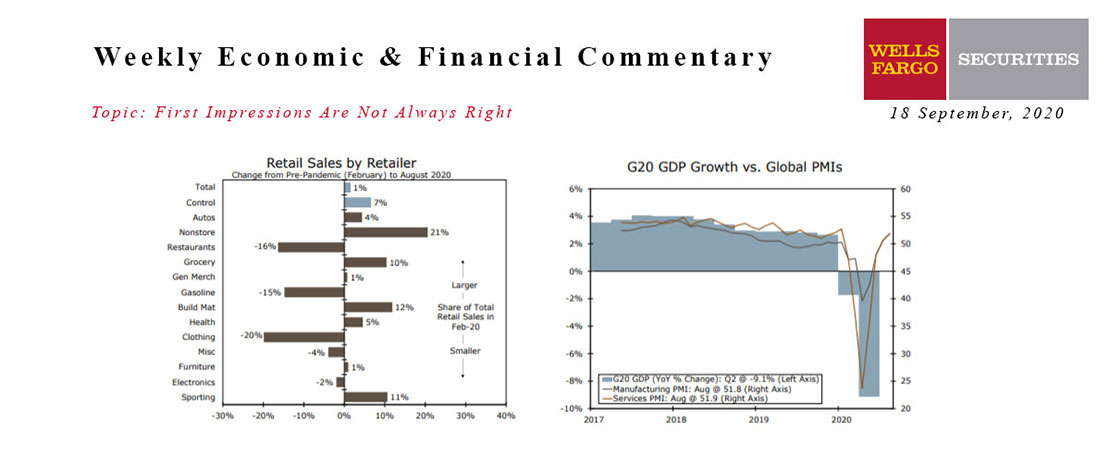

This Week's State Of The Economy - What Is Ahead? - 18 September 2020

Wells Fargo Economics & Financial Report / Sep 15, 2020

The details were generally more favorable. The retail sectors hurt most by the pandemic saw gains in August, factory output is growing and soaring homebuilder confidence suggests soft construction data this week may be transitory.

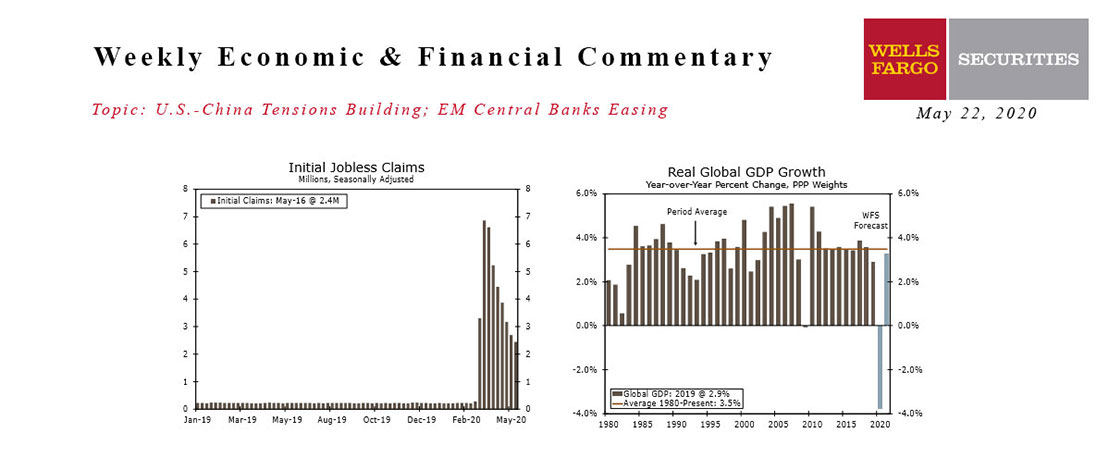

This Week's State Of The Economy - What Is Ahead? - 22 May 2020

Wells Fargo Economics & Financial Report / May 25, 2020

The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions.

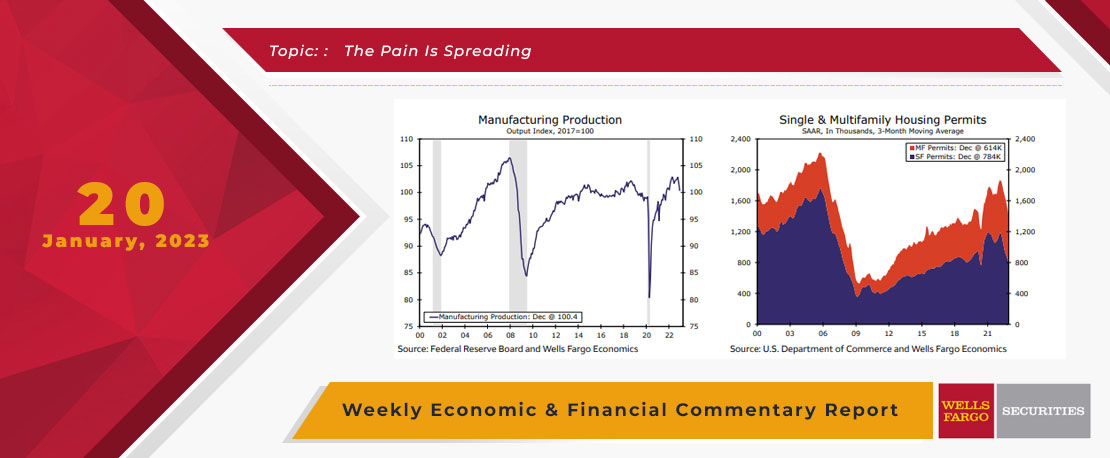

This Week's State Of The Economy - What Is Ahead? - 20 January 2023

Wells Fargo Economics & Financial Report / Jan 20, 2023

The housing sector has borne the brunt of the Fed\'s efforts to slow the economy, and this week\'s data showed the industry continues to reel.

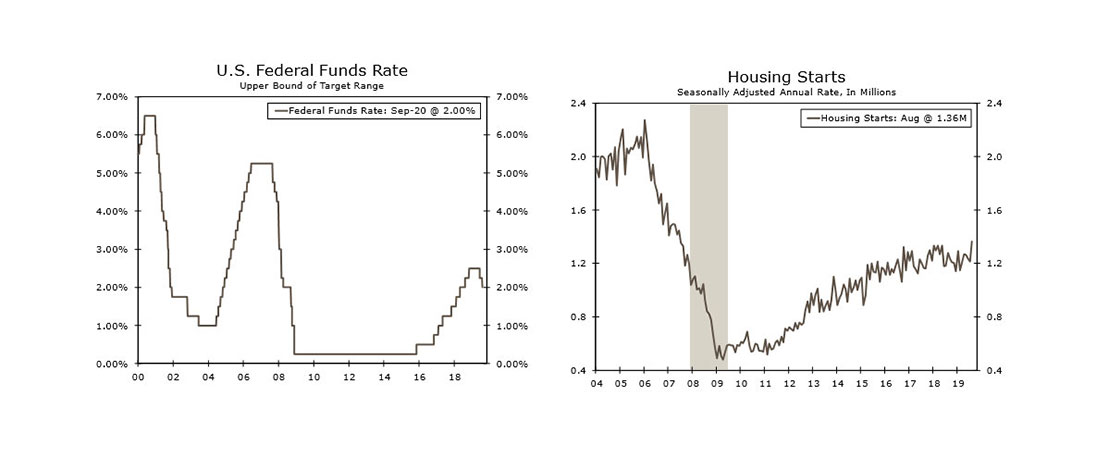

This Week's State Of The Economy - What Is Ahead? - 20 September 2019

Wells Fargo Economics & Financial Report / Sep 21, 2019

The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.