The first economic data released this week in the United States reinforced the theme that labor supply and demand are struggling to come into balance. Total job openings declined modestly in August, but at 10.4 million, they remain roughly 50% above their pre-COVID levels. Despite the decline, a few sectors saw job openings increase, such as transportation, warehousing and utilities. Perhaps more interesting, the quit rate jumped 0.2 percentage points in August and hit the highest level on record (see chart). Quits increased the most in accommodation & food services, which makes sense given that significant upward pressure on wages in that industry is likely keeping competition for workers intense. A high quit rate is typically a sign that workers are confident they can voluntarily leave their current job and find gainful employment elsewhere. Based off of the weak labor supply numbers in last week's September employment report, we doubt the September job openings and labor turnover data to be released next month will show supply and demand reaching any kind of balance. As we have written before, we expect the labor supply picture to resolve slowly over time rather than all at once

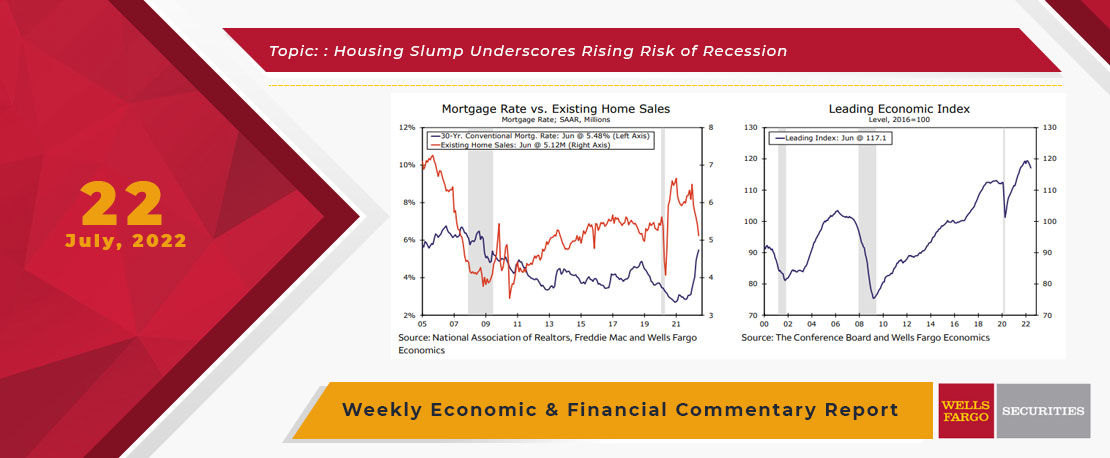

This Week's State Of The Economy - What Is Ahead? - 22 July 2022

Wells Fargo Economics & Financial Report / Jul 27, 2022

July\'s NAHB Housing Market Index dropped 12 points to 55, the second largest monthly decline on record behind April 2020\'s pandemic-induced collapse.

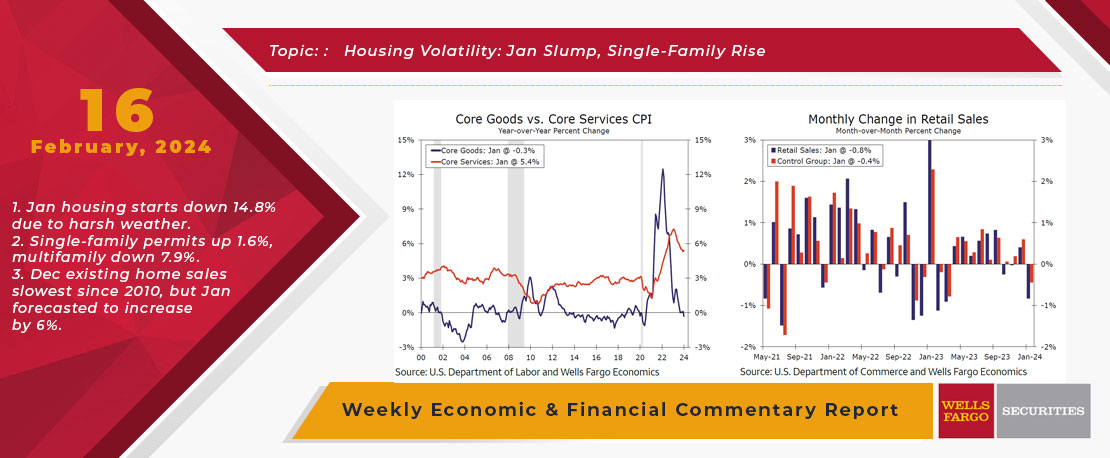

This Week's State Of The Economy - What Is Ahead? - 16 February 2024

Wells Fargo Economics & Financial Report / Feb 20, 2024

The out-of-consensus start to the year for economic data continued with a slip in retail sales and industrial production followed by a startling 14.8% drop in housing starts during January.

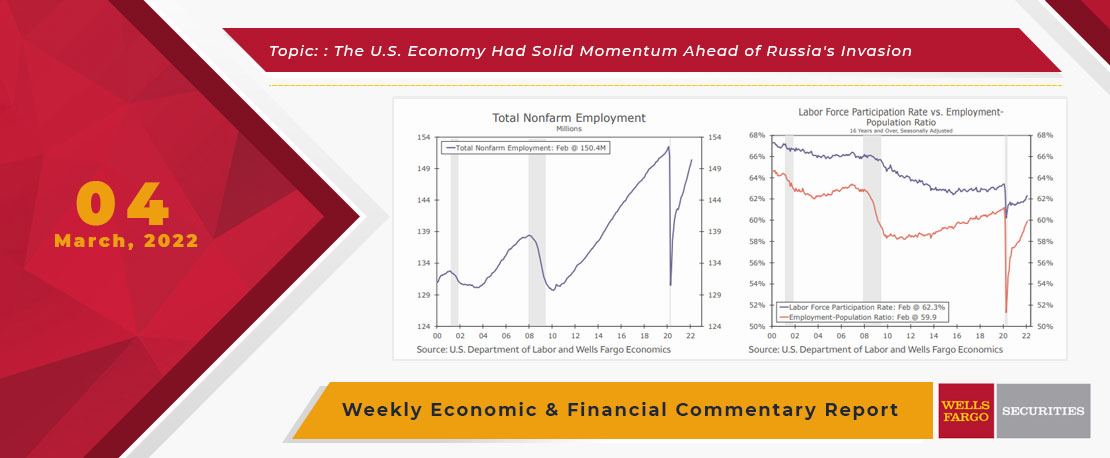

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

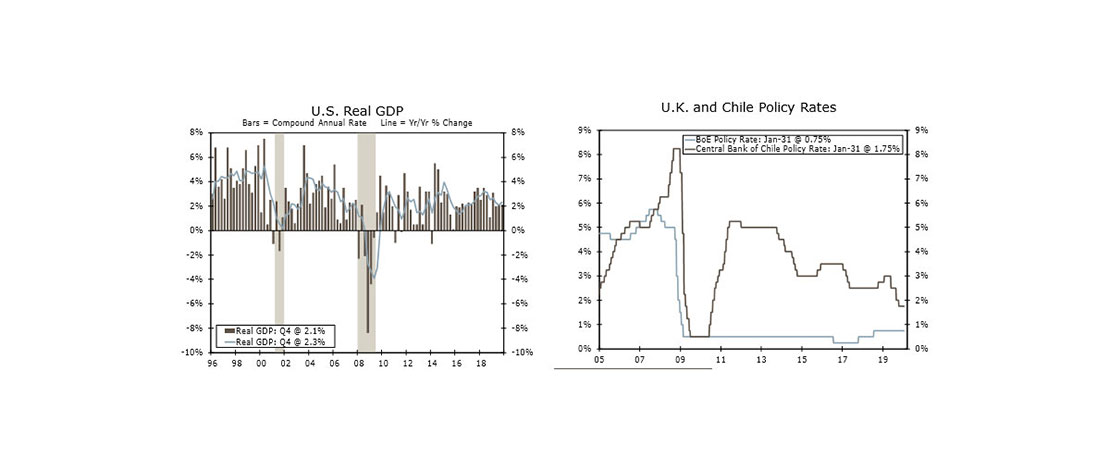

This Week's State Of The Economy - What Is Ahead? - 31 January 2020

Wells Fargo Economics & Financial Report / Feb 01, 2020

Mexico’s economy has slowed notably over the last year, with the economy contracting again in Q4, indicating a full-year contraction for 2019.

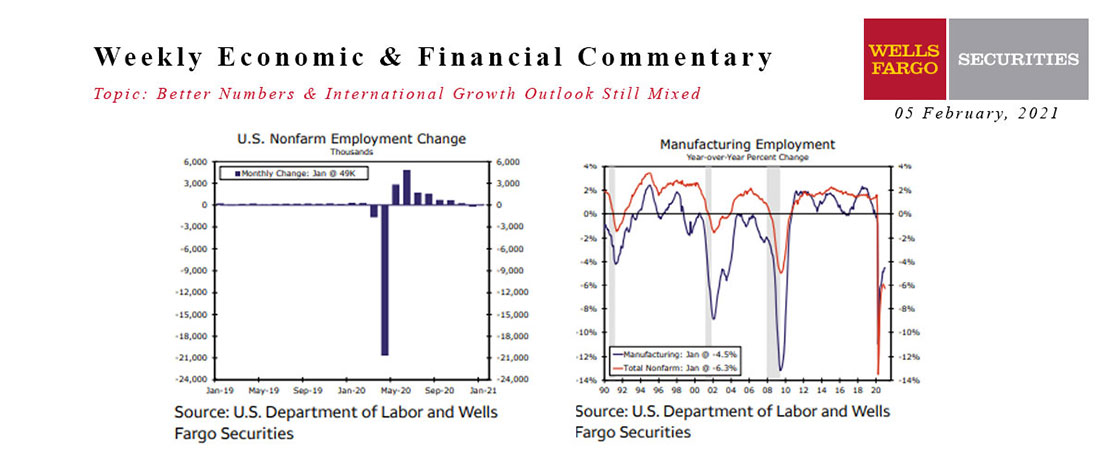

This Week's State Of The Economy - What Is Ahead? - 05 February 2021

Wells Fargo Economics & Financial Report / Feb 10, 2021

Nonfarm employment rebounded in January, with employers adding 49,000 jobs following the prior month\'s 227,000-job drop.

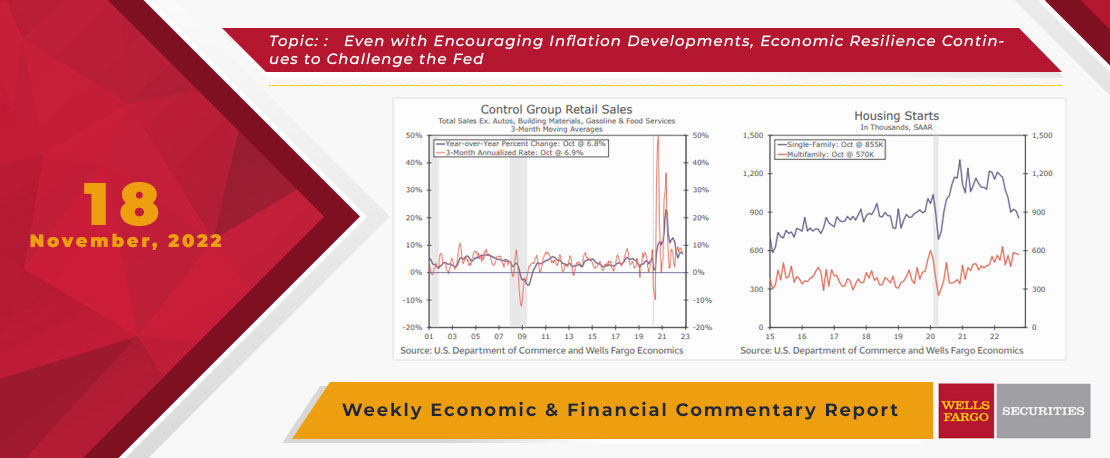

This Week's State Of The Economy - What Is Ahead? - 18 November 2022

Wells Fargo Economics & Financial Report / Nov 21, 2022

The resiliency of the U.S. consumer was also on display, as total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations.

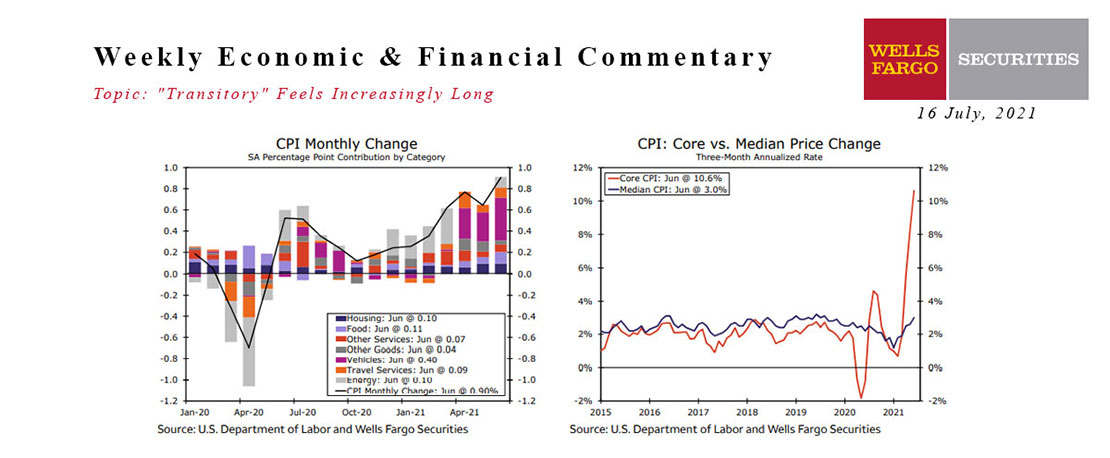

This Week's State Of The Economy - What Is Ahead? - 16 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

Visiting from Texas, it felt more like fall, which like the Texas cold-snap last February just goes to show that it’s a case of what you’re used to.

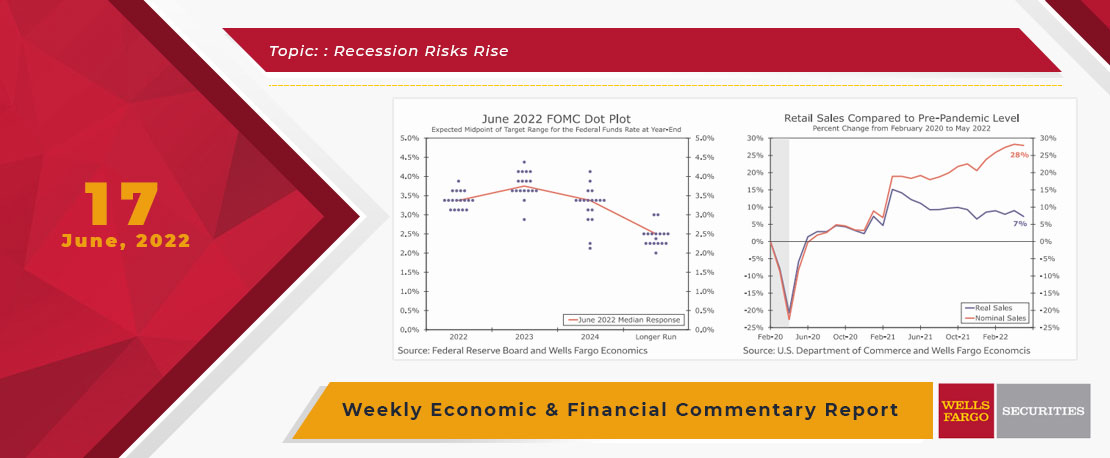

This Week's State Of The Economy - What Is Ahead? - 17 June 2022

Wells Fargo Economics & Financial Report / Jun 20, 2022

After last week\'s stronger-than-expected CPI, less surprising was the 75 point rate increase put forth by the Fed.

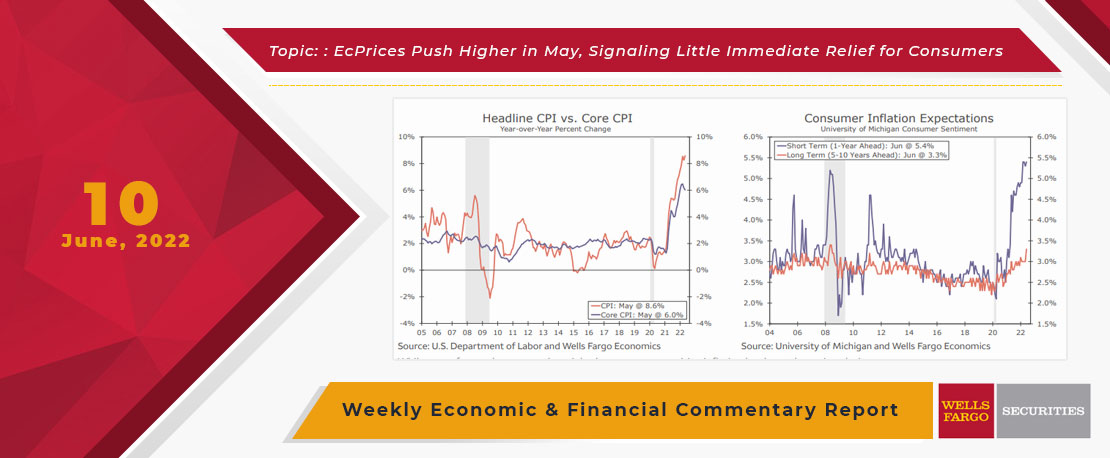

This Week's State Of The Economy - What Is Ahead? - 10 June 2022

Wells Fargo Economics & Financial Report / Jun 13, 2022

CPI increases continue to sizzle like this weekend’s temperature, putting consumers in a worse mood than Texas Rangers fans (with their 9.5 games back $500 million middle infield).

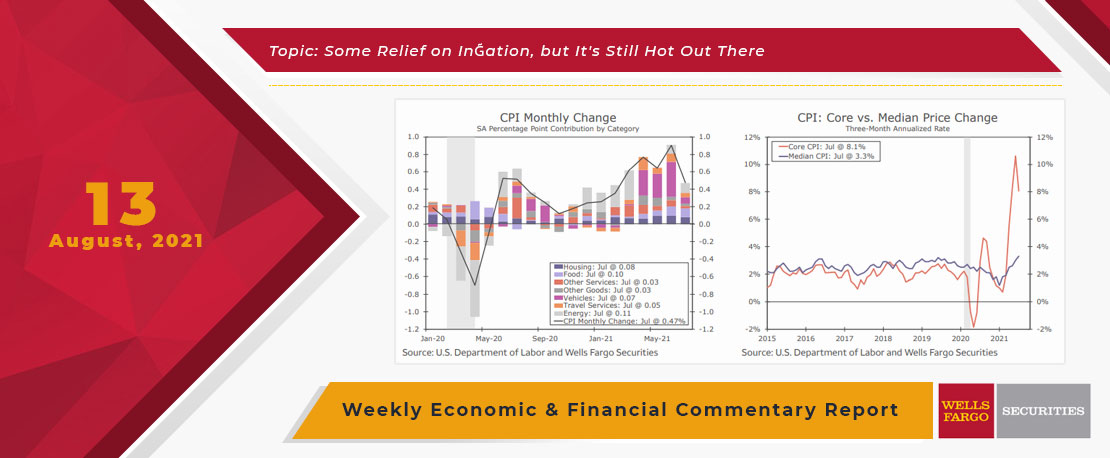

This Week's State Of The Economy - What Is Ahead? - 13 August 2021

Wells Fargo Economics & Financial Report / Aug 19, 2021

The general outlook remains positive as households have accumulated over $2T in excess savings on their balance sheets and net worth has risen across all income groups.