CPI increases continue to sizzle like this weekend’s temperature, putting consumers in a worse mood than Texas Rangers fans (with their 9.5 games back $500 million middle infield). In case you’ve been in a news blackout, the Labor Department reported this morning that year-over-year consumer prices rose 8.6% in May, the biggest monthly jump since December, 1981 and breaking the previous “biggest jump since 1981” set in…..April. It’s fair to say that the Feds previously telegraphed 0.50% rate increases next week and again in July remain on track. To the extent that inflation is a global issue, it’s worth noting that the European Central Bank has also jumped on the rate increase bandwagon with guidance to expect a 0.25% rate increase in July followed by a series of larger increases.

Where Will That $2 Trillion Come From Anyway?

Wells Fargo Economics & Financial Report / Apr 01, 2020

Net Treasury issuance is set to surge in the coming weeks and months. At present, we look for the federal budget deficit to be $2.4 trillion in FY 2020 and $1.7 trillion in FY 2021.

This Week's State Of The Economy - What Is Ahead? - 10 November 2022

Wells Fargo Economics & Financial Report / Nov 11, 2022

Relief in October inflation gives the FOMC the ability to slow the pace of rate hikes ahead. But make no mistake, the Fed\'s job of taming inflation remains far from over.

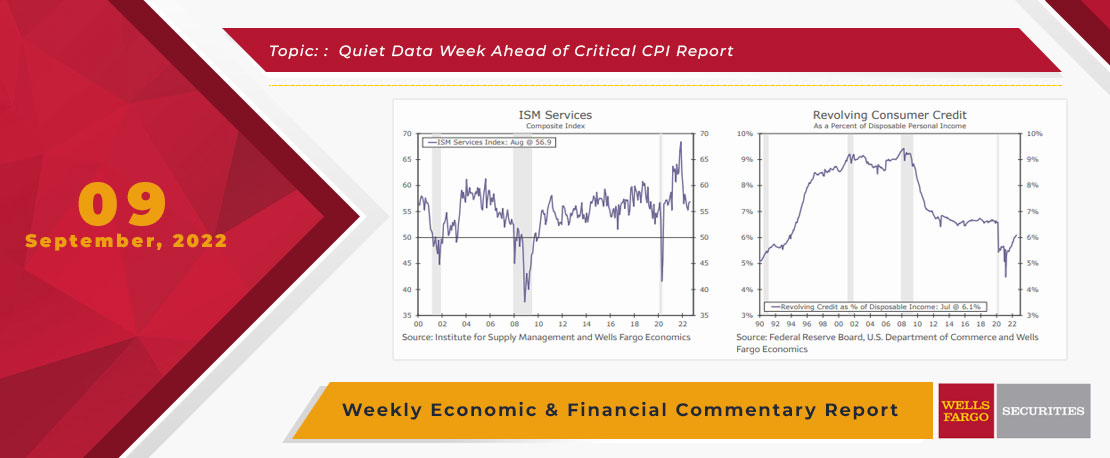

This Week's State Of The Economy - What Is Ahead? - 09 September 2022

Wells Fargo Economics & Financial Report / Sep 10, 2022

The ISM services index came in stronger than expected, and the underlying details pointed to service sector resilience with business activity and new orders notching their highest reading this year.

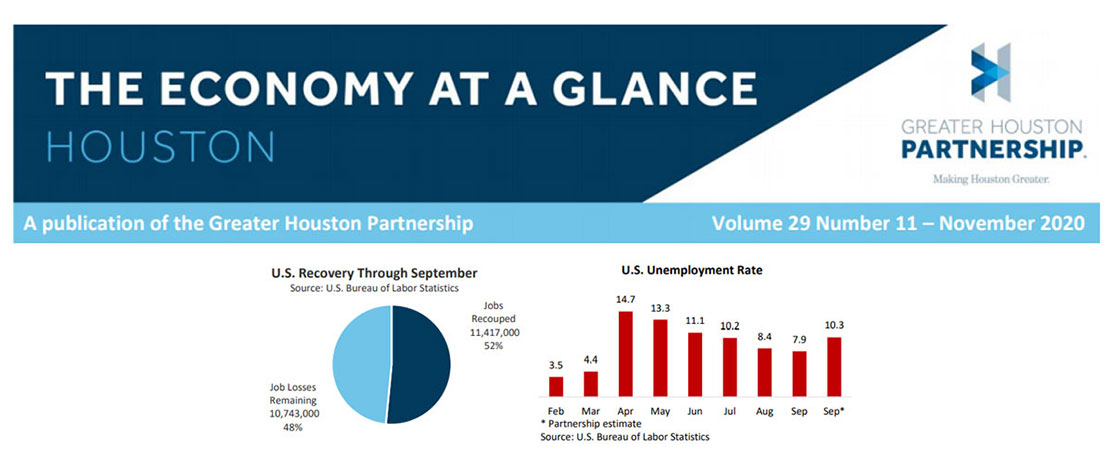

November 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Nov 12, 2020

U.S. gross domestic product (GDP) grew 7.4 percent, or $1.3 trillion in Q3, adjusted for inflation.

This Week's State Of The Economy - What Is Ahead? - 14 January 2022

Wells Fargo Economics & Financial Report / Jan 18, 2022

As you may have already seen, inflation is running almost as hot as the stock of our favorite bank. The Consumer Price Index (CPI) rose 7.0% year-over-year in December, the fastest increase in nearly 40 years.

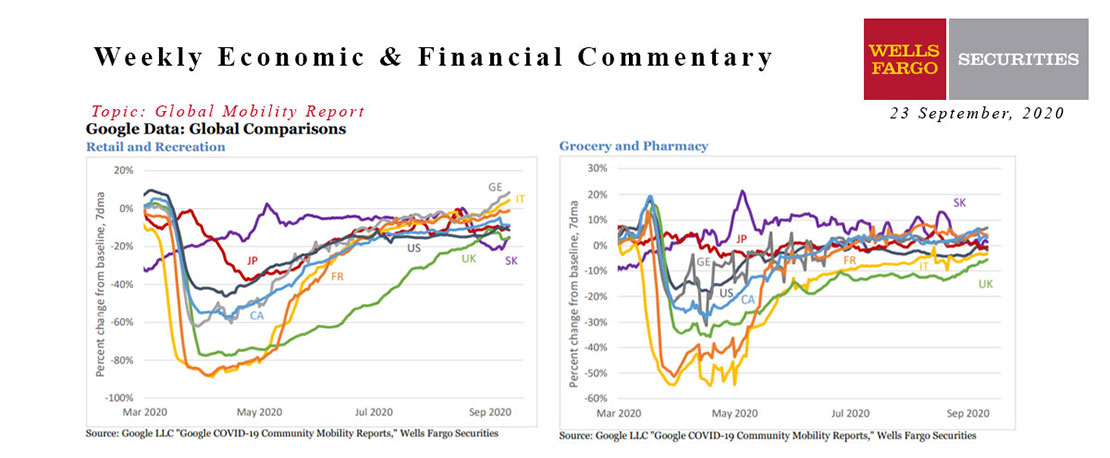

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

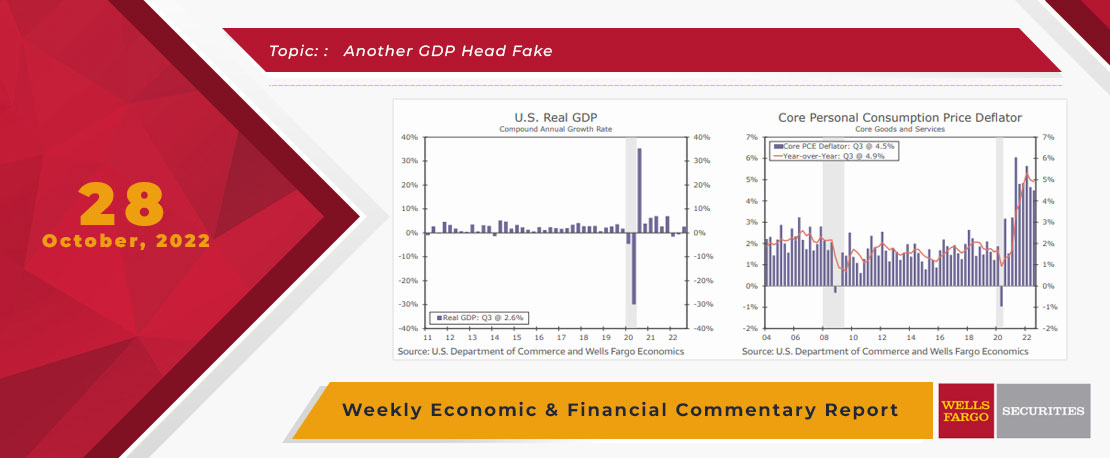

This Week's State Of The Economy - What Is Ahead? - 28 October 2022

Wells Fargo Economics & Financial Report / Oct 31, 2022

Headline GDP continues to send mixed signals on the direction of the U.S. economy. During Q3, real GDP rose at a 2.6% annualized rate, ending the recent string of quarterly declines in growth registered in the first half of 2022.

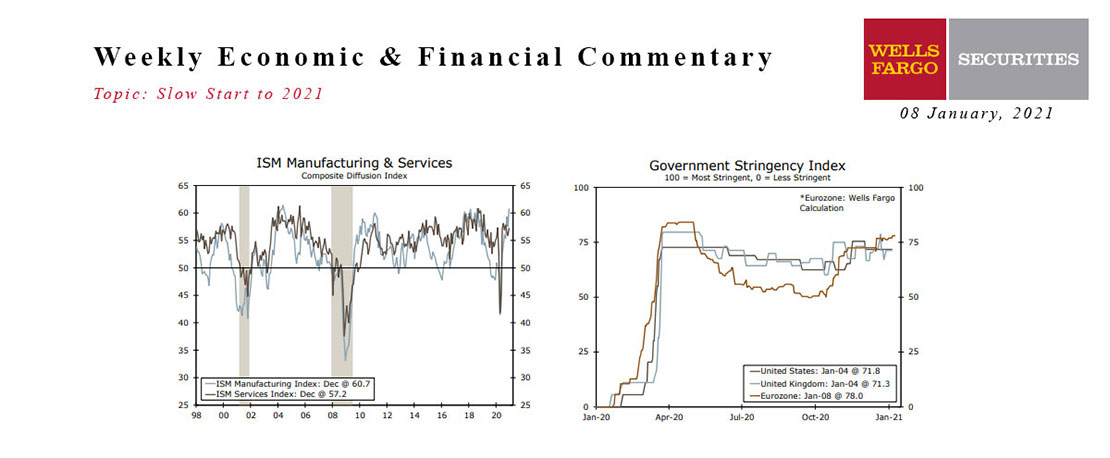

This Week's State Of The Economy - What Is Ahead? - 08 January 2021

Wells Fargo Economics & Financial Report / Jan 12, 2021

The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

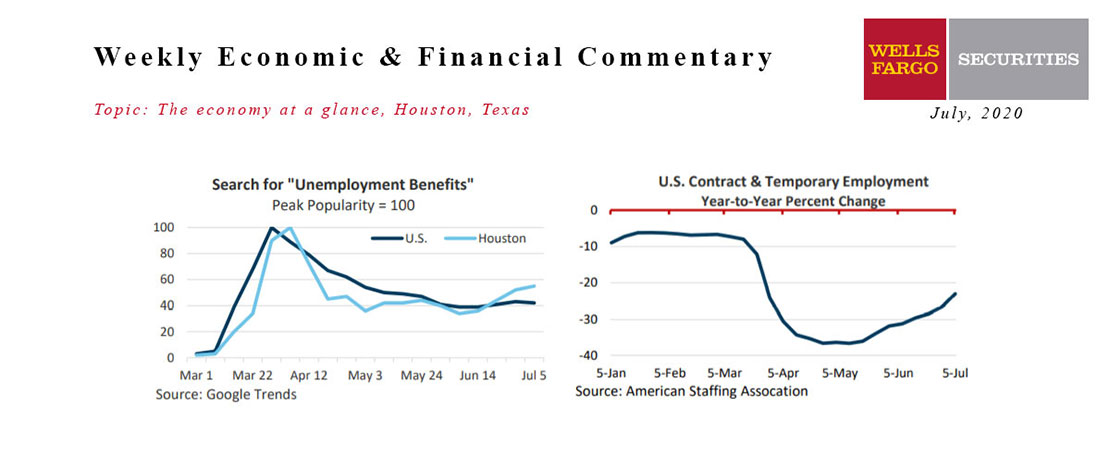

July 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jul 30, 2020

The recent surge in COVID-19 cases indicates that elected officials re-opened the economy too soon, that too many Americans are flaunting social distancing guidelines, and that the virus is likely to be around longer than we’d hoped.

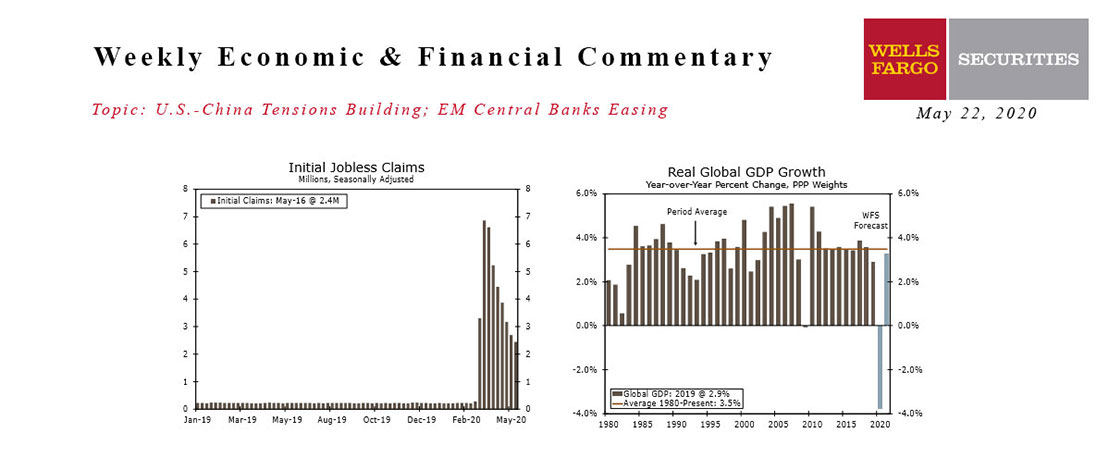

This Week's State Of The Economy - What Is Ahead? - 22 May 2020

Wells Fargo Economics & Financial Report / May 25, 2020

The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions.