There was some clear relief in consumer inflation in October, which is a welcome development for households and policymakers alike. The headline consumer price index rose "just" 0.4% during the month, which was below the Bloomberg consensus expectation for a 0.6% gain and caused the yearago pace to fall back to 7.7%, or the lowest annual rate of inflation in nine months (chart). Core prices also rose a more muted 0.3% during the month as core goods prices declined 0.4% amid an easing in supply chain constraints, which have boosted retail inventories. Core services prices rose 0.5% during the month, which is still quite fast compared to the pre-pandemic run rate but a bit softer than we anticipated.

Overall, October's moderation in inflation is welcome, but with the core CPI up at an annualized rate of 5.8% between July and October, there remains a long way to go before inflation returns to a rate the Fed will tolerate. The way back down to the Committee's 2% inflation goal will also likely be bumpy with services inflation particularly difficult to stomp out. The October CPI report reduced the likelihood of another 75 bps rate hike in December, but we expect policymakers to remain biased toward overtightening rather than under-tightening for the foreseeable future.

The FOMC noted for the first time it will consider the cumulative degree of tightening and the lags inherent in monetary policy when deciding on future rate moves at its November policy meeting. Chair Powell also emphasized the Committee is not done tightening yet. We take this communication and the lower-than-expected gain in inflation as evidence that the Fed will continue to hike rates, but at a slower pace, and we forecast the FOMC will hike the federal funds rate by 50 bps at its next monetary policy meeting.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

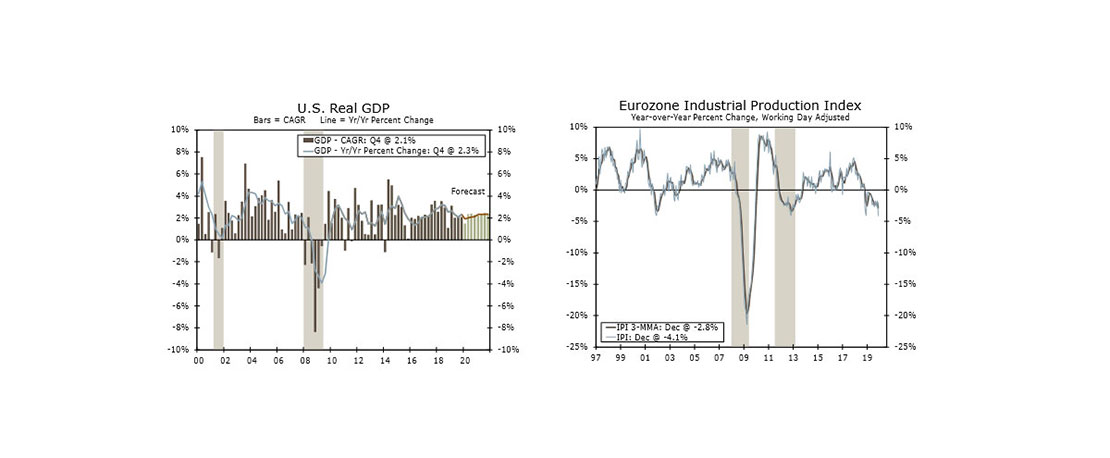

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

This Week's State Of The Economy - What Is Ahead? - 28 June 2024

Wells Fargo Economics & Financial Report / Jul 04, 2024

According to the Federal Reserve\'s preferred gauge, core inflation cooled to its softest pace in more than three years in May against a backdrop of measured consumer spending and still-strong personal income.

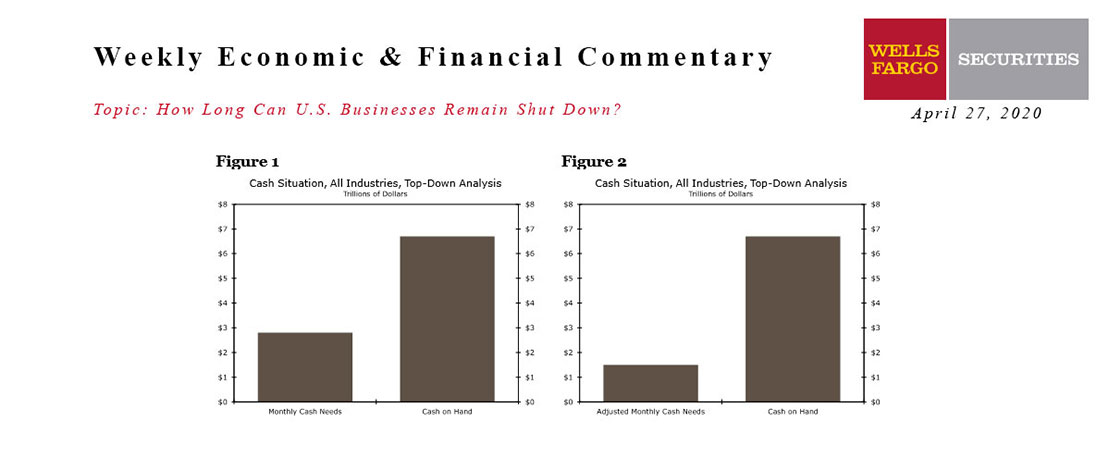

How Long Can US Businesses Remain Shut Down?

Wells Fargo Economics & Financial Report / Apr 29, 2020

The sudden stop in economic activity caused by the COVID-19 pandemic means that many businesses will need to rely on their cash reserves to survive the next few months.

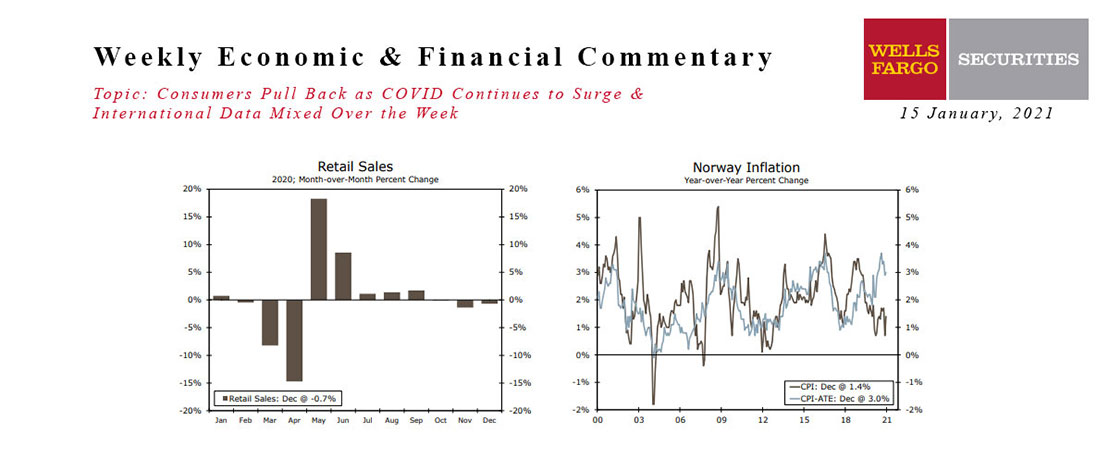

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

This Week's State Of The Economy - What Is Ahead? - 11 August 2023

Wells Fargo Economics & Financial Report / Aug 15, 2023

During July, both the headline and core Consumer Price Index (CPI) rose 0.2%. On a year-over-year basis, the core CPI was up 4.7% in July. Recent signs have been more encouraging, with core CPI running at a 3.1% three-month annualized pace.

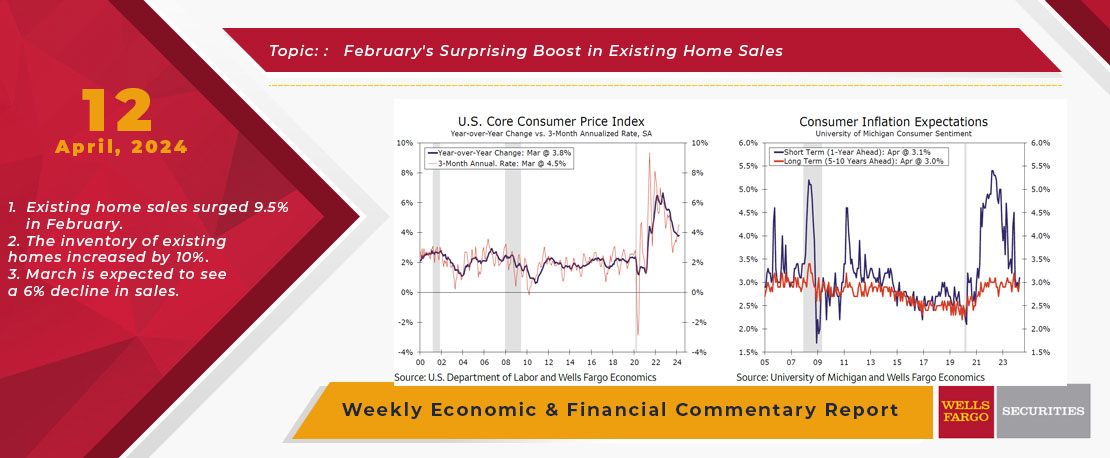

This Week's State Of The Economy - What Is Ahead? - 12 April 2024

Wells Fargo Economics & Financial Report / Apr 18, 2024

The March consumer price data dominated the economic discussion this week and are the latest to support that the timing and degree of Fed easing will be later and smaller than many of us previously expected.

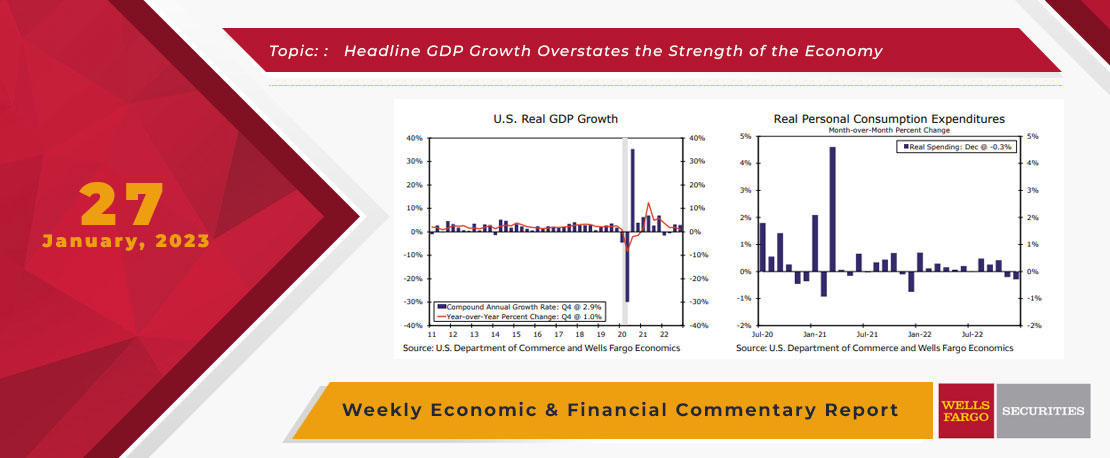

This Week's State Of The Economy - What Is Ahead? - 27 January 2023

Wells Fargo Economics & Financial Report / Jan 28, 2023

Real GDP expanded at a 2.9% annualized pace in Q4. While beating expectations, the underlying details were not as encouraging. Moreover, the weakening monthly indicator performances to end the year suggest the decelerating trend will continue in Q1.

This Week's State Of The Economy - What Is Ahead? - 21 June 2024

Wells Fargo Economics & Financial Report / Jun 25, 2024

Retail sales rose just 0.1% over the month, falling short of consensus and suggesting that consumers may finally be feeling some spending fatigue.

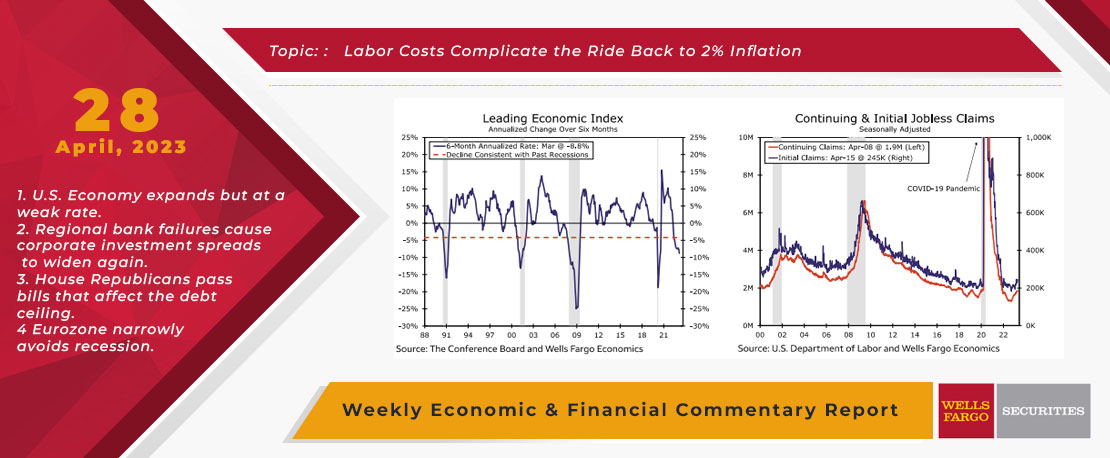

This Week's State Of The Economy - What Is Ahead? - 28 April 2023

Wells Fargo Economics & Financial Report / May 03, 2023

U.S. Economy expands but at a weak rate. Regional bank failures cause corporate investment spreads to widen again. House Republicans pass bills that affect the debt ceiling.