On balance, this week's indicator performance came in slightly better than expected, supporting economic resilience so far through the fourth quarter even as the headwinds of elevated inflation, tightening monetary policy and heightened uncertainty about the outlook remain firmly intact. While supportive to the sustainability of the economic expansion, the stronger-than-expected performance makes the Fed's job of taming inflation that much more difficult.

The first piece of encouraging news this week was the lower-than-expected gain in producer prices. In line with last week's CPI performance, the headline PPI increased 0.2% sequentially, two-tenths below expectations. The more moderate pace of price gains cooled the year-over-year rate for the fourth straight month, dropping 0.5 percentage points to a still elevated 8.0%. October's headline increase reflected a 0.6% rise in final demand goods prices (about 60% of this increase can be traced to a 5.7% gain in gasoline) as final demand services prices slipped 0.1%, marking the first monthly drop since November 2020. While showing prices are beginning to head in the right direction, inflation is still running at an unacceptably high pace for the Fed. Yet another similar, downward trending performance from the November CPI report next month may provide enough evidence for the Fed to pull back on the pace of rate hikes as it seeks to bring down inflation markedly.

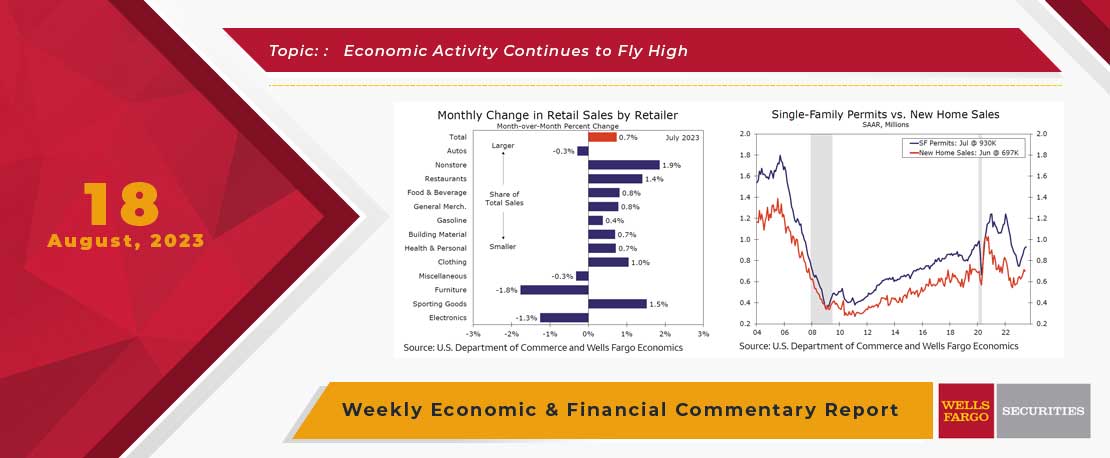

Highlighting the resiliency of the U.S. consumer, total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations. Excluding the aforementioned and building materials and food, control group sales—which feed into the personal consumption expenditures component of GDP—increased by a strong 0.7% last month, on top of upward revisions to September and August. It is clear consumers are willing to run down savings and accumulate credit card debt in order to maintain their current pace of spending. The strong start to the current quarter suggests upside risk to our 6% year-over-year holiday shopping spending call and, in turn, Q4 consumer spending and GDP growth. Indeed, the Atlanta Fed GDPNow model currently projects Q4 U.S. real GDP growth at a 4.2% annualized rate.

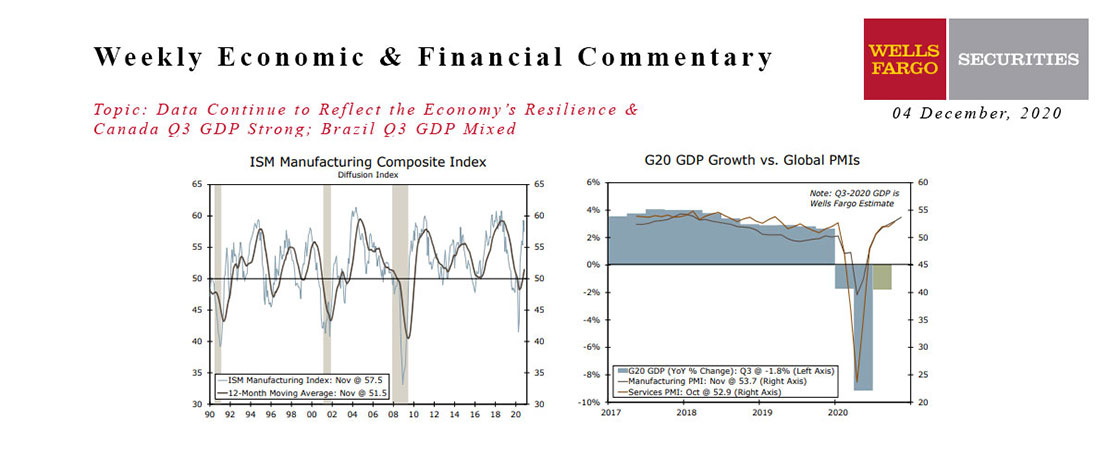

This Week's State Of The Economy - What Is Ahead? - 04 December 2020

Wells Fargo Economics & Financial Report / Dec 09, 2020

Manufacturing held up relatively well in November, despite a larger-than-expected dip in the ISM manufacturing survey. The nonfarm manufacturing survey rose slightly.

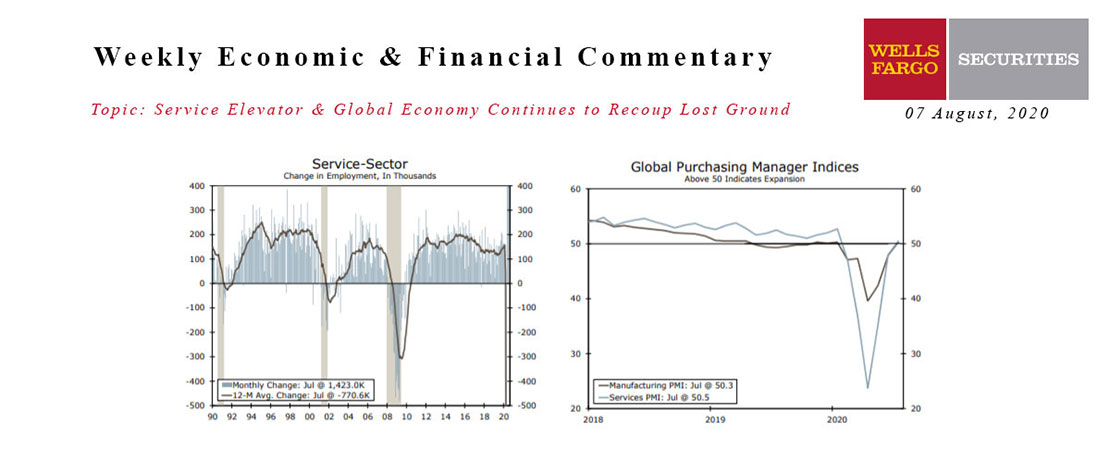

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

There were more signs of global recovery this week and PMI surveys improved further across the world.

This Week's State Of The Economy - What Is Ahead? - 18 August 2023

Wells Fargo Economics & Financial Report / Aug 23, 2023

The FOMC meeting minutes acknowledged the economy\'s resilience and continued to stress the Committee\'s resolve to bring inflation back down toward its 2% goal.

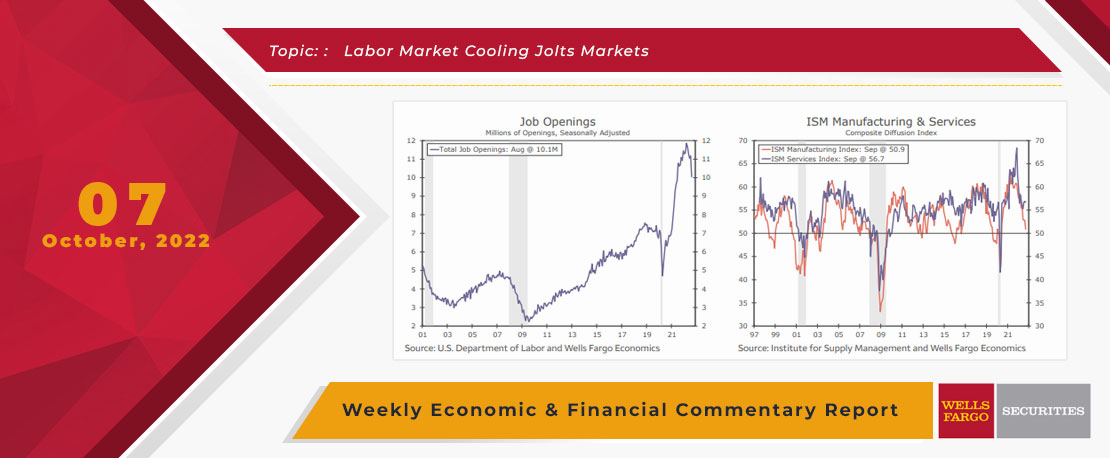

This Week's State Of The Economy - What Is Ahead? - 07 October 2022

Wells Fargo Economics & Financial Report / Oct 10, 2022

higher interest rates and inflation appear to be weighing on manufacturing and construction, yet service sector activity remains fairly resilient.

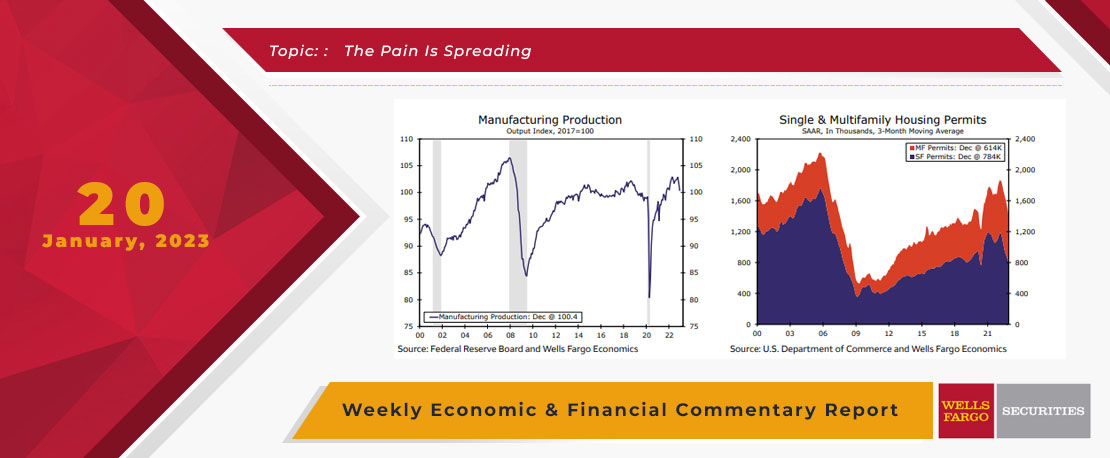

This Week's State Of The Economy - What Is Ahead? - 20 January 2023

Wells Fargo Economics & Financial Report / Jan 20, 2023

The housing sector has borne the brunt of the Fed\'s efforts to slow the economy, and this week\'s data showed the industry continues to reel.

2021 Annual Economic Outlook

Wells Fargo Economics & Financial Report / Dec 16, 2020

The longest U.S. economic expansion since the end of the Second World War came to an abrupt end earlier this year as the COVID pandemic essentially shut down the economy.

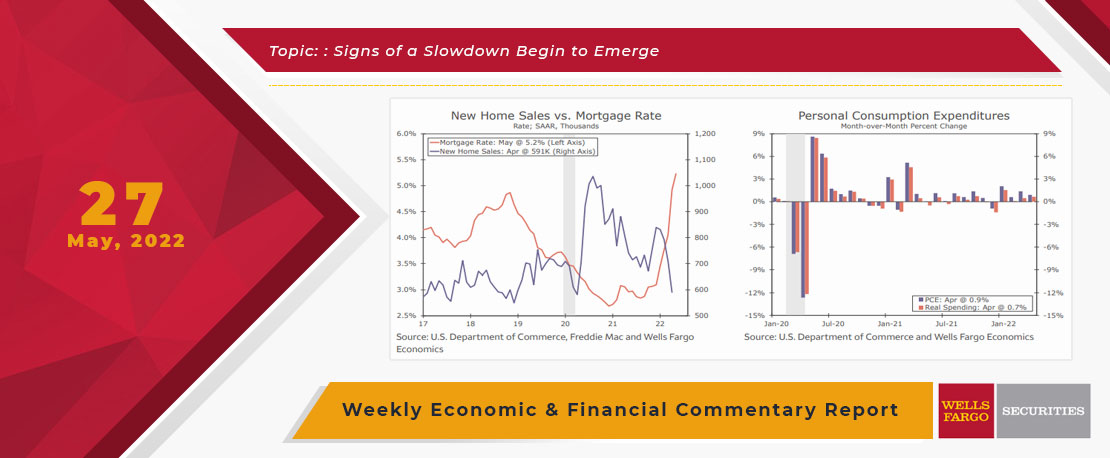

This Week's State Of The Economy - What Is Ahead? - 27 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

it looks like higher mortgage rates are starting to have some effect on the housing market as April...

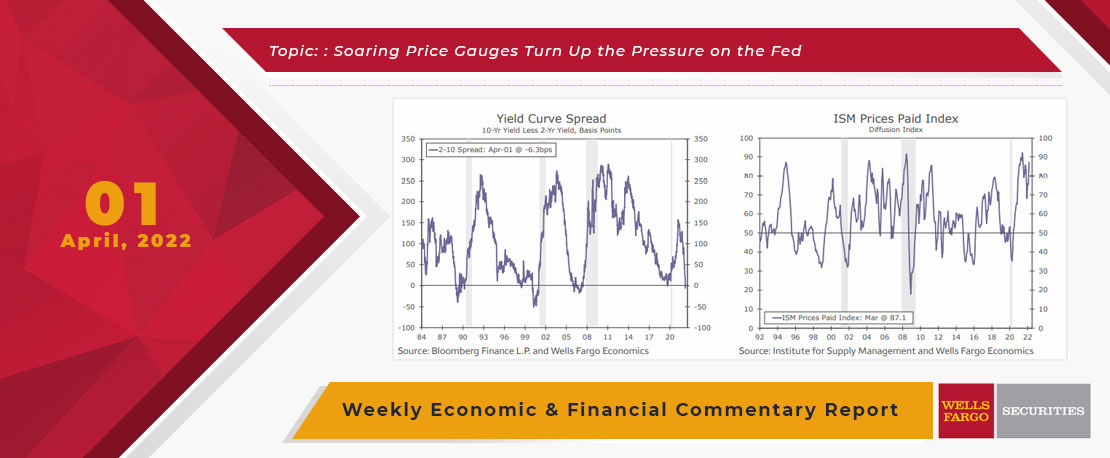

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

This Week's State Of The Economy - What Is Ahead? - 05 February 2021

Wells Fargo Economics & Financial Report / Feb 10, 2021

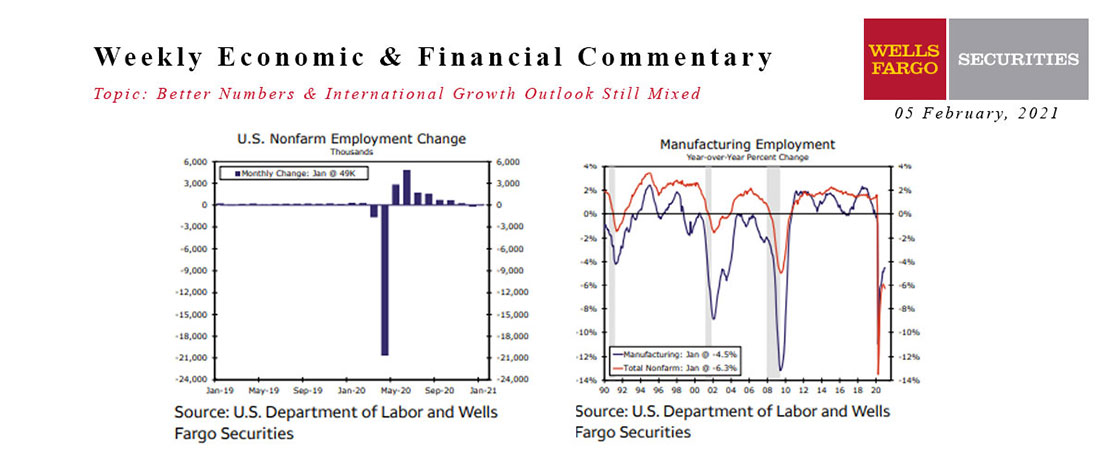

Nonfarm employment rebounded in January, with employers adding 49,000 jobs following the prior month\'s 227,000-job drop.