An onslaught of economic indicators arrived this week. To summarize: higher interest rates and inflation appear to be weighing on manufacturing and construction, yet service sector activity remains fairly resilient. Financial markets were largely focused on signs that the labor market is starting to loosen. Notably, stocks rallied early in the week following a surprisingly sharp drop in job openings. According to the latest Job Openings and Labor Turnover Survey (JOLTS), the count of job openings plummeted by 1.1 million vacancies in August. The monthly decline was the sharpest drop since 2020 during the throes of the pandemic.

The JOLTS plunge will come as welcome news to the FOMC. Fed Chair Powell has frequently cited the high number of openings relative to the number of unemployed workers as indicative of a labor market that is too tight. August's plunge in openings is a sign that tighter monetary policy is starting to slow hiring, and possibly the inflation pressures stemming from rapid wage growth. The market reaction to the news was likely owed to the belief that a pivot towards less-hawkish monetary policy could be coming sooner than expected.

Given the steep drop in job openings, Friday’s employment report took on new significance. Payrolls rose by 263K jobs during September, a gain just a shade above market expectations. The monthly improvement reflects a slowing pace of job growth this year, however labor markets remain remarkably tight. The unemployment rate ticked back down to 3.5% during the month, matching a 50-year low. The dip in the jobless rate occurred alongside a solid rise in household employment and only mild decline in the labor force. The labor force participation rate, which is still hovering below prepandemic averages, inched down to 62.3%.

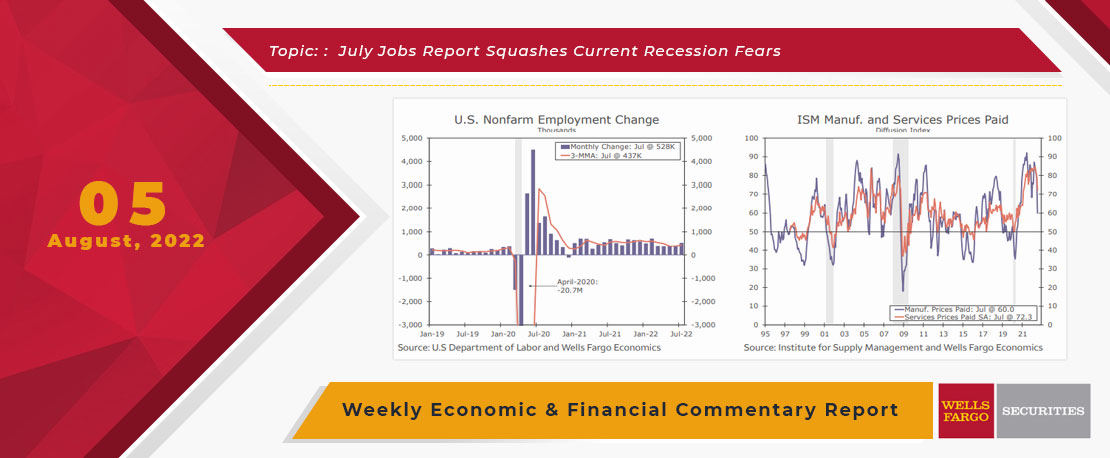

This Week's State Of The Economy - What Is Ahead? - 05 August 2022

Wells Fargo Economics & Financial Report / Aug 08, 2022

The Bureau of Labor Statistics reported this morning that nonfarm payrolls increased 528,000 for the month of July, easily topping estimates, lowering the unemployment rate to 3.5%.

This Week's State Of The Economy - What Is Ahead? - 27 November 2019

Wells Fargo Economics & Financial Report / Nov 28, 2019

A series of U.K. general election polls released this week continue to show Boris Johnson’s Conservative Party with a significant lead over the opposition Labor Party.

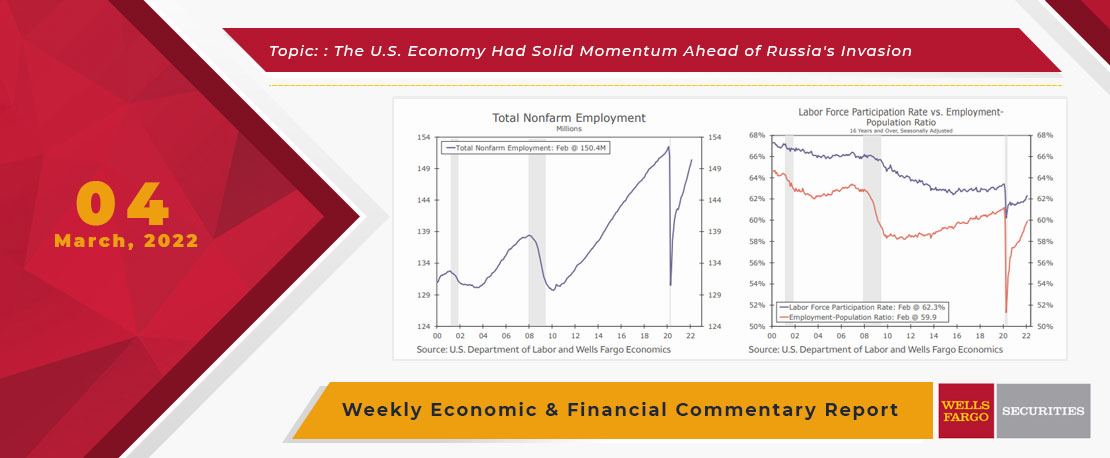

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

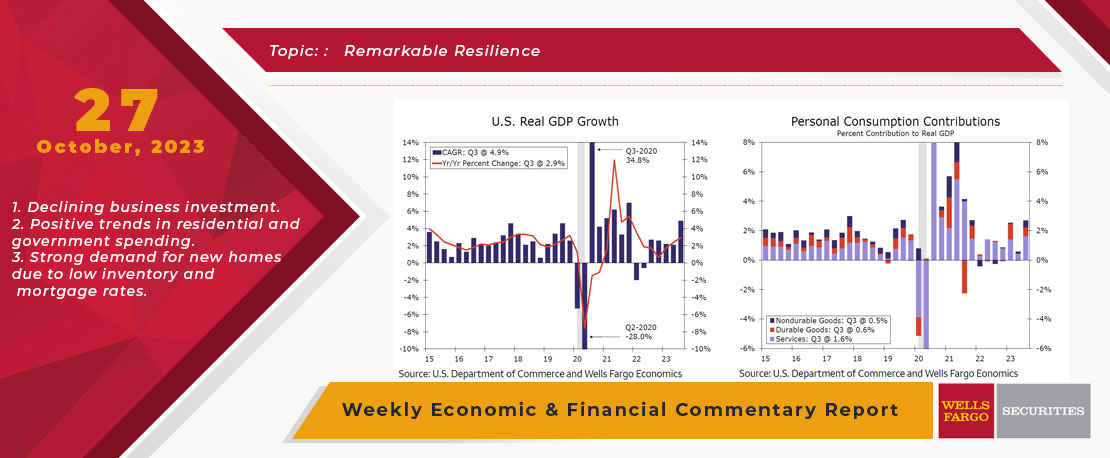

This Week's State Of The Economy - What Is Ahead? - 27 October 2023

Wells Fargo Economics & Financial Report / Nov 02, 2023

The U.S. economy expanded at a stronger-than-expected pace in Q3, with real GDP increasing at a robust 4.9% annualized rate.

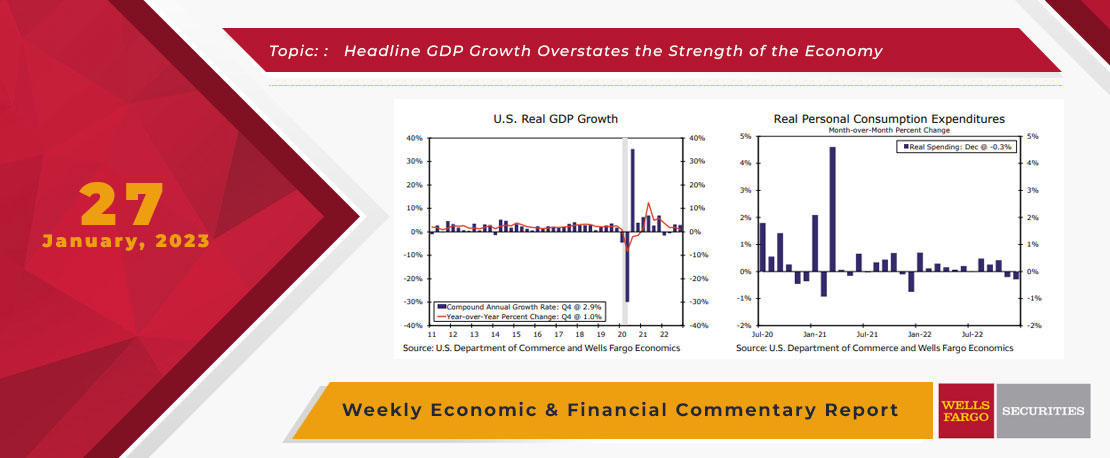

This Week's State Of The Economy - What Is Ahead? - 27 January 2023

Wells Fargo Economics & Financial Report / Jan 28, 2023

Real GDP expanded at a 2.9% annualized pace in Q4. While beating expectations, the underlying details were not as encouraging. Moreover, the weakening monthly indicator performances to end the year suggest the decelerating trend will continue in Q1.

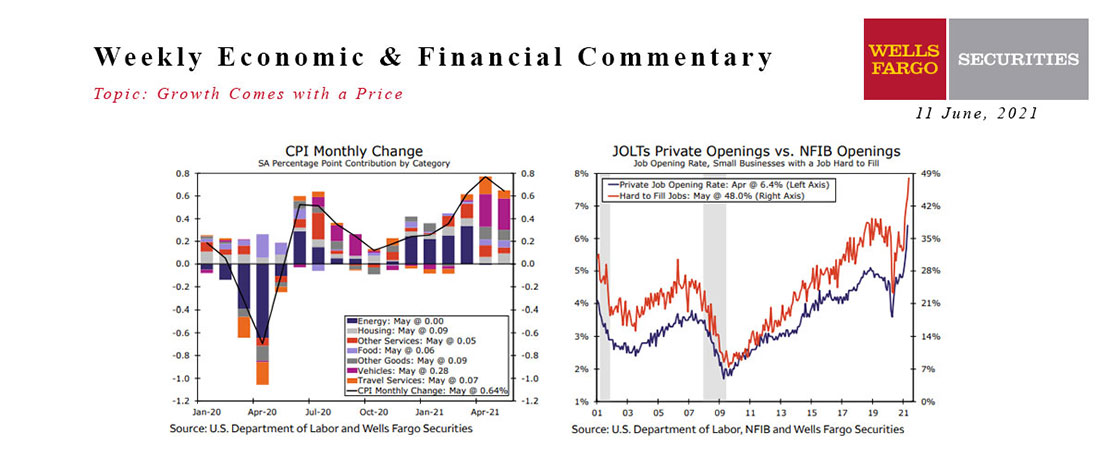

This Week's State Of The Economy - What Is Ahead? - 11 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Okay, so I’ve gotten about half a dozen calls since Wednesday asking if I saw the May CPI numbers that came out this week.

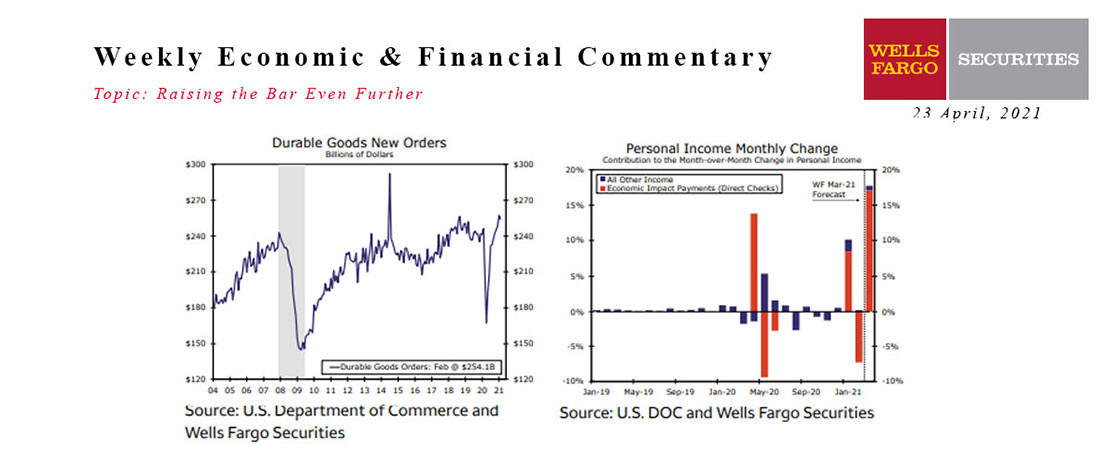

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

This Week's State Of The Economy - What Is Ahead? - 21 June 2024

Wells Fargo Economics & Financial Report / Jun 25, 2024

Retail sales rose just 0.1% over the month, falling short of consensus and suggesting that consumers may finally be feeling some spending fatigue.

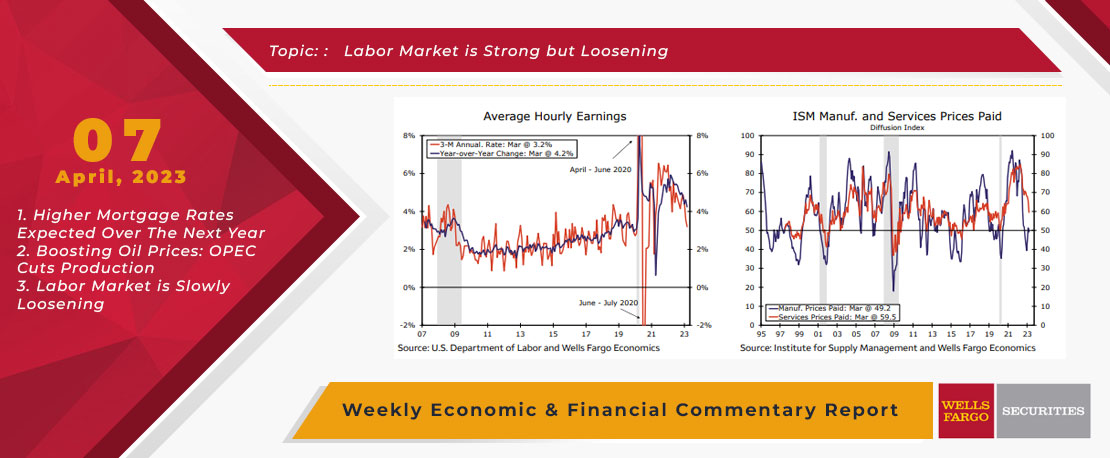

This Week's State Of The Economy - What Is Ahead? - 07 April 2023

Wells Fargo Economics & Financial Report / Apr 10, 2023

Employers added jobs at the slowest pace since 2020 in March, job openings fell and an upward trend in initial jobless claims has emerged.

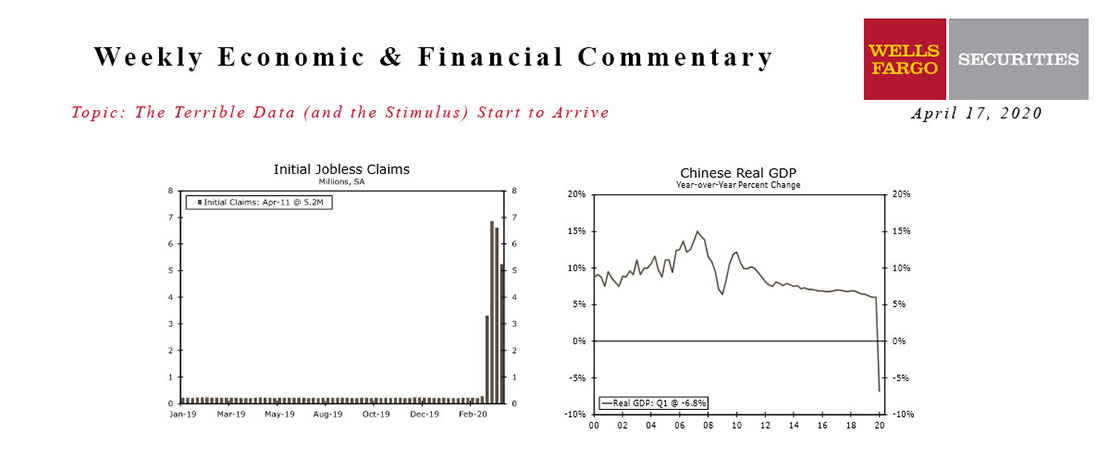

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.