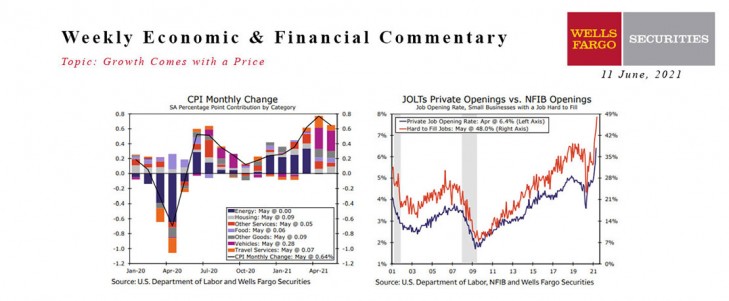

Okay, so I’ve gotten about half a dozen calls since Wednesday asking if I saw the May CPI numbers that came out this week. The answer is yes. Pretty eye-popping…especially if you have the misfortune of being in the market for a new or used car. Drive extra careful, because you don’t want to be that person right now!

There are some more complete indicators on tap to be released next week that should give a more complete picture of what’s really going on, but it only makes sense that labor and product shortages are going to have to price-adjust at some point to bring demand and supply back into equilibrium, and that could definitely result in more inflationary pressure.

Wells Fargo’s Economists have pulled-out their Ouija board and looked into the future at the FOMC meeting that concludes June 16th. They don’t expect any major policy changes from that meeting. The recent increase in inflation could however induce some committee members to bring forward their forecasts of future rate hikes and open the discussion regarding the pace of asset purchases.

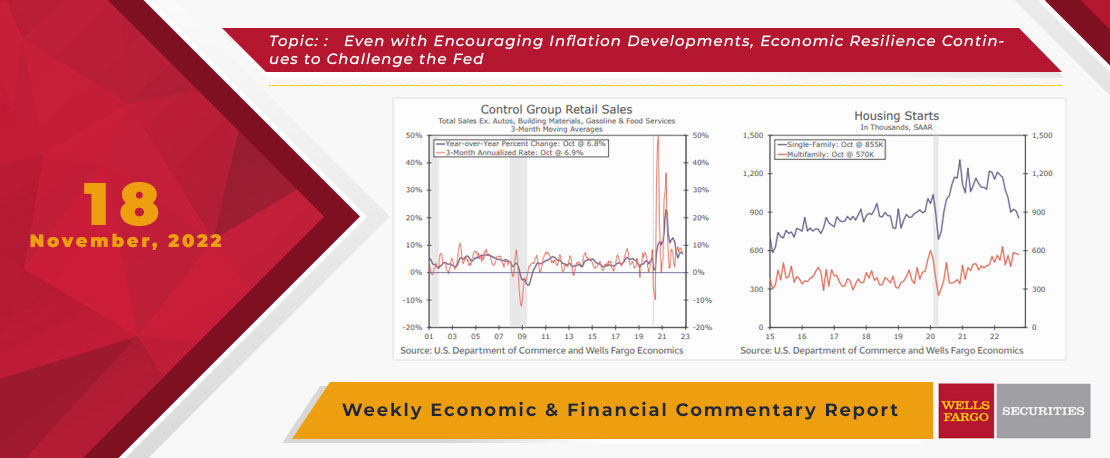

This Week's State Of The Economy - What Is Ahead? - 18 November 2022

Wells Fargo Economics & Financial Report / Nov 21, 2022

The resiliency of the U.S. consumer was also on display, as total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations.

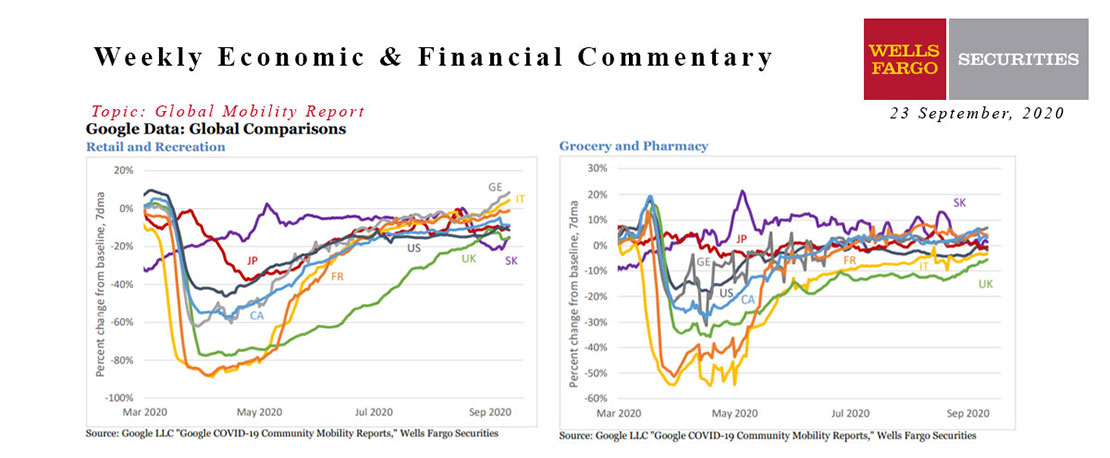

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

Where Will That $2 Trillion Come From Anyway?

Wells Fargo Economics & Financial Report / Apr 01, 2020

Net Treasury issuance is set to surge in the coming weeks and months. At present, we look for the federal budget deficit to be $2.4 trillion in FY 2020 and $1.7 trillion in FY 2021.

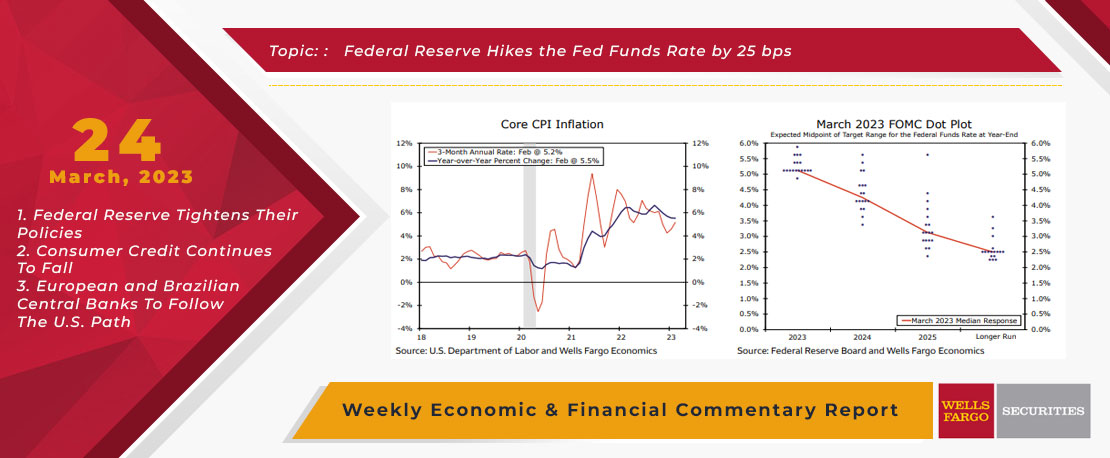

This Week's State Of The Economy - What Is Ahead? - 24 March 2023

Wells Fargo Economics & Financial Report / Mar 29, 2023

The FOMC hiked the federal funds rate by 25 bps on Wednesday amid continued strength in the labor market and elevated inflation.

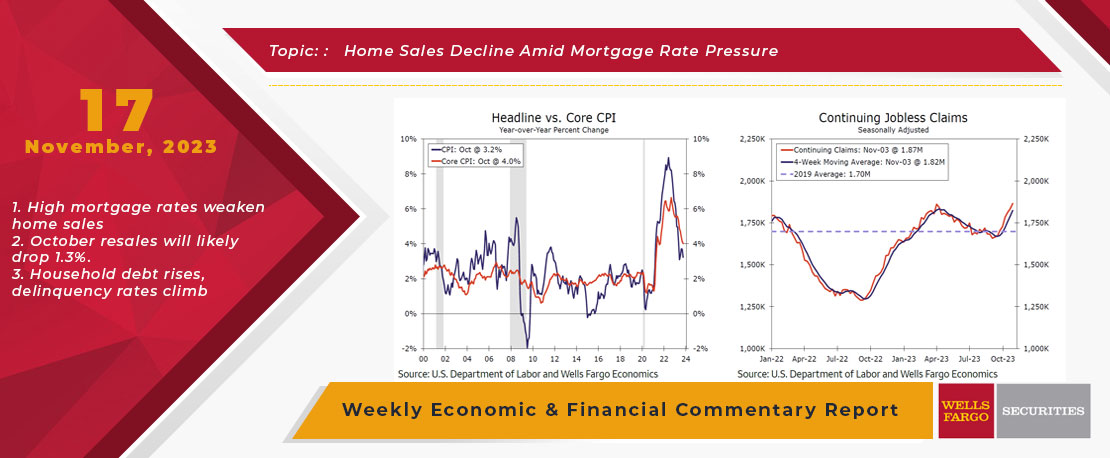

This Week's State Of The Economy - What Is Ahead? - 17 November 2023

Wells Fargo Economics & Financial Report / Nov 23, 2023

Retail and Industrial activity were stronger than the headline data suggest, there are also some signs of weakening.

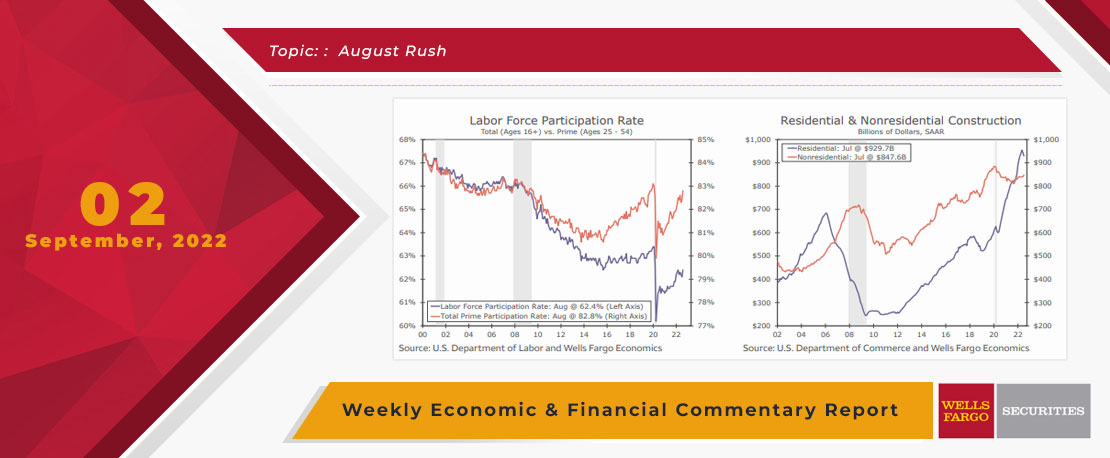

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

This Week's State Of The Economy - What Is Ahead? - 17 May 2024

Wells Fargo Economics & Financial Report / May 23, 2024

The Producer Price Index (PPI) was a bit firm in April, rising 0.5% amid higher services prices, though it did come with slight downward revisions to prior month\'s data.

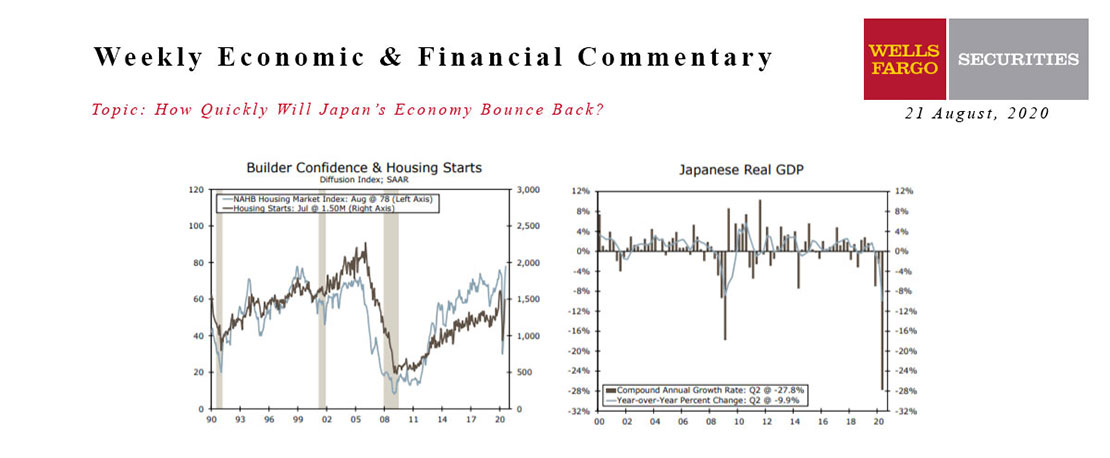

This Week's State Of The Economy - What Is Ahead? - 21 August 2020

Wells Fargo Economics & Financial Report / Aug 18, 2020

Despite indications of lost momentum elsewhere, residential construction activity is picking up steam.

This Week's State Of The Economy - What Is Ahead? - 13 May 2022

Wells Fargo Economics & Financial Report / May 18, 2022

While small business enthusiasm appears to have stalled, as owners are concerned about their ability to continue to pass on higher costs to consumers, cautious enthusiasm around rookie Jeremy Pena’s start persists.

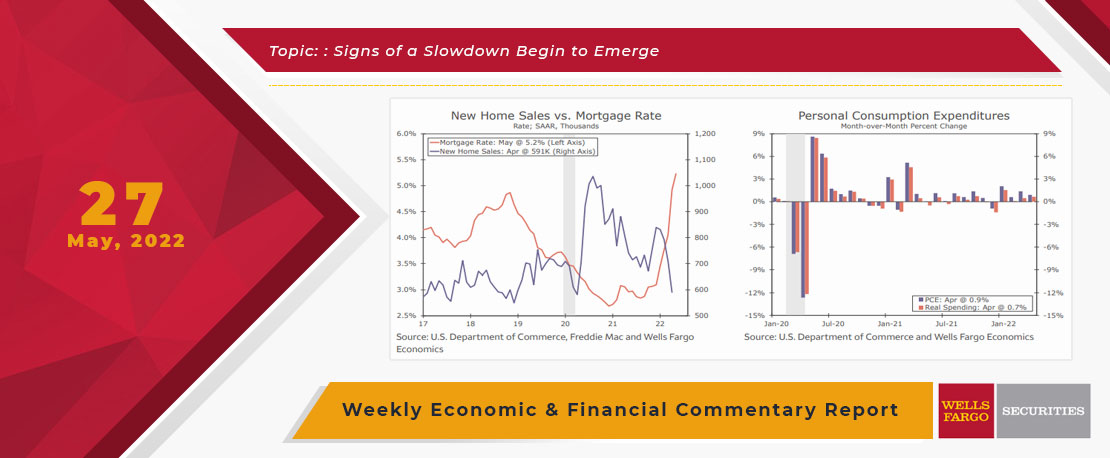

This Week's State Of The Economy - What Is Ahead? - 27 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

it looks like higher mortgage rates are starting to have some effect on the housing market as April...