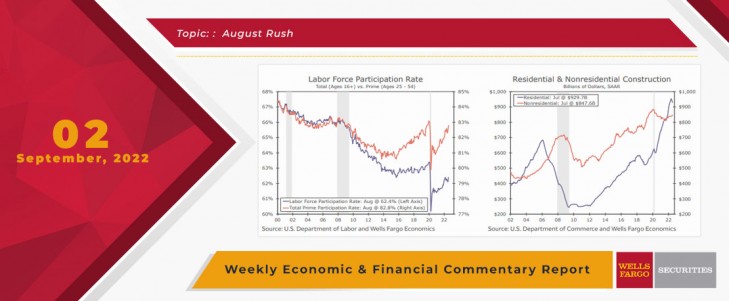

It’s been a great week for history buffs like me, who were encouraged to see the Battleship Texas (the last dreadnought-style warship still in existence) slip uneventfully from her mooring at San Jacinto battleground and move safely to dry-dock in Galveston for some much needed restoration work before moving to a new, more tourist-friendly location. Similarly, economic news was buoyed by reports that employers added 315K new names to their payrolls in August. At the same time an additional 786K people stepped back into the labor force looking for work. Amid such a rush, the unemployment rate rose to 3.7%. More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

With the Fed laser-focused on inflation, the August CPI will offer the last major piece of the 50 bps vs. 75 bps puzzle. But we do not see anything in the August employment report to alter the general path ahead. See Interest Rate Watch for further details.

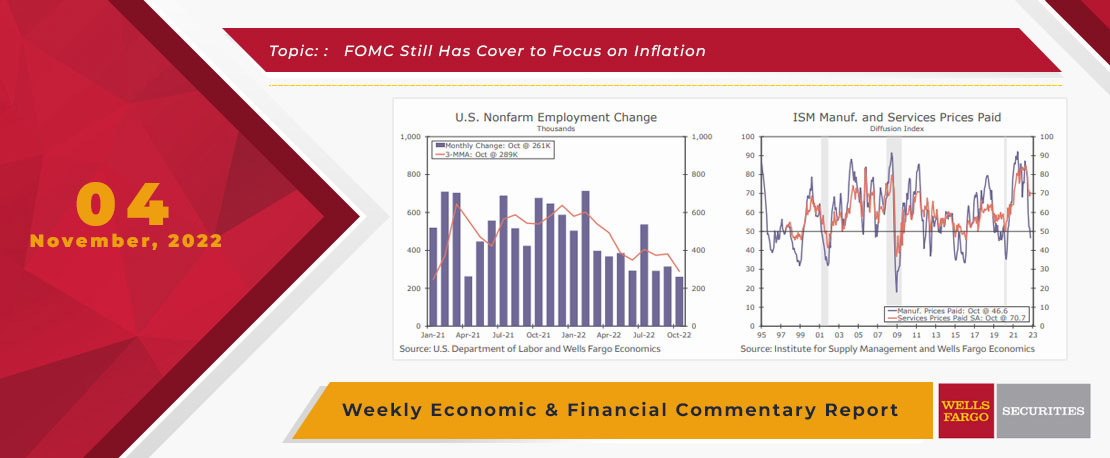

This Week's State Of The Economy - What Is Ahead? - 04 November 2022

Wells Fargo Economics & Financial Report / Nov 07, 2022

Employers continued to add jobs at a steady clip in October, demonstrating the labor market remains tight and the FOMC will continue to tighten policy.

This Week's State Of The Economy - What Is Ahead? - 24 September 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

While fears of an Evergrande default in China were rattling financial markets, for those of us in Southeast Texas who have survived the typically very hot months of July, August and September, this week brought the very welcome first early fall-like

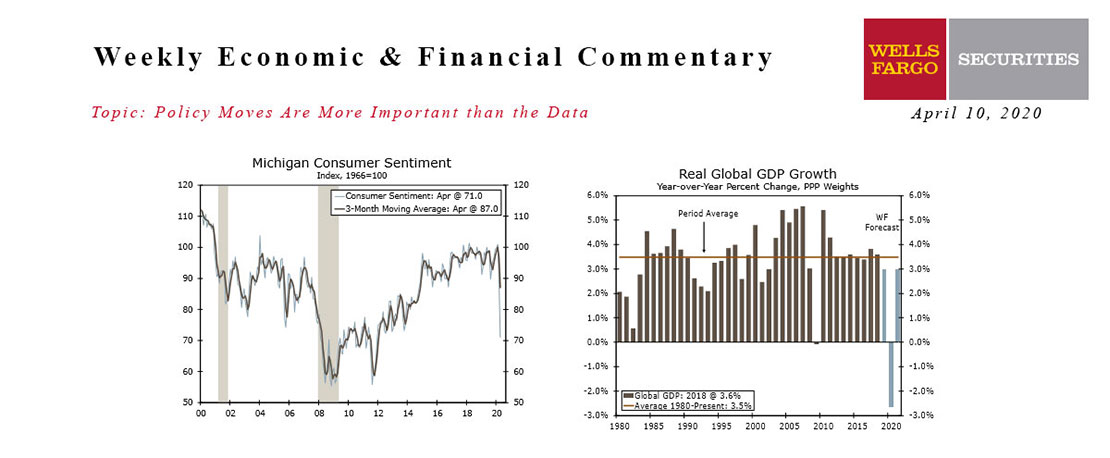

This Week's State Of The Economy - What Is Ahead? - 10 April 2020

Wells Fargo Economics & Financial Report / Apr 11, 2020

The Federal Reserve greatly expanded the collateral that it is willing to buy, further easing pressures in financial markets.

This Week's State Of The Economy - What Is Ahead? - 24 February 2023

Wells Fargo Economics & Financial Report / Feb 28, 2023

Existing home sales declined 0.7% in January, while new home sales leaped 7.2%. Real personal spending shot higher in January, and solid growth in discretionary spending suggests continued consumer resilience.

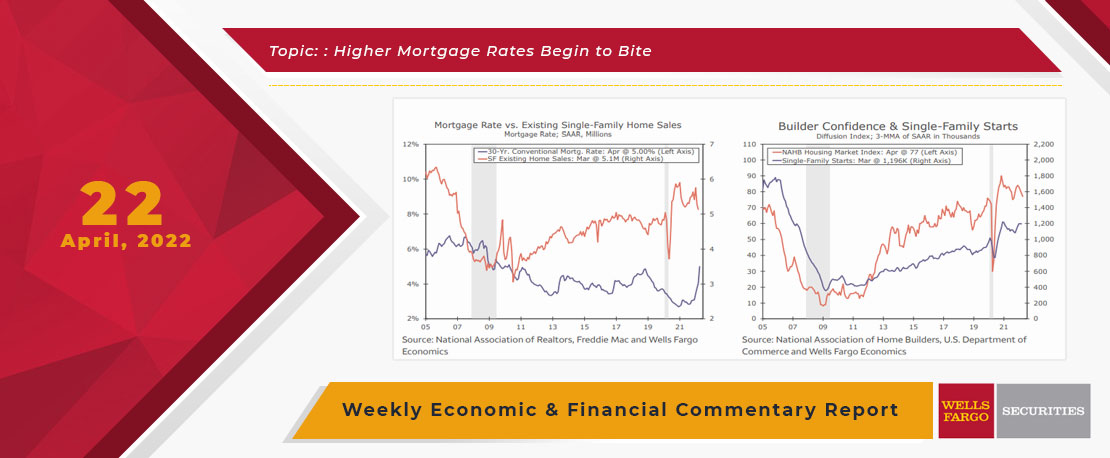

This Week's State Of The Economy - What Is Ahead? - 22 April 2022

Wells Fargo Economics & Financial Report / Apr 27, 2022

I’ll wish you a Happy Earth Day anyway. Don’t expect a card this year. While the Earth continues to thankfully revolve at a steady rate, rising mortgage rates appear to be slowing residential activity

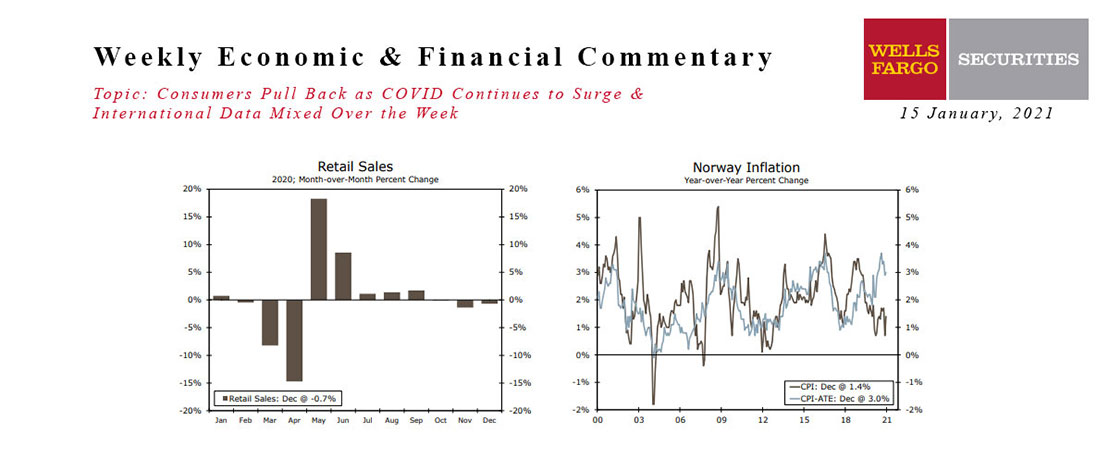

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

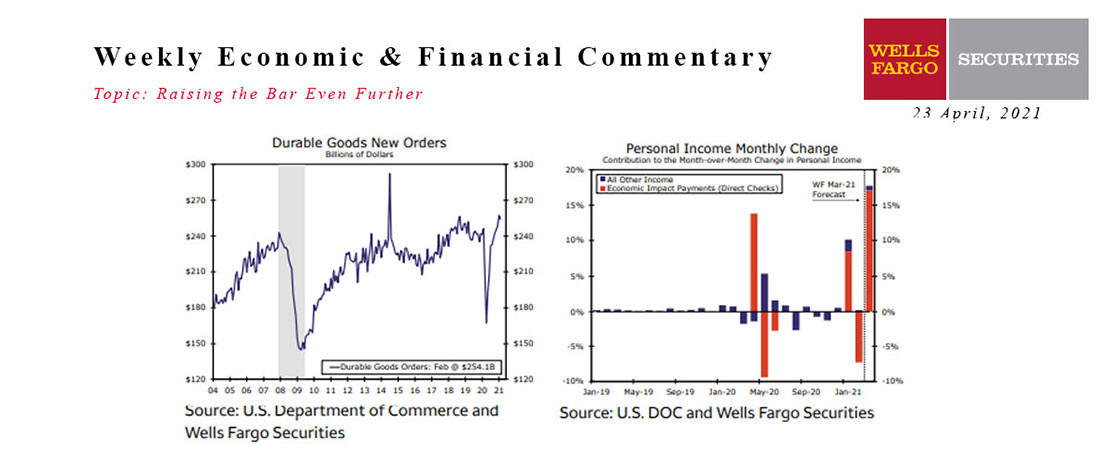

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

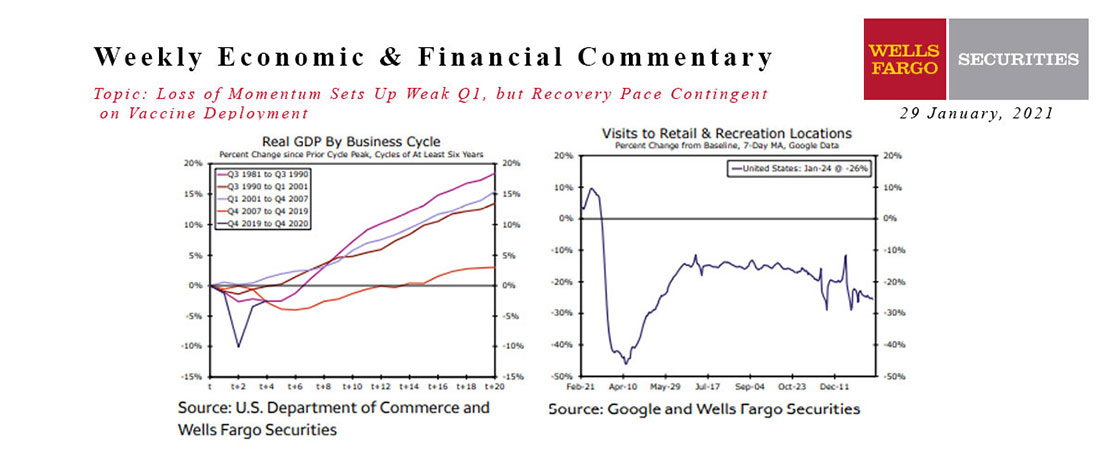

This Week's State Of The Economy - What Is Ahead? - 29 January 2021

Wells Fargo Economics & Financial Report / Feb 09, 2021

Economic data came in largely as expected this week and suggest continued economic recovery.

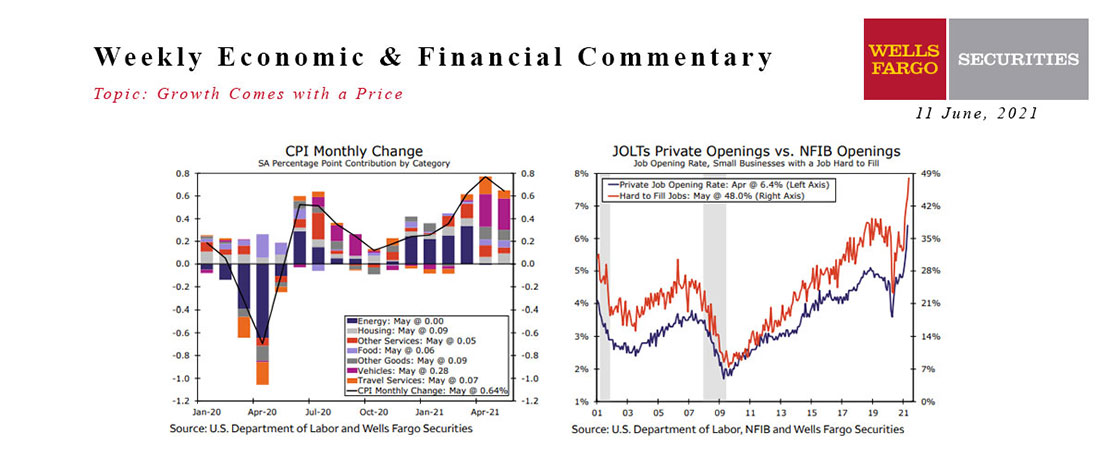

This Week's State Of The Economy - What Is Ahead? - 11 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Okay, so I’ve gotten about half a dozen calls since Wednesday asking if I saw the May CPI numbers that came out this week.

This Week's State Of The Economy - What Is Ahead? - 31 March 2023

Wells Fargo Economics & Financial Report / Apr 08, 2023

This week brought glimpses of market stabilization after weeks of turmoil. Although consumers seem unfazed by the uproar, tighter credit conditions coming down the pipeline will likely weigh on growth.