Mixed Housing Data and Upside Inflation Surprise

n a light week for economic data, market participants continued to digest last week's slew of strongerthan-expected reports. Retail sales and manufacturing production surprised to the upside, while the Consumer Price Index rose at its fastest pace since October. While seasonal factors likely boosted some of these headline figures, the string of beats raises the potential for more aggressive moves from the Federal Reserve. As discussed in Interest Rate Watch, the minutes of the last FOMC meeting (released on Wednesday) underscored the Committee's resolve to bring down inflation and suggest more members may be drifting toward the hawkish camp.

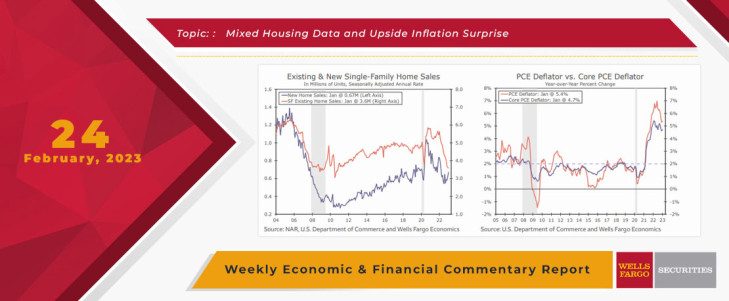

One sector that has acutely felt the effects of the FOMC's policy tightening thus far is housing. Existing home sales fell 0.7% to a 4.0 million-unit annualized pace in January. The slip marks the 12th consecutive month that sales have declined and brought the year-over-year change down to an alltime low of -36.9%. The pullback in sales has helped to cool off home price appreciation. The median single-family home price was $363,100 in January, down nearly 14% from its recent peak of $420,900 in June 2022. Inventory remains low by historical standards but edged up slightly in January as the spring selling season starts to get under way. This year will likely be different than last year—to learn more, join a webinar with our real estate economists on Wednesday, March 1 as they discuss the housing market outlook for 2023.

Meanwhile, new home sales leaped 7.2% in January to a 670,000-unit annualized pace, the highest since March. The median new home sales price was $427,500 during the month, which is down 0.7% over the year. The price decline likely reflects home builders offering interest rate buy-downs and sale price discounts to move inventory. For-sale inventory totaled 439,000 units at the end of January, down nearly 3% over the month.

Despite the bite of high mortgage rates and still-elevated home prices, brighter days may be ahead for housing demand. Strong labor market conditions have supported real income growth, and recent upward revisions to personal income suggest households have more purchasing power than previously thought. Specifically, fourth quarter personal income was lifted by $185B and the third quarter was revised higher by roughly $108B. The positive revisions meant consumers came into the year with a bit more dry powder, likely driving the 1.1% jump in real personal spending in January. Solid spending in discretionary categories, such as food services & accommodations (+4.6%), recreation services (+1.4%) and transportation services (+0.9%), is a sign of the continued resilience of household spending.

While strength in real consumption is a positive development, it also adds pressure to inflation. The core PCE deflator, which excludes food and energy, rose a higher-than-expected 0.6% in January. The increase bumped the year-over-year percent change to 4.7%, up from 4.6% in December, which is well-above the FOMC's 2% inflation target.

This Week's State Of The Economy - What Is Ahead? - 03 June 2022

Wells Fargo Economics & Financial Report / Jun 08, 2022

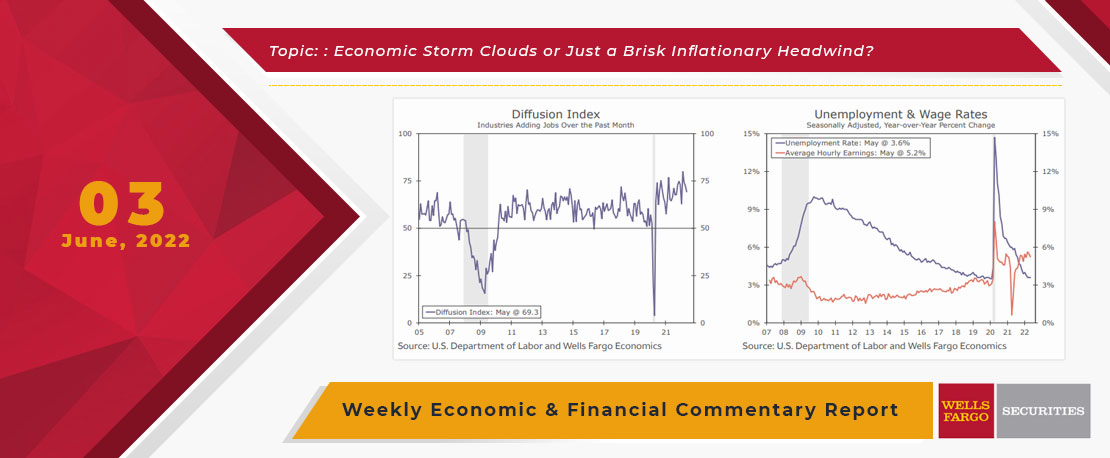

While talk of recession has kicked up in recent weeks, the majority of economic data remain consistent with modest growth.

This Week's State Of The Economy - What Is Ahead? - 11 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

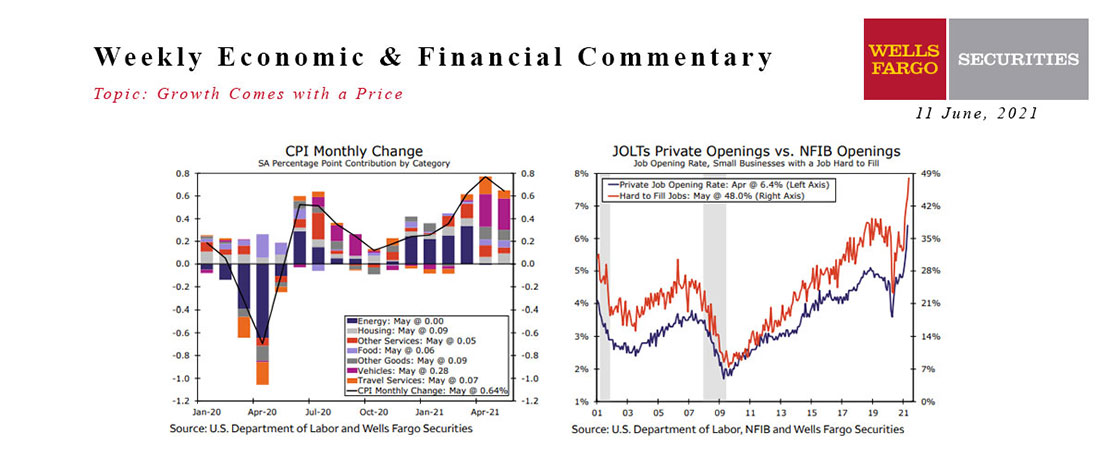

Okay, so I’ve gotten about half a dozen calls since Wednesday asking if I saw the May CPI numbers that came out this week.

This Week's State Of The Economy - What Is Ahead? - 06 January 2023

Wells Fargo Economics & Financial Report / Jan 12, 2023

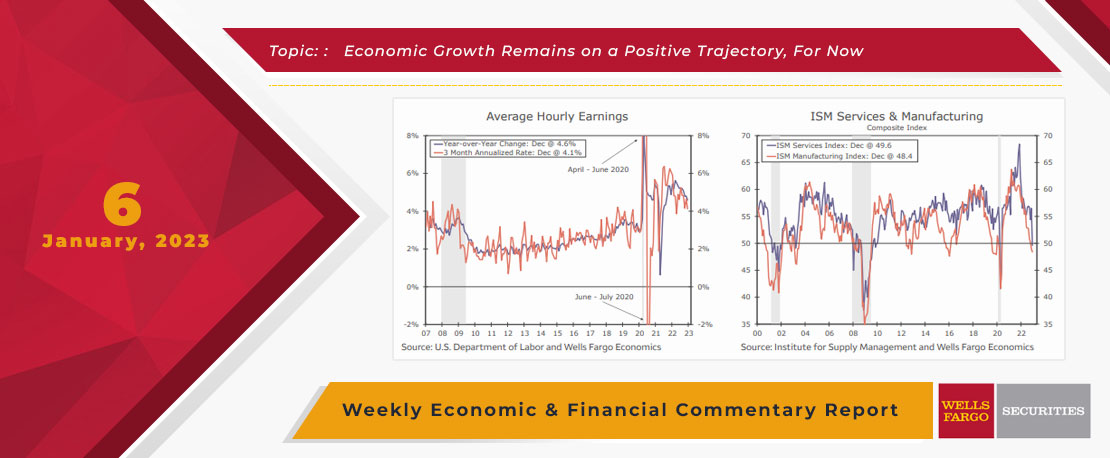

During December, payrolls rose by 223K while the unemployment rate fell to 3.5% and average hourly earnings eased 0.3%. Job openings (JOLTS) edged down to 10.46 million in November.

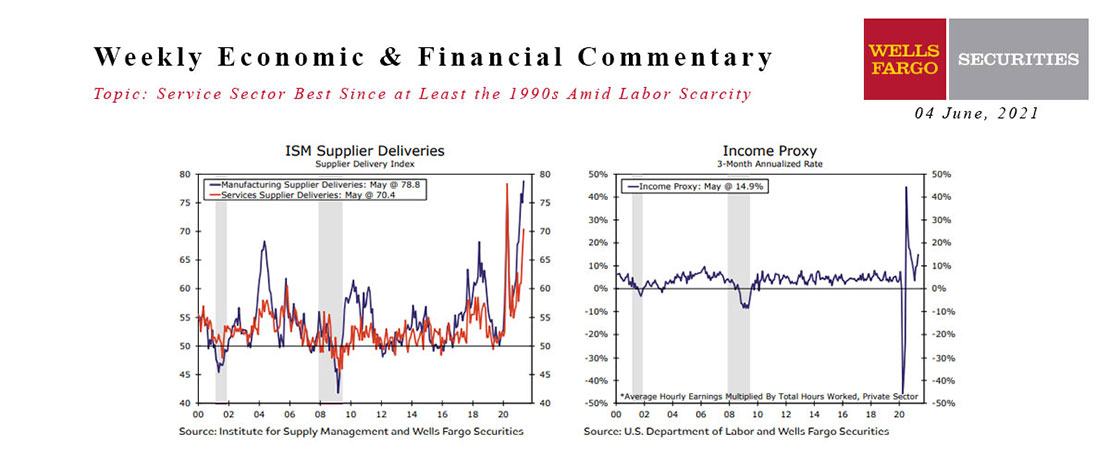

This Week's State Of The Economy - What Is Ahead? - 04 June 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

The CDC\'s relaxation of its mask mandate occurred mid-May, and as data for that month begins rolling in this week, it is evident there is no lack of demand. Supplies, on the other hand, are a worsening problem.

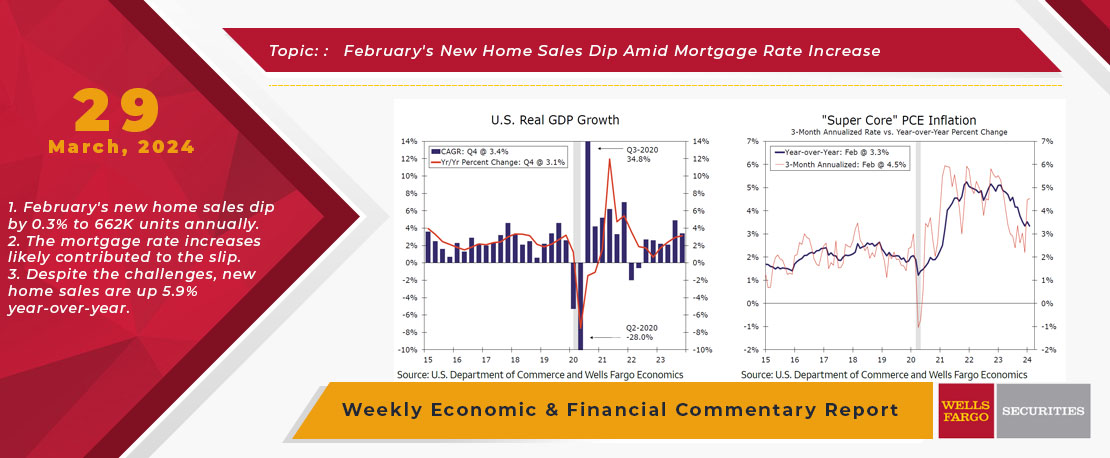

This Week's State Of The Economy - What Is Ahead? - 29 March 2024

Wells Fargo Economics & Financial Report / Apr 03, 2024

Consumer momentum remains largely intact, inflation continues to inch back down, albeit at a slower pace, and rate-sensitive sectors stayed in a holding pattern.

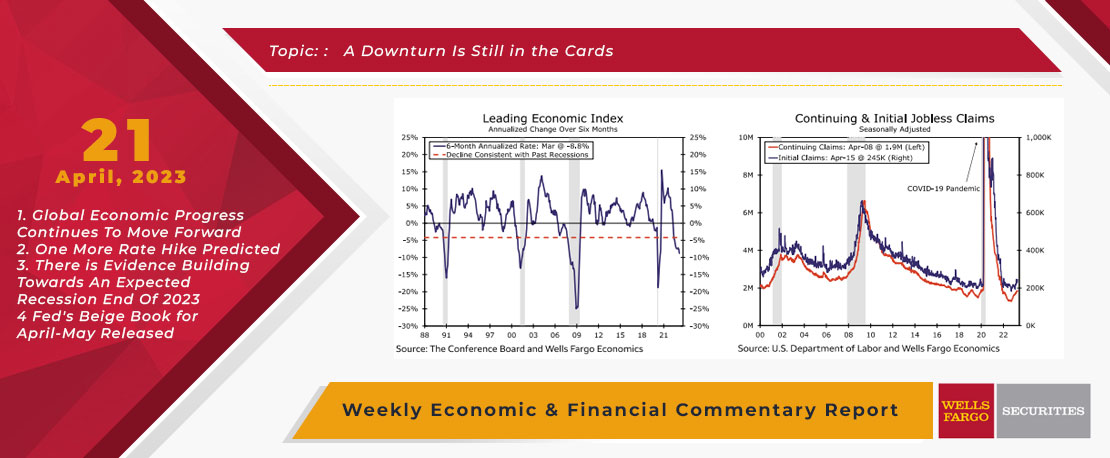

This Week's State Of The Economy - What Is Ahead? - 21 April 2023

Wells Fargo Economics & Financial Report / Apr 26, 2023

The Leading Economic Index (“LEI”) continued to flash contraction as early signs of labor market weakening are starting to emerge. Meanwhile, a batch of housing data confirmed that a full-fledged housing market recovery is still far off.

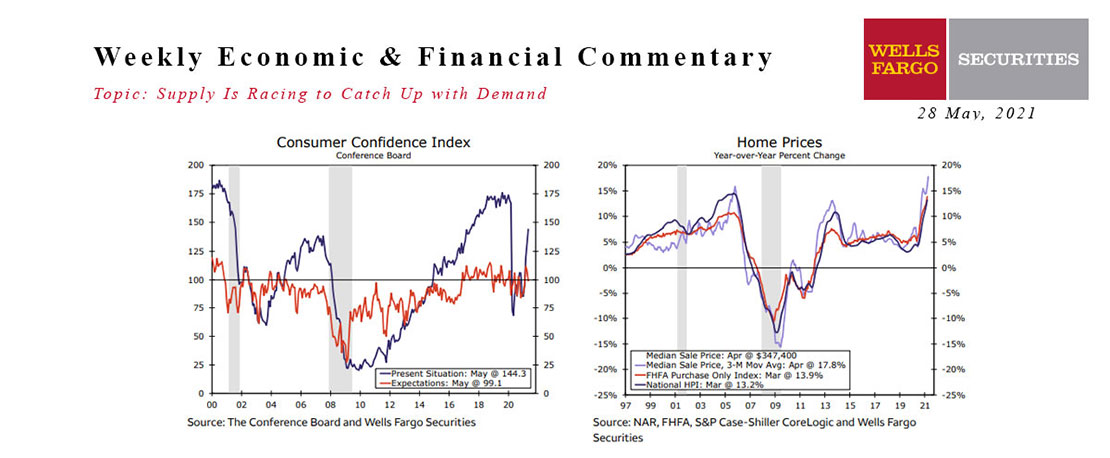

This Week's State Of The Economy - What Is Ahead? - 28 May 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

This week\'s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth.

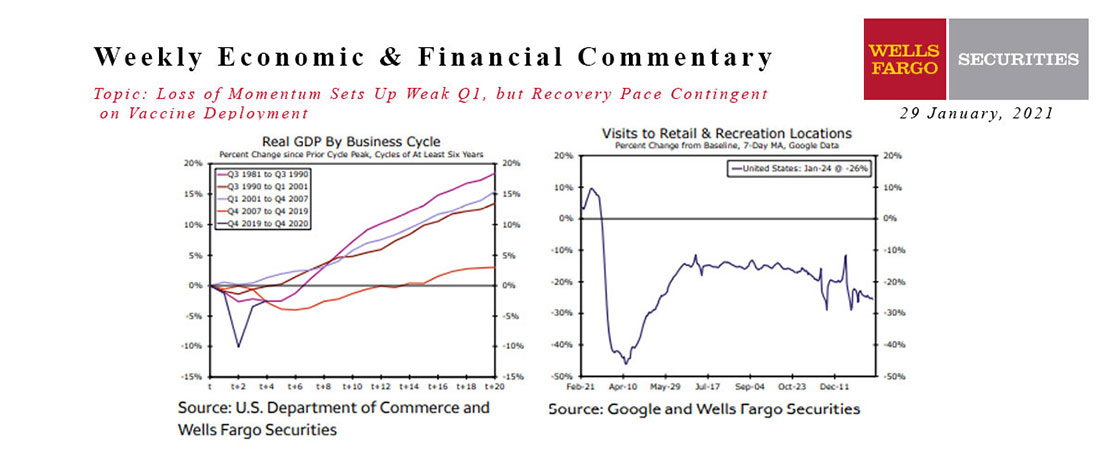

This Week's State Of The Economy - What Is Ahead? - 29 January 2021

Wells Fargo Economics & Financial Report / Feb 09, 2021

Economic data came in largely as expected this week and suggest continued economic recovery.

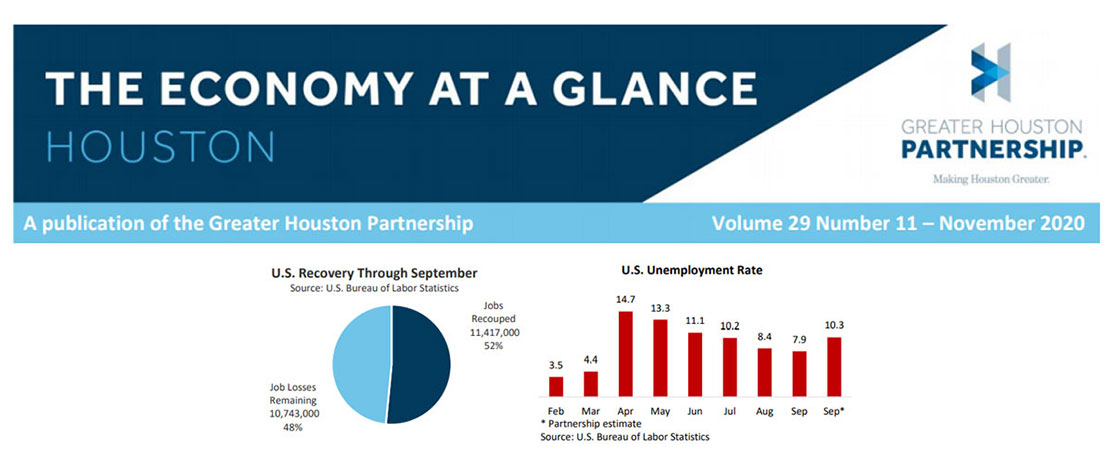

November 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Nov 12, 2020

U.S. gross domestic product (GDP) grew 7.4 percent, or $1.3 trillion in Q3, adjusted for inflation.

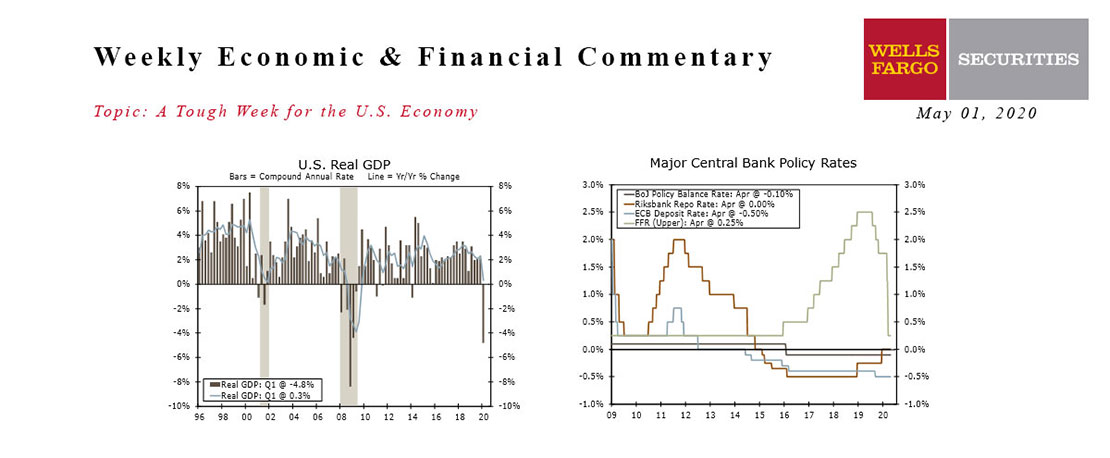

This Week's State Of The Economy - What Is Ahead? - 01 May 2020

Wells Fargo Economics & Financial Report / May 04, 2020

U.S. GDP declined at an annualized rate of 4.8% in the first quarter, only a hint of what is to come in the second quarter.