U.S. Review Short on Supplies

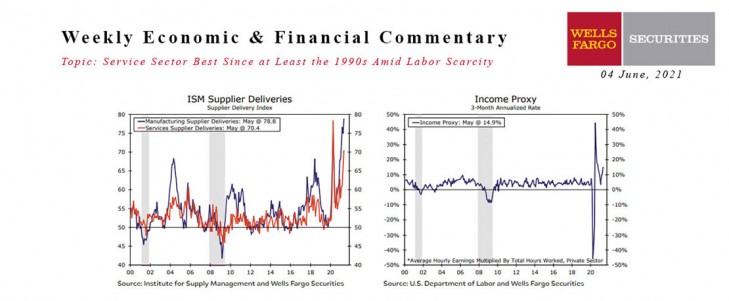

The CDC's relaxation of its mask mandate occurred mid-May, and as data for that month begins rolling in this week, it is evident there is no lack of demand. Supplies, on the other hand, are a worsening problem. Napoleon famously observed that an army marches on its stomach; in a similar vein, an economy can grow only as fast as its supply chains. The message from this week's economic data is that it is not enough to overcome a pandemic and provide federal relief to households and businesses for the past 15 months, the global flow of raw materials and input components needs to be restored in order for this or any modern economy to run at full steam.

This was evident in the ISM manufacturing survey that kicked off the data flow at the start of this holiday-shortened week. This bellwether of industrial activity exceeded consensus expectations coming in at 61.2 in May, half a point higher than the prior month. The subcomponents moved in both directions. The story that emerges is one of a manufacturing sector that could be growing much faster were it not for supply-side growing pains.

This Week's State Of The Economy-What Is Ahead?

Wells Fargo Economics & Financial Report / Aug 03, 2019

How will Fed rates-cut and Trump 10% tariff on $300 Billion Chinese Goods countered by Chinese currency devaluation against Dollar, affect inflation and economic slowdown in US economy?

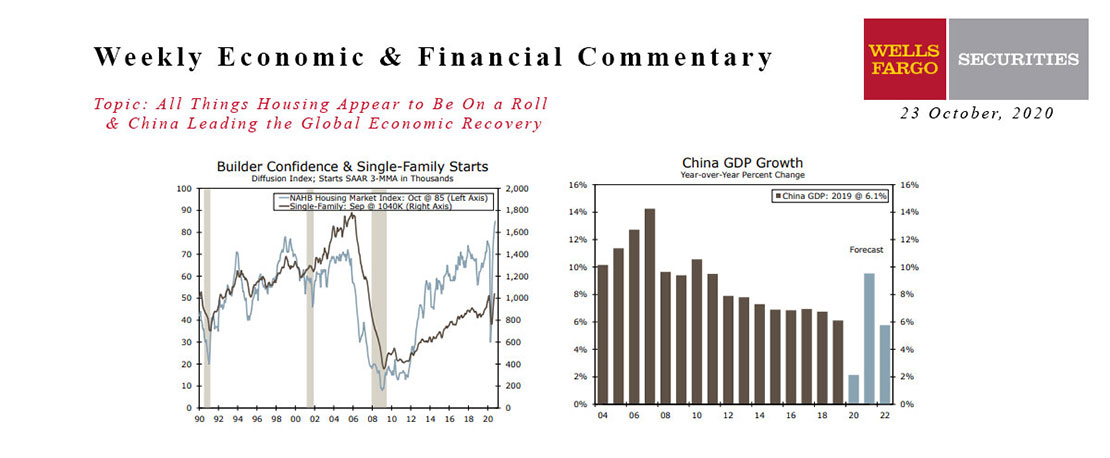

This Week's State Of The Economy - What Is Ahead? - 23 October 2020

Wells Fargo Economics & Financial Report / Oct 24, 2020

A recent strong report from the National Association of Homebuilders set the tone for another round of strong housing data. The NAHB index rose two points to a record high 85.

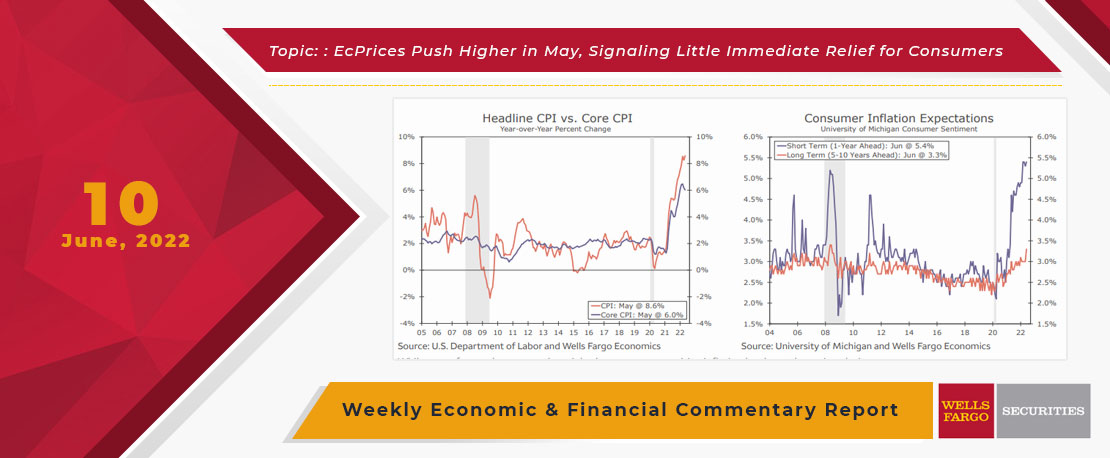

This Week's State Of The Economy - What Is Ahead? - 10 June 2022

Wells Fargo Economics & Financial Report / Jun 13, 2022

CPI increases continue to sizzle like this weekend’s temperature, putting consumers in a worse mood than Texas Rangers fans (with their 9.5 games back $500 million middle infield).

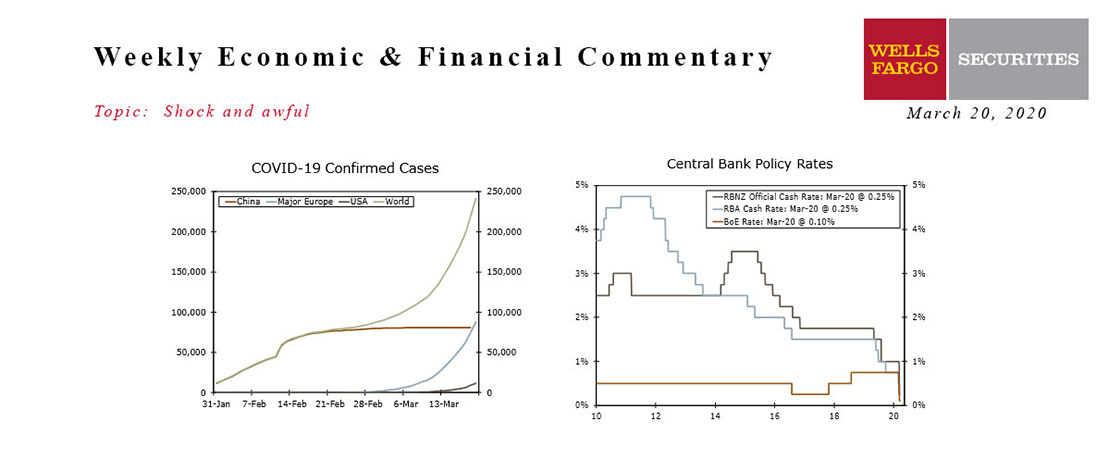

This Week's State Of The Economy - What Is Ahead? - 20 March 2020

Wells Fargo Economics & Financial Report / Mar 21, 2020

Daily life came to a screeching halt this week as governments, businesses and consumers took drastic steps to halt the COVID-19 pandemic.

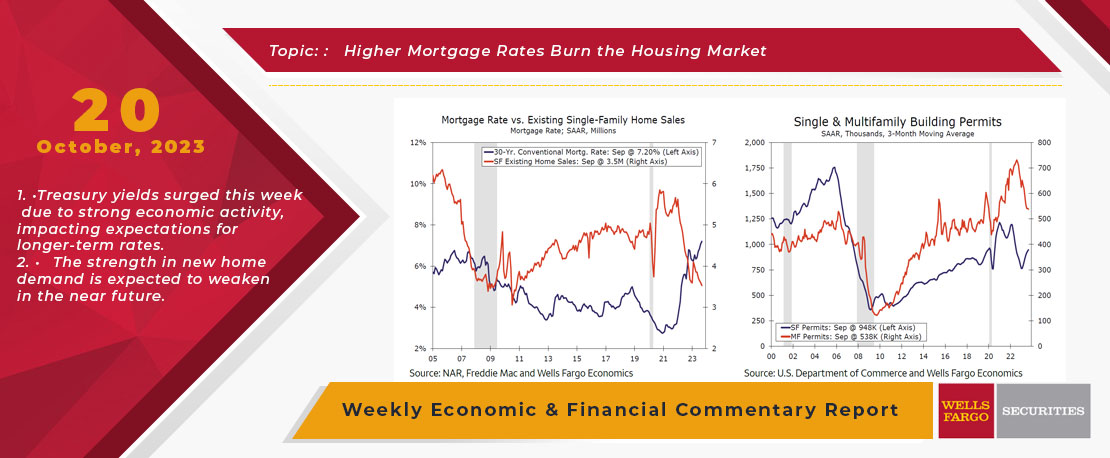

This Week's State Of The Economy - What Is Ahead? - 20 October 2023

Wells Fargo Economics & Financial Report / Oct 27, 2023

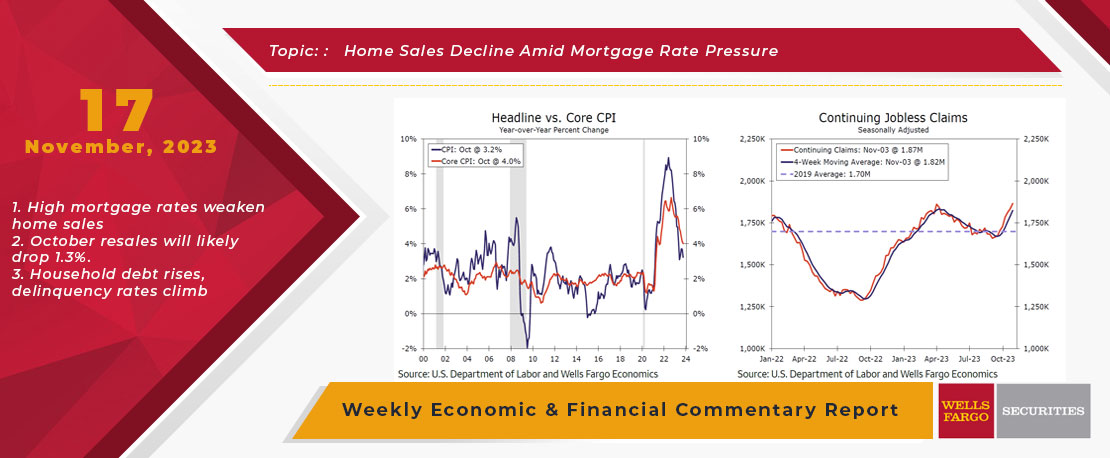

Treasury yields surged this week due to strong economic activity, impacting expectations for longer-term rates. New home sales led to a rise in single-family permits, but spiking mortgage rates are testing builder affordability strategies.

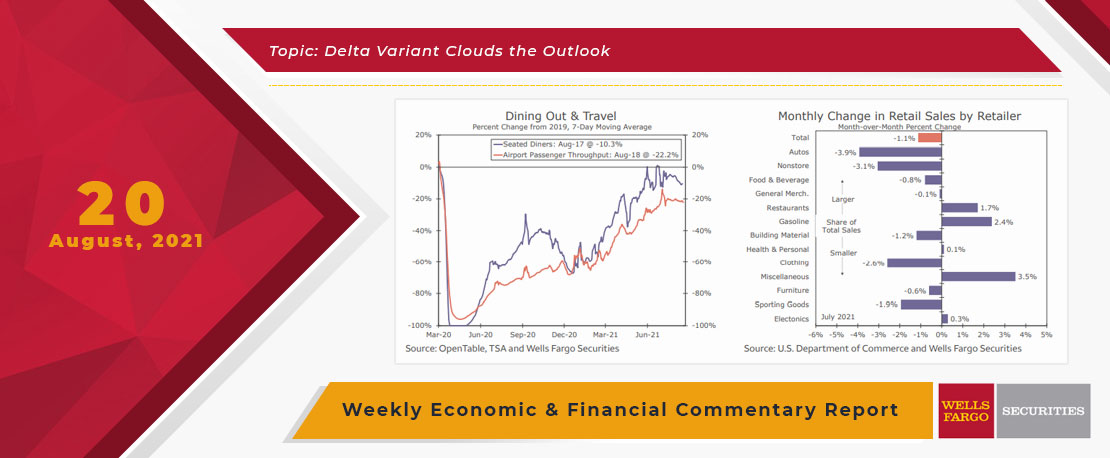

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

This Week's State Of The Economy - What Is Ahead? - 21 February 2020

Wells Fargo Economics & Financial Report / Feb 22, 2020

Minutes from the January 28-29 FOMC meeting indicate the coronavirus will not push the Fed to cut interest rates, and for the most part housing and manufacturing survey data this week supported that view.

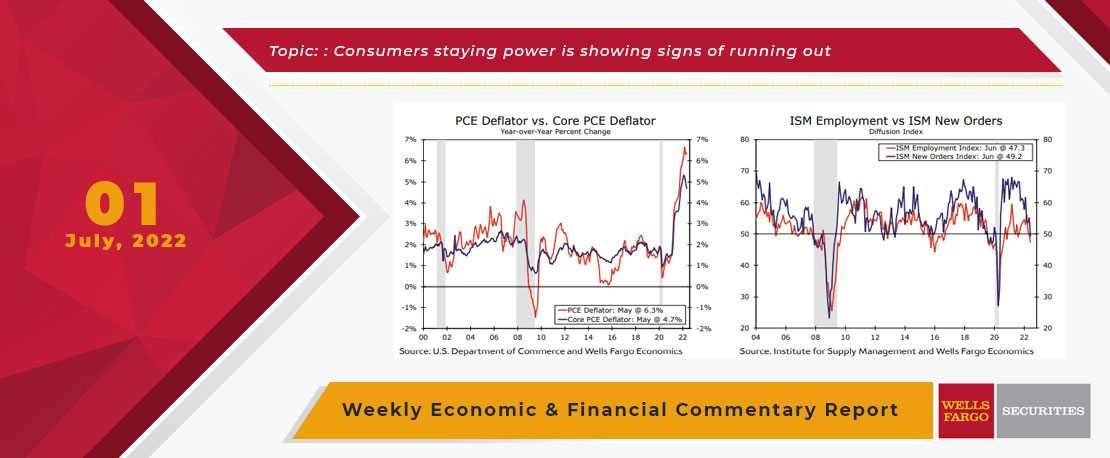

This Week's State Of The Economy - What Is Ahead? - 01 July 2022

Wells Fargo Economics & Financial Report / Jul 14, 2022

As with the Mets and Yankees when they ran into the Astros over the last couple days, consumers staying power is showing signs of running out as inflation persists and confidence moves sharply lower.

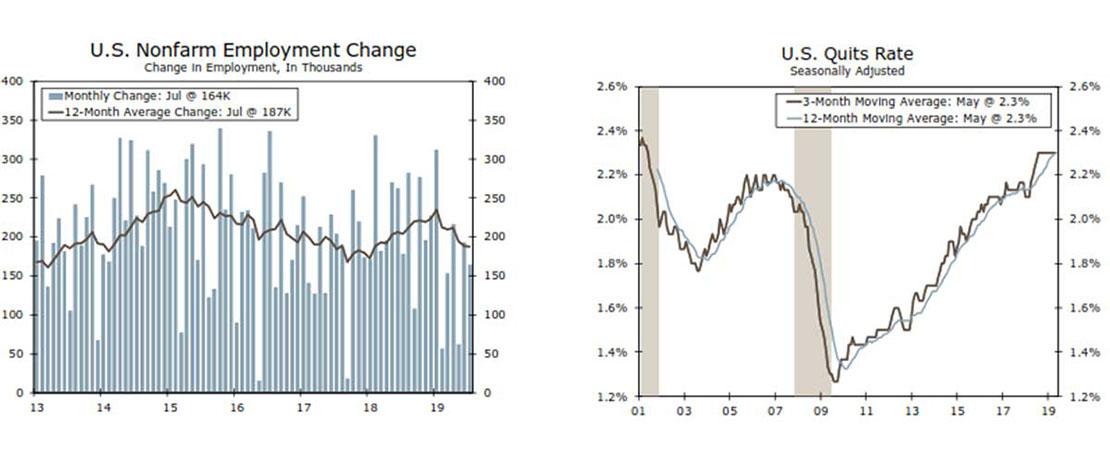

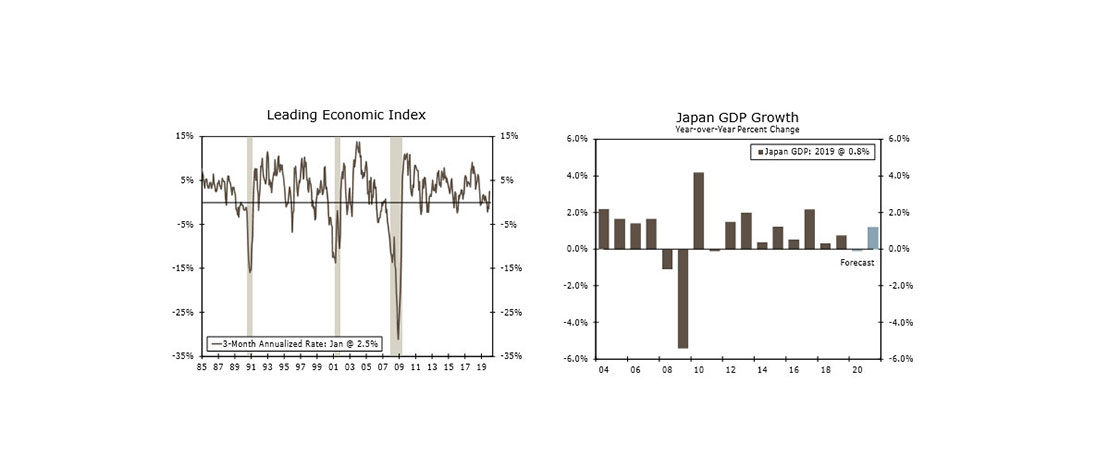

This Week's State Of The Economy - What Is Ahead? - 06 December 2019

Wells Fargo Economics & Financial Report / Dec 07, 2019

The latest hiring data are an encouraging sign that the U.S. economy is withstanding the global slowdown and continued trade-related uncertainty.

This Week's State Of The Economy - What Is Ahead? - 17 November 2023

Wells Fargo Economics & Financial Report / Nov 23, 2023

Retail and Industrial activity were stronger than the headline data suggest, there are also some signs of weakening.