Treasury yields shot up this week amid resilient economic activity. As markets adjust their expectations for longer-term rates, the yield on the 10-year has moved to its highest level since the months preceding the global financial crisis. This development has numerous implications for the path of the economy and the Federal Reserve’s policymaking. Chair Powell acknowledged that the recent jump in yields intensifies the financial tightening already under way in the economy, noting that the Federal Reserve is paying attention to financial conditions as it charts the course of monetary policy.

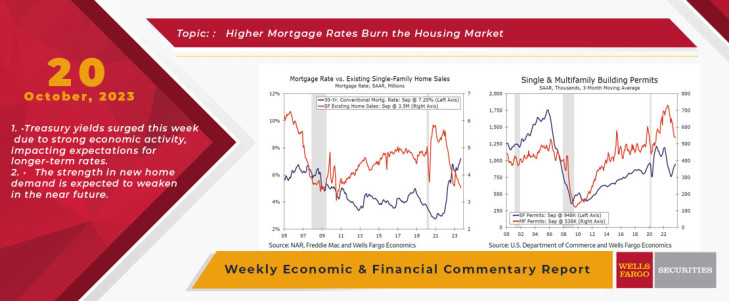

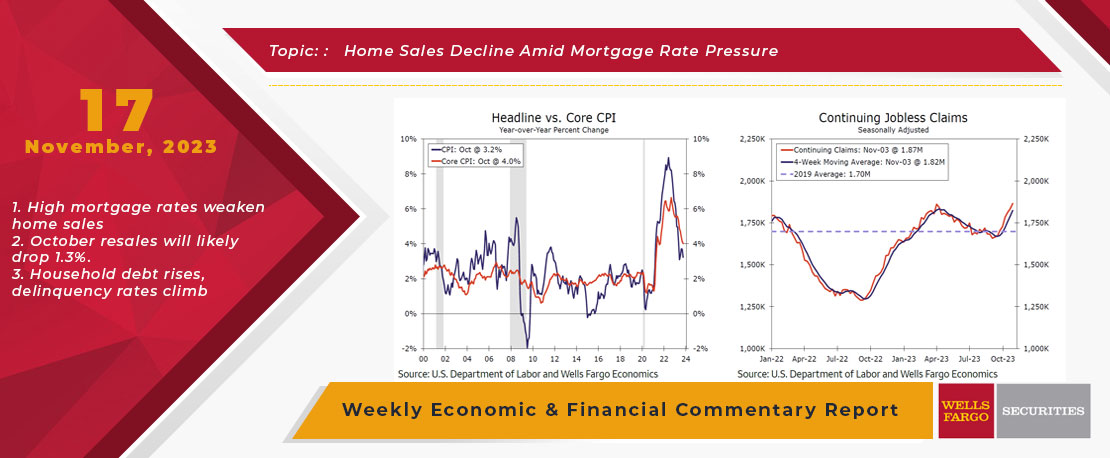

The run-up in yields set off a surge in mortgage rates, nudging the housing market back toward recession. This week, the average 30-year fixed mortgage rate reported by Freddie Mac hit a near 23-year high of 7.6%. Higher frequency data from Mortgage News Daily suggest that mortgage rates are currently hovering above 8.0%, adding a new layer of financial and psychological strain for prospective homebuyers. Housing demand was in retreat long before this week’s increase, however. Existing home sales have posted four back-to-back declines culminating in a new cycle low in September, when sales sank to their slowest pace since 2010. With near-term affordability relief out of sight, the persistent downward trend in mortgage purchase applications suggests that resales likely have further to fall.

Single-family building has remained fairly resilient amid rising pressure on housing demand. In contrast to weakening resales, builders have found success using mortgage rate buydowns and price discounts to sell new construction. A pickup in new home sales sparked a trend rise in single-family permits since the start of the year, which notched its eighth back-to-back upswing in September. Tides may be turning as spiking mortgage rates test builders’ ability to bridge the affordability gap. The NAHB Housing Market Index gauging builder sentiment fell to a nine-month low in October, reflecting a worsening sales outlook. Meanwhile, multifamily construction continued to downshift as builders battle tighter credit conditions and rising trend in apartment vacancies. Despite a bump in multifamily starts in September, multifamily permits plunged to their lowest level since October 2020.

Higher financing costs are also pressuring the manufacturing sector. An uptick in manufacturing output drove industrial production 0.3% higher in September. That said, prior revisions revealed that manufacturing has largely flatlined since late last year. We expect manufacturing to continue to flounder as tighter credit conditions create an unfavorable environment for new capital investment. The ISM Manufacturing Survey has long signaled that higher rates are reducing demand for manufactured goods, and that sentiment was echoed this week in the Federal Reserve’s October Beige Book. Better inventory management is also taking some air out of production as producers opt not to stockpile into a slowdown.

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

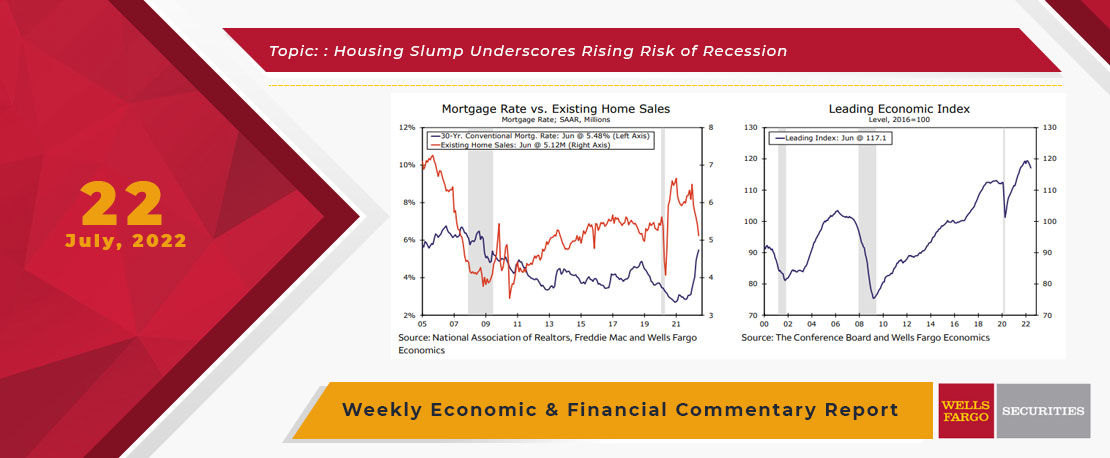

This Week's State Of The Economy - What Is Ahead? - 22 July 2022

Wells Fargo Economics & Financial Report / Jul 27, 2022

July\'s NAHB Housing Market Index dropped 12 points to 55, the second largest monthly decline on record behind April 2020\'s pandemic-induced collapse.

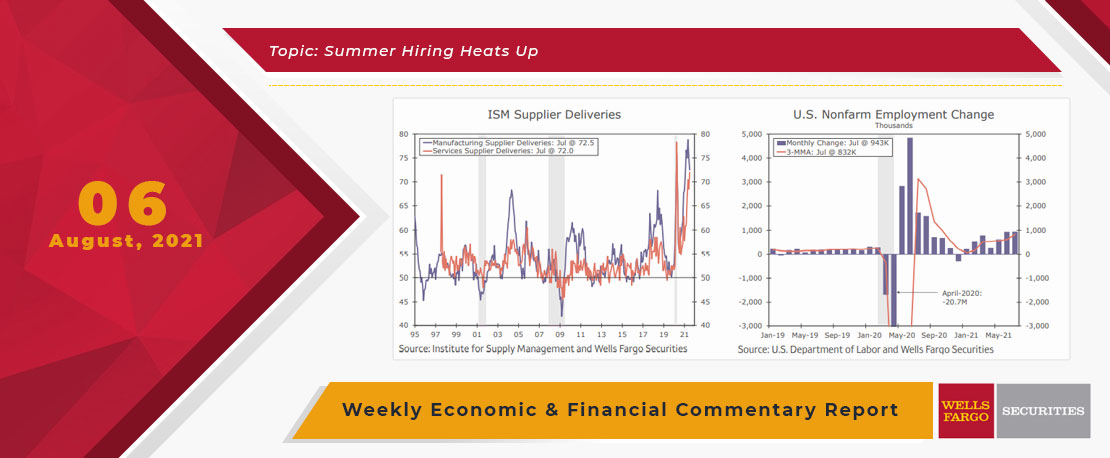

This Week's State Of The Economy - What Is Ahead? - 06 August 2021

Wells Fargo Economics & Financial Report / Aug 16, 2021

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy\'s resilience in spite of those continuing problems.

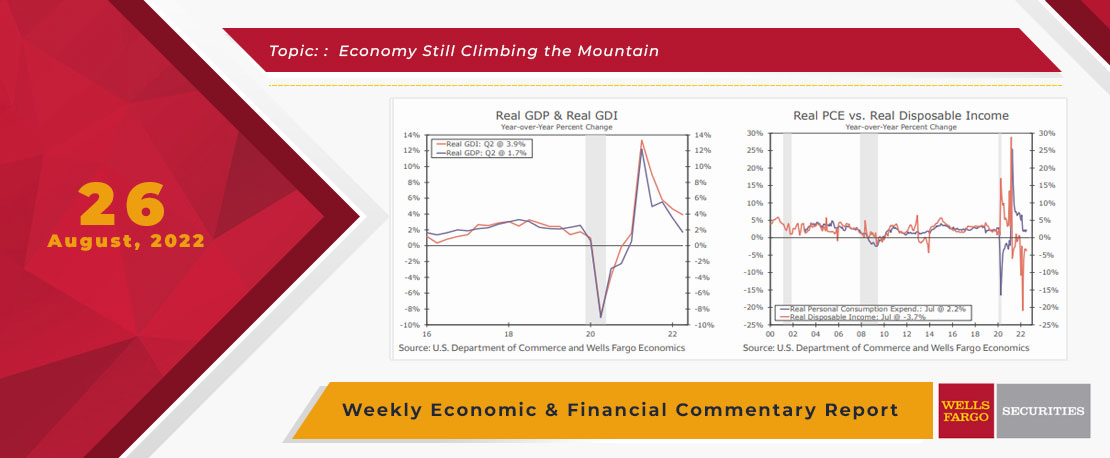

This Week's State Of The Economy - What Is Ahead? - 26August 2022

Wells Fargo Economics & Financial Report / Aug 29, 2022

I can understand how the opportunity to participate in lots of scintillating economic policy discussions could make fishing look exciting in comparison.

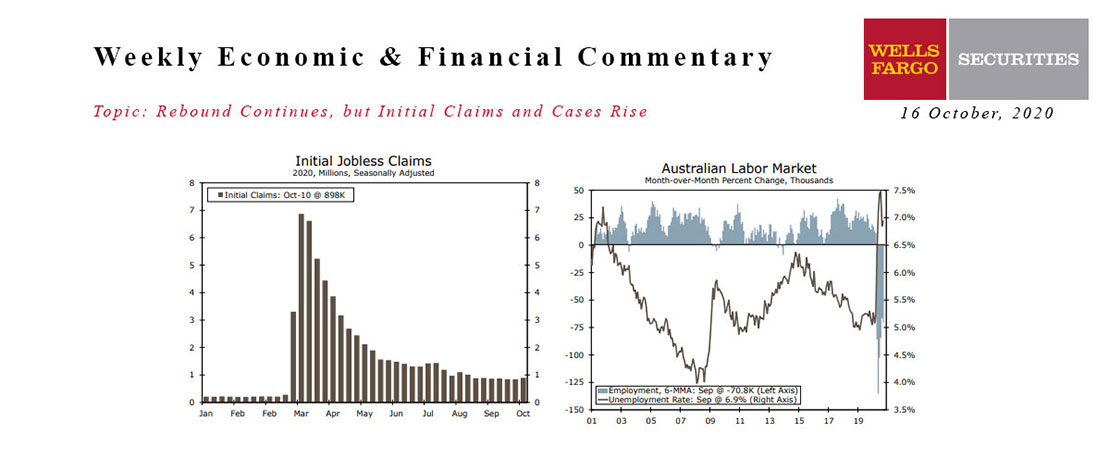

This Week's State Of The Economy - What Is Ahead? - 16 October 2020

Wells Fargo Economics & Financial Report / Oct 20, 2020

Data continue to reflect an economy digging itself out of the lockdown-induced slump.

This Week's State Of The Economy - What Is Ahead? - 17 November 2023

Wells Fargo Economics & Financial Report / Nov 23, 2023

Retail and Industrial activity were stronger than the headline data suggest, there are also some signs of weakening.

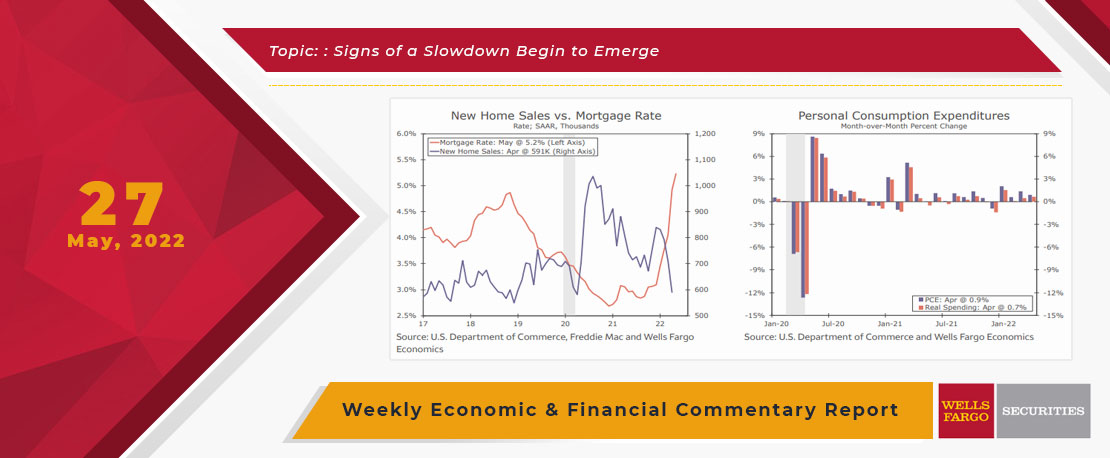

This Week's State Of The Economy - What Is Ahead? - 27 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

it looks like higher mortgage rates are starting to have some effect on the housing market as April...

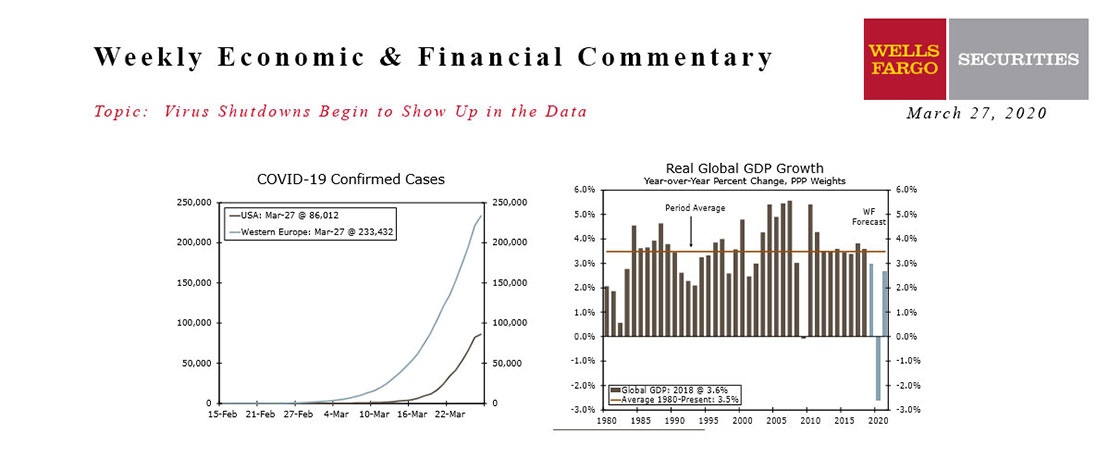

This Week's State Of The Economy - What Is Ahead? - 27 March 2020

Wells Fargo Economics & Financial Report / Mar 28, 2020

The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

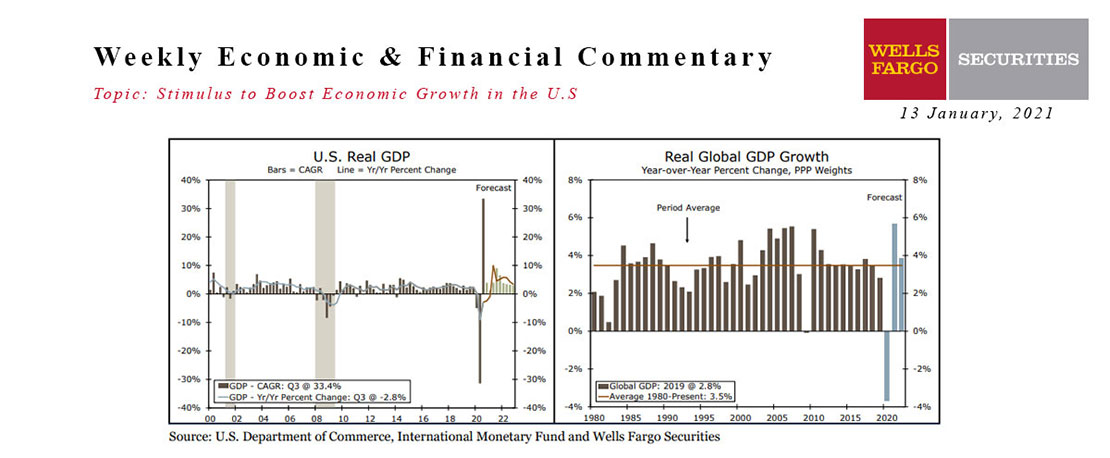

13 January 2021 Monthly Outlook Report

Wells Fargo Economics & Financial Report / Jan 19, 2021

The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate.