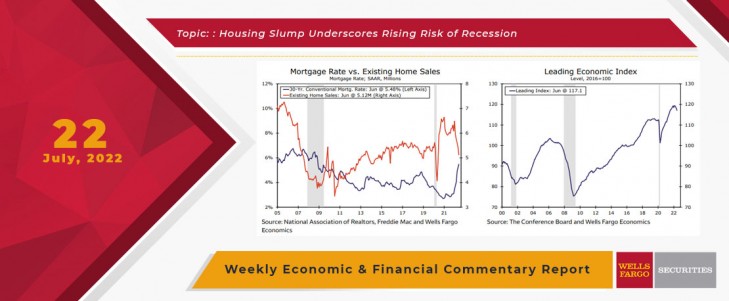

The housing market took center stage this week. The week began with an eye-catching plunge in home builder sentiment. July's NAHB Housing Market Index dropped 12 points to 55, the second largest monthly decline on record behind April 2020's pandemic-induced collapse. There was not a bright spot to be found in the underlying details, with measures of buyer traffic and single-family sales, both present and future, posting substantial declines. For most of the past two years, home builders have been navigating a rising cost environment, namely for building materials, labor and land. However, the straw that breaks the back of builder sentiment now appears to be higher financing costs. According to Freddie Mac, the average 30-year mortgage was 5.54% during the week ended July 21, a jump from the 3.22% averaged during the first week of 2022.

The downturn in home builder confidence provided an early clue that June's data for new home production would surprise to the downside. Total housing starts declined 2.0% to a 1.559 million-unit pace during June, below consensus estimates for a modest increase following May's sharp contraction. Single-family starts dropped 8.1%, the fourth consecutive monthly decline. Single-family starts are now running at a 982,000-unit pace, which is a bit higher than the sluggish pace registered for much of the decade predating the pandemic, but still the slowest since June 2020. The sharp rise in borrowing costs is clearly leading home builders to scale back production plans, with single-family permits recently taking a downward trajectory. Single-family permits dropped 8% in June, the fourth consecutive drop.

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

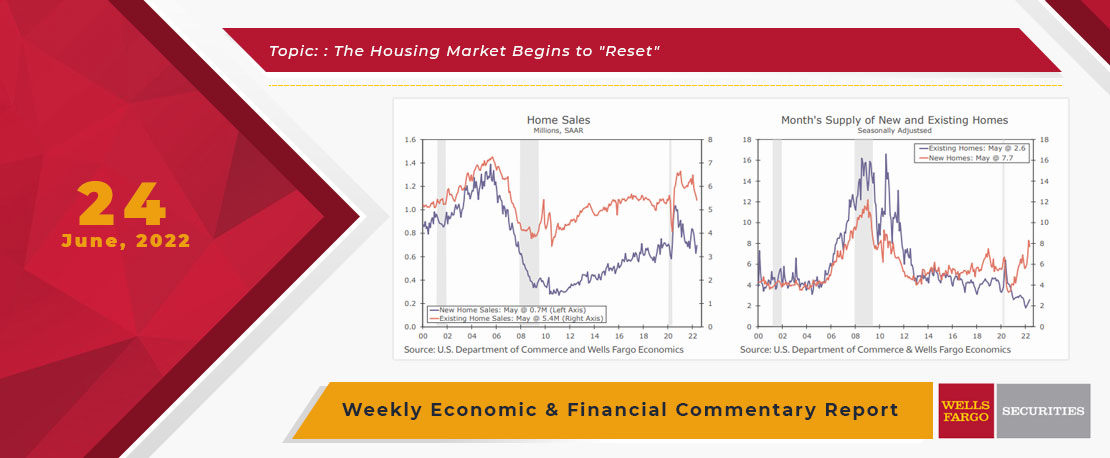

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

This Week's State Of The Economy - What Is Ahead? - 04 December 2020

Wells Fargo Economics & Financial Report / Dec 09, 2020

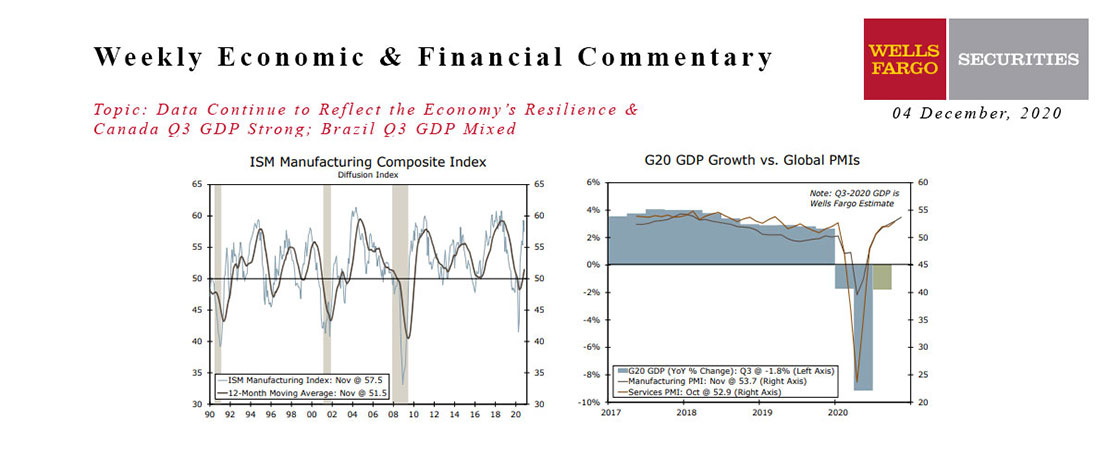

Manufacturing held up relatively well in November, despite a larger-than-expected dip in the ISM manufacturing survey. The nonfarm manufacturing survey rose slightly.

This Week's State Of The Economy - What Is Ahead? - 13 November 2020

Wells Fargo Economics & Financial Report / Nov 14, 2020

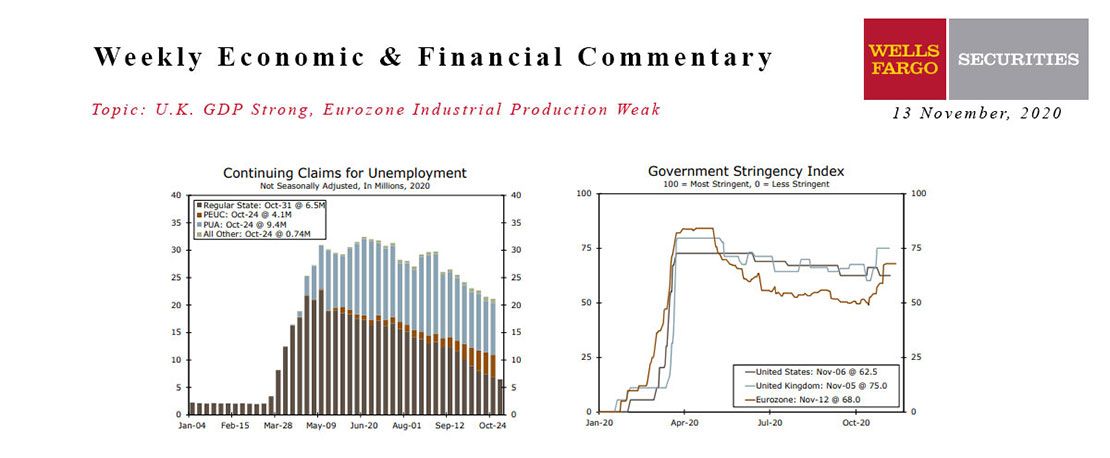

The combination of the election outcome and a workable vaccine boosted financial markets and set the background music for this week’s short list of indicators.

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

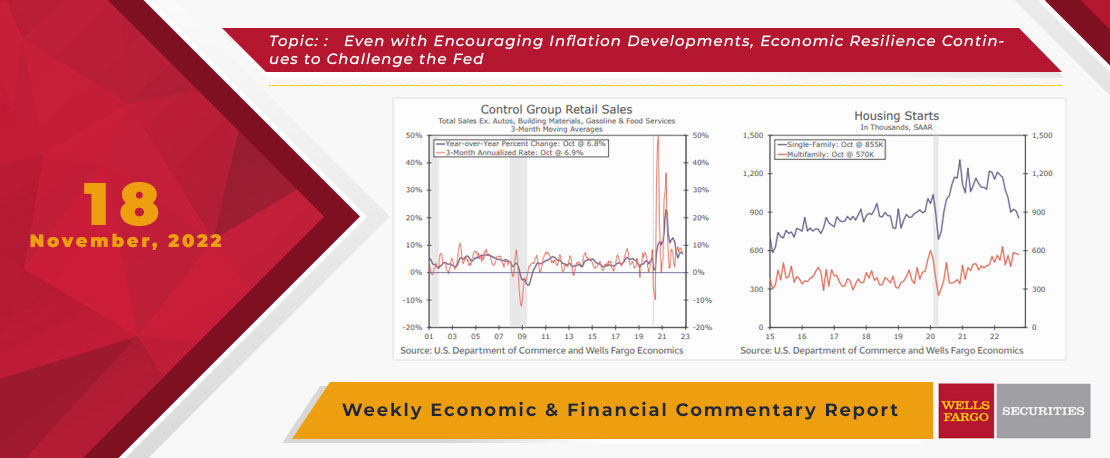

This Week's State Of The Economy - What Is Ahead? - 18 November 2022

Wells Fargo Economics & Financial Report / Nov 21, 2022

The resiliency of the U.S. consumer was also on display, as total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

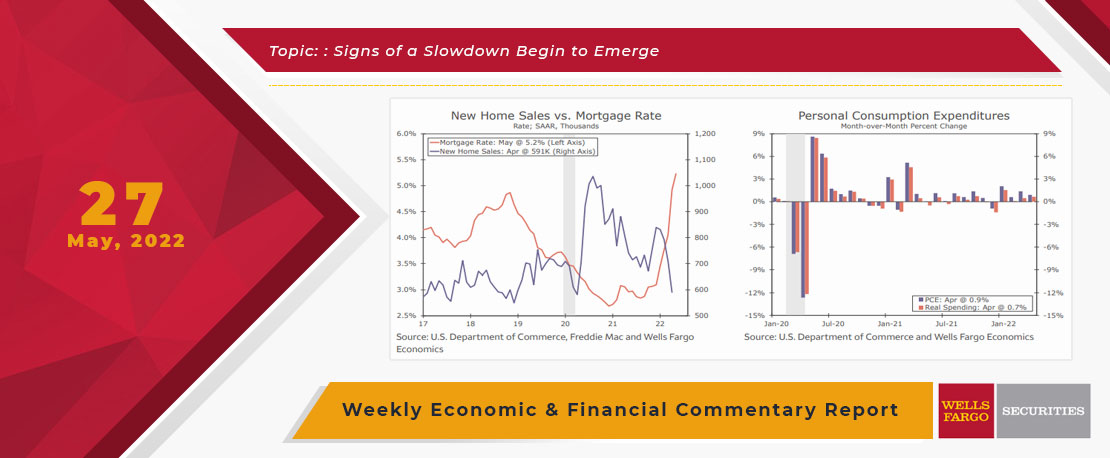

This Week's State Of The Economy - What Is Ahead? - 27 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

it looks like higher mortgage rates are starting to have some effect on the housing market as April...

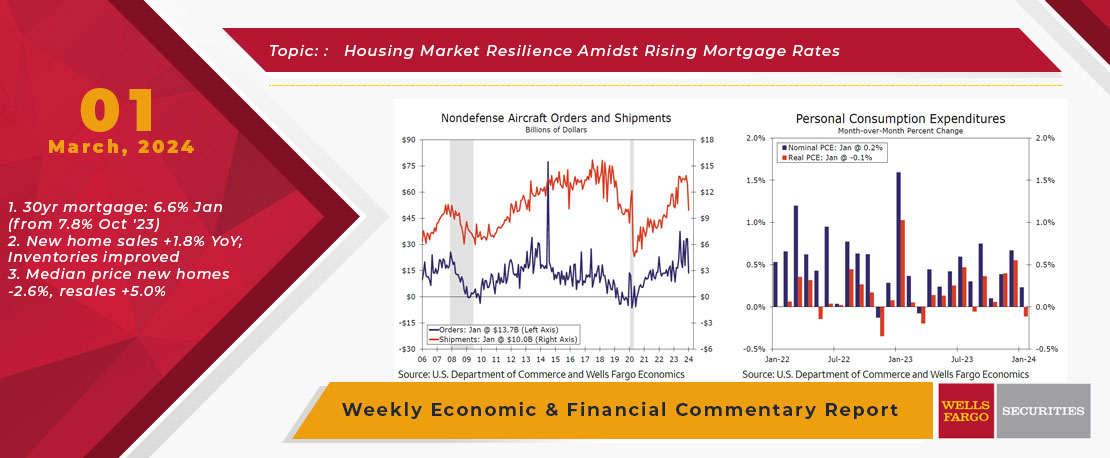

This Week's State Of The Economy - What Is Ahead? - 01 March 2024

Wells Fargo Economics & Financial Report / Mar 05, 2024

Economic data were downbeat this week, as downward revisions took some of the shine out of the marquee headline numbers. Despite the somewhat weak start to Q1, economic growth continues to trek along.

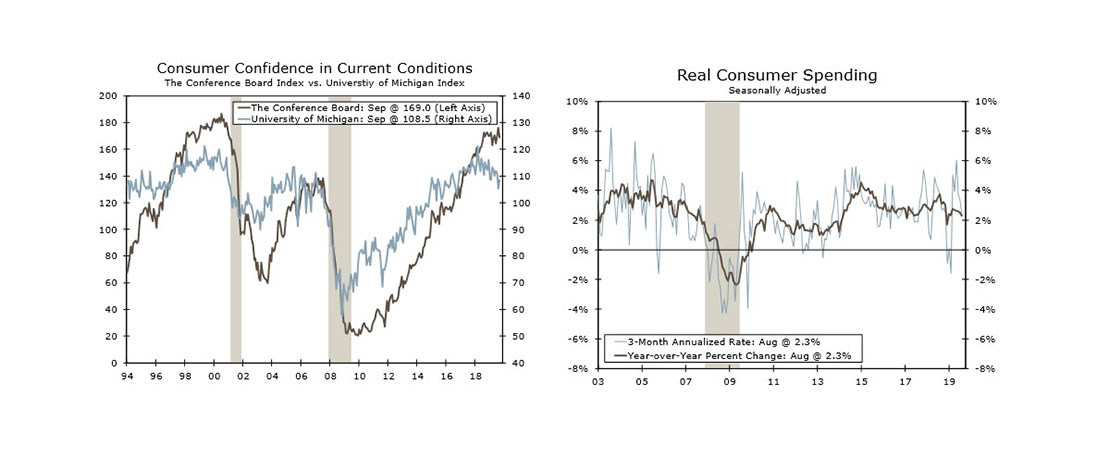

This Week's State Of The Economy - What Is Ahead? - 27 September 2019

Wells Fargo Economics & Financial Report / Sep 28, 2019

The release of the transcript of President Trump\'s phone conversation with Ukraine President Volodymyr Zelenskiy and the whistle blower complaint overshadowed most of this week\'s economic reports and took bond yields modestly lower.

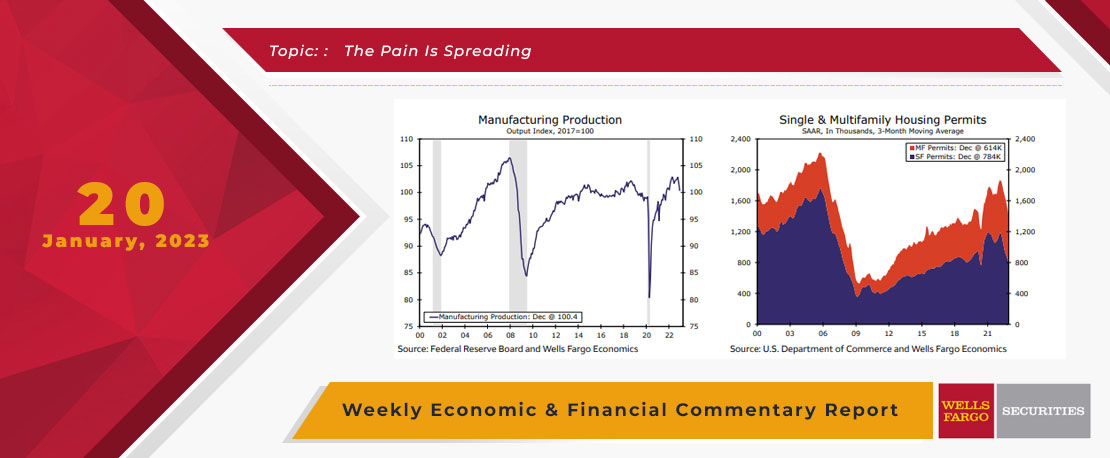

This Week's State Of The Economy - What Is Ahead? - 20 January 2023

Wells Fargo Economics & Financial Report / Jan 20, 2023

The housing sector has borne the brunt of the Fed\'s efforts to slow the economy, and this week\'s data showed the industry continues to reel.