We have been looking at interest rates rising steadily since a few months now, and looking at this upward trajectory, it seems like interest will continue to rise going into the rest of 2022. "With inflation running north of 9%, we're not at the finish line and there will be more interest rate increases to come in the months ahead," said Greg McBride, chief financial analyst at Bankrate.com. How does this affect you and your investments? Well, interest rates have a direct effect on the purchasing power of people. When interest rates rise, it is usually followed by a period of rising costs in the economy and marketplace. This means that you need more money for daily expenses and have lesser funds in your bank accounts for investments and other expenses that aren’t immediate.

Does this mean that this is a bad time to buy a house or make real estate investments?

The short answer to this is No! When the economy is in such a state of rising mortgage prices, increasing interest rates etc. it reduces the number of active buyers in the market causing a fall in the asking price of properties. If you have surplus funds that are just lying in your bank account, invest now!

Here are a few advantages of investing during high interest rates –

- Boost your NOI - Rising rates are an ideal way for commercial real estate investors to realize optimal cap rates and improve the NOI or Net Operating Income on their deals. Look for undervalued properties and give them a ‘facelift’ through renovations to increase their market price. In an environment of rising interest rates, there is potential to find inexpensive funding for improvements.

- Tax Benefits - Everybody loves tax benefits and saving on their bucks. This is the ideal scenario for investors to do exactly that! Depreciation on property is one of the biggest deductions that investors can declare. “If you surrender a percentage of income and capital gains on one side of the equation, you can take full advantage of deductions on the other end,” according to leading investment experts. Furthermore, investors can write-off assets not attached to the property, like furniture or appliances, as depreciation over shorter spans of three to five years of time. This reduces the overall impact of increased interest rates.

- Financial Planning Is Key - Real estate experts always suggest starting off investments early on to safeguard financial stability in the long run. Take advantage of the intentionally defective grantor trust (IDGT) to lower taxes and give inexperienced family members experience in the investment market. What is IDGT? It essentially gives the heirs of a property property-ownership while allowing the grantor or patron some control over the property. This is beneficial to both parties as it reduces the taxable estate of the grantor and gives experience to the grantee.

- Sell Assets - Selling dead assets in the ideal thing to do if you want to take advantage of rising interest rates. Because of the uncertainty that rising interest rates bring, buyers ideally look at locking in rates today, rather than waiting for rates to fall tomorrow, as those may go even higher in the future. This makes it a perfect market for sellers to get rid of unneeded property, as they can even ask for a premium which buyers will be willing to pay to acquire property before rates go up.

There are several factors that investors, both buyers and sellers need to consider before investing in real estate. It is always best to take advice from an expert in the field before making any decision. Hiring a brokerage or a real estate agent for their services is always a good idea, as they will be able to match you with the best property for your investment profile.

Why Invest In Retail Properties?

Real Estate Articles / Mar 09, 2019

Are you considering investing in commercial real estate? Not exactly sure which type of property to start with? Fret no more!

How you can profit from investing in Texas wetlands

Real Estate Articles / Dec 21, 2022

Wetlands are profitable investments if done right. Texas has multiple real estate investment options, including wetlands and you can get great returns on investment from them.

How increase in interest rates will affect the real estate market in 2022

Real Estate Articles / Jul 08, 2022

2022 has proven to be a pivotal year for the housing and real estate market. With the ongoing Ukraine war on one side, and the rising interest rates on the other, the housing market is seeing a shift from the post-Covid boost.

Reviving Campus Spaces: Adaptive Reuse Solutions for Modern Education

Real Estate Articles / Jan 26, 2024

Transformative Real Estate: Navigating the Evolution of College Campuses through Adaptive Reuse and Strategic Solutions

Houston is the best real estate market for industrial spaces in the country as of 2023

Real Estate Articles / Jul 25, 2023

Houston\'s industrial market has experienced impressive activity and has been recognized as the nation\'s top industrial market 2023.

Wealth management tips. How to create wealth?

Real Estate Articles / Jun 08, 2022

We have listed the best ways through which you can make money in a low risk manner. Create wealth using these investment options. It is the easiest way to get rich.

Navigating the Future of Real Estate: Trends in Houston and Beyond

Real Estate Articles / Apr 01, 2024

Exploring Real Estate Trends in Houston: Embracing Online Innovations and Smart Home Features

What You Need To Know About Closing

Real Estate Articles / May 11, 2022

Whether you are buying property or selling property, closing is a crucial part that will make or break your deal. We have listed major pointers that will help you deal with your next closing much better.

Everything you need to know about capital gains tax and real estate investment

Real Estate Articles / Apr 01, 2022

Capital gains tax is levied on the profits made when you sell property or sell investments owned by you. Here’s how you can be exempt from taxes along with the top tax tips for investors and property owners.

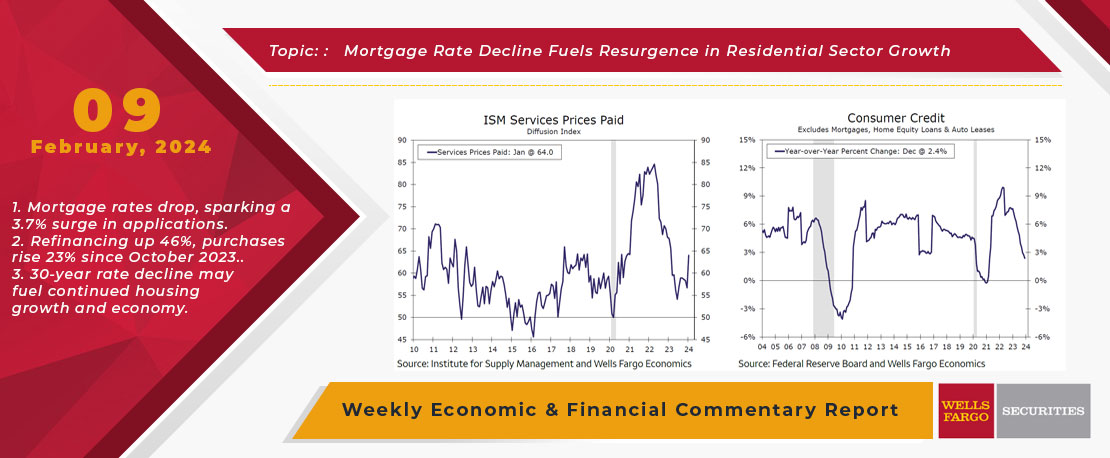

This Week's State Of The Economy - What Is Ahead? - 09 February 2024

Real Estate Articles / Feb 14, 2024

The ISM services index shot higher into expansion territory during January, which is the latest piece of evidence that economic growth is still firmly in positive territory.