Houston's industrial market has been recognized as the nation's top emerging industrial market, according to a new report. Despite the delivery of 53M SF of new industrial facility space, the industrial vacancy rate in Houston has declined, and this was cited as a key reason for the city's top-ranking. Since the beginning of 2020, Houston's industrial market has experienced impressive activity driven by strong e-commerce and wholesaler/retailer activity. A report by Cushman & Wakefield noted that Houston recorded nine deals of over 1 million SF during this period.

Houston's recognition as the top emerging industrial market underscores its potential for growth, even in the face of increasing amounts of available space. Not only Houston, but Texas as a whole, has seen a surge in real estate activity. Houston emerged at the top of the list of the best real estate market, but closely following are San Antonio, Austin, Fort Worth, and Dallas. Here are some of the recent findings about Houston’s real estate market:

- Single-family Real Estate: The years 2021 and 2022 were the best for residential development in the decade, with an estimated 55,600 units, the most across the nation, being authorized.

- Multi-family Real Estate: Permits have been issued for about 90,000 new apartments in the multifamily sector.

- Office Sector: Corporate relocations contributed significantly to Houston's office boom. Houston's office sector grew by 27 million square feet, falling behind New York City.

- Industrial Sector: Industrial space increased by about 65 million square feet, ranking first nationally.

- Self-storage: The Houston self-storage sector has also seen a significant increase in new construction, addressing the city's complex space needs. Over the last ten years, the local inventory has grown by around 5.7 million square feet.

Houston's industrial market continued to expand exceptionally in the first quarter, with 6.9 million square feet (msf) of new deliveries led by robust occupier demand. Developers have boosted their product choices, with 33.8 million square feet of building currently ongoing. Population expansion, combined with increased shipping activity through the Port of Houston, has fueled growth in both e-commerce and consumer goods. Despite persistent global economic uncertainties, several multinational retailers and third-party logistics companies continue to pursue growth plans to support solid consumer growth.

Developers are keeping up with robust demand in each submarket by building at historic levels. Due to increased shipping activity at the Port of Houston, the Southeast sector currently leads all submarkets, with 7.6 million square feet or 23% of total market building underway.

Investing in real estate can be a tricky business if not done correctly. Having an expert guide you through the process is not just advised but is essential for successful investment. Do not make real estate or other investment decisions by yourselves without the supervision of an advisor or broker. TC Global Commercial offers expert advice, consultation, representation, and more. Get in touch with industry experts and begin your investment journey toward successful wealth management.

Revolutionizing Student Housing: Advancements in Development and Design

Real Estate Articles / Jan 17, 2024

Capital Market Challenges and Design Evolution in Student Housing Development: Navigating Financing Hurdles, Innovative Trends, and Future Prospects in 2024

Reviving Campus Spaces: Adaptive Reuse Solutions for Modern Education

Real Estate Articles / Jan 26, 2024

Transformative Real Estate: Navigating the Evolution of College Campuses through Adaptive Reuse and Strategic Solutions

What REIT Means And How You Can Make Big Bucks With It!

Real Estate Articles / Feb 01, 2022

What if you were told that you could earn regular dividends from your investments without the hassles relating to buying, managing or even financing a property?

Late 2022, Early 2023 Market Trends

Real Estate Articles / Dec 05, 2022

Real estate investors are keen to invest in real estate. End of year real estate trends and market predictions and trends that can be expected in commercial real estate for 2023.

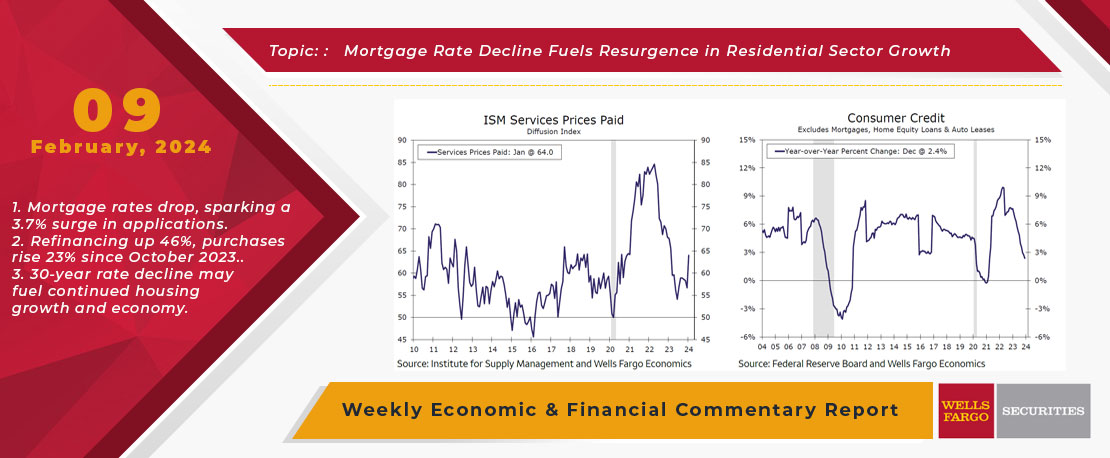

This Week's State Of The Economy - What Is Ahead? - 09 February 2024

Real Estate Articles / Feb 14, 2024

The ISM services index shot higher into expansion territory during January, which is the latest piece of evidence that economic growth is still firmly in positive territory.

How is crypto and blockchain changing real estate business and money making?

Real Estate Articles / Oct 14, 2022

Cryptocurrency and blockchain technology is changing the real estate business in many ways. Real estate investing has started shifting to a digital and virtual space slowly.

Rise In Population Is Causing This Real Estate Phenomenon To Take Place In Cypress, Texas!

Real Estate Articles / May 20, 2023

Population rise causes a rise in need for medical institutes, hospitals and other commercial real estate in Cypress, Texas.

What You Need To Know About Closing

Real Estate Articles / May 11, 2022

Whether you are buying property or selling property, closing is a crucial part that will make or break your deal. We have listed major pointers that will help you deal with your next closing much better.

Why Invest In Retail Properties?

Real Estate Articles / Mar 09, 2019

Are you considering investing in commercial real estate? Not exactly sure which type of property to start with? Fret no more!

Navigating Challenges in Affordable Housing Finance: Strategies for Developers

Real Estate Articles / Dec 08, 2023

Developers in the affordable housing sector face unprecedented challenges in financing that are primarily revolving around construction-related hurdles.