The term "adaptive reuse" in real estate typically recalls repurposing old commercial buildings, but the focus is shifting towards underused assets in higher learning institutions. With the rise of online learning, colleges face challenges in managing facilities built for traditional in-person classes. Larry Gautier, Senior Vice President of NAI Miami | Fort Lauderdale, discusses how NAI is addressing this need by helping schools develop strategies, whether it's leasing to commercial users, forming joint ventures, or entering long-term leases with developers. The emphasis is on revenue generation, enhancing the student experience, and community engagement.

Traditionally focused on conventional real estate transactions, NAI has adapted its approach to meet the evolving needs of higher learning institutions. The shift to remote learning has left colleges with surplus facilities, prompting NAI to step in and help create strategies for these schools. Larry Gautier emphasizes the importance of addressing key factors such as revenue, student experience, and community engagement. The approach involves exploring options like Aerospace or engineering companies for educational programs or leasing to commercial users, forming joint ventures, or entering long-term leases with developers. NAI's involvement with Broward College and the successful adaptation of its surplus facilities showcase the practical application of these strategies.

- Changing Landscape: The rise of online learning has left many higher learning institutions with underused or vacant assets.

- NAI's Adaptation: NAI, traditionally focused on conventional real estate, now addresses the unique challenges faced by colleges and universities.

- Strategic Solutions: NAI helps schools create strategies, considering factors like revenue, student experience, and community engagement.

- Diversification: Options include leasing to commercial users, forming joint ventures with companies for educational programs, and entering long-term leases with developers.

- Broward College Success: NAI's involvement with Broward College resulted in a successful adaptation of surplus facilities, generating revenue through leasing to a soccer academy and pickleball operator.

- Revenue Generation: The focus is on helping schools generate revenue, adapt to changing circumstances, and enhance the overall student experience.

- Community Engagement: NAI considers how properties contribute to the community, emphasizing the importance of engaging with the local population.

- Case Studies: Examples like Broward College and Notre Dame of Maryland University highlight the practical application of adaptive reuse strategies.

- Market Dynamics: While some schools seek to reduce or reuse properties, others, especially community colleges, are looking to expand and lease additional space off the main campus.

- Opportunities in Softening Markets: Softening office space markets provide opportunities for community colleges to secure additional space for growing enrollment.

This shift in focus towards adaptive reuse in higher education real estate reflects the dynamic nature of the industry, where strategic solutions are essential for navigating challenges and seizing opportunities.

Extending a Warm Welcome to Savings for All Property OWNER

Real Estate Articles / Oct 27, 2023

Texas\' Landmark Property Tax Reform: Securing Affordable and Sustainable Homeownership for Texans, Envisioning Average Yearly Savings of $1,300.

What developers are saying about the 2023 real estate market

Real Estate Articles / Apr 26, 2023

The 2023 market condition,specifically commercial real estate development and construction industry is set for significant growth and innovation. Developers are saying that recession may be mild, and many growth and investment opportunities\'ll arise.

Rise In Population Is Causing This Real Estate Phenomenon To Take Place In Cypress, Texas!

Real Estate Articles / May 20, 2023

Population rise causes a rise in need for medical institutes, hospitals and other commercial real estate in Cypress, Texas.

Everything you need to know about capital gains tax and real estate investment

Real Estate Articles / Apr 01, 2022

Capital gains tax is levied on the profits made when you sell property or sell investments owned by you. Here’s how you can be exempt from taxes along with the top tax tips for investors and property owners.

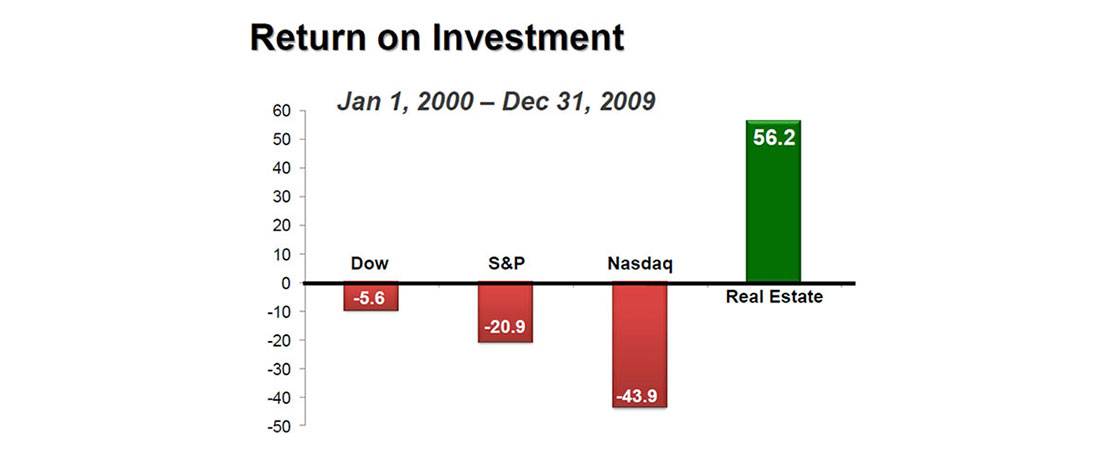

Who Should Invest In Commercial Real Estate

Real Estate Articles / Mar 16, 2019

There are several reasons why someone would choose to invest in commercial real estate.

Navigating the Future of Real Estate: Trends in Houston and Beyond

Real Estate Articles / Apr 01, 2024

Exploring Real Estate Trends in Houston: Embracing Online Innovations and Smart Home Features

Legal Victories Unleash Potential to Cut Property Taxes - Impact on Hospitality and more

Real Estate Articles / Nov 15, 2023

Landmark Court Decisions Pave the Way for Lower Property Taxes and Intangible Asset Considerations

How is crypto and blockchain changing real estate business and money making?

Real Estate Articles / Oct 14, 2022

Cryptocurrency and blockchain technology is changing the real estate business in many ways. Real estate investing has started shifting to a digital and virtual space slowly.

Wealth management tips. How to create wealth?

Real Estate Articles / Jun 08, 2022

We have listed the best ways through which you can make money in a low risk manner. Create wealth using these investment options. It is the easiest way to get rich.

Late 2022, Early 2023 Market Trends

Real Estate Articles / Dec 05, 2022

Real estate investors are keen to invest in real estate. End of year real estate trends and market predictions and trends that can be expected in commercial real estate for 2023.