The year 2022 is coming to an end, and with it come market trends that seem to be changing on a consistent level. Like 2022, the new year will also see investors act with caution when it comes to commercial real estate. This, however, is not a bad sign, but the opposite of it. According to the reports, investors, though cautious, are keen to invest in real estate. Inflation, high interest rates, and an overall economic shift can be expected towards the end of 2022 and in the beginning of 2023. These changes in the market are changing the way people invest in real estate and get great returns on investment. According CCIM’s Commercial Investment Real Estate Magazine these are the predictions and trends that can be expected the following year in commercial real estate:

Office Retail Space Owners Seeking Shorter Lease

The survey, Colliers’ “Return to Office” showed that 40% of participants said they are looking at shorter lease options. This isn’t coming as a big show to anybody as Covid-19 and the post-pandemic work scenario (can you use the word “mindset” instead?) shows a preference given to hybrid or remote jobs over in-office jobs. According to the same survey’s results, 60% of participants said that they prefer a 3-day in-person work week. Hybrid work environments are up to 77% after the pandemic, compared to the 20% pre-pandemic.

Retail Market Investment Boom

Commercial real estate proved to be a hedge against inflation towards the end of 2022. CBRE’s data suggests that approximately $98.4 billion was invested in the retail sector in 2022 (including the month of December.) This is a whopping 115.4% increase compared to the figures last year!

Hospitality Industry Paints A Promising Picture

Covid-19 caused an irrevocable change to the hospitality industry. Average daily-rates of hotel rooms has seen an increase in price at around 7% from last year, as per the Midyear Hospitality National Report by Marcus & Millichap. This means that despite a slow start, hospitality is seeing a rise in occupancy and per-room returns or revenue per room, making it the ideal time to invest in the hospitality sector. Cap rates have dropped to 7.5% from the 9% mark of 2019.

Retail Income To See A Hike

According to recent reports, new tenants are paying a higher rent when compared to their predecessors. RealPage Market Analytics suggests that this hike is close to 19% (new tenants are paying 19% more than old tenants of the same property) and the market right now and continuing into 2023 is going to stay hot.

Logistics and Data Centers Booming

The data center market of Nort America is booming. Development has been on a stable and continuous rise since H12022 and is expected to stay the same moving into the new year. The perfect example of this is the state of Texas. Dallas, Texas had the second highest amount under construction in the past year.

All in all, 2022 has been a year of ups and downs for real estate. In 2023, we can expect good returns on investments, especially in the retail sector. TC Global Commercial can help you get the best real estate deal this new year! Get in touch with one of our experts today for great return on investments.

This article has been adapted from the CCIM, “Commercial Investment Real Estate” magazine.

The content in this blog is for information only. No information on here constitutes a solicitation, recommendation, endorsement, or offer by TC Global Commercial Real Estate. All investment and other real estate or financial transactions should be taken after consulting with a professional financial and/or investment advisor. The article is, in no way, an example of professional and/or financial advice. Reader discretion is advised. TC Global Commercial is not responsible for any action taken by the reader in terms of, but not limited to, real estate investments and financial undertakings.

Falling Home Prices? Here's All You Need To Know!

Real Estate Articles / Aug 08, 2022

Here’s how you can take advantage of rising interest rates. Advantages of investing during high interest rates are listed below. Invest in real estate today.

How is crypto and blockchain changing real estate business and money making?

Real Estate Articles / Oct 14, 2022

Cryptocurrency and blockchain technology is changing the real estate business in many ways. Real estate investing has started shifting to a digital and virtual space slowly.

US REAL ESTATE REMAINS TOP DRAW FOR FOREIGN INVESTORS

Real Estate Articles / Mar 02, 2019

The US continues to be the world\'s leading recipient of cross-border capital, and it has no plans of slowing down. During the first half of 2017 the United States attracted 19.8 billion U.S dollars from foreign investors.

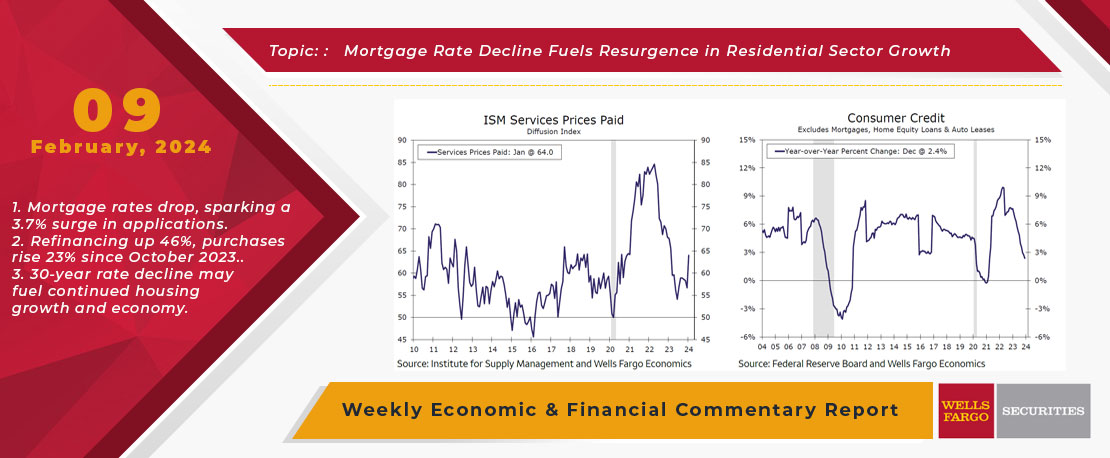

This Week's State Of The Economy - What Is Ahead? - 09 February 2024

Real Estate Articles / Feb 14, 2024

The ISM services index shot higher into expansion territory during January, which is the latest piece of evidence that economic growth is still firmly in positive territory.

Everything you need to know about capital gains tax and real estate investment

Real Estate Articles / Apr 01, 2022

Capital gains tax is levied on the profits made when you sell property or sell investments owned by you. Here’s how you can be exempt from taxes along with the top tax tips for investors and property owners.

Short term rentals are declining but you can still make money with the right kind of investment

Real Estate Articles / Jul 26, 2023

There are still opportunities to earn money from short-term rentals, despite the ongoing decline. strategic investments and a proactive approach can lead to success in the evolving short-term rental industry.

Purchasing Commercial Real Estate? Consider These 5 Things Before You Buy

Real Estate Articles / Feb 09, 2019

Whether you are a seasoned investor, or you\'re researching for your first property there is always a certain risk factor that makes us hesitate before signing the dotted line.

Crypto is changing the real estate industry. Invest in real estate using crypto currency!

Real Estate Articles / Sep 01, 2022

With the economic inflation rising, the real estate and financial market is undergoing changes. Crypto currency is the new trend in real estate and in the investment world as more people are using crypto to invest in real estate.

Stocks Or Real Estate? Which Is The Better Investment?

Real Estate Articles / Feb 09, 2022

Want to invest and make money? We have listed out the pros and cons of the real estate market and the stock market so that you can decide if you want to invest in stocks or real estate.

Houston excels in the latest ranking of top U.S. cities for working-class families

Real Estate Articles / Dec 29, 2023

Houston-The-Woodlands-Sugar Land Secures 30th Spot in National Economic Prosperity Rankings, Revealing Robust Growth Amidst Population Surge and Varied Socioeconomic Challenges