Payrolls Beat Expectations, but Signs of Moderation on the Horizon

Fed Chair Powell’s speech at the Brookings Institute on Wednesday was the focus of attention during a week replete with economic data. As we write in the Interest Rate Watch, Chair Powell hinted that the magnitude of rate hikes moving forward could be smaller than the string of 75 bps hikes implemented over the previous four FOMC meetings. While Chair Powell’s speech was slightly out of line with market expectations, it was in-line with our current macroeconomic forecast.

One of the reasons why we believe the Fed will turn slightly less aggressive in the months ahead is that inflation, while still uncomfortably hot, no longer appears to be intensifying. Similar to October’s core CPI print, the core PCE deflator rose 0.2% in October, a softer-than-expected increase. Several underlying drivers of inflation also look to be rolling over. For example, the prices paid component of the ISM manufacturing index during November fell to the lowest level since May 2020, suggesting manufacturing input costs are declining outright.

That said, the labor market remains strong, which is a reason why the Fed will want to continue raising rates. Total nonfarm payrolls rose by 263K in November. The gain represents a moderation from the robust pace seen at the start of the year, but still quite strong by historical standards. Nonfarm payroll growth has averaged 272K per month over the past three months, stronger than the average monthly gain of roughly 190K that was registered during the last economic expansion. The unemployment rate was unchanged at 3.7%, while average hourly earnings surprised to the upside and rose 0.6% during the month. Household employment, which is highly volatile and generally viewed as a somewhat less reliable estimate of hiring compared to the payroll number, dropped by 138K, the second straight monthly decline.

The modest downshift in job growth relative to earlier this year is not the only indication of labor market moderation. Reported earlier this week, the Job Openings and Labor Turnover Survey (JOLTS) for October revealed that job openings fell to 10.3 million from 10.7 million the month prior. Job openings remain highly elevated, but have trended lower since peaking in March. One factor that may be contributing to the fall in openings is that the number of quits has now declined in six of the past seven months. The number of job openings per unemployed, a measure of labor market tightness frequently cited by Chair Powell, fell to 1.71 from 1.86 in September, continuing the slide that began in April.

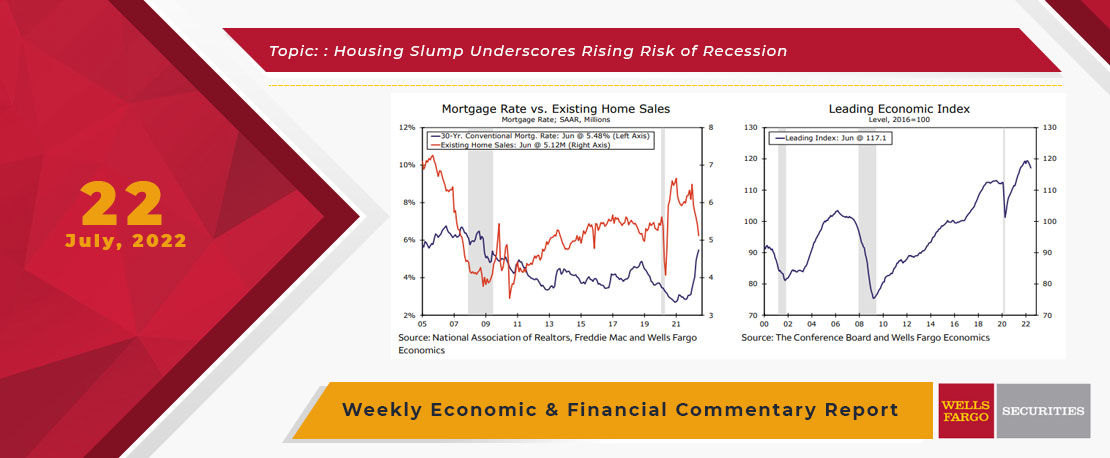

This Week's State Of The Economy - What Is Ahead? - 22 July 2022

Wells Fargo Economics & Financial Report / Jul 27, 2022

July\'s NAHB Housing Market Index dropped 12 points to 55, the second largest monthly decline on record behind April 2020\'s pandemic-induced collapse.

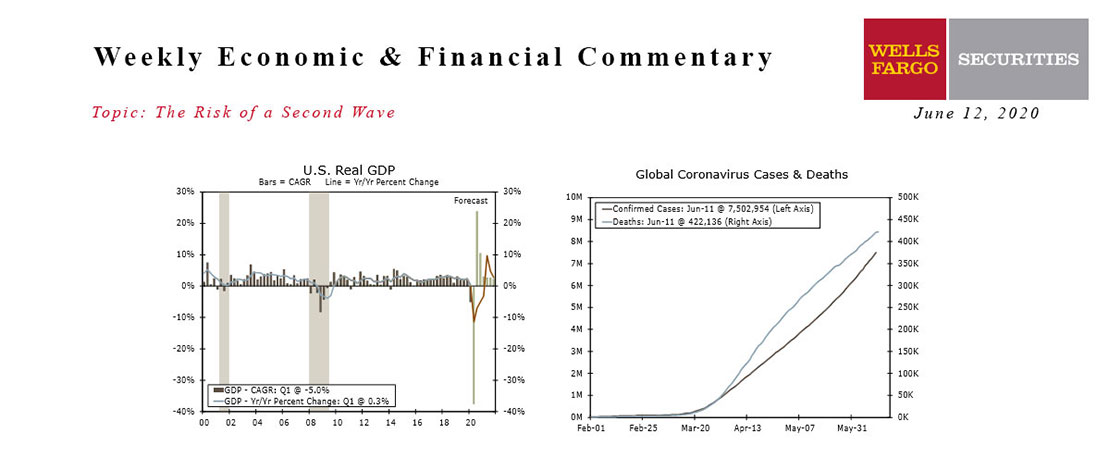

This Week's State Of The Economy - What Is Ahead? - 12 June 2020

Wells Fargo Economics & Financial Report / Jun 13, 2020

Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.

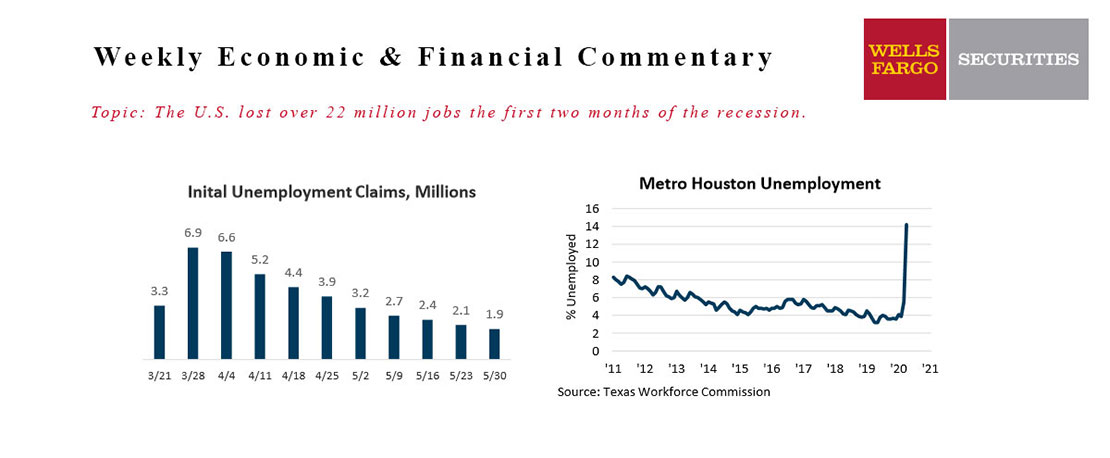

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

This Week's State Of The Economy - What Is Ahead? - 24 May 2024

Wells Fargo Economics & Financial Report / May 29, 2024

Homebuying retreated in April following a leg up in mortgage rates. Meanwhile, durable goods orders surprised to the upside, suggesting the manufacturing industry is on better footing.

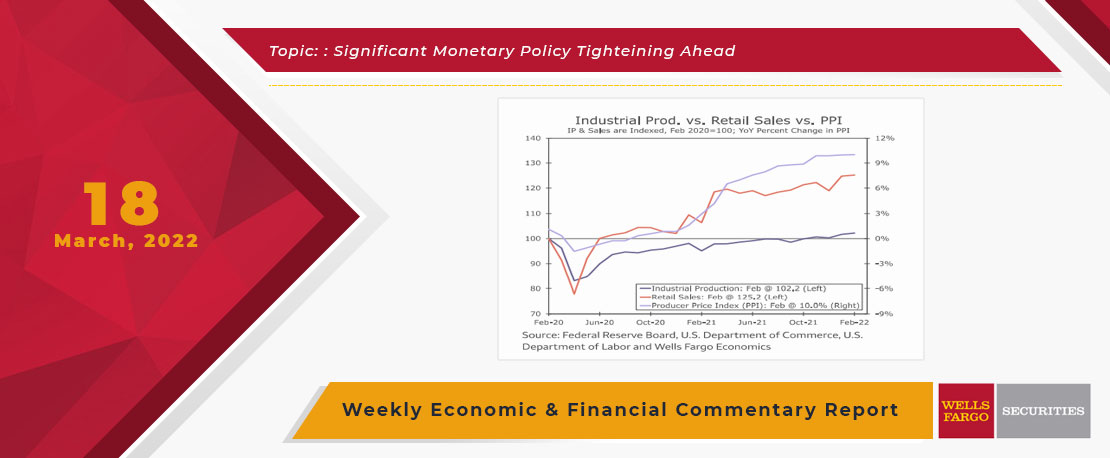

This Week's State Of The Economy - What Is Ahead? - 18 March 2022

Wells Fargo Economics & Financial Report / Mar 21, 2022

it was a big week for economic news as the Astros allowed the TWINS of all teams to sign Carlos Correa to the type of short-term deal that the Astros have historically been open to.

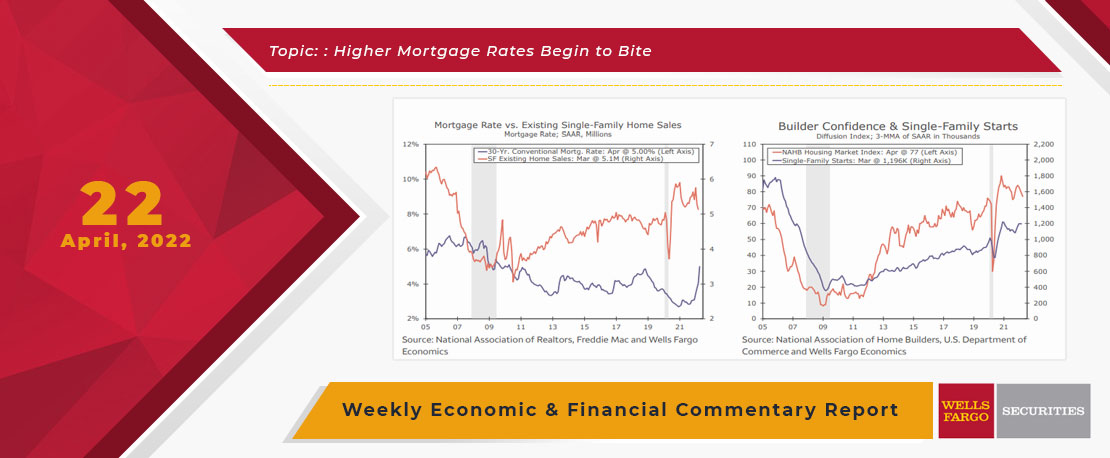

This Week's State Of The Economy - What Is Ahead? - 22 April 2022

Wells Fargo Economics & Financial Report / Apr 27, 2022

I’ll wish you a Happy Earth Day anyway. Don’t expect a card this year. While the Earth continues to thankfully revolve at a steady rate, rising mortgage rates appear to be slowing residential activity

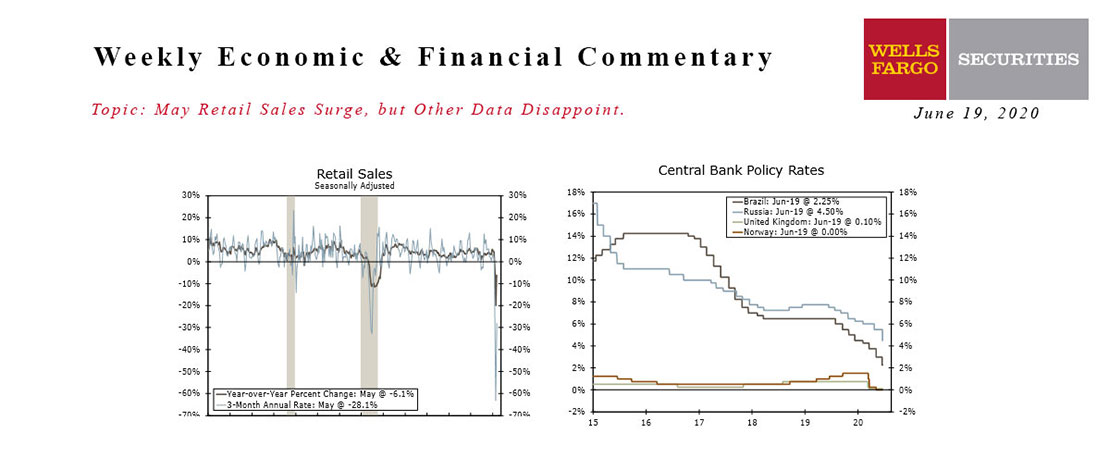

This Week's State Of The Economy - What Is Ahead? - 19 June 2020

Wells Fargo Economics & Financial Report / Jun 22, 2020

Retail sales kicked off the week with a bang, rising 17.7% month-over-month in May. The increase was larger than every single one of the 74 forecast submissions.

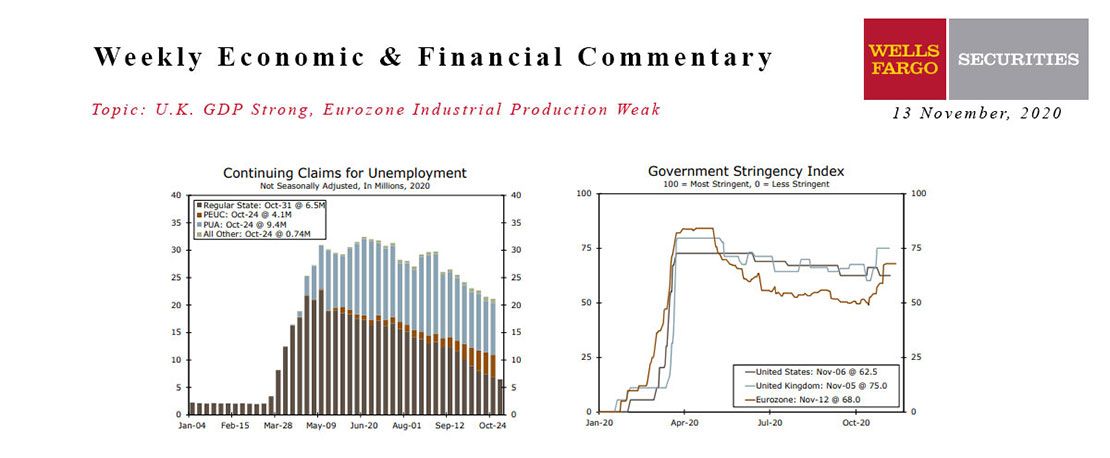

This Week's State Of The Economy - What Is Ahead? - 13 November 2020

Wells Fargo Economics & Financial Report / Nov 14, 2020

The combination of the election outcome and a workable vaccine boosted financial markets and set the background music for this week’s short list of indicators.

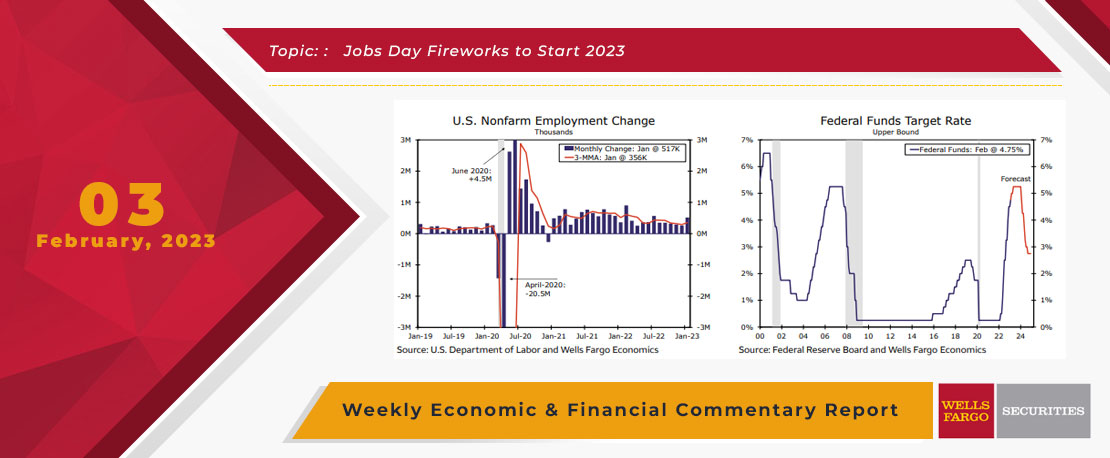

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

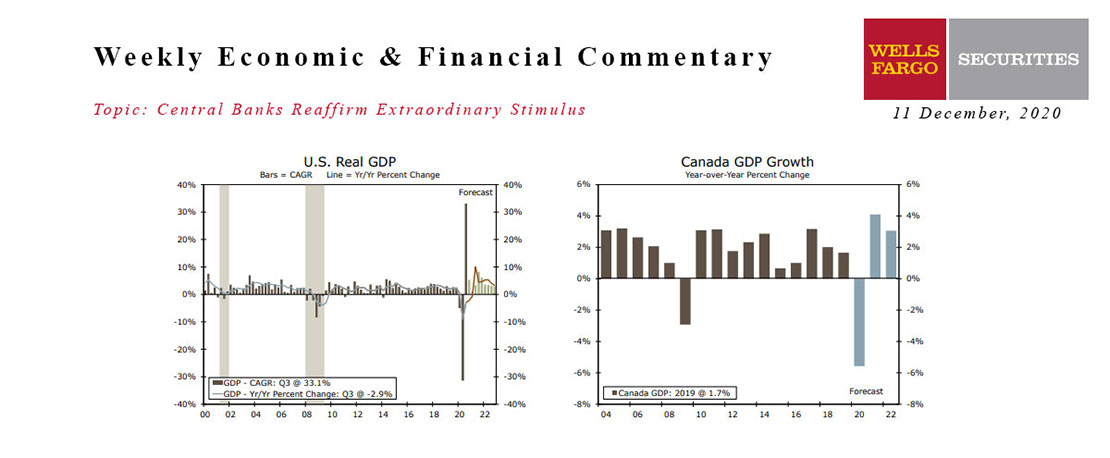

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.