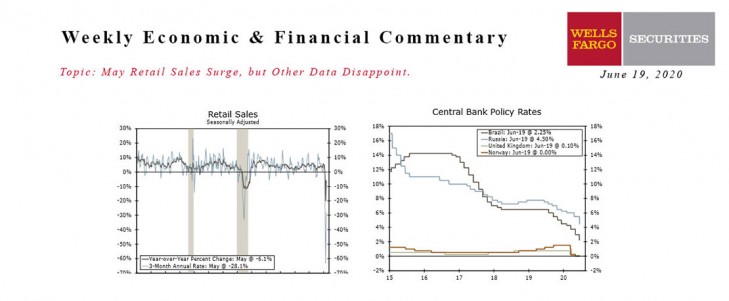

U.S. - May Retail Sales Surge, but Other Data Disappoint

- Retail sales kicked off the week with a bang, rising 17.7% month-over-month in May. The increase was larger than every single one of the 74 forecast submissions.

- The factory data were not as encouraging. Industrial production growth was just 1.4% in May, below the 3.0% consensus. On a year-over-year basis, the decline in industrial output was more than double the decline in retail sales.

- The initial jobless claims data were the last major release of the week, and they too were disappointing. Even more disappointing were the continuing claims data, which showed almost no change in those receiving unemployment benefits from May 30 to June 6.

Global - Global Central Banks Back in Focus This Week

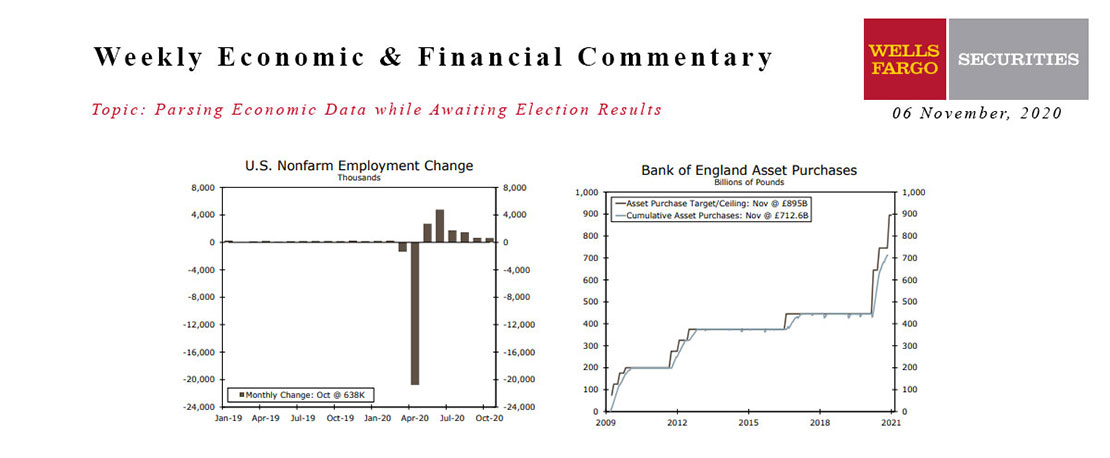

- It was a busy week for central banks across the globe, with some opting to ease monetary policy further.

- Within the G10, the Bank of England announced a £100B increase in its asset purchase target, but some elements of the accompanying statement were less dovish in tone. Meanwhile, the Norges Bank left its policy rate unchanged at zero.

- Among the emerging economies, Brazil’s central bank delivered a 75 bps rate cut, and left the door open to additional cuts. Meanwhile, the Bank of Russia cut its Key rate a full percentage point, but Taiwan’s central bank kept rates on hold.

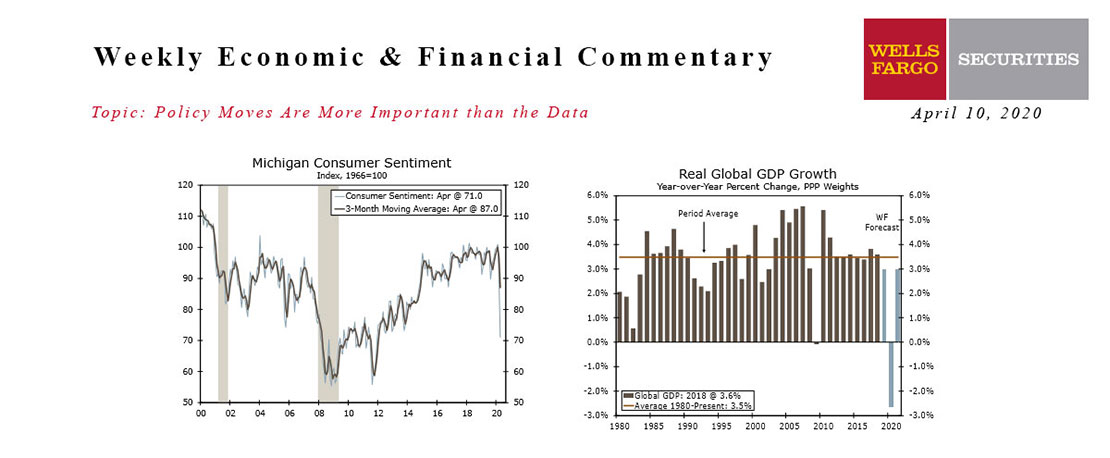

This Week's State Of The Economy - What Is Ahead? - 10 April 2020

Wells Fargo Economics & Financial Report / Apr 11, 2020

The Federal Reserve greatly expanded the collateral that it is willing to buy, further easing pressures in financial markets.

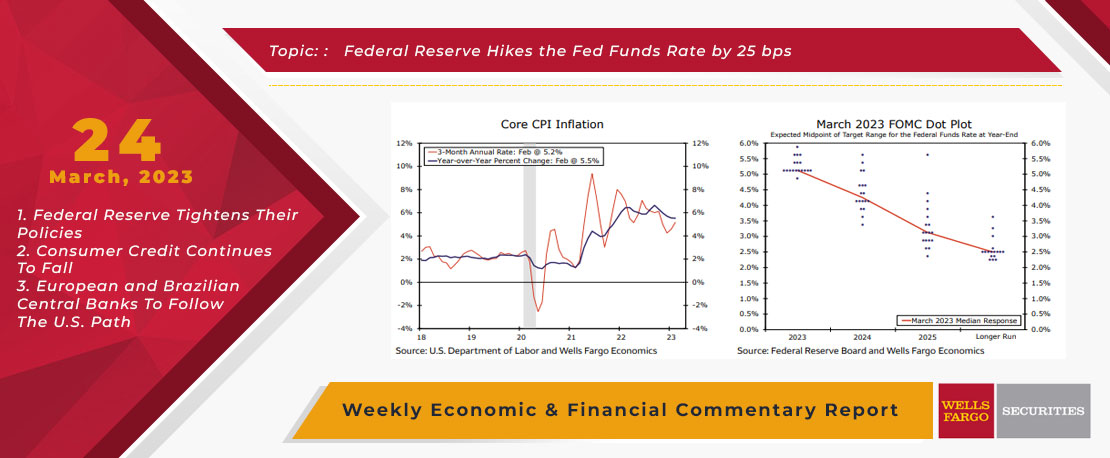

This Week's State Of The Economy - What Is Ahead? - 24 March 2023

Wells Fargo Economics & Financial Report / Mar 29, 2023

The FOMC hiked the federal funds rate by 25 bps on Wednesday amid continued strength in the labor market and elevated inflation.

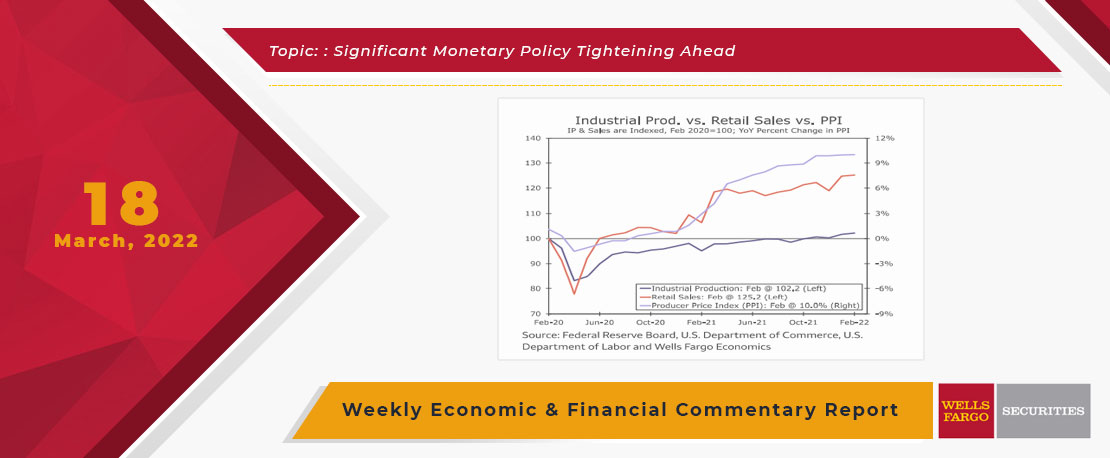

This Week's State Of The Economy - What Is Ahead? - 18 March 2022

Wells Fargo Economics & Financial Report / Mar 21, 2022

it was a big week for economic news as the Astros allowed the TWINS of all teams to sign Carlos Correa to the type of short-term deal that the Astros have historically been open to.

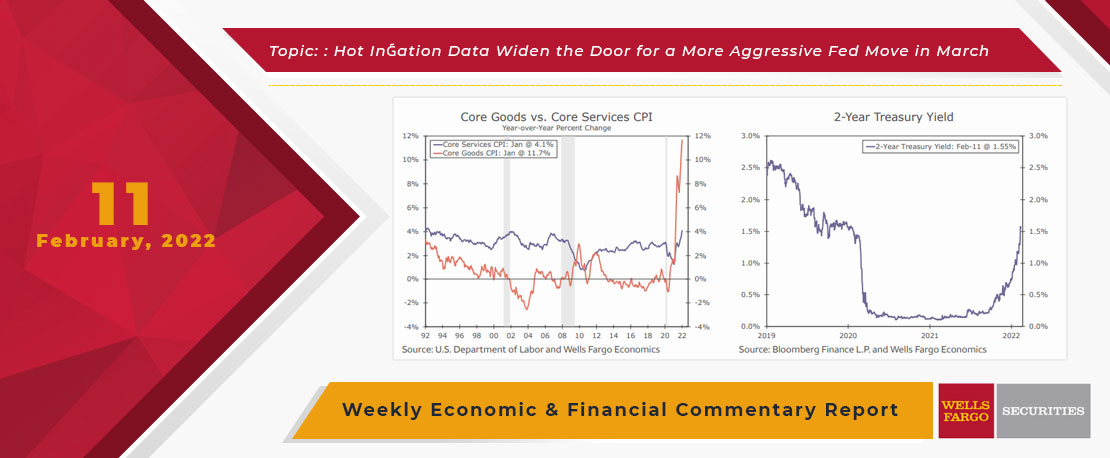

This Week's State Of The Economy - What Is Ahead? - 11 February 2022

Wells Fargo Economics & Financial Report / Feb 14, 2022

Deep thought for the week, if a tree falls in the forest, or an Olympics occurs, and no one is there to hear it or see it, did it really occur?

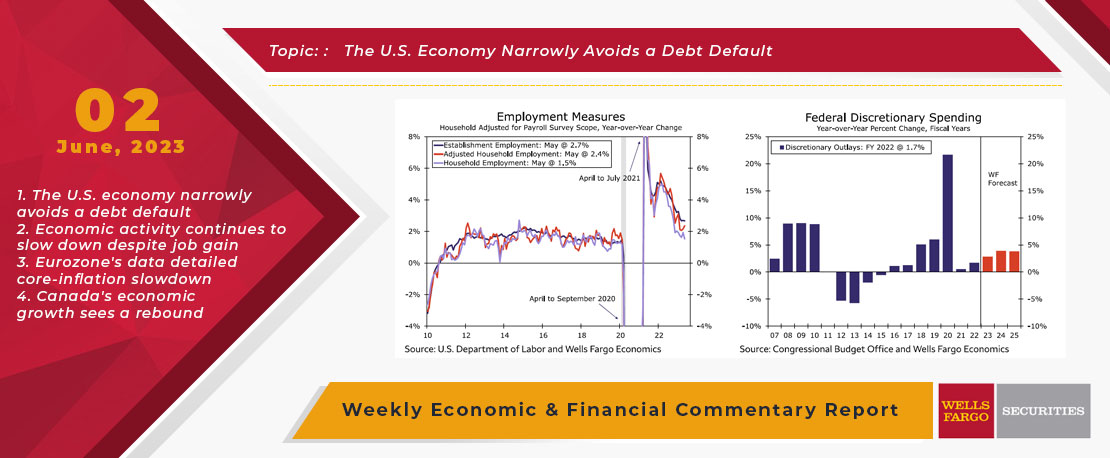

This Week's State Of The Economy - What Is Ahead? - 02 June 2023

Wells Fargo Economics & Financial Report / Jun 06, 2023

This week, Congress and the president prevented what would have been the first default in U.S. history by agreeing to suspend the debt ceiling through the end of 2024.

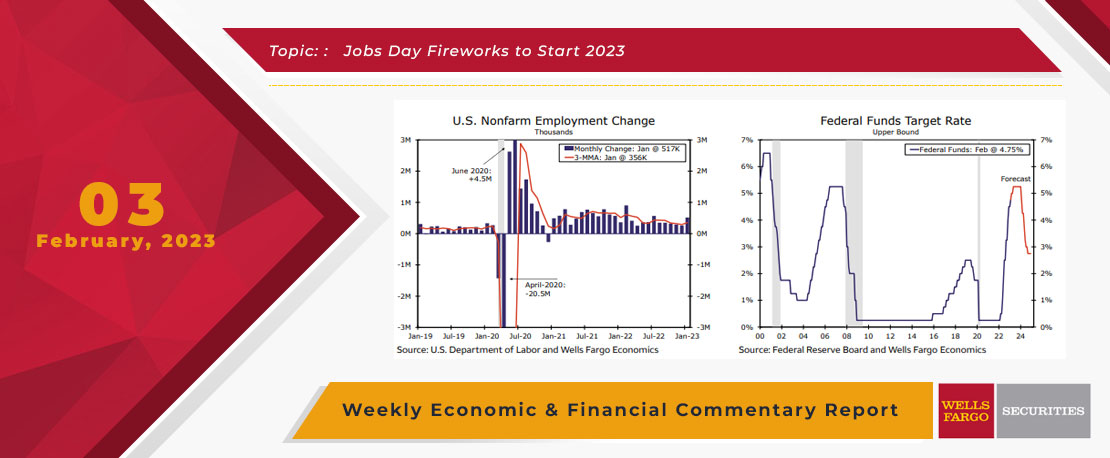

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

This Week's State Of The Economy - What Is Ahead? - 06 November 2020

Wells Fargo Economics & Financial Report / Nov 10, 2020

As of this writing, the outcome of the U.S. presidential election is undecided. Joe Biden, however, appears likely to become president based off of his growing lead in several key states.

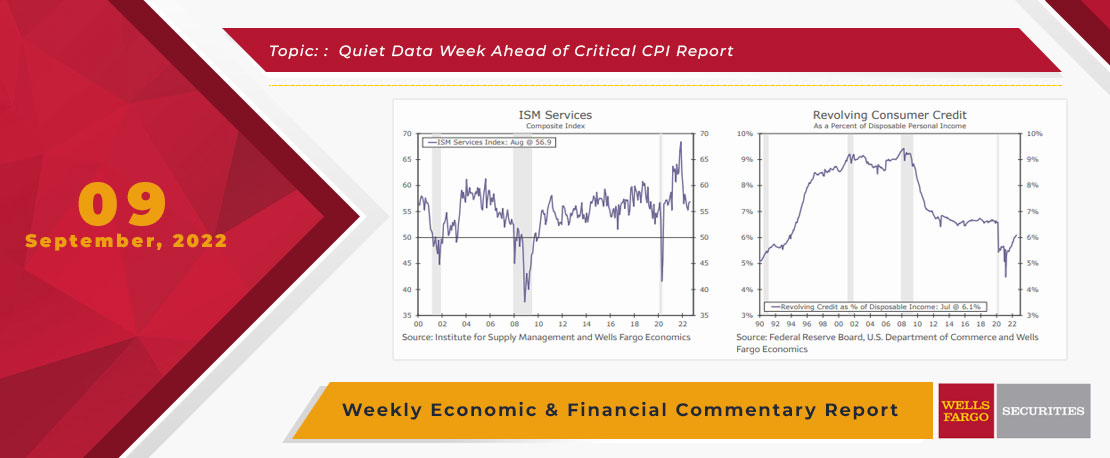

This Week's State Of The Economy - What Is Ahead? - 09 September 2022

Wells Fargo Economics & Financial Report / Sep 10, 2022

The ISM services index came in stronger than expected, and the underlying details pointed to service sector resilience with business activity and new orders notching their highest reading this year.

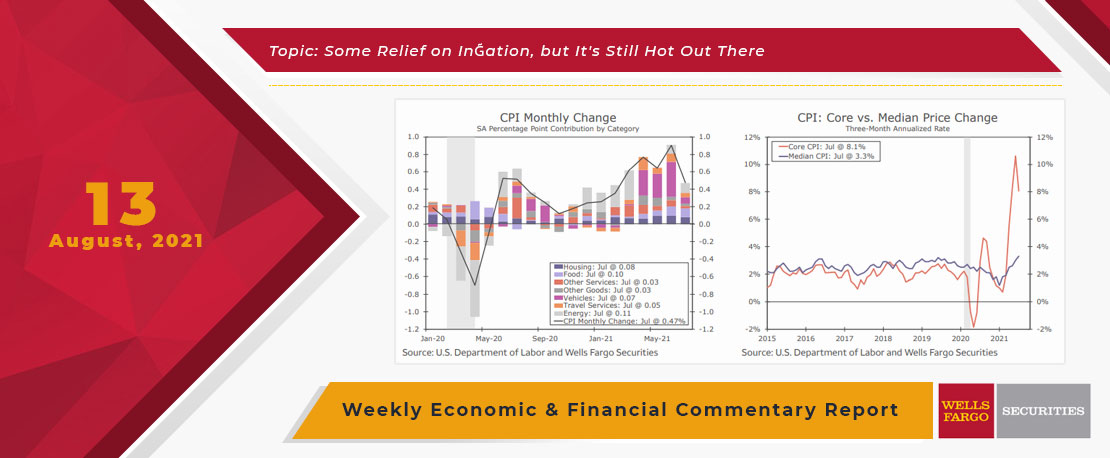

This Week's State Of The Economy - What Is Ahead? - 13 August 2021

Wells Fargo Economics & Financial Report / Aug 19, 2021

The general outlook remains positive as households have accumulated over $2T in excess savings on their balance sheets and net worth has risen across all income groups.

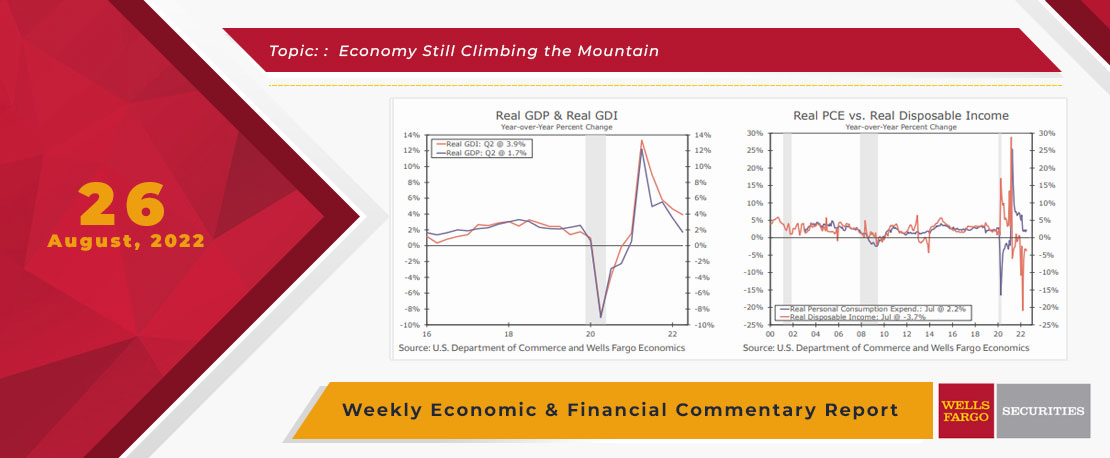

This Week's State Of The Economy - What Is Ahead? - 26August 2022

Wells Fargo Economics & Financial Report / Aug 29, 2022

I can understand how the opportunity to participate in lots of scintillating economic policy discussions could make fishing look exciting in comparison.