Federal Reserve Hikes the Fed Funds Rate by 25 bps

A highly anticipated Federal Open Market Committee (FOMC) meeting concluded on Wednesday, and monetary policy officials at the Federal Reserve elected to increase the target range for the federal funds rate by 25 bps to 4.75%-5.00%. In addition, the FOMC reaffirmed the current pace of quantitative tightening. Since September, the central bank has allowed up to $60 billion of Treasury securities and $35 billion of mortgage-backed securities to runoff its balance sheet each month.

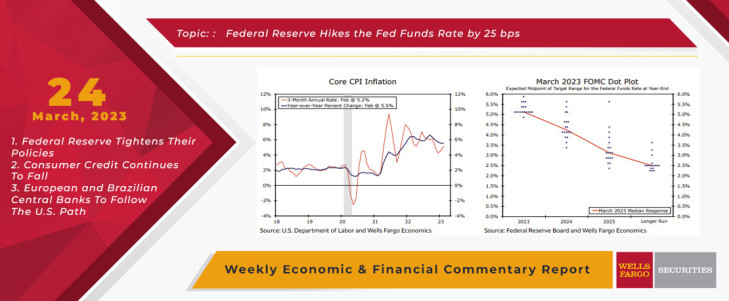

The FOMC continued to characterize the current state of the economy in favorable terms. The meeting statement noted that "recent indicators point to modest growth in spending and production," and that job gains "are running at a robust pace." According to the FOMC, "inflation remains elevated." Indeed, the core CPI has risen 5.5% over the past year and at a 5.2% annualized pace over the past three months. A very tight labor market and elevated inflation argue for continued monetary policy tightening, but the Committee also noted the strains that have appeared in the banking system recently. In the FOMC's view, these strains "are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation," although "the extent of these effects is uncertain."

Given the uncertain outlook, Federal Reserve officials made relatively small changes to their projections for the economy and the federal funds rate. The median projection for real GDP growth this year was 0.4%, more or less unchanged from their previous projection of 0.5%. Similarly, the median projections for headline and core inflation in 2023 rose by just 0.2 and 0.1 percentage points, respectively. In the post-meeting press conference, Chair Powell argued that although the recent data have shown faster economic growth and inflation than was previously anticipated, the recent financial system stresses have created additional downside risks to future economic growth and inflation.

Accordingly, the FOMC backed off somewhat on its forward guidance regarding further tightening. Previously, the meeting statement said that "ongoing increases (emphasis ours) in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time." The FOMC now judges that "some additional policy firming may be appropriate." The dot plot, which shows each FOMC participant's projection for the year-end federal funds rate over the next few years, had a median projection for 2023 of 5.00%-5.25%. This was unchanged from the previous update in December 2022. If realized, this would imply just one more 25 bps rate hike this year, followed by a long hold and eventual rate cuts in 2024. For further reading on our outlook for U.S. monetary policy.

This Week's State Of The Economy - What Is Ahead? - 13 November 2020

Wells Fargo Economics & Financial Report / Nov 14, 2020

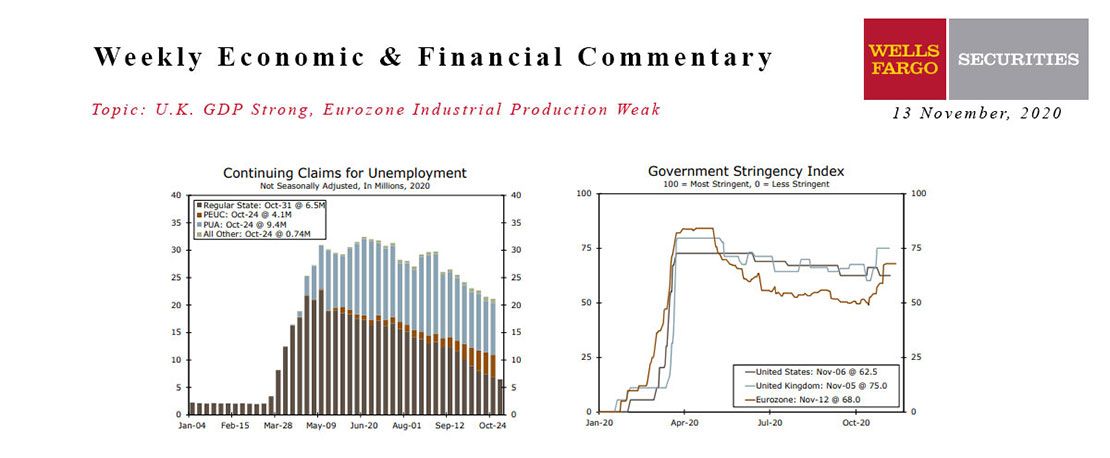

The combination of the election outcome and a workable vaccine boosted financial markets and set the background music for this week’s short list of indicators.

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

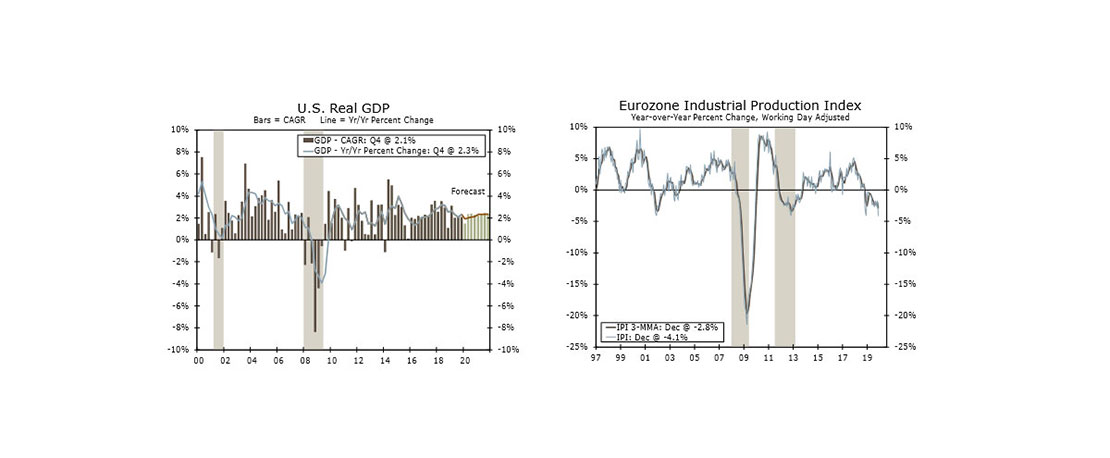

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

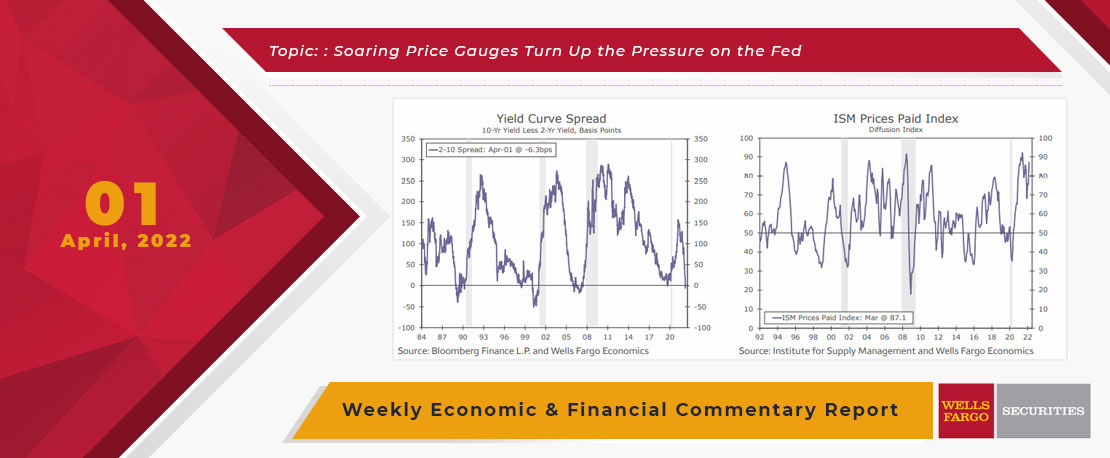

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

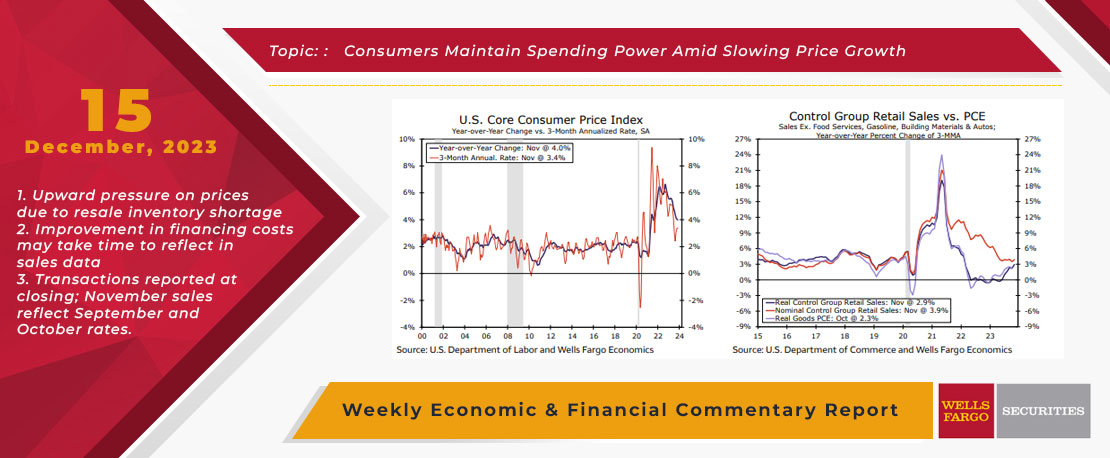

This Week's State Of The Economy - What Is Ahead? - 15 December 2023

Wells Fargo Economics & Financial Report / Dec 21, 2023

core CPI remained elevated in November at a 4.0% annual rate, a string of slower monthly prints suggests that disinflation has more room to run.

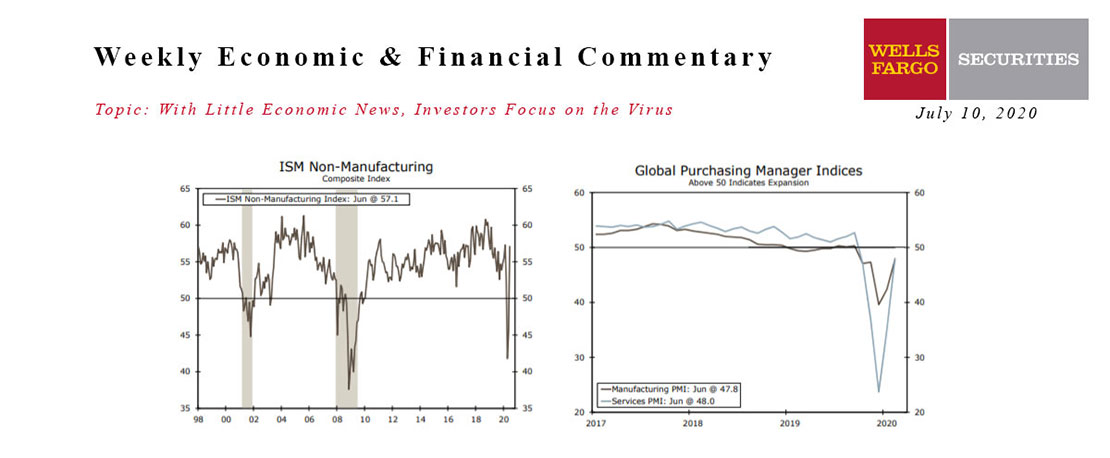

This Week's State Of The Economy - What Is Ahead? - 10 July 2020

Wells Fargo Economics & Financial Report / Jul 13, 2020

The ISM non-manufacturing index jumped 11.7 points to 57.1, reflecting the broadening re-opening of the economy.

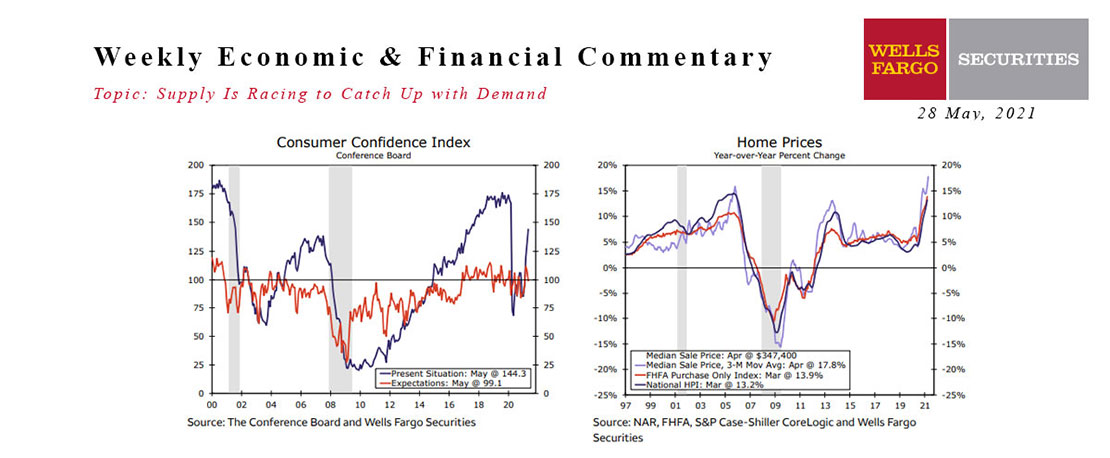

This Week's State Of The Economy - What Is Ahead? - 28 May 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

This week\'s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth.

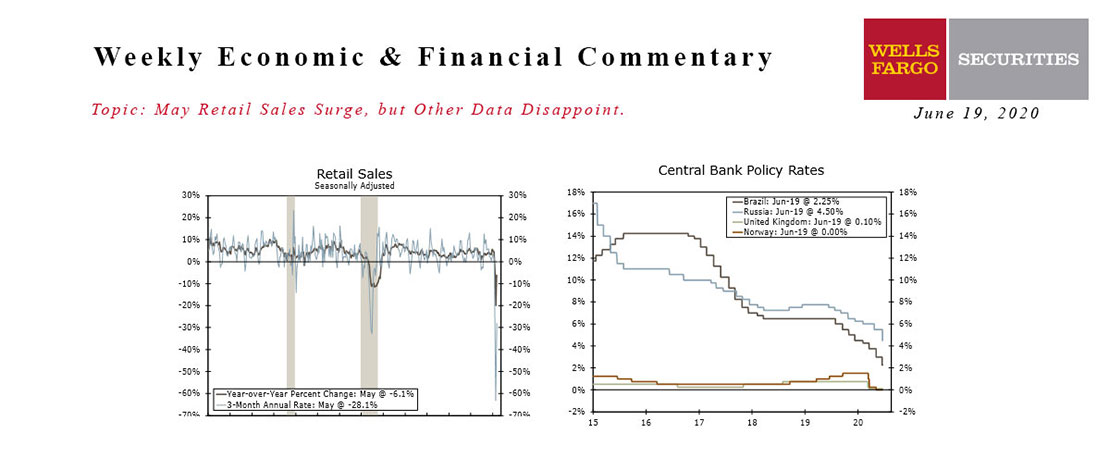

This Week's State Of The Economy - What Is Ahead? - 19 June 2020

Wells Fargo Economics & Financial Report / Jun 22, 2020

Retail sales kicked off the week with a bang, rising 17.7% month-over-month in May. The increase was larger than every single one of the 74 forecast submissions.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

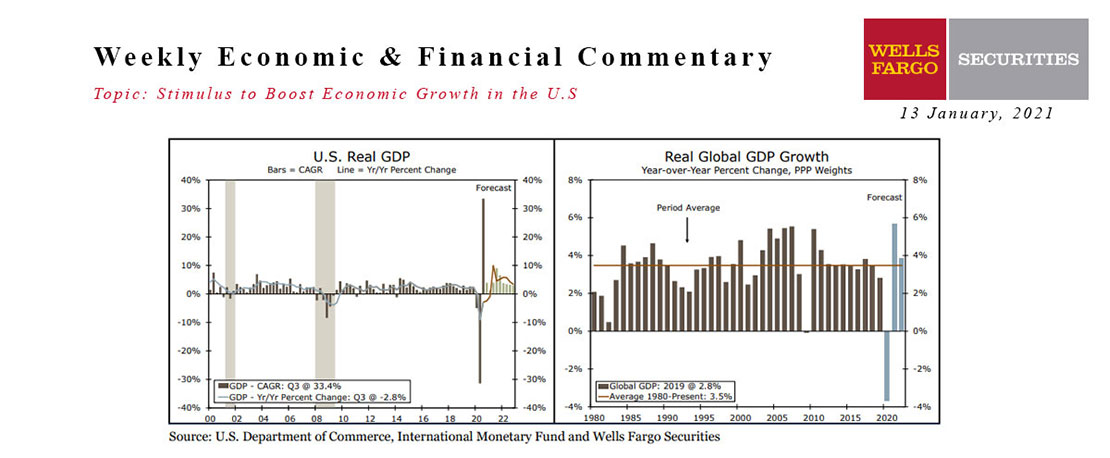

13 January 2021 Monthly Outlook Report

Wells Fargo Economics & Financial Report / Jan 19, 2021

The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate.

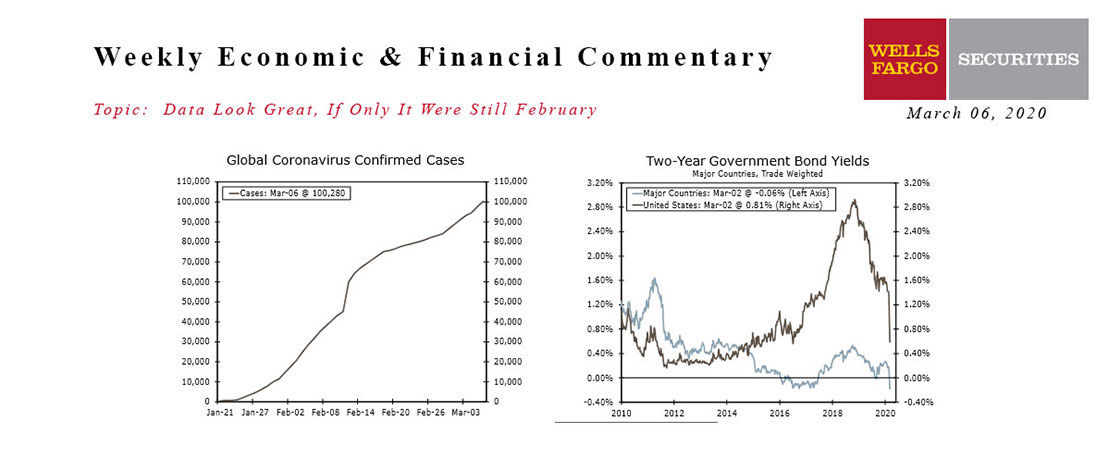

This Week's State Of The Economy - What Is Ahead? - 06 March 2020

Wells Fargo Economics & Financial Report / Mar 07, 2020

An inter-meeting rate cut by the FOMC did little to stem financial market volatility, as the number of confirmed COVID-19 cases continued to climb.