The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate. Despite some near-term moderation, we are a bit more constructive on 2021 as a whole thanks to several new developments.

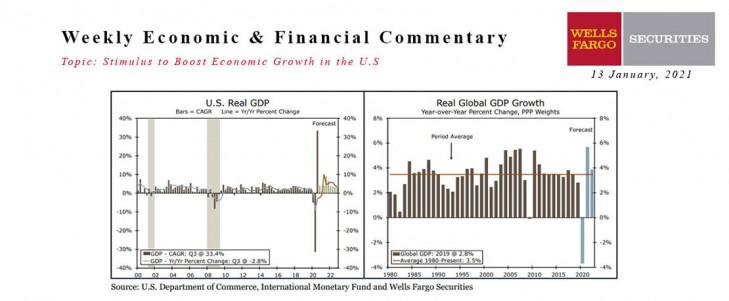

Stimulus to Boost Economic Growth in the U.S.

The U.S. economy appears to be losing some momentum as the calendar turns to 2021. The cause of the recent slowdown is clear. The public health situation continues to deteriorate, which has led to a patchwork of new business restrictions, diminished consumer confidence and weaker-than-anticipated consumer spending. As a result, we have altered our estimate for real GDP growth in Q4-2020 and Q1-2021, which we now expect to rise 4.0% and 1.3%, respectively, on a quarterly annualized basis.

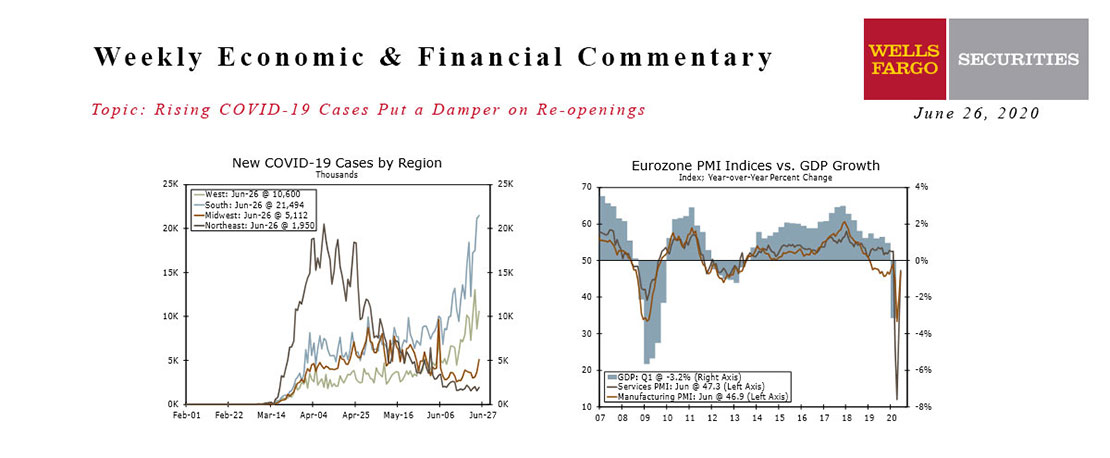

Rising COVID-19 Cases Put A Damper On Re-openings

Wells Fargo Economics & Financial Report / Jun 27, 2020

The rising number of COVID-19 infections gained momentum this week, with most of the rise occurring in the South and West. The rise in infections is larger than can be explained by increased testing alone and is slowing re-openings.

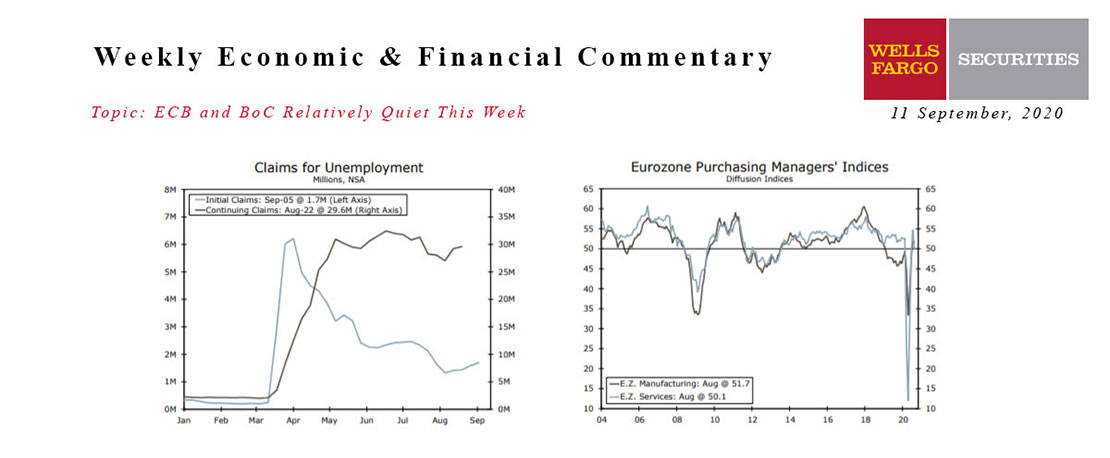

This Week's State Of The Economy - What Is Ahead? - 11 September 2020

Wells Fargo Economics & Financial Report / Sep 14, 2020

In the holiday-shortened week, analysts’ attention remained on the progress of the labor market. Recent jobless claims data remain stubbornly high and point to a slowing jobs rebound.

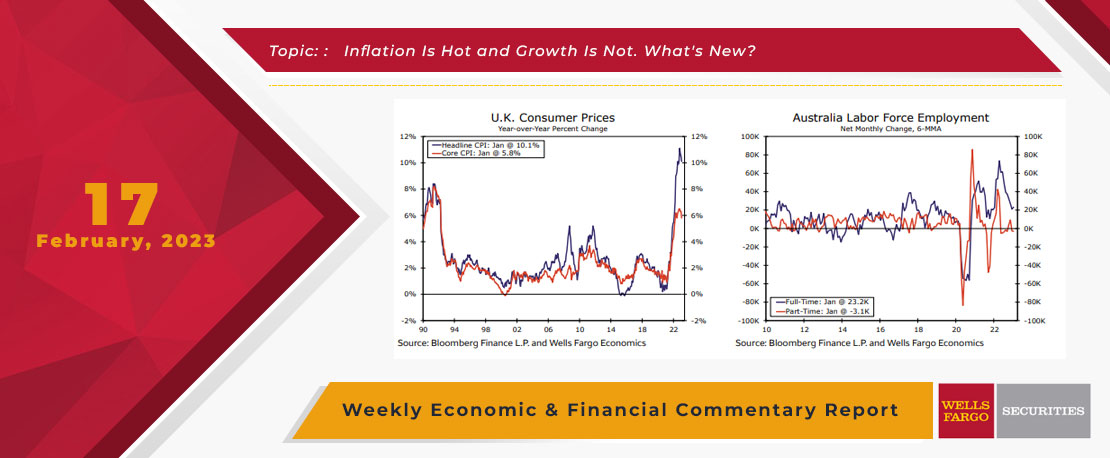

This Week's State Of The Economy - What Is Ahead? - 17 February 2023

Wells Fargo Economics & Financial Report / Feb 20, 2023

Inflation in the U.K. receded for the third straight month in January, with the headline rate coming in at 10.1% year-over-year. In bad news, this is still five times the Bank of England\'s 2% target.

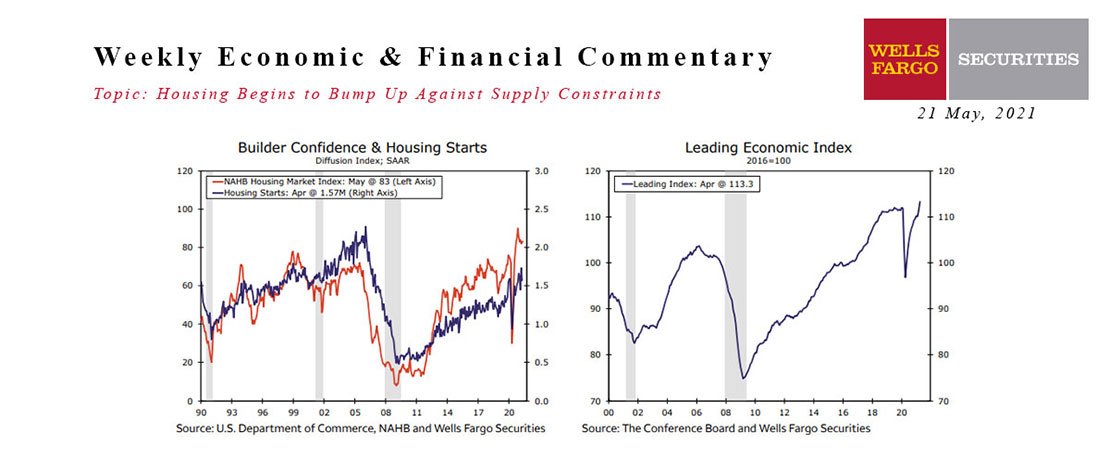

This Week's State Of The Economy - What Is Ahead? - 21 May 2021

Wells Fargo Economics & Financial Report / May 25, 2021

Over the past year, the housing market has become white-hot.

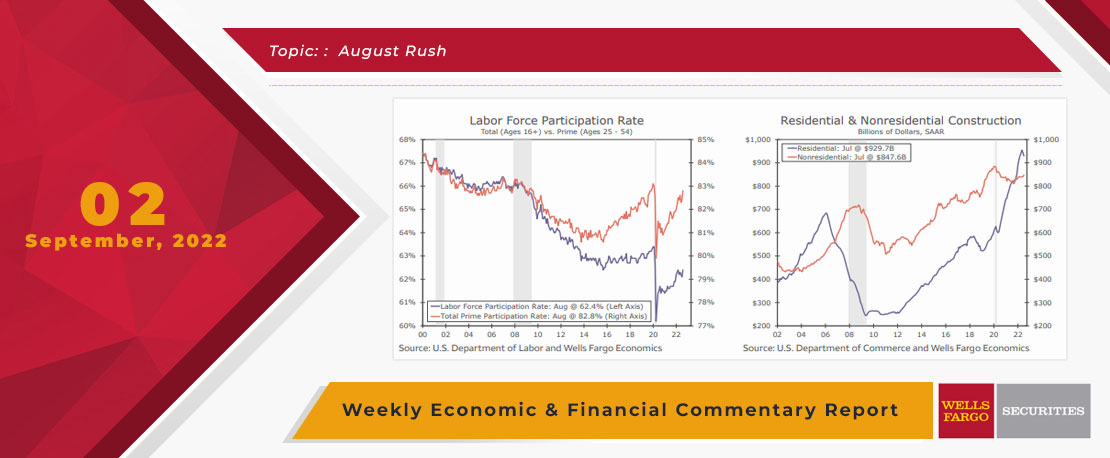

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

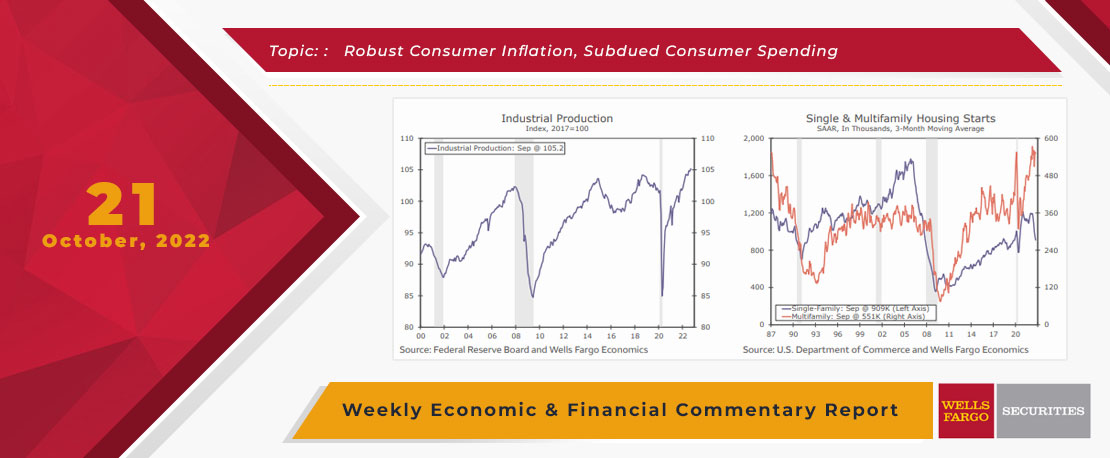

This Week's State Of The Economy - What Is Ahead? - 21 October 2022

Wells Fargo Economics & Financial Report / Oct 25, 2022

The real estate sector has been significantly affected by rising interest rates, with total housing starts falling 8.1% in September. Peering ahead, the forward-looking Leading Economic Index points to a recession in the coming year.

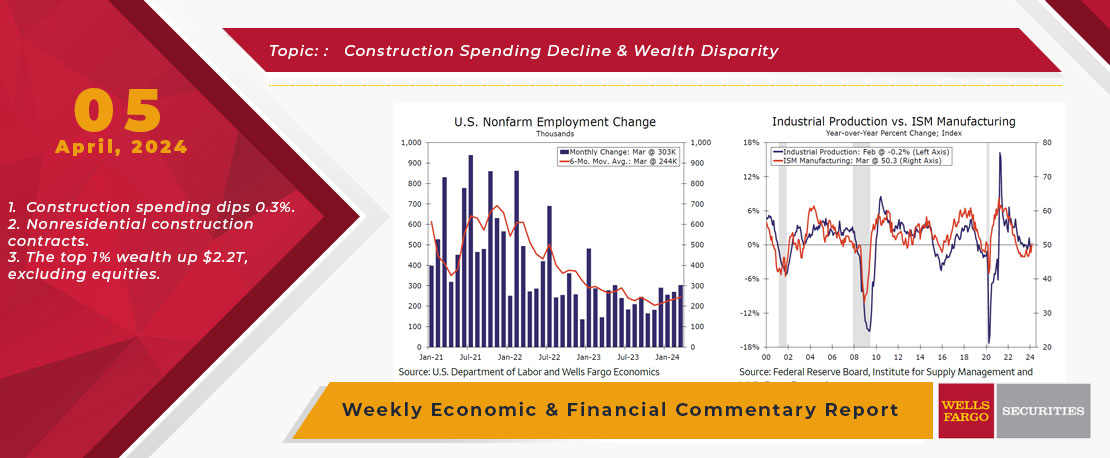

This Week's State Of The Economy - What Is Ahead? - 05 April 2024

Wells Fargo Economics & Financial Report / Apr 09, 2024

Nonfarm payrolls expanded 303K in March, surpassing all estimates submitted to Bloomberg. The continued strength in hiring suggests less urgency for policymakers at the Federal Reserve to lower the target range of the fed funds rate.

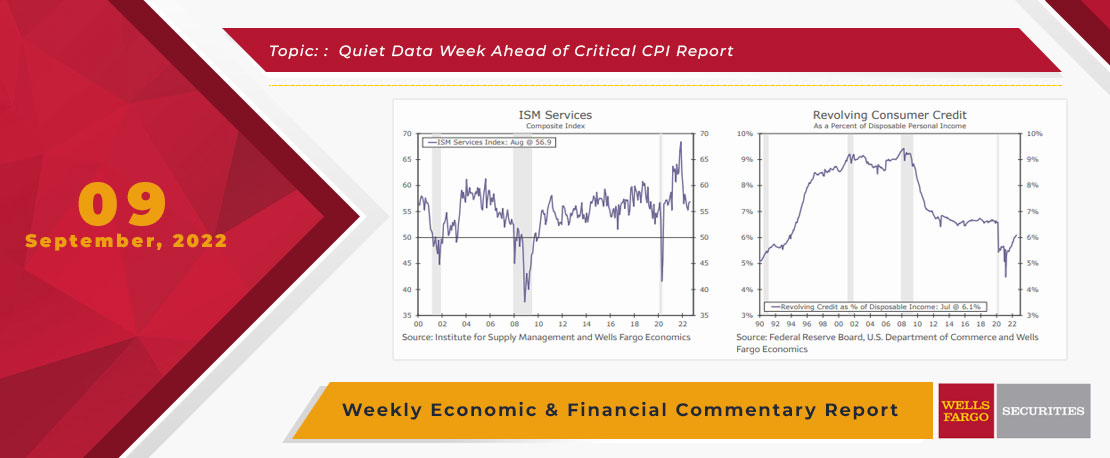

This Week's State Of The Economy - What Is Ahead? - 09 September 2022

Wells Fargo Economics & Financial Report / Sep 10, 2022

The ISM services index came in stronger than expected, and the underlying details pointed to service sector resilience with business activity and new orders notching their highest reading this year.

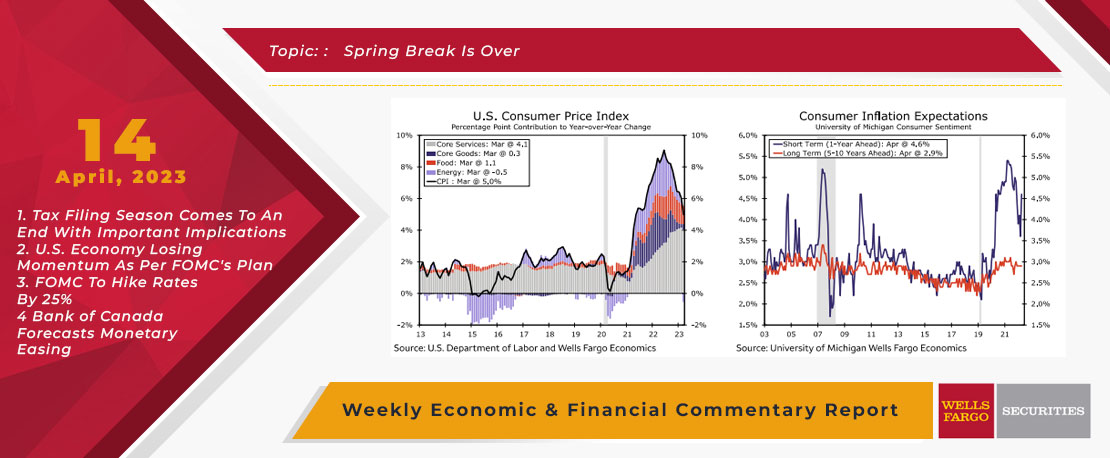

This Week's State Of The Economy - What Is Ahead? - 14 April 2023

Wells Fargo Economics & Financial Report / Apr 20, 2023

In March retail sales fell 1.0%, manufacturing production slipped 0.5% and the consumer price index rose a modest 0.1%.

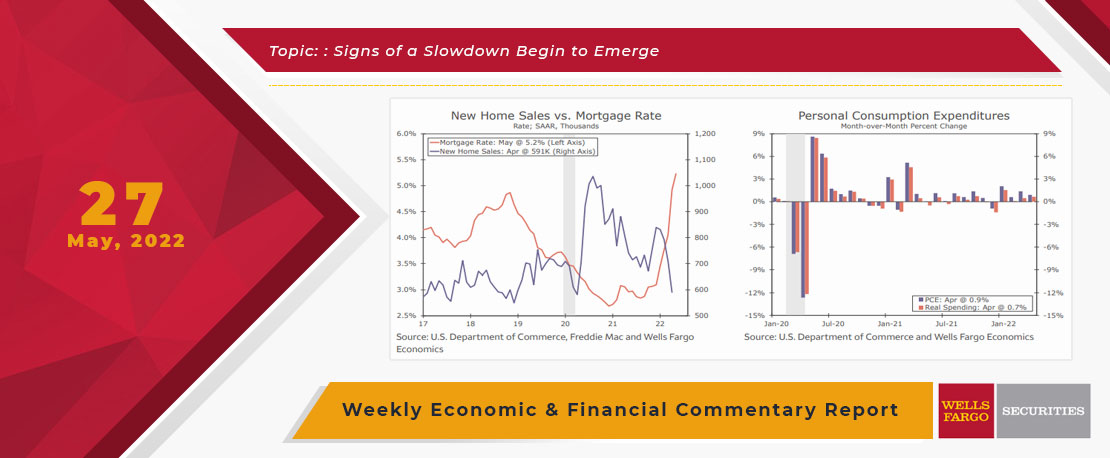

This Week's State Of The Economy - What Is Ahead? - 27 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

it looks like higher mortgage rates are starting to have some effect on the housing market as April...