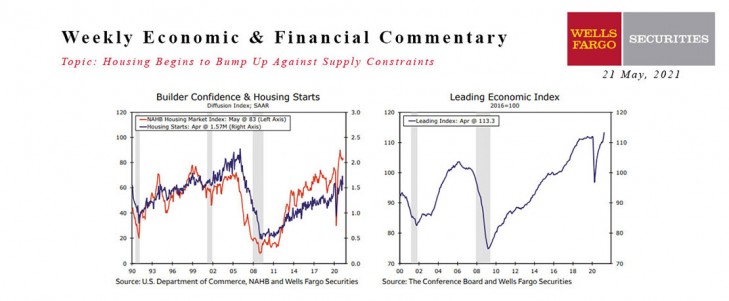

U.S. Review Housing Begins to Bump Up Against Supply Constraints

Over the past year, the housing market has become white-hot. Low mortgage rates and increased household space needs have propelled home sales, builder confidence and residential construction to highs not seen since the housing boom in the early 2000s. Like many other parts of the economy, however, robust housing market activity appears to be bumping up against some supply constraints.

Housing starts fell 9.5% to a still-strong 1.57-million unit pace in April. Unusually wet weather in the South and Midwest may have contributed to the decline, but the larger-than-expected drop looks to be primarily owed to shortages of building materials and qualified labor. Shortages of lumber, copper and appliances have caused the prices of those building materials to skyrocket, and builders appear to be delaying project starts as a result. Single-family starts fell 13.4% during the month, while multifamily starts edged up 0.8%. Apartment projects appear to be moving forward again alongside rebounding leasing activity, both in the suburbs and hard-hit urban markets.

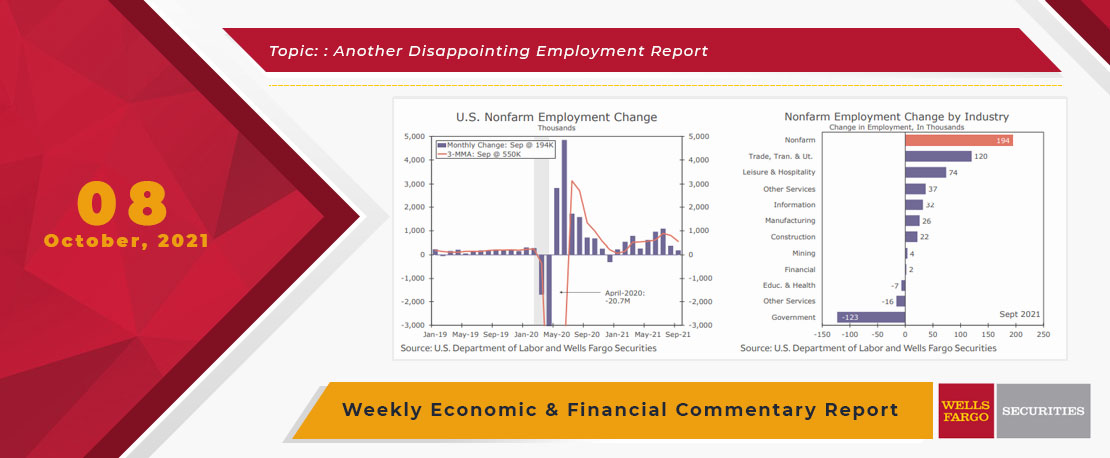

This Week's State Of The Economy - What Is Ahead? - 08 October 2021

Wells Fargo Economics & Financial Report / Oct 15, 2021

September\'s disappointing employment report clearly takes center stage over this week\'s other economic reports. Nonfarm employment rose by just 194,000 jobs, as employers continue to have trouble finding the workers they need.

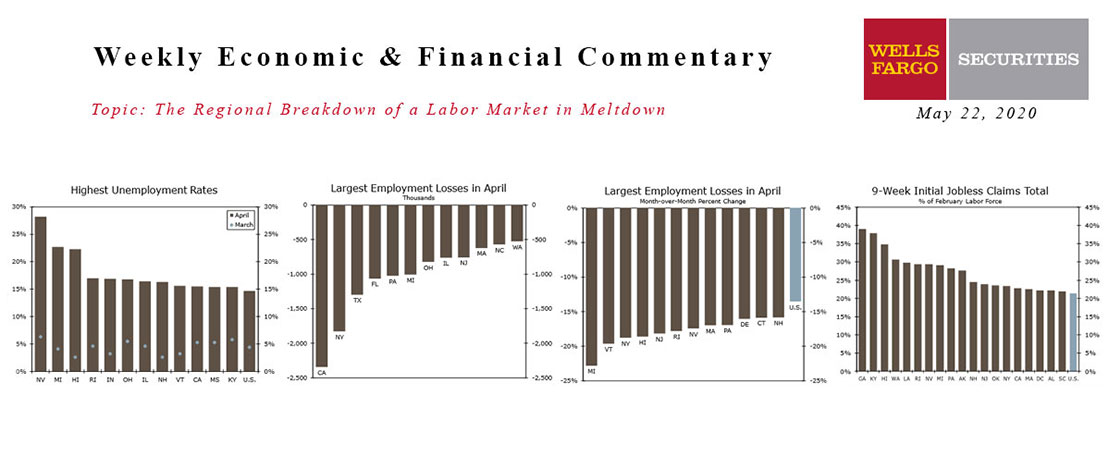

The Regional Breakdown Of A Labor Market In Meltdown

Wells Fargo Economics & Financial Report / May 26, 2020

Employment fell in all 50 states and 43 states saw their unemployment rate rise to a record in April. The damage is already hard to fathom-a 28% unemployment rate in Nevada and still another month of job losses ahead.

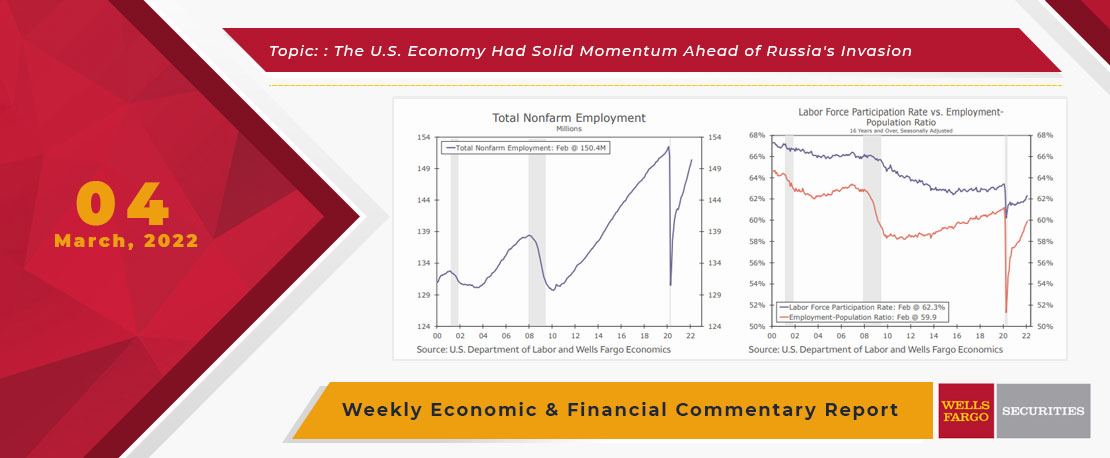

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

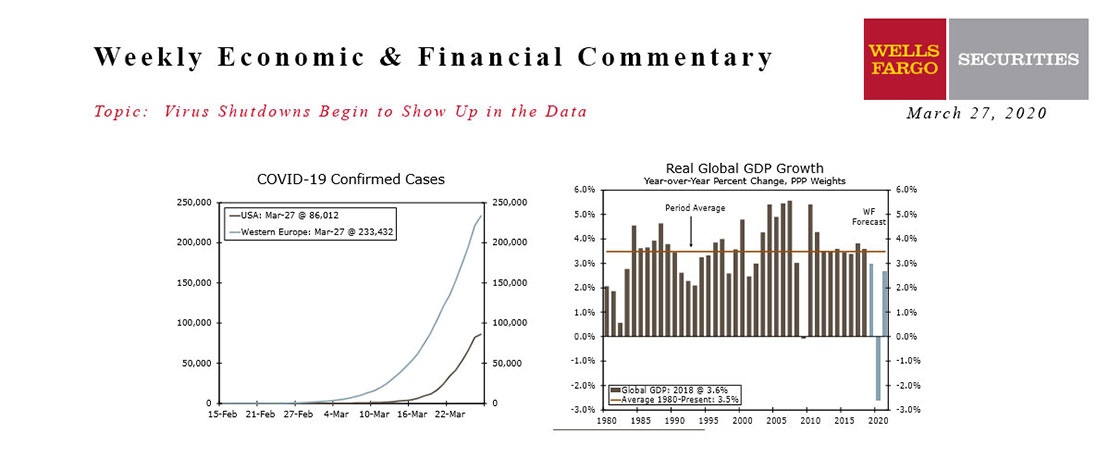

This Week's State Of The Economy - What Is Ahead? - 27 March 2020

Wells Fargo Economics & Financial Report / Mar 28, 2020

The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

This Week's State Of The Economy - What Is Ahead? - 14 January 2022

Wells Fargo Economics & Financial Report / Jan 18, 2022

As you may have already seen, inflation is running almost as hot as the stock of our favorite bank. The Consumer Price Index (CPI) rose 7.0% year-over-year in December, the fastest increase in nearly 40 years.

This Week's State Of The Economy - What Is Ahead? - 29 September 2023

Wells Fargo Economics & Financial Report / Oct 02, 2023

On the housing front, new home sales dropped more than expected in August, though an upward revision to July results left us about where everyone expected us to be year-to-date.

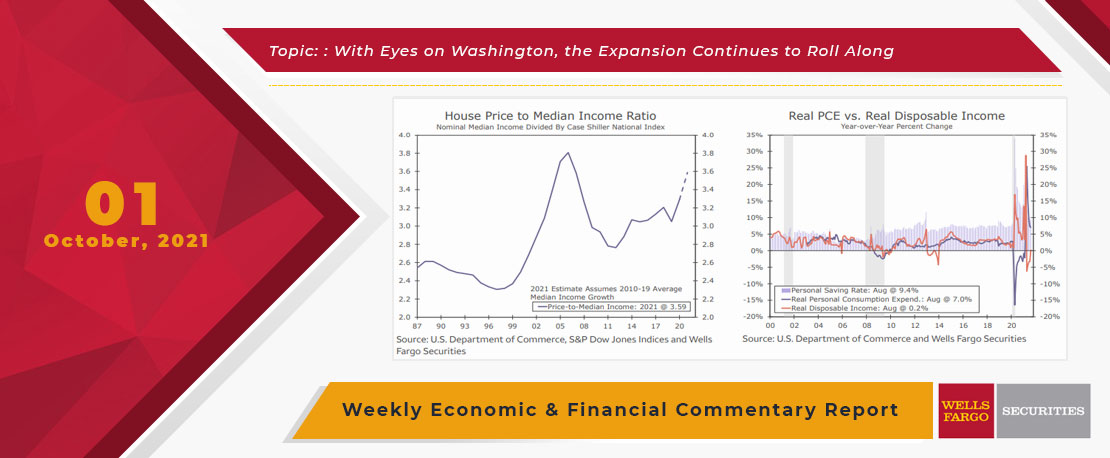

This Week's State Of The Economy - What Is Ahead? - 01 October 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

Economic data this week indicated that the ongoing expansion still has some momentum despite some familiar headwinds, though this week\'s releases were largely overshadowed by a busy week on Capitol Hill.

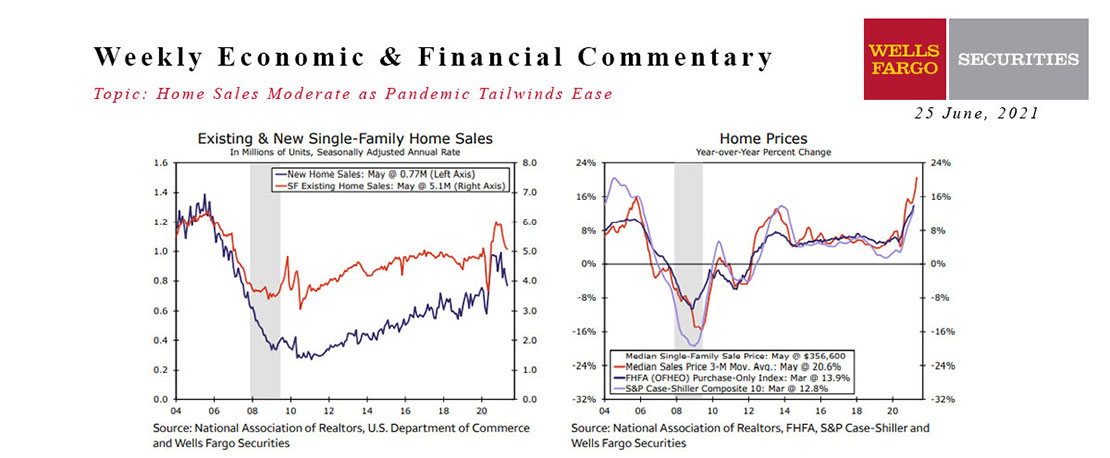

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.

This Week's State Of The Economy - What Is Ahead? - 07 October 2020

Wells Fargo Economics & Financial Report / Oct 10, 2020

In the immediate fallout after the lockdowns in the early stages of this pandemic, there was a lot of discussion about the shape of the recovery.

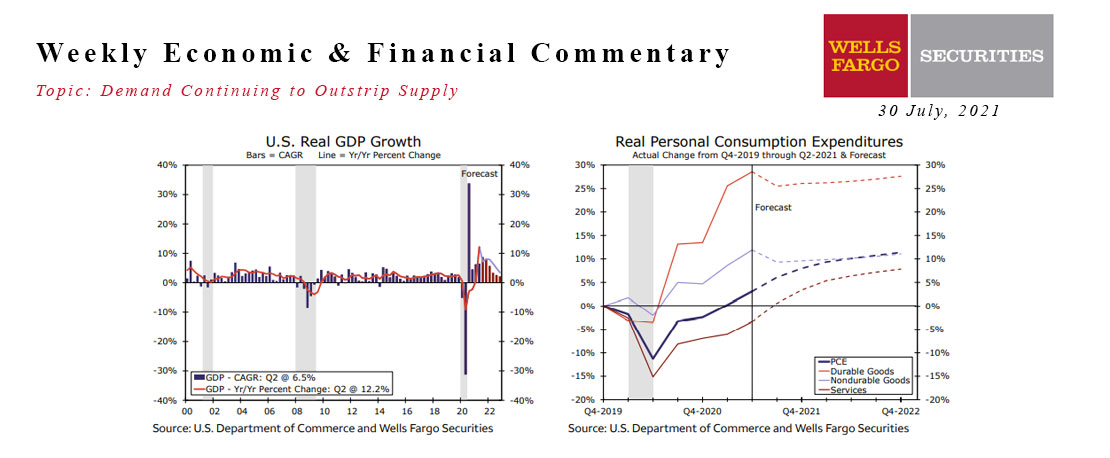

This Week's State Of The Economy - What Is Ahead? - 30 July 2021

Wells Fargo Economics & Financial Report / Aug 11, 2021

Despite a few misses on the headline numbers, economic data this week highlighted a theme of demand continuing to outstrip supply and ongoing slack in the labor market.