On the housing front, new home sales fell 8.7% in August to a 675,000 annualized unit pace. The drop was larger than expected, though an upward revision to the July data left sales fairly close to consensus expectations. Mirroring the challenges seen in the existing home sales market, new home sales are coming under pressure from higher mortgage rates, which have risen above 7.75% in recent days. For the better part of this year, builders have benefited from the persistent lack of existing home inventory, which has allowed new home sales to rise even as mortgage rates have climbed higher.That said, the NAHB home builder sentiment survey reported that buyer traffic fell to a seven-month low in September as higher mortgage rates continue to push many prospective buyers out of the market. Builders are becoming more cautious, given that higher interest rates, higher home prices and higher construction costs suggest housing affordability is likely to remain problematic for the foreseeable future.As a result, builders are responding through discounting, with 32% of builders reportedly offering discounts, up from 25% in August and the highest share since December 2022. Discounting helps at the margin, though is less effective as mortgage rates climb.

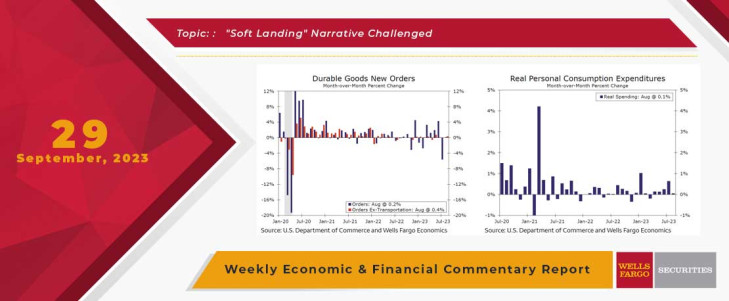

On the consumer front, consumer confidence fell 5.7 points in September to 103.0, which was a touch lower than consensus expectations. September's performance was the second straight monthly decline, the lowest overall reading since May and the biggest monthly drop since December 2020. The decline was entirely attributable to the expectations index, down nearly 10 points; the current economic conditions index edged slightly higher, largely due to another strong assessment of current labor market conditions. Deterioration in the expectations index reflects consumers' growing concerns about the consequences of stubborn inflation, rising food and gasoline prices and higher interest rates. While soft consumer confidence readings have not always translated into weaker spending, the most recent spending data do suggest the consumer is pulling back. In August, inflation-adjusted personal spending rose just 0.1%, marking the slowest pace in five months. The 0.6% surge in July suggests that real consumer spending growth is still set to accelerate in Q3 to about a 3% annualized rate, up from a 0.8% pace in Q2. Looking ahead, however, we believe households will become more vulnerable as economic and labor market growth slows, interest rates remain high, excess savings dwindle and student loan payments resume.

On the production front, advance durable goods orders rose 0.2% in August, following July's 5.6% drop. Although volatility in aircraft orders has distorted the monthly performance, underlying demand has remained surprisingly resilient. Excluding transportation, new orders were up 0.4% in August, above the year-to-date monthly average of 0.2%. This performance appears to reflect solid consumer goods demand, with the recent strength of retail sales supporting restocking and fixed investment. Core capital goods orders increased 0.9%, marking the largest monthly gain over the past year. Nondefense capital goods shipments, which feeds into the calculation of equipment spending in GDP, increased 1.2% in August and suggest that real equipment investment is now tracking to rise at about a 1% annualized pace in Q3. That said, the outlook for the factory sector looks challenged with headwinds accumulating for consumer demand.

The comprehensive benchmark revisions to the GDP data did not do much to alter the economic landscape, as real GDP is still 6.1% larger in the second quarter than it was before the pandemic in Q4-2019. The composition of growth in the second quarter of this year, however, was substantially different from the previous estimate, as real personal consumption expenditures were cut to a 0.8% annualized pace from 1.7%, while nonresidential business investment was revised up to a 7.4% annualized pace from the previous estimate of 6.1%—largely due to much stronger structures investment. Further back, the comprehensive revisions showed that real GDP growth between 2017 and 2022 was only 0.1% stronger than previously estimated. The gap between GDP and Gross Domestic Income (GDI) tightened a bit, particularly following the upward revision to GDI in Q1-2023 to +0.5% from the previous estimate of -1.8%. That said, GDI is still only up 0.2% over the past year, nowhere near as strong as the 2.4% year-over-year gain in GDP.

On balance, this week's indicators illustrated that economic growth continues to moderate. Elevated inflation, rising interest rates and concerns about the outlook appear to be having a more marked impact on consumer and business activity than was seen during the first half of the year. While prospects of a "soft landing" have increased in the eyes of several Fed officials, our forecast continues to project a mild downturn in the first half of 2024 as rising real interest rates look to increasingly exert headwinds on the economy.

And finally, while the House of Representatives and the Senate have advanced separate pieces of legislation on government spending for the start of the new fiscal year, prospects for avoiding a government shutdown on Oct. 1 do not look promising. Uncertainty over the situation is elevated, though knowing the length and severity of the potential shutdown would help determine the impact on economic growth. Moreover, a prolonged shutdown could have implications for the Fed, which may have to consider a temporary policy hold to avoid the risk of destabilizing financial markets and consumer confidence in this period of heightened uncertainty.

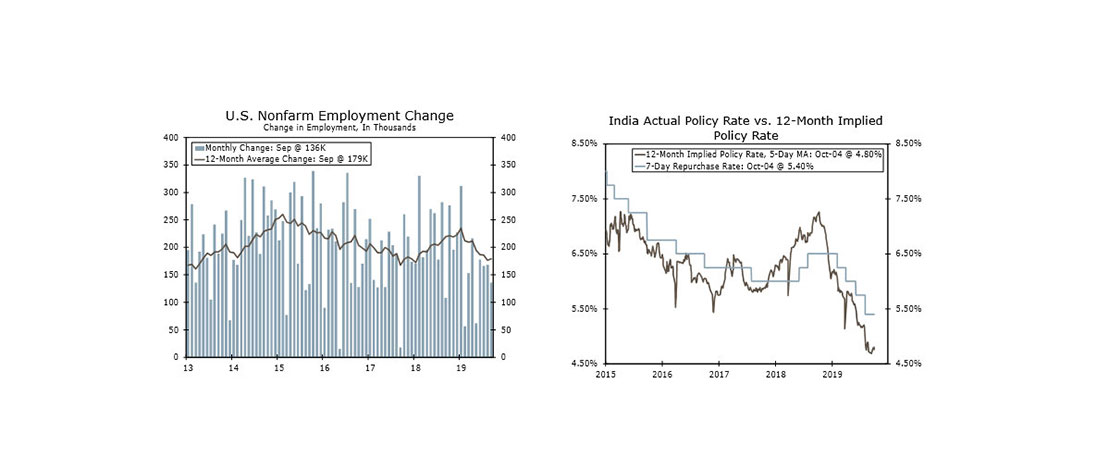

This Week's State Of The Economy - What Is Ahead? - 4 October 2019

Wells Fargo Economics & Financial Report / Oct 05, 2019

Survey evidence flashed signs of contraction in the manufacturing sector and indicated weakness spreading to the services side of the economy, while employers added a less-than-expected 136K jobs in September.

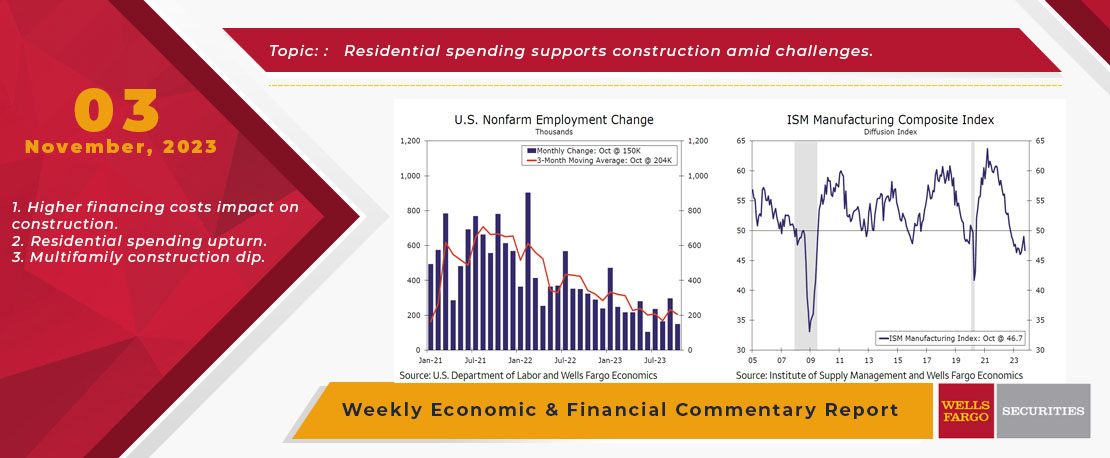

This Week's State Of The Economy - What Is Ahead? - 03 November 2023

Wells Fargo Economics & Financial Report / Nov 08, 2023

Although payroll growth is easing, the labor market remains relatively tight. The unemployment rate inched up to 3.9% in October, slightly higher than the cycle low of 3.4% first hit in January 2023, but still low compared to historical averages.

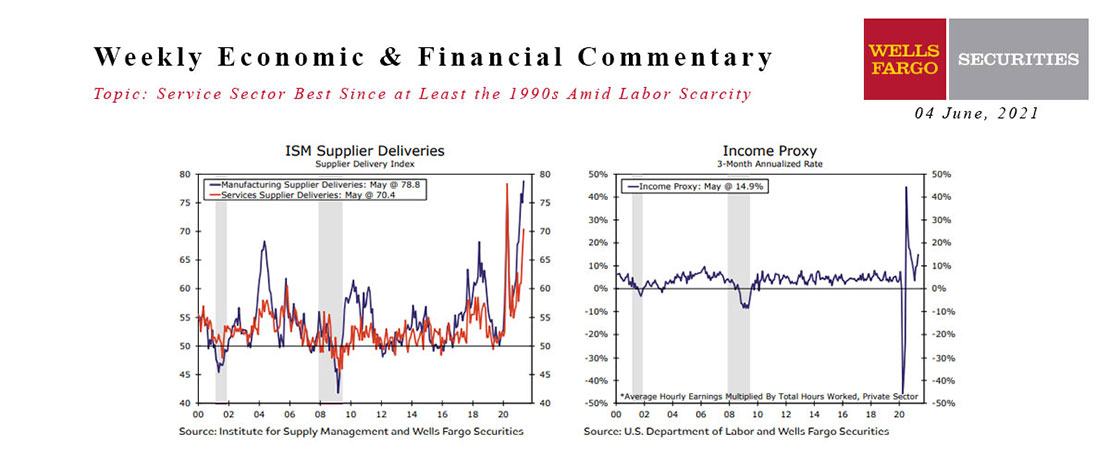

This Week's State Of The Economy - What Is Ahead? - 04 June 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

The CDC\'s relaxation of its mask mandate occurred mid-May, and as data for that month begins rolling in this week, it is evident there is no lack of demand. Supplies, on the other hand, are a worsening problem.

This Week's State Of The Economy - What Is Ahead? - 13 May 2022

Wells Fargo Economics & Financial Report / May 18, 2022

While small business enthusiasm appears to have stalled, as owners are concerned about their ability to continue to pass on higher costs to consumers, cautious enthusiasm around rookie Jeremy Pena’s start persists.

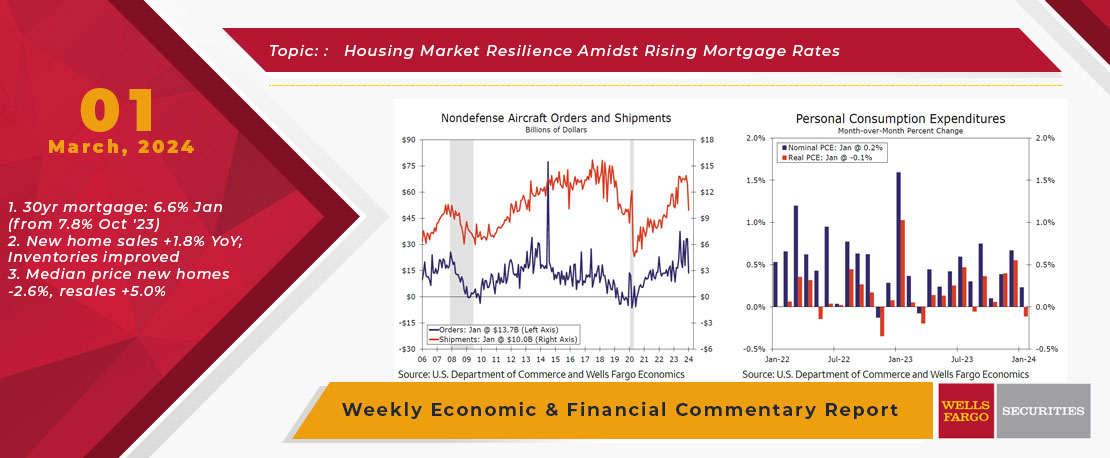

This Week's State Of The Economy - What Is Ahead? - 01 March 2024

Wells Fargo Economics & Financial Report / Mar 05, 2024

Economic data were downbeat this week, as downward revisions took some of the shine out of the marquee headline numbers. Despite the somewhat weak start to Q1, economic growth continues to trek along.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

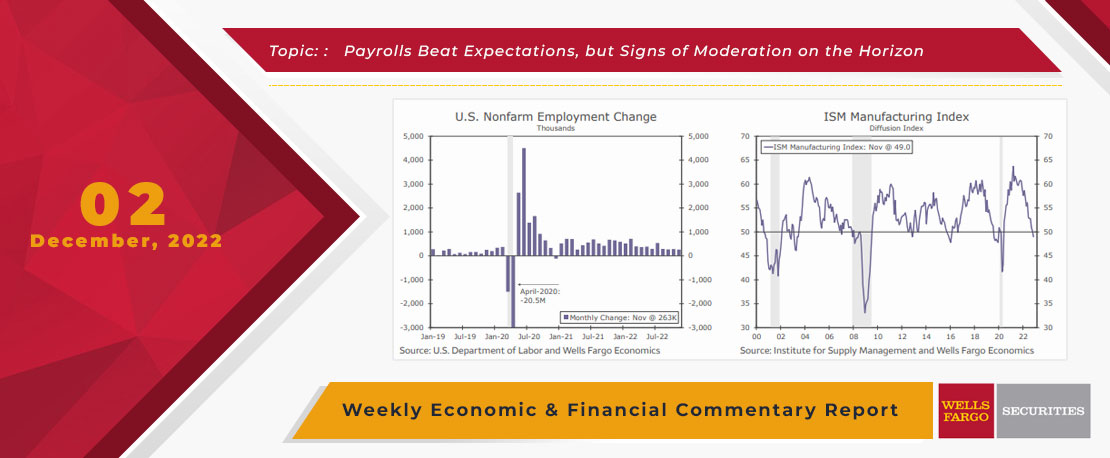

This Week's State Of The Economy - What Is Ahead? - 02 December 2022

Wells Fargo Economics & Financial Report / Dec 08, 2022

Total payrolls rose by 263K in November, with the unemployment rate holding steady at 3.7% and average hourly earning rising by 0.6%.

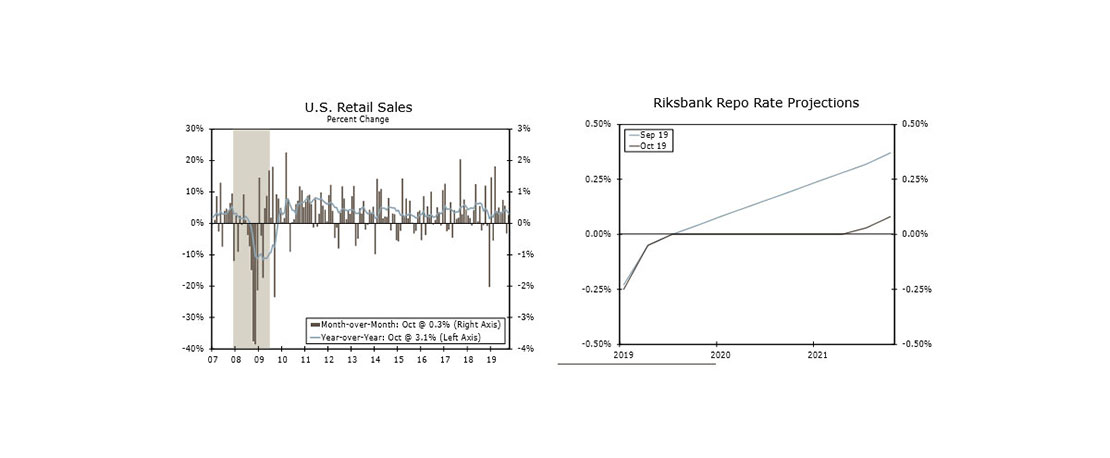

This Week's State Of The Economy - What Is Ahead? - 15 November 2019

Wells Fargo Economics & Financial Report / Nov 16, 2019

Retail sales beat expectations and rose 0.3% in October, reflecting the ongoing strength of the consumer. Control group sales, a major input to GDP, also increased 0.3%.

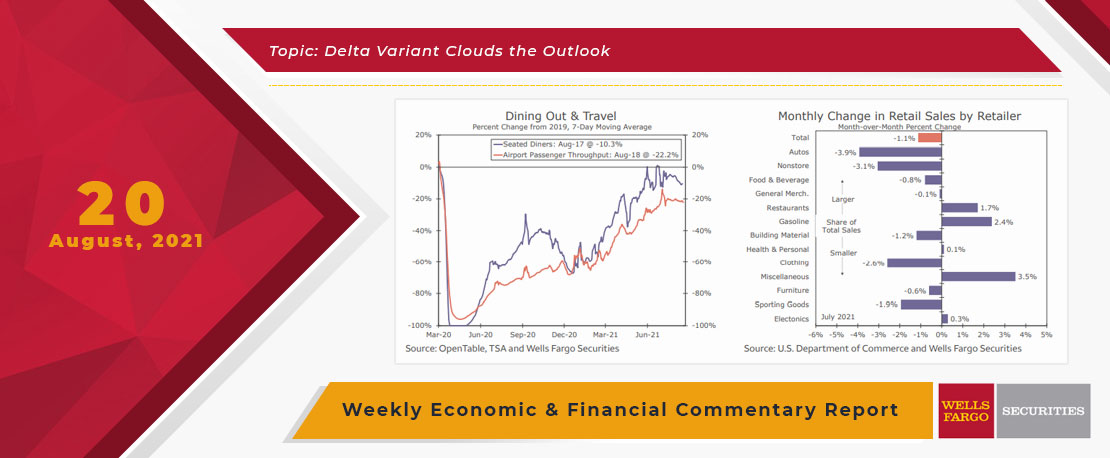

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

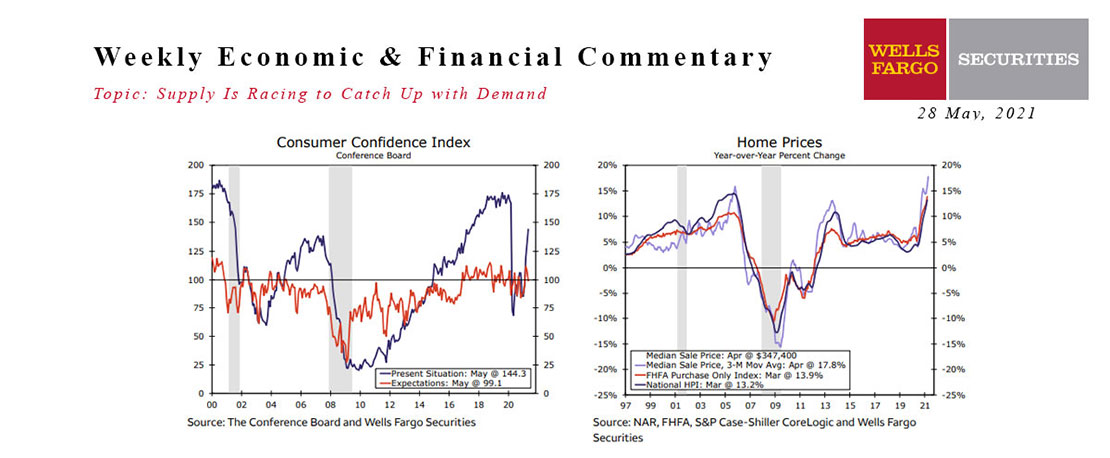

This Week's State Of The Economy - What Is Ahead? - 28 May 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

This week\'s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth.