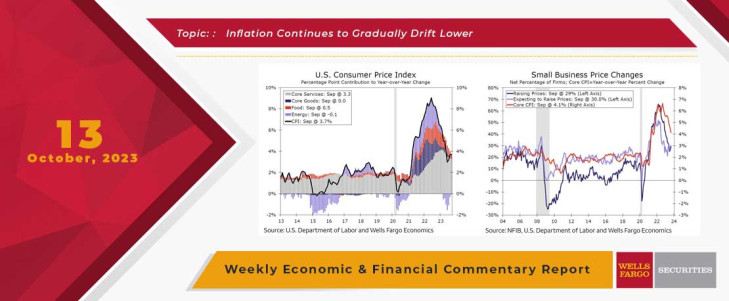

Inflation was back in the spotlight this week. So far, the moderation in price pressures without a material deterioration in economic growth has been remarkable. Another deceleration in the Consumer Price Index (CPI) during September is the latest sign that the easing trend remains in place. During September, the headline CPI rose 0.4%, a monthly change that was a bit softer than the 0.6% increase registered in August. Although the descent has been gradual and a bit bumpy, inflation pressures have cooled considerably over the past year. In September, the headline CPI was up 3.7% on a year-to-year basis, while the core CPI, which strips out volatile food and energy prices, was up 4.1%. Both the headline and core measures are running significantly slower than the rapid annual pace registered in the summer of 2022. Furthermore, the core CPI has advanced at a 3.1% annualized rate over the past three months, which indicates a cooler pace of price changes.

That noted, inflation is still hovering well above the Federal Reserve's 2% inflation target. Recent volatility in energy prices serves as a reminder that the path back to 2% looks to be winding and filled with obstacles. According to the CPI, energy prices advanced just 1.5% during September. However, prices over the past three months were still up at an annualized rate of 33%. After rising for most of September, oil prices have since retreated, and the drop in retail gasoline prices since the end of the month should offer some relief to consumers in the near term. That noted, moving forward, energy looks like it will no longer be pulling down on inflation as it generally has so far this year. Slower moderation in food prices could be another factor in keeping inflation above the FOMC's goal. Food costs rose 0.2% in September for the third straight month and are now up 3.7% over the past year.

The slowdown in core inflation can be attributed to falling goods prices, which continued to trend in the right direction in September. Goods prices declined for the fourth straight month and are now essentially back to the levels seen a year ago. Apparel, used autos, motor vehicle parts and equipment and prices all fell during the month. Conversely, services inflation has yet to display the same downward movement. Core services prices rose 0.6% in September. The monthly gain was driven by a surprise uptick in owners' equivalent rent, which measures housing inflation and is the largest single component in the CPI. We expect the jump to reverse over the next couple of months given that the upturn is out of line with private sector measures of housing inflation. Core services excluding housing and travel moderated on the back of softer medical and transportation services costs.

All told, September's CPI was another step in the right direction and adds credence to our view that inflation will continue to ease slowly as supply-related pressures ease, shelter costs moderate and consumers become less willing to digest higher prices. Yet, the report also illustrates the many challenges ahead to return to the Fed's 2% inflation target. In addition to uncertainty about energy prices, the recent rate of decline in vehicle prices, which has been a drag on overall goods prices, is unlikely to be sustained given that used vehicle auction prices have been on the rise since July and the UAW strike which stands to put a dent in production. Recent declines in travel prices are also unlikely to endure, while medical services inflation looks set to rebound next month with the incorporation of the most recent health insurance source data.

What's more, beyond the CPI, underlying price pressures do not appear to be fully tamped down.The Producer Price Index (PPI) arrived on the hot side of consensus expectations and rose 0.5% during September. The monthly increase in factory gate prices equates to a 2.2% year-over-year gain, up from 2.0% in August. Furthermore, the share of small firms that are raising selling prices looks to be edging higher. According to the NFIB Small Business Optimism Index, the net share of owners raising prices increased two percentage points to 29%, the highest since June 2023. Meanwhile, inflation and labor quality remained tied as the top two concerns of business owners in September. Although inflation concerns are down on an annual basis, the measure is still above its pre-pandemic trend. Inflation challenges, in addition to labor shortages, higher financing costs and reduced credit access, help explain why small business sentiment, which slipped to 90.8 in September, continues to hover around levels not experienced since 2012 in the aftermath of the Great Recession.

This Week's State Of The Economy - What Is Ahead? - 02 April 2021

Wells Fargo Economics & Financial Report / Apr 08, 2021

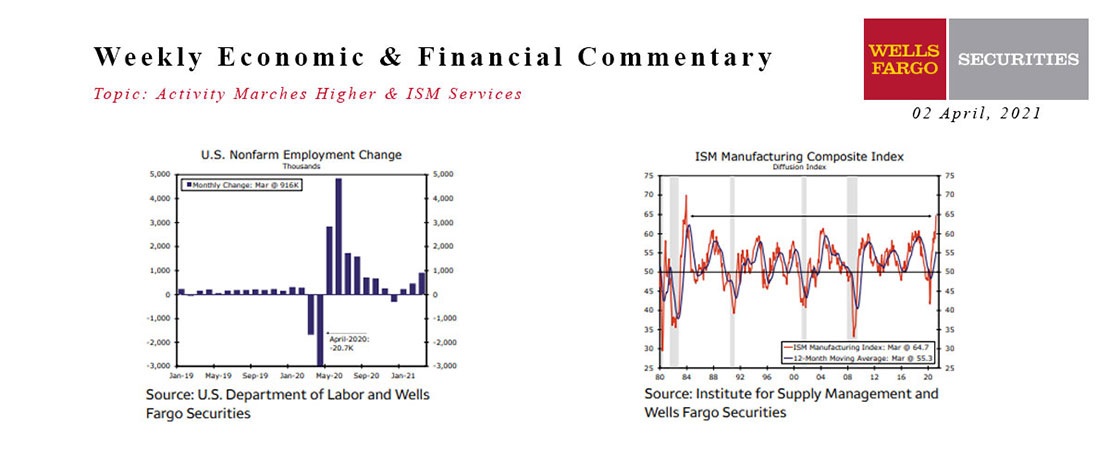

Increased vaccinations and an improving public health position led to an easing of restrictions and pickup in activity across the country in March.

This Week's State Of The Economy - What Is Ahead? - 17 January 2020

Wells Fargo Economics & Financial Report / Jan 18, 2020

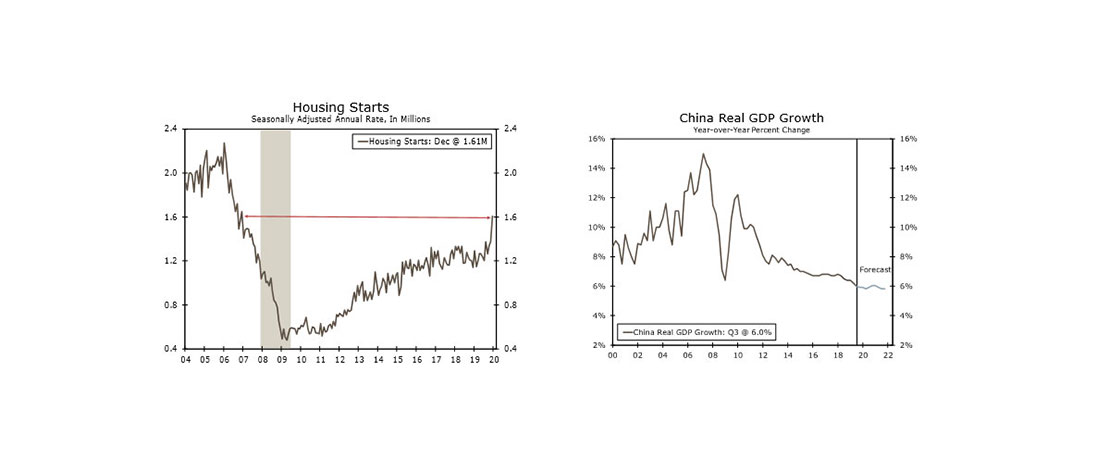

Mild weather helped housing starts surge 16.9% in December to a 1.61 million-unit pace, the highest in 13 years. Manufacturing surveys from the New York Fed and Philadelphia Fed both rose more than expected in December.

This Week's State Of The Economy - What Is Ahead? - 18 September 2020

Wells Fargo Economics & Financial Report / Sep 15, 2020

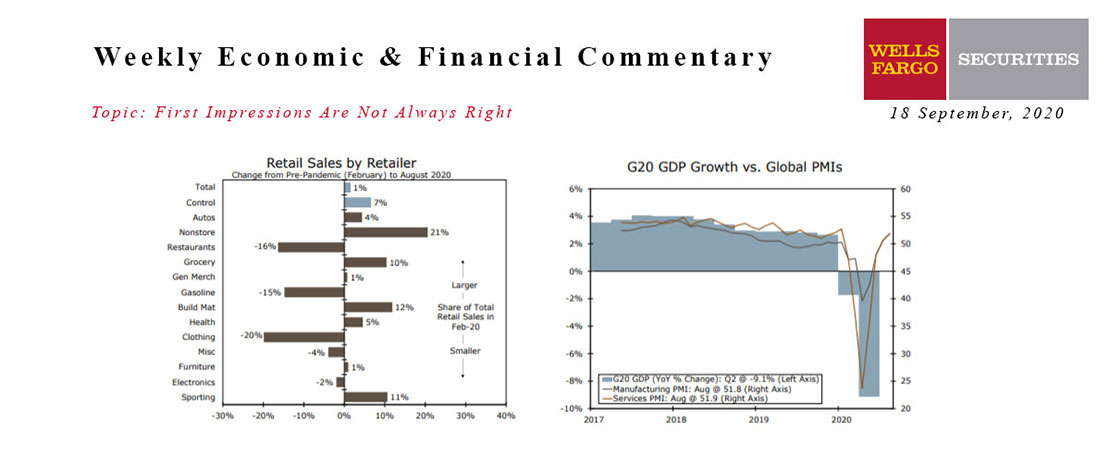

The details were generally more favorable. The retail sectors hurt most by the pandemic saw gains in August, factory output is growing and soaring homebuilder confidence suggests soft construction data this week may be transitory.

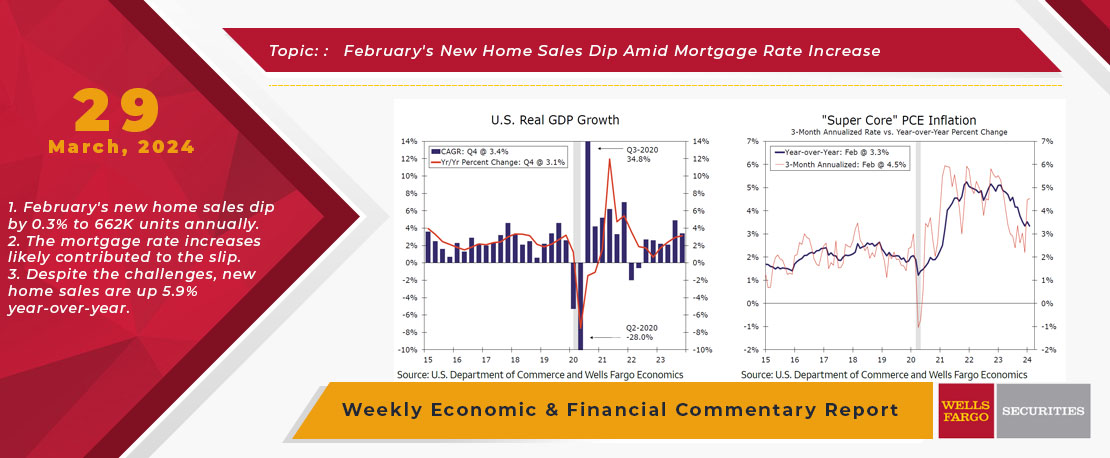

This Week's State Of The Economy - What Is Ahead? - 29 March 2024

Wells Fargo Economics & Financial Report / Apr 03, 2024

Consumer momentum remains largely intact, inflation continues to inch back down, albeit at a slower pace, and rate-sensitive sectors stayed in a holding pattern.

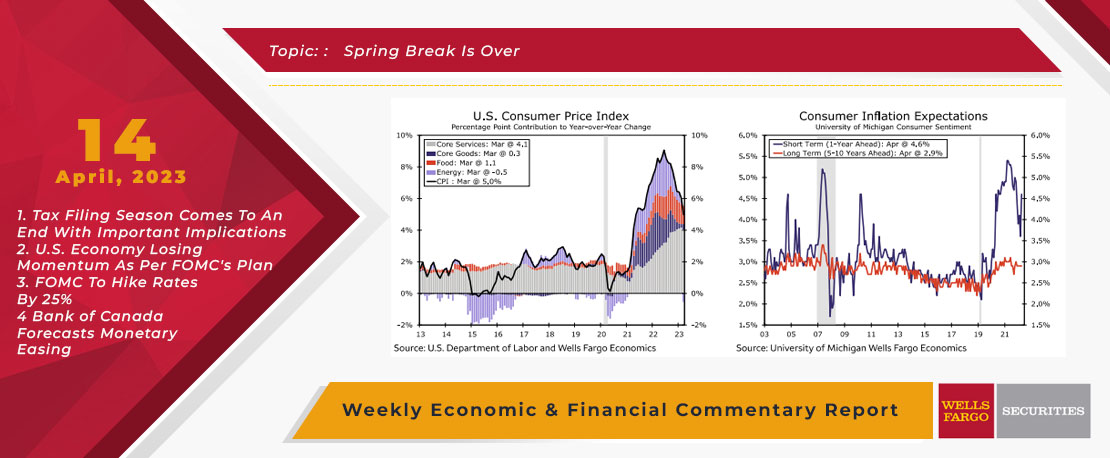

This Week's State Of The Economy - What Is Ahead? - 14 April 2023

Wells Fargo Economics & Financial Report / Apr 20, 2023

In March retail sales fell 1.0%, manufacturing production slipped 0.5% and the consumer price index rose a modest 0.1%.

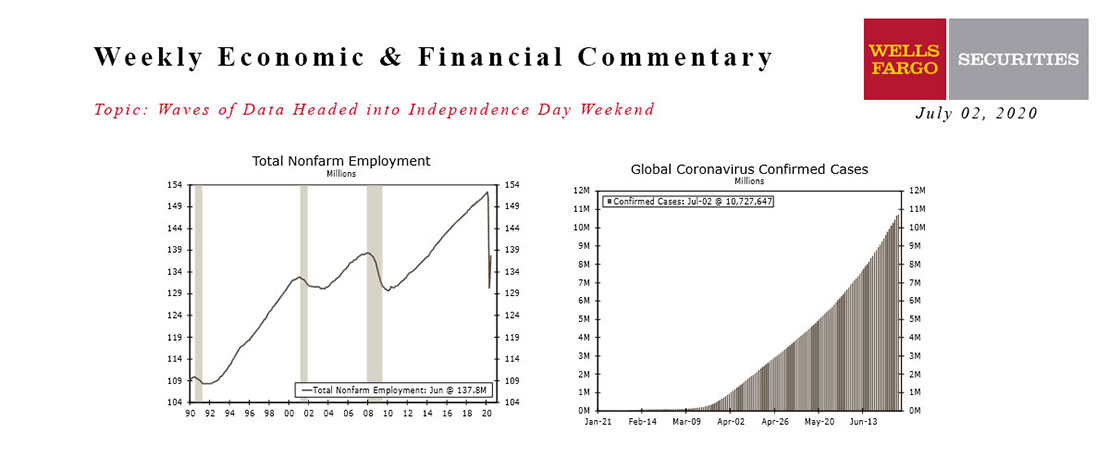

This Week's State Of The Economy - What Is Ahead? - 02 July 2020

Wells Fargo Economics & Financial Report / Jul 04, 2020

It was a mildly busy week for foreign economic data and events, while global COVID-19 cases continued to rise.

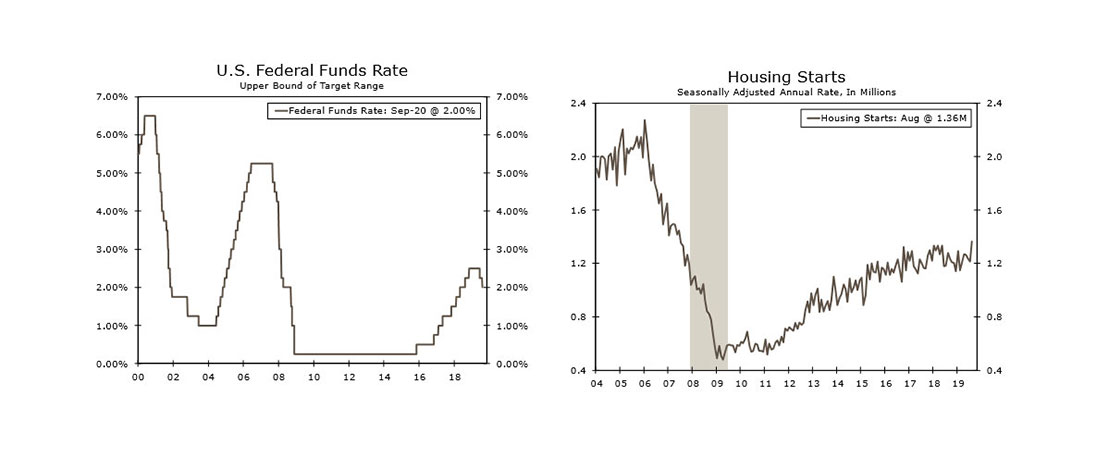

This Week's State Of The Economy - What Is Ahead? - 20 September 2019

Wells Fargo Economics & Financial Report / Sep 21, 2019

The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.

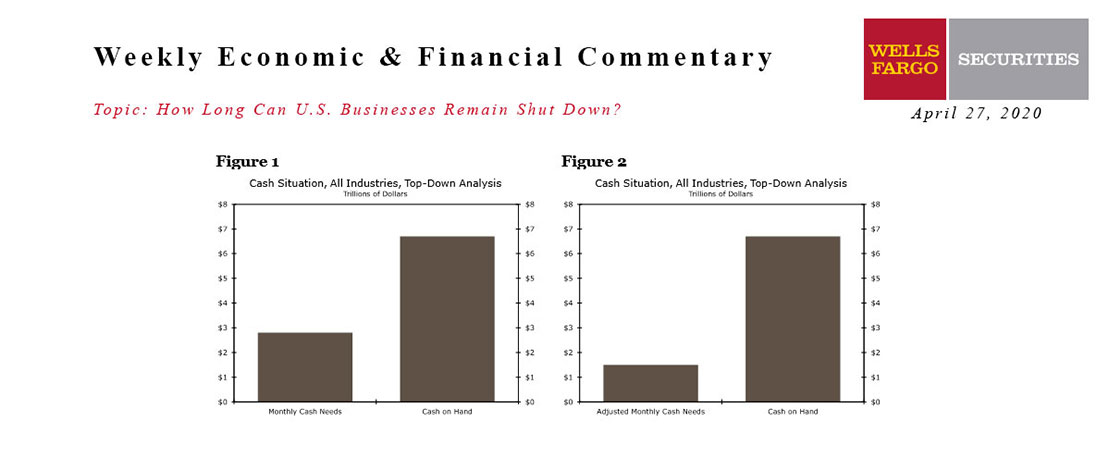

How Long Can US Businesses Remain Shut Down?

Wells Fargo Economics & Financial Report / Apr 29, 2020

The sudden stop in economic activity caused by the COVID-19 pandemic means that many businesses will need to rely on their cash reserves to survive the next few months.

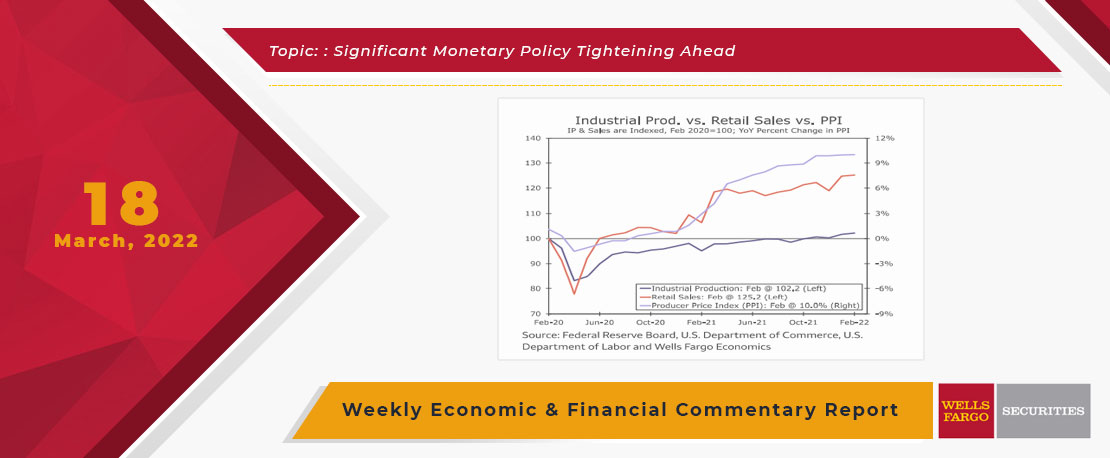

This Week's State Of The Economy - What Is Ahead? - 18 March 2022

Wells Fargo Economics & Financial Report / Mar 21, 2022

it was a big week for economic news as the Astros allowed the TWINS of all teams to sign Carlos Correa to the type of short-term deal that the Astros have historically been open to.

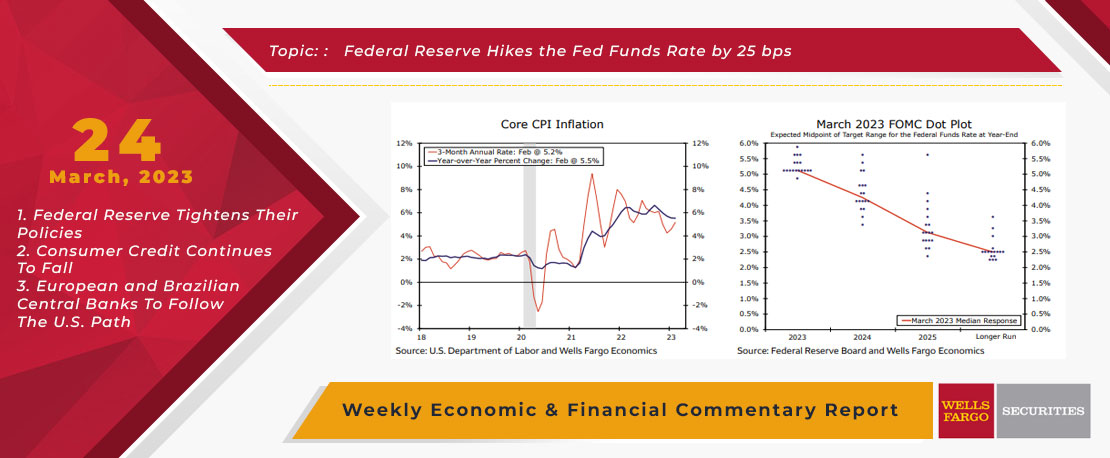

This Week's State Of The Economy - What Is Ahead? - 24 March 2023

Wells Fargo Economics & Financial Report / Mar 29, 2023

The FOMC hiked the federal funds rate by 25 bps on Wednesday amid continued strength in the labor market and elevated inflation.