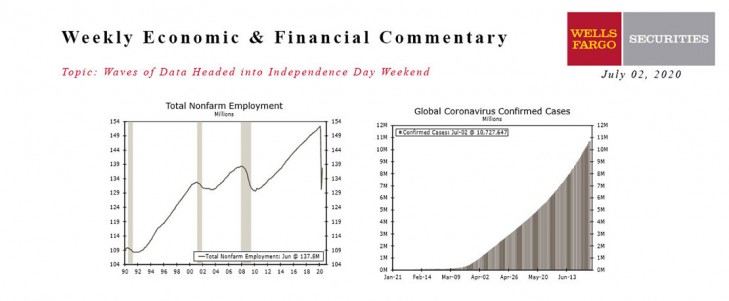

U.S. - Waves of Data Headed into Independence Day Weekend

- Total payrolls rose by 4.8 million and the unemployment rate fell to 11.1%. Another step in the right direction, but employment remains nearly 10% below the February peak.

- Initial jobless claims slightly fell to 1.4 million for the week ending June 27. Continuing claims came in at 19.3 million for the week ending June 20. Processing issues may be overstating the numbers, but claims remain highly elevated nevertheless.

- The ISM manufacturing index blew past expectations during June, rising to a 14-month high of 52.6. The surge likely reflects relief about reopening rather than a full rebound in activity.

Global - Q2 Set to Be a Tough Quarter for Most Global Economies

- It was a mildly busy week for foreign economic data and events, while global COVID-19 cases continued to rise.

- China’s PMIs beat market expectations in June as the manufacturing and services PMIs as well as the Caixin manufacturing PMI strengthened and remained above the breakeven 50 level.

- Data out of Canada were less encouraging, however. Economic activity fell sharply in April as strict COVID-19 lockdown measures weighed on growth.

- Finally, the Riksbank caught market participants off guard by delivering a SEK200B increase in its QE program.

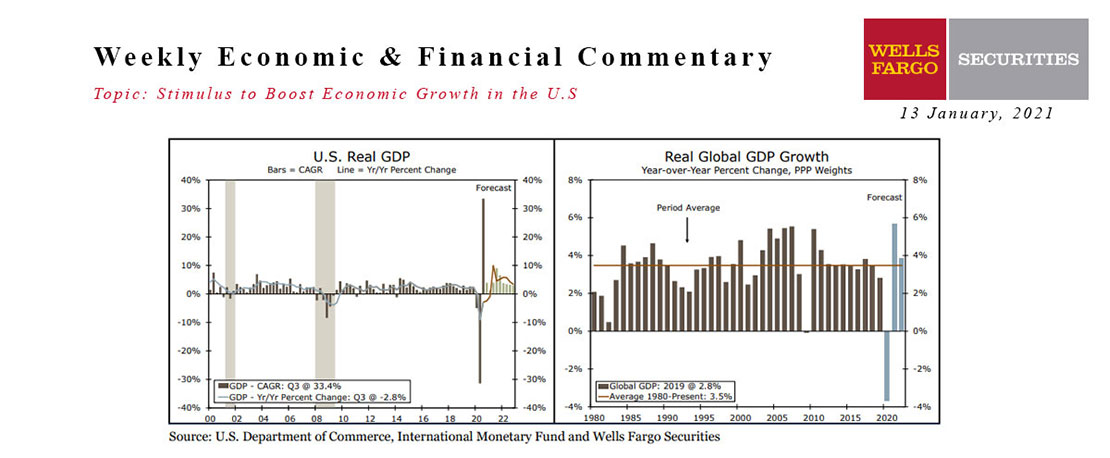

13 January 2021 Monthly Outlook Report

Wells Fargo Economics & Financial Report / Jan 19, 2021

The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate.

This Week's State Of The Economy - What Is Ahead? - 12 August 2020

Wells Fargo Economics & Financial Report / Aug 15, 2020

The consumer has been a bright spot in the recovery so far, but with jobless benefits in flux and no clear path for the long-awaited stimulus bill, the support here could fade.

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

This Week's State Of The Economy - What Is Ahead? - 27 November 2019

Wells Fargo Economics & Financial Report / Nov 28, 2019

A series of U.K. general election polls released this week continue to show Boris Johnson’s Conservative Party with a significant lead over the opposition Labor Party.

This Week's State Of The Economy - What Is Ahead? - 03 May 2024

Wells Fargo Economics & Financial Report / May 10, 2024

The Federal Reserve can afford patience thanks to a resilient labor market. During April, total nonfarm payrolls rose by 175,000 net jobs, continuing a string of solid monthly payroll additions.

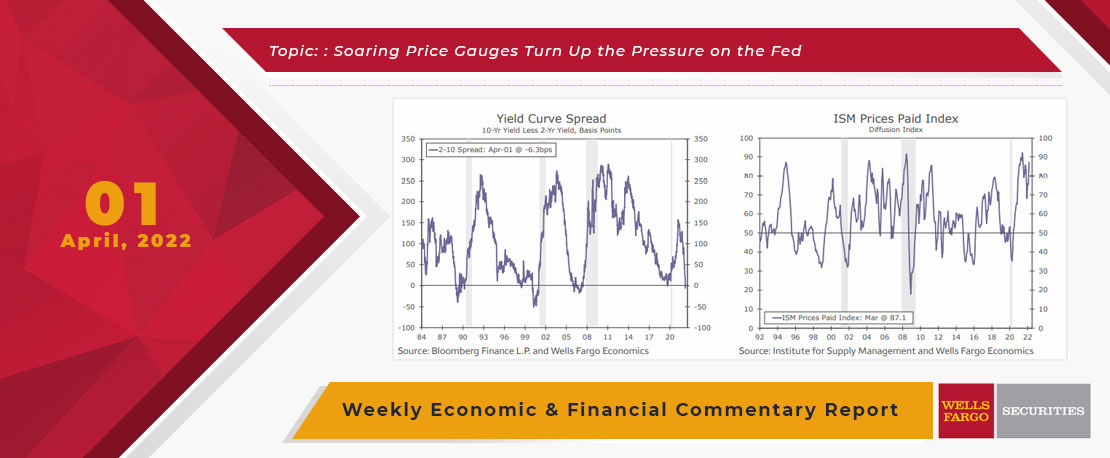

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

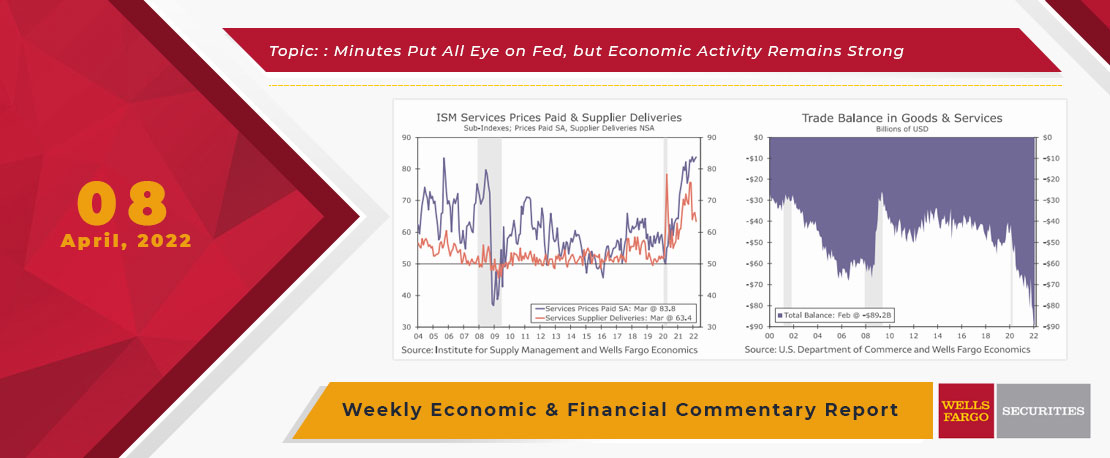

This Week's State Of The Economy - What Is Ahead? - 08 April 2022

Wells Fargo Economics & Financial Report / Apr 11, 2022

Wednesday\'s release of the FOMC minutes stirred things up as comments showed committee members agreeing that elevated inflation and the tight labor market at present warrant balance sheet reduction to begin soon.

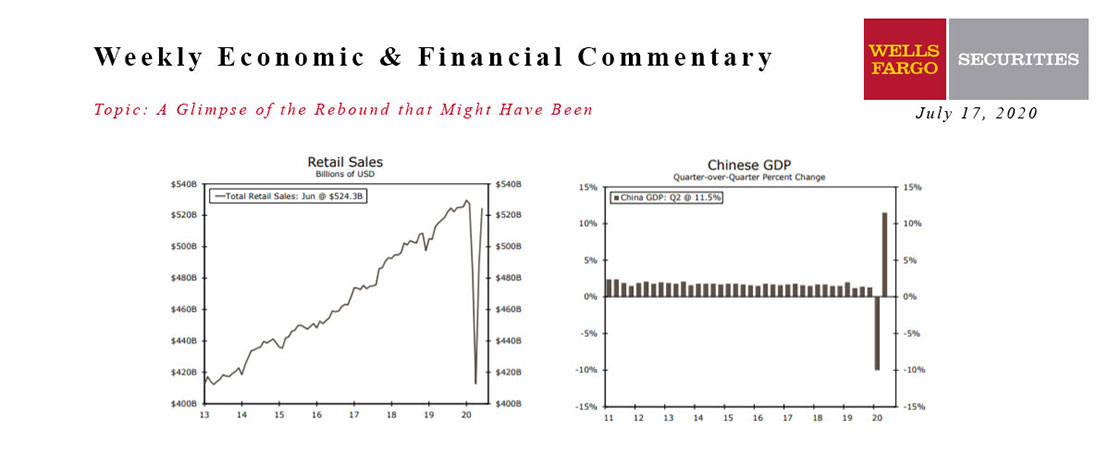

This Week's State Of The Economy - What Is Ahead? - 17 July 2020

Wells Fargo Economics & Financial Report / Jul 18, 2020

Two countervailing themes competed for attention this week in financial markets. The first is that for the most part, economic data continue to surprise to the upside and do not yet rule out prospects for that elusive V-shaped recovery.

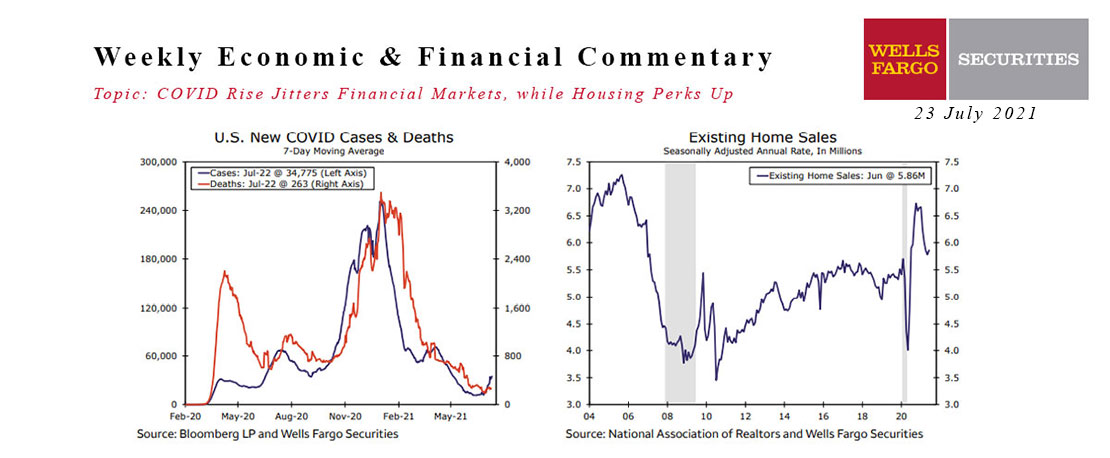

This Week's State Of The Economy - What Is Ahead? - 23 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

In the biggest financial news this week not connected to college football conference realignment, July\'s NAHB Housing Market Index slipped one point to 80.

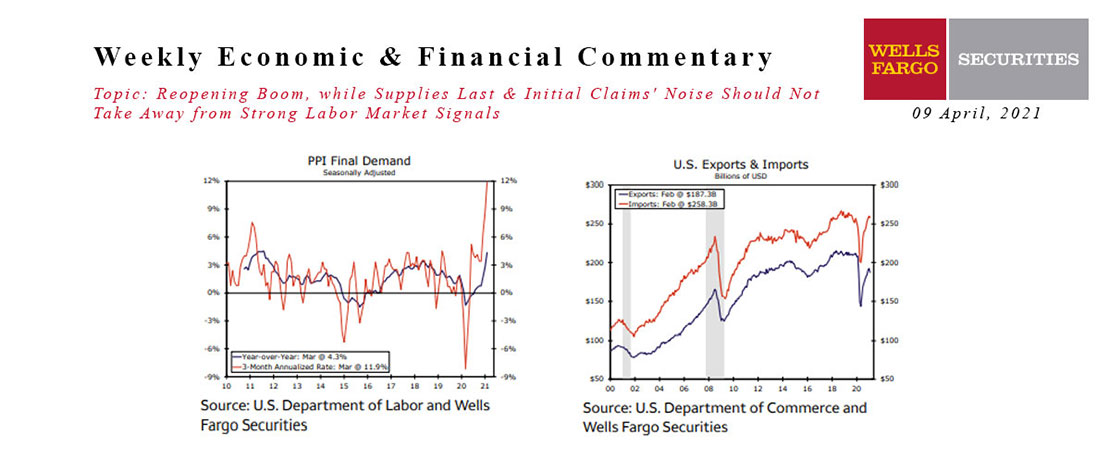

This Week's State Of The Economy - What Is Ahead? - 09 April 2021

Wells Fargo Economics & Financial Report / Apr 10, 2021

This week\'s economic data kicked of with a bang. The ISM Services Index jumped more than eight points to 63.7, signaling the fastest pace of expansion in the index\'s 24-year history.