The economic data released this week showed a still-sturdy labor market and stubborn underlying inflation pressures, developments which lend further credence to our view that the Federal Reserve will continue to be patient in adjusting the federal funds target range. The flow of economic news was heavy this week, but the outcome of May’s FOMC meeting took center stage. Although the Committee announced that it will dial back the pace of quantitative tightening (QT) starting in June, there were no changes to the federal funds target range. For more on the FOMC meeting, please see the Interest Rate Watch.

The Federal Reserve can afford patience thanks to a resilient labor market. During April, total nonfarm payrolls rose by 175,000 net jobs, continuing a string of solid monthly payroll additions. There have been a few signs that labor market conditions are cooling a bit. The monthly payroll gain was a bit softer than consensus expectations and amounted to the lowest net increase since October 2023. The unemployment rate also ticked up slightly, rising to 3.9% from 3.8% in March. The moderation in the labor market arrives amid a cooling trend in demand for workers. Earlier this week, the Job Openings and Labor Turnover Survey (JOLTS) showed a decrease in the rate of job openings, hiring and quits, which presages further easing in employment growth in the months ahead. What's more, April's drop in consumer confidence to the lowest level since July 2022 was partly prompted by mounting labor market concerns, with consumers reporting that jobs are becoming harder to find. That said, initial jobless claims and continuing claims have both remained low over the past few weeks, which suggests that layoffs are not accelerating and those that need a job are finding one relatively quickly. All told, some further cooling appears in order, but a material deterioration in labor market conditions does not appear imminent.

The major reason that the FOMC is not in any hurry to begin a rate-cutting cycle is that progress on reducing price pressures appears to have plateaued. On the heels of last week's warm PCE deflator reading, a batch of indicators measuring labor costs came in on the hot side of expectations this week, showing that underlying inflation pressures are still percolating. The Employment Cost Index (ECI), which is the Fed’s preferred measure of labor costs, rose 1.2% on a quarter-over-quarter basis and 4.2% on a yearly basis in Q1, both stronger than consensus expectations. Separately reported, unit labor costs accelerated at a 4.7% annualized pace in the same period, a gain which accompanied a tepid quarterly improvement in productivity growth. Encouragingly, average hourly earnings, which were published in the April employment report, were weaker than anticipated and rose just 0.2% during the month. Although labor costs are still running at a toasty pace that is not consistent with 2% inflation, April's easing in average hourly earnings is a reassuring sign that softer labor market conditions will lead to more moderate labor cost pressures in the coming months.

That said, stalled progress on inflation was also evident in the April ISM manufacturing and services reports. The ISM manufacturing headline index slipped to a reading of 49.2 during April, falling back into contraction territory and providing a reminder that the factory sector remains constrained by higher interest rates. However, the prices-paid index jumped more than five points to the highest level since 2022. The rise in manufacturing prices paid reflects the recent uptick in commodity prices and offers more evidence that, moving forward, goods prices are not likely to be the same disinflationary force as they were last year.

Similarly, a leap in the ISM services prices-paid index during April points to continued stickiness in service sector inflation, even as activity looks to be downshifting. Similar to its manufacturing counterpart, the headline ISM services index faltered in April and dropped below the 50-demarcation line indicating contraction for the first time since December 2022. The business activity, new orders and employment sub-indexes all fell back during the month. Over the past several years, services activity has been seemingly unmoved by higher interest rates thanks to strong household finances and pent-up demand from the pandemic. One month of data does not make a trend, but April's decline in the ISM services index suggests that services activity may be starting to feel the effects of tighter monetary policy.

Elsewhere, higher interest rates are clearly restricting construction activity. Total construction spending declined 0.2% in March, the second drop in three months. Overall construction spending has gotten off to a slow start in 2024, and on balance, total spending declined in the first quarter. Residential spending weakened in March with pullbacks across both single-family and multifamily segments. Meanwhile, nonresidential spending edged up slightly, but that was fueled by spending on the public side, particularly for infrastructure projects. Private nonresidential spending fell for a third straight month as developers remain constrained by weak demand for commercial real estate, higher interest rates and tighter lending standards. A downdraft in nonresidential project starts for these types of construction and a pullback in architecture firm billings suggests a drop in private nonresidential activity is ahead in the near term.

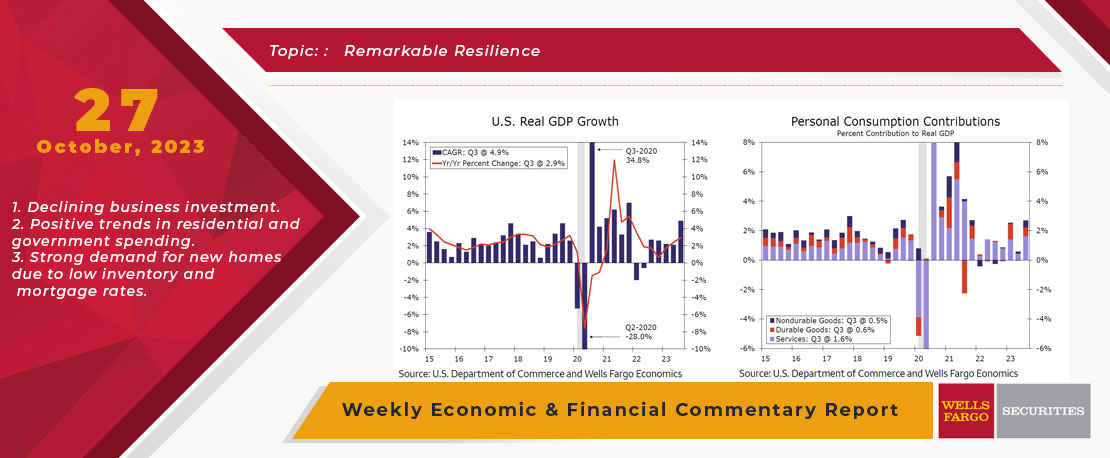

This Week's State Of The Economy - What Is Ahead? - 27 October 2023

Wells Fargo Economics & Financial Report / Nov 02, 2023

The U.S. economy expanded at a stronger-than-expected pace in Q3, with real GDP increasing at a robust 4.9% annualized rate.

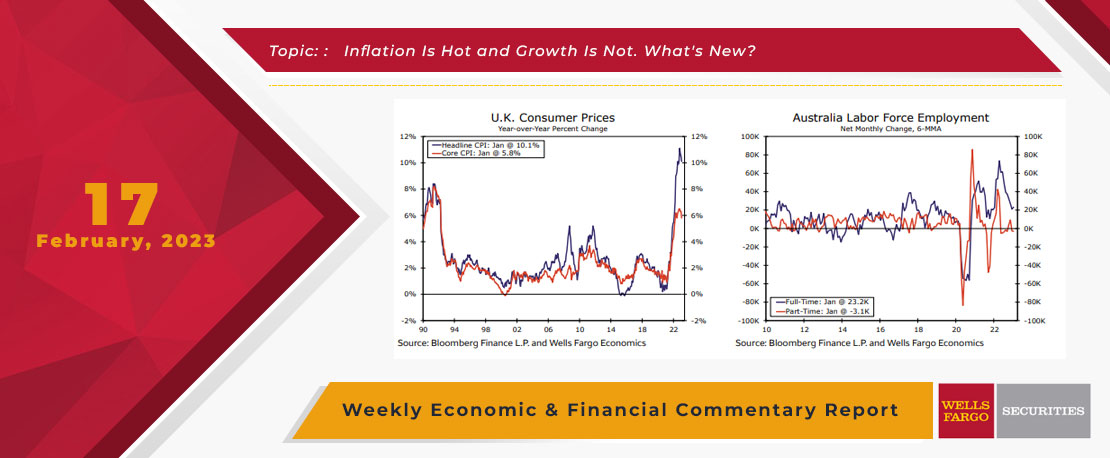

This Week's State Of The Economy - What Is Ahead? - 17 February 2023

Wells Fargo Economics & Financial Report / Feb 20, 2023

Inflation in the U.K. receded for the third straight month in January, with the headline rate coming in at 10.1% year-over-year. In bad news, this is still five times the Bank of England\'s 2% target.

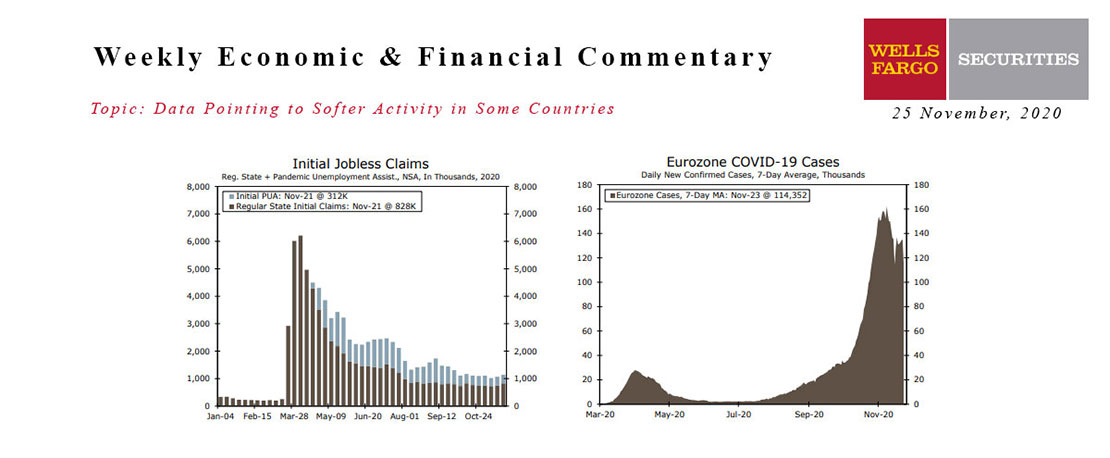

This Week's State Of The Economy - What Is Ahead? - 25 November 2020

Wells Fargo Economics & Financial Report / Nov 28, 2020

It may be a holiday-shortened week, but there have been as many developments and economic indicators packed into three days as we can recall seeing in any other week this year.

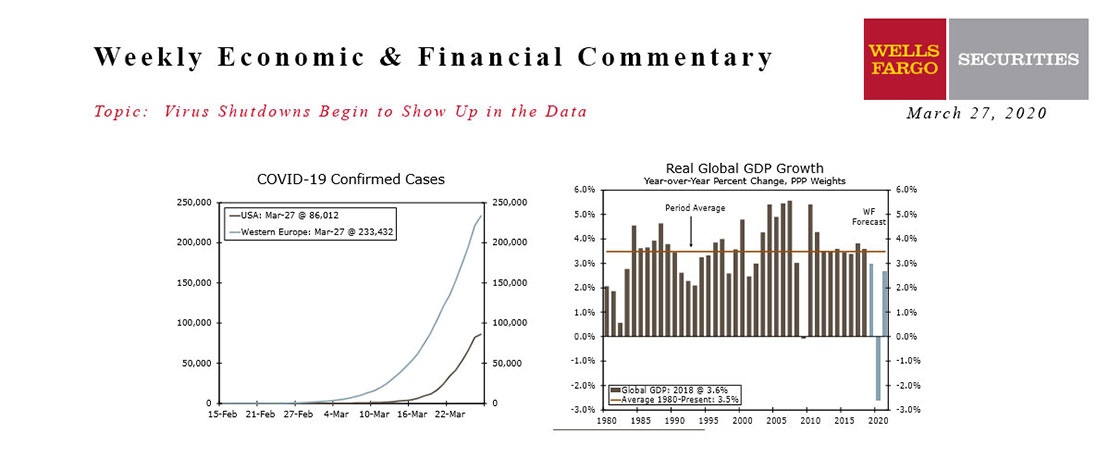

This Week's State Of The Economy - What Is Ahead? - 27 March 2020

Wells Fargo Economics & Financial Report / Mar 28, 2020

The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

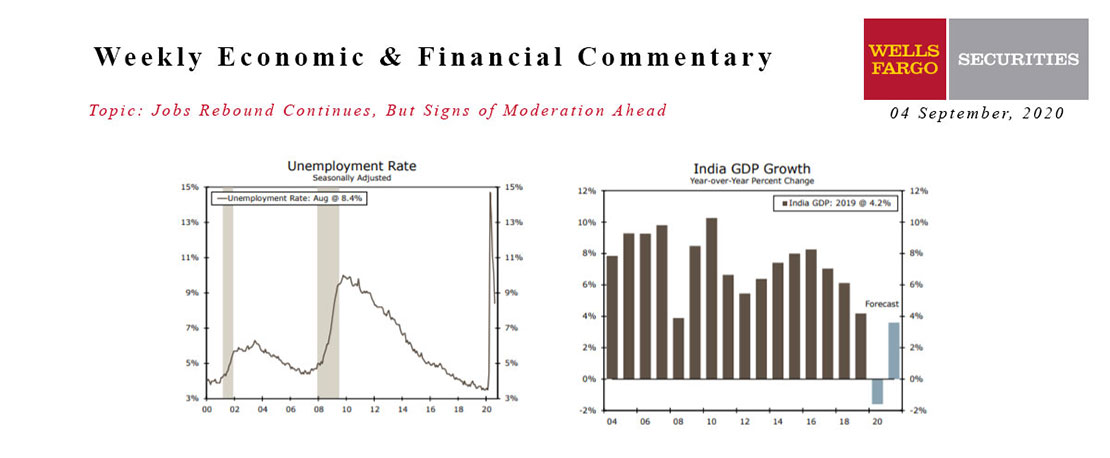

This Week's State Of The Economy - What Is Ahead? - 04 September 2020

Wells Fargo Economics & Financial Report / Aug 29, 2020

Employers added jobs for the fourth consecutive month in August, bringing the total number of jobs recovered from the virus-related low to 10.5 million.

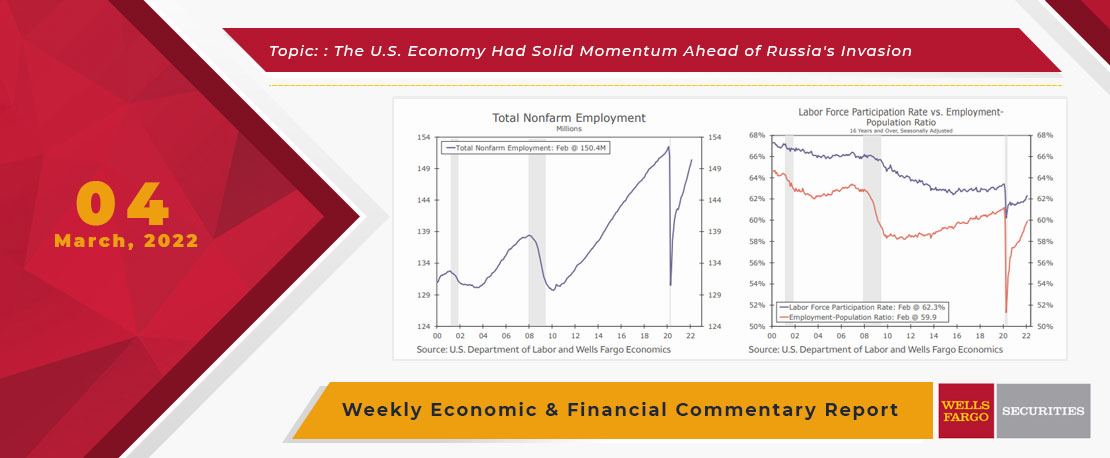

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

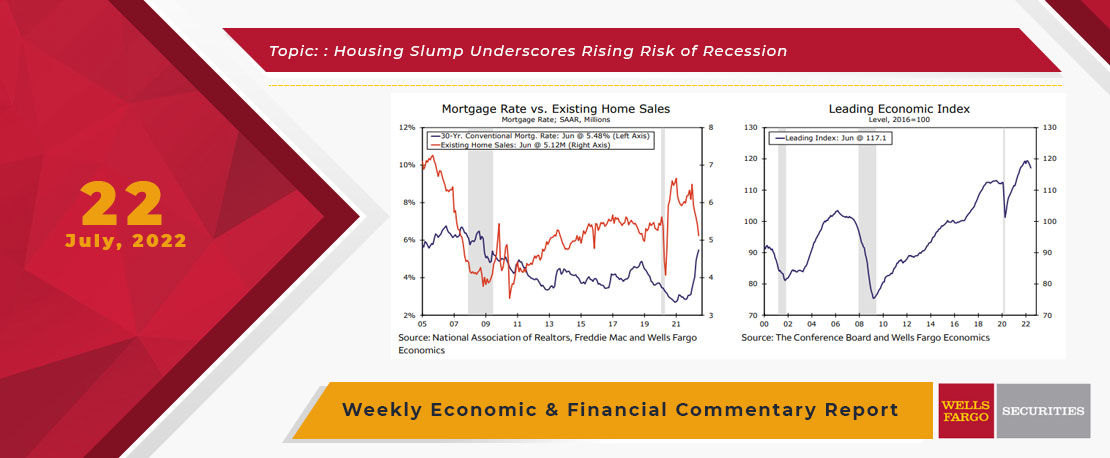

This Week's State Of The Economy - What Is Ahead? - 22 July 2022

Wells Fargo Economics & Financial Report / Jul 27, 2022

July\'s NAHB Housing Market Index dropped 12 points to 55, the second largest monthly decline on record behind April 2020\'s pandemic-induced collapse.

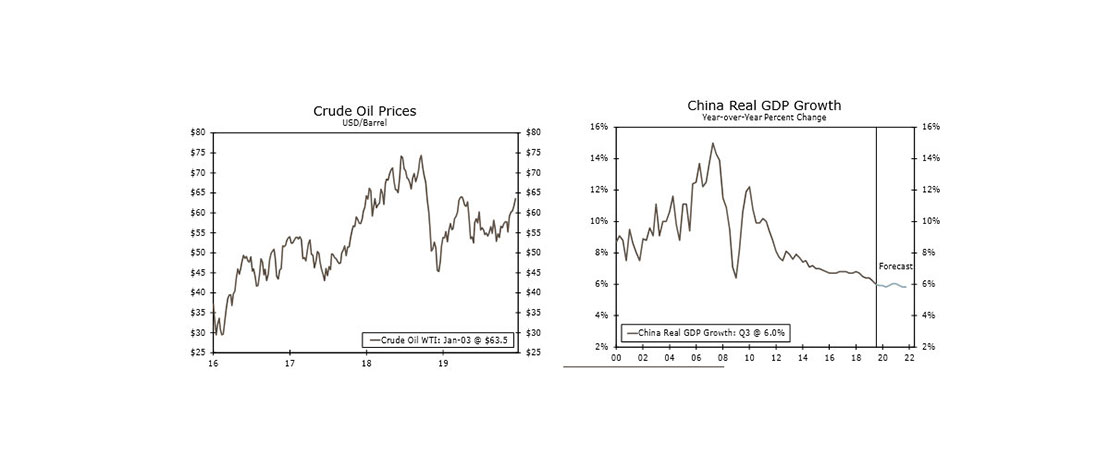

This Week's State Of The Economy - What Is Ahead? - 03 January 2020

Wells Fargo Economics & Financial Report / Jan 04, 2020

Markets were also pressured from the latest ISM manufacturing report, which signaled further deterioration in the sector with the index falling to its lowest level since 2009.

This Week's State Of The Economy - What Is Ahead? - 28 February 2020

Wells Fargo Economics & Financial Report / Feb 29, 2020

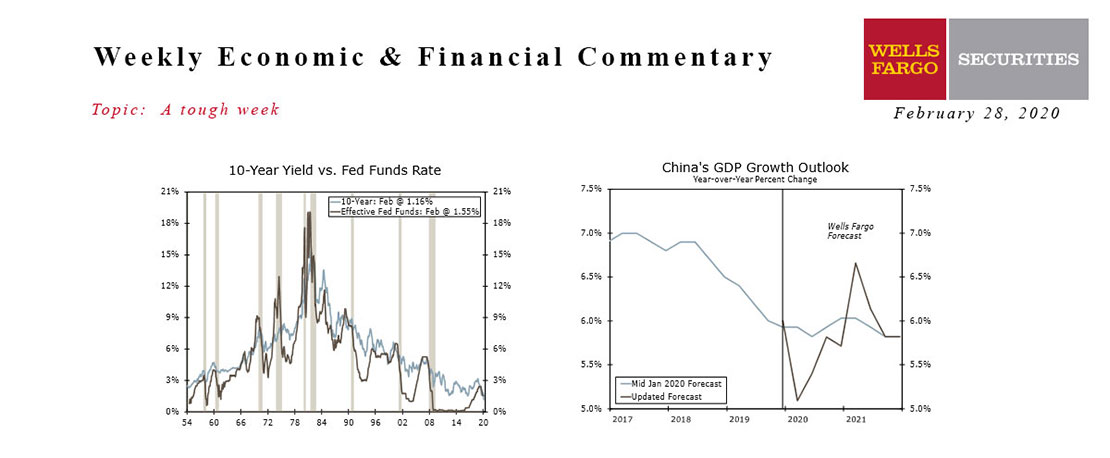

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

This Week's State Of The Economy - What Is Ahead? - 28 June 2024

Wells Fargo Economics & Financial Report / Jul 04, 2024

According to the Federal Reserve\'s preferred gauge, core inflation cooled to its softest pace in more than three years in May against a backdrop of measured consumer spending and still-strong personal income.