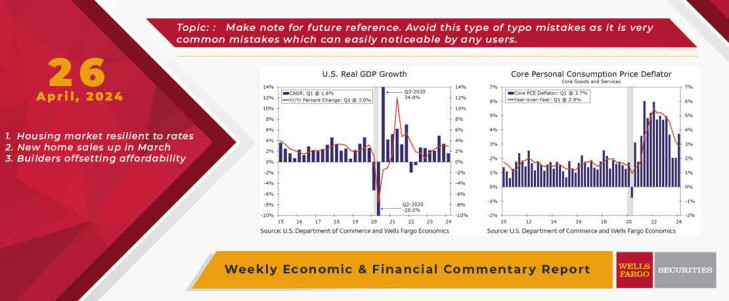

The case for rate cuts this summer continued to weaken as this week’s economic data painted a scene of stubborn inflation against the backdrop of defiant consumer demand. On Thursday, we got our first look at Q1 GDP, which downshifted to a 1.6% annualized pace. Q1’s print was lower than all 69 estimates submitted to Bloomberg, and on first take, it appears that the economy is finally giving way to the inevitable gravity of higher rates. Peeking under the hood, however, the GDP components tell a different story. The overall soft GDP reading can be attributed to a significant drag from trade and slower inventory growth. Net exports subtracted 0.86 percentage points from headline growth and without that drag growth would have printed in line with consensus. Business inventories also weighed on headline growth. Although real private inventories rose in Q1, it was at slower pace compared to the previous quarter, resulting in a 0.35 percentage point drag on the headline. Stripping out net exports, inventories and government investment, real final sales to domestic private purchasers rose at a 3.1% annualized rate, signaling a still healthy economy.

To this point, consumers remain unfazed by high rates and inflation as personal consumption expenditures grew at a solid 2.5% pace. Consumers continued to direct their spending toward services, which came in at a blistering 4% annualized growth rate. Spending was weaker for big-ticket durable goods items, but the splurge on services was more than enough to offset this.

A disconcerting detail within the GDP report was a hot core PCE deflator reading, which accelerated to a 3.7% annualized rate in Q1. That said, the March personal income and spending report released today revealed the surprise jump in core PCE inflation was due to more inflation in January, and not a significant pickup late in the quarter. Indeed, price growth was front-loaded in Q1 with a monthly pattern of 0.50%, 0.27% and 0.32% from January to March, respectively. That being said, year-over-year core inflation still came in hot at 2.8%. The hotter-than-expected inflation reading raises further questions on the path of monetary policy. Markets are currently pricing between one and two rate cuts with the risks skewed to the downside. As discussed in our April Fed Flashlight, stubborn inflation and resilient economic activity through the first few months of the year have left the FOMC little reason to ease policy in the near term. In addition, a chorus of Fed officials, which tellingly include a number of “doves,” have indicated that there is no hurry to cut rates at this time.

Continued patience from the Fed may be appropriate as consumers have demonstrated in this cycle that they will continue to spend even in the face of higher interest rates and inflation. Nominal personal spending improved by a better-than-expected 0.8% in March. On an inflation-adjusted basis, real spending has risen 0.5% in back-to-back months. Real disposable personal income rose 0.2% over the month, continuing to help firm up consumer spending. Households also remain comfortable dipping into savings to drive spending as the personal saving rate slid to 3.2% in March, the lowest since October 2022. A strong consumer isn't necessarily a bad thing for the Fed, unless spending continues to feed into stronger-than-desired inflation pressures. Price growth was firm in Q1, placing more emphasis on Q2 to determine the eventual start of Fed easing.

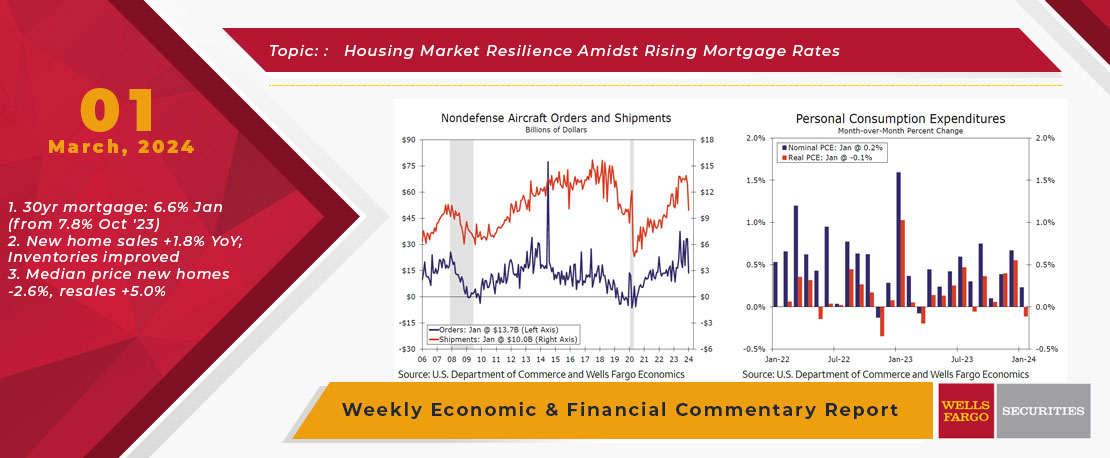

The March durable goods report was in line with consensus as orders rose 2.6% over the month. Taking volatile aircraft orders out of the equation, orders were up a more modest 0.2% over the month. The underlying order details indicate a still-hesitant demand environment. Core capital goods orders rose in March but were down slightly for Q1 as a whole. Nearly all major orders categories saw an uptick in orders in March, but most gains were modest. Ultimately, the capex environment remains hindered by elevated borrowing costs and increased uncertainty around the path of Fed policy and the economy generally.

The housing market seems to be weathering higher interest rates with greater success than the manufacturing sector. Residential investment rose at a 13.9% annualized pace in the Q1 GDP report, fueled by single-family housing construction and an increase in brokers’ commissions. A strong showing for new home sales in March provided further encouragement as sales jumped 8.8% to a 693K-unit pace. March’s print was a strong rebound from a disappointing February print, which was revised lower. First quarter sales averaged 667K units, which represents a 4.5% improvement from the pace averaged in Q4 2023. The upturn in new home sales despite higher interest rates largely reflects builders' ability to offset eroding housing affordability conditions through price discounts, mortgage rate buy-downs and other incentives. That said, the boost in sales may be a result of homebuyers trying to front-run rising mortgage rates, which breached 7% in April, reaching 7.2% this week, according to Freddie Mac. If rates continue to climb, we may witness more buyers being forced to the sidelines in the coming months.

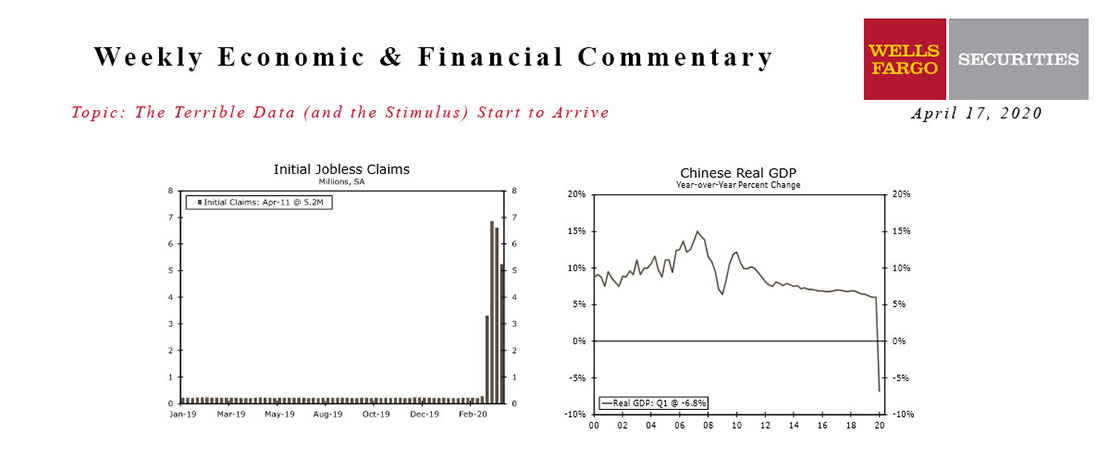

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

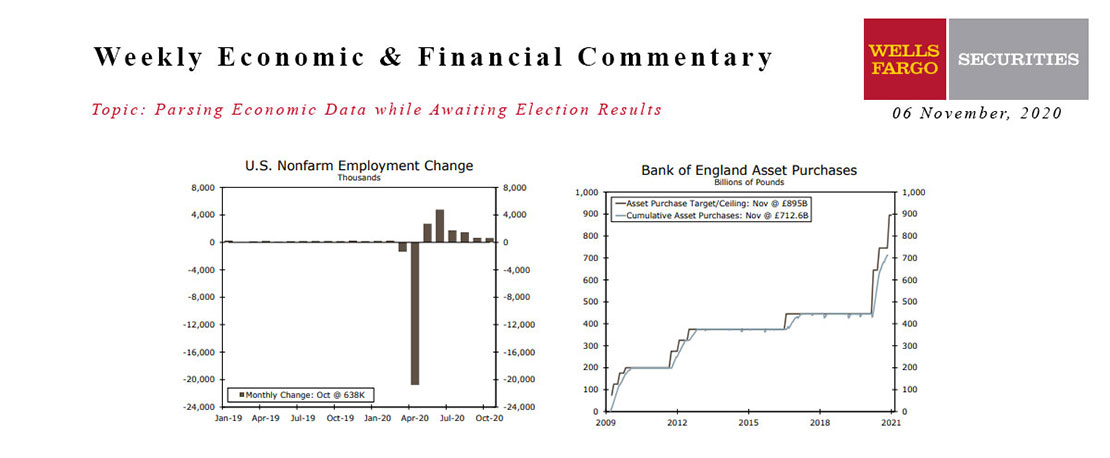

This Week's State Of The Economy - What Is Ahead? - 06 November 2020

Wells Fargo Economics & Financial Report / Nov 10, 2020

As of this writing, the outcome of the U.S. presidential election is undecided. Joe Biden, however, appears likely to become president based off of his growing lead in several key states.

This Week's State Of The Economy - What Is Ahead? - 01 March 2024

Wells Fargo Economics & Financial Report / Mar 05, 2024

Economic data were downbeat this week, as downward revisions took some of the shine out of the marquee headline numbers. Despite the somewhat weak start to Q1, economic growth continues to trek along.

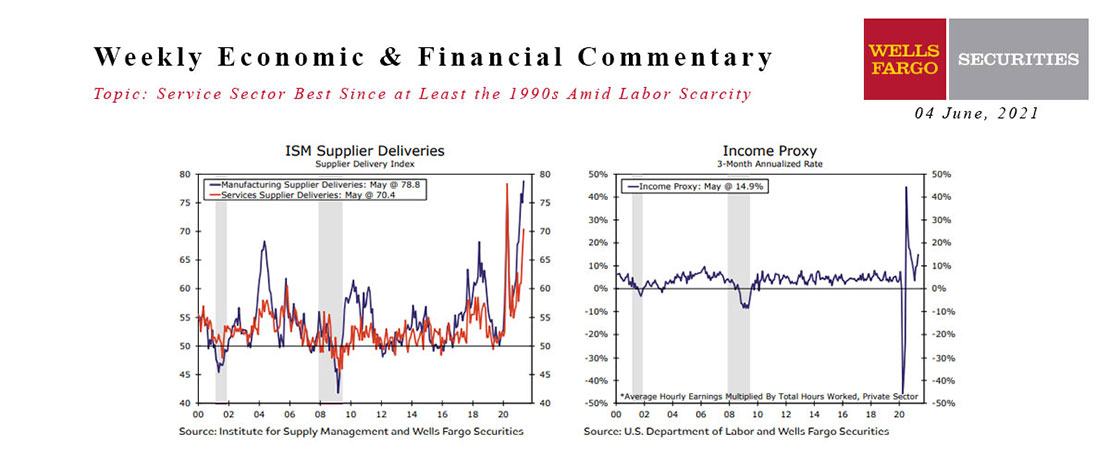

This Week's State Of The Economy - What Is Ahead? - 04 June 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

The CDC\'s relaxation of its mask mandate occurred mid-May, and as data for that month begins rolling in this week, it is evident there is no lack of demand. Supplies, on the other hand, are a worsening problem.

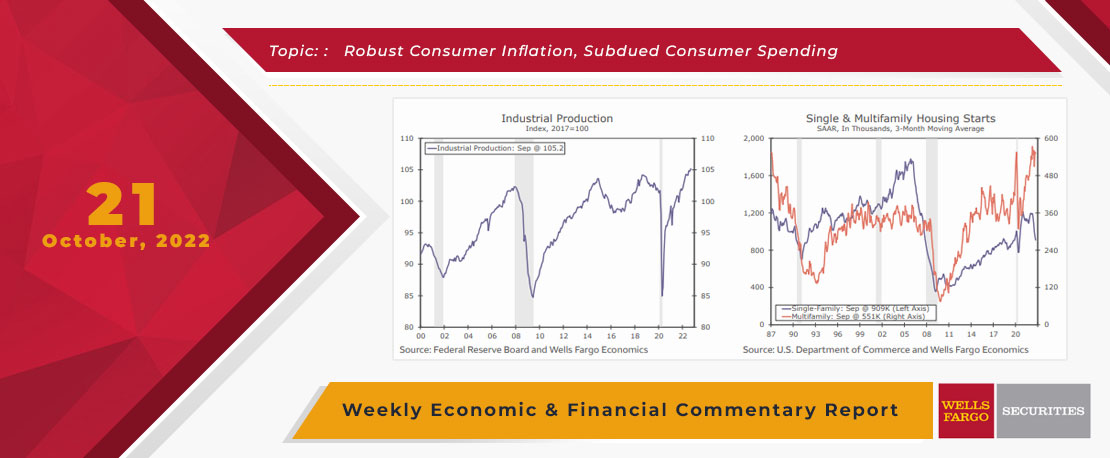

This Week's State Of The Economy - What Is Ahead? - 21 October 2022

Wells Fargo Economics & Financial Report / Oct 25, 2022

The real estate sector has been significantly affected by rising interest rates, with total housing starts falling 8.1% in September. Peering ahead, the forward-looking Leading Economic Index points to a recession in the coming year.

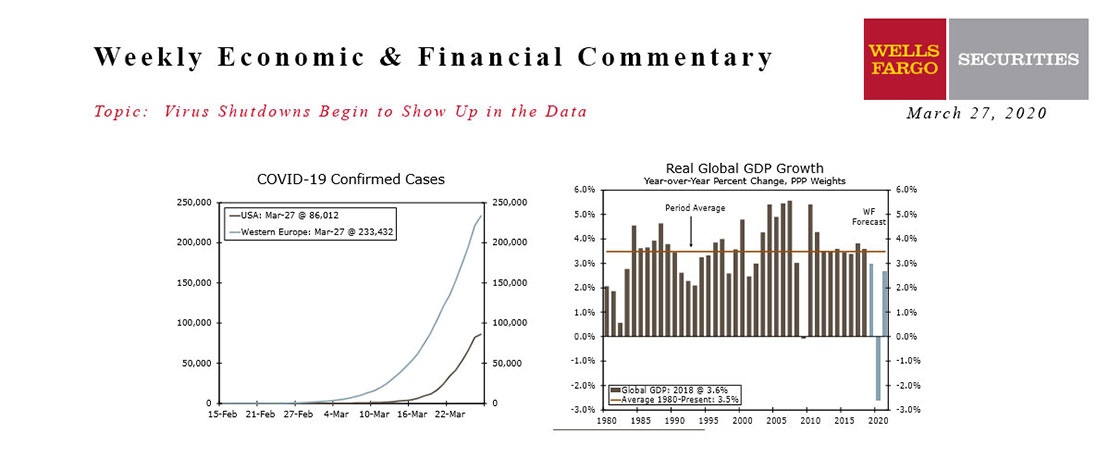

This Week's State Of The Economy - What Is Ahead? - 27 March 2020

Wells Fargo Economics & Financial Report / Mar 28, 2020

The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

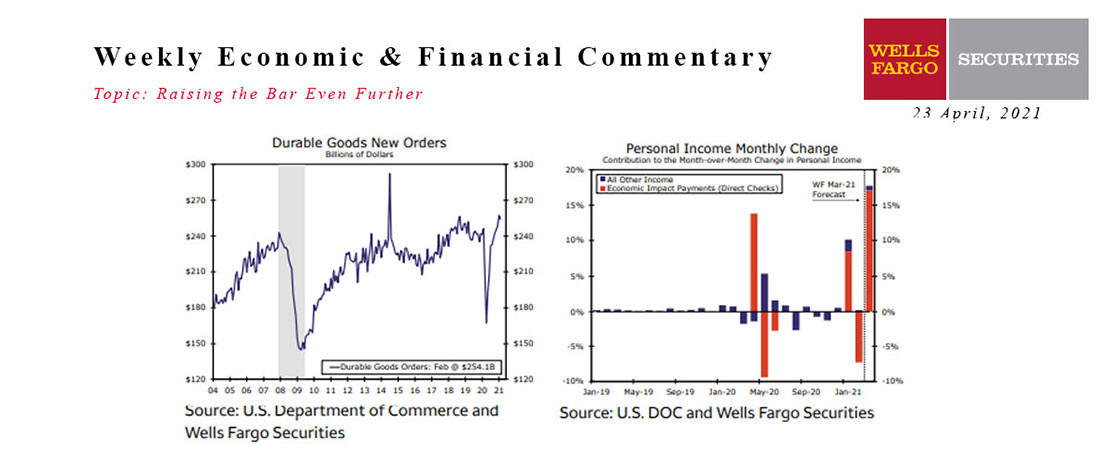

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

This Week's State Of The Economy - What Is Ahead? - 12 August 2020

Wells Fargo Economics & Financial Report / Aug 15, 2020

The consumer has been a bright spot in the recovery so far, but with jobless benefits in flux and no clear path for the long-awaited stimulus bill, the support here could fade.

This Week's State Of The Economy - What Is Ahead? - 27 November 2019

Wells Fargo Economics & Financial Report / Nov 28, 2019

A series of U.K. general election polls released this week continue to show Boris Johnson’s Conservative Party with a significant lead over the opposition Labor Party.

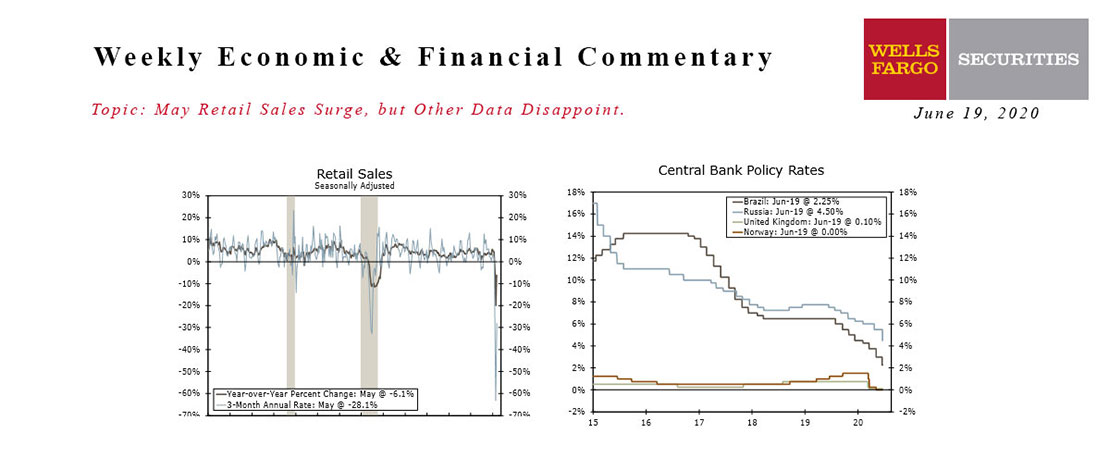

This Week's State Of The Economy - What Is Ahead? - 19 June 2020

Wells Fargo Economics & Financial Report / Jun 22, 2020

Retail sales kicked off the week with a bang, rising 17.7% month-over-month in May. The increase was larger than every single one of the 74 forecast submissions.