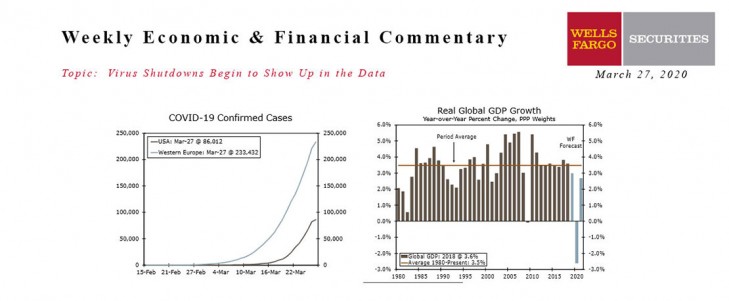

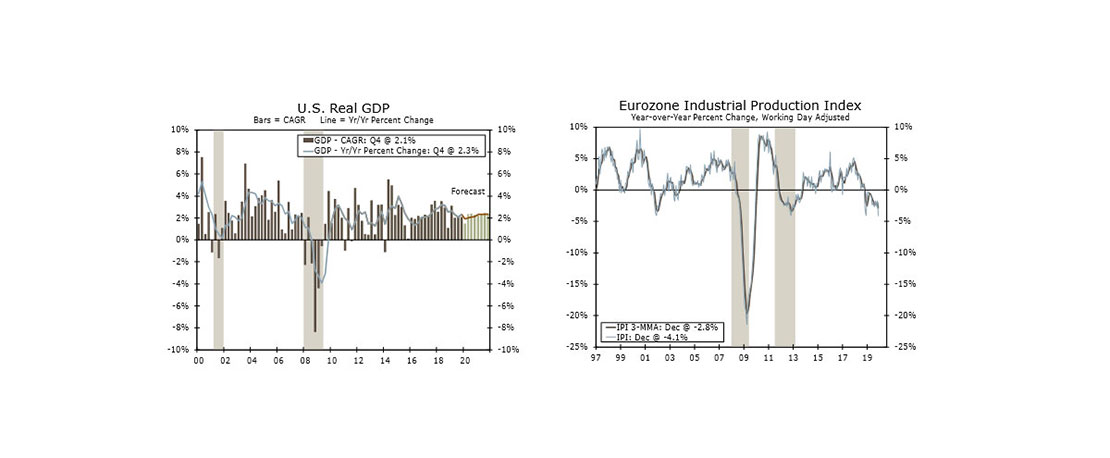

U.S. - Virus Shutdowns Begin to Show Up in the Data

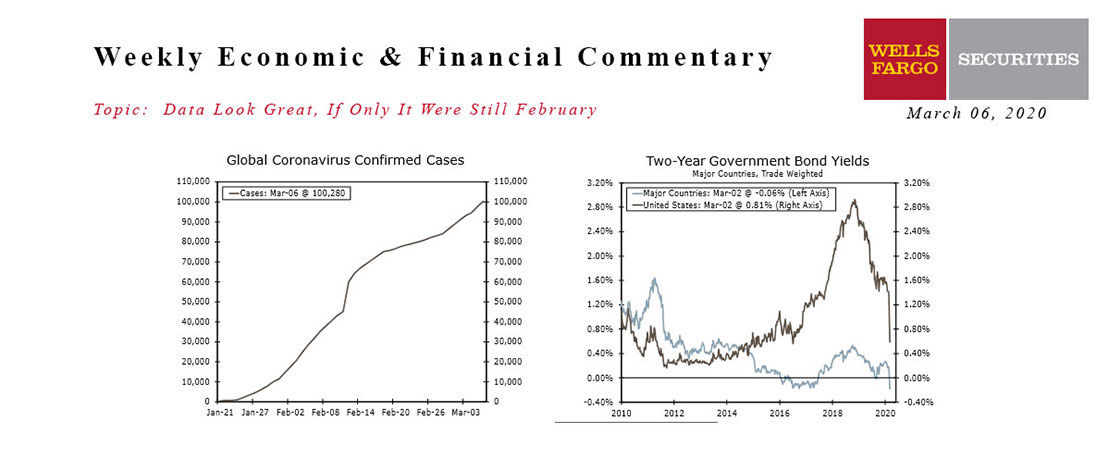

- The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

- The impact of virus-related shutdowns became readily apparent in this week’s initial unemployment claims, which soared to 3.3 million.

- Most economic data reflect the period before the COVID-19 outbreak intensified in mid-March. New home sales averaged their strongest pace in over 12 years during the three months ended in February, while consumer spending rose modestly.

Global - Virus Hits Eurozone Data; Global Growth Downgraded

- This past week, March PMI surveys for the Eurozone were released, with data suggesting a sharp deceleration in the broader European economy is likely. The services PMI fell to a record low of 28.4, while the manufacturing PMI dropped to 44.8, which signals the Eurozone economy could contract more than 4.0% in 2020.

- As the COVID-19 virus intensifies, we downgraded our international growth forecasts once again. We now expect annual contractions in the U.K., Japan as well as Canada, and forecast China to experience its first annual contraction since at least 1980.

This Week's State Of The Economy - What Is Ahead? - 29 September 2023

Wells Fargo Economics & Financial Report / Oct 02, 2023

On the housing front, new home sales dropped more than expected in August, though an upward revision to July results left us about where everyone expected us to be year-to-date.

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

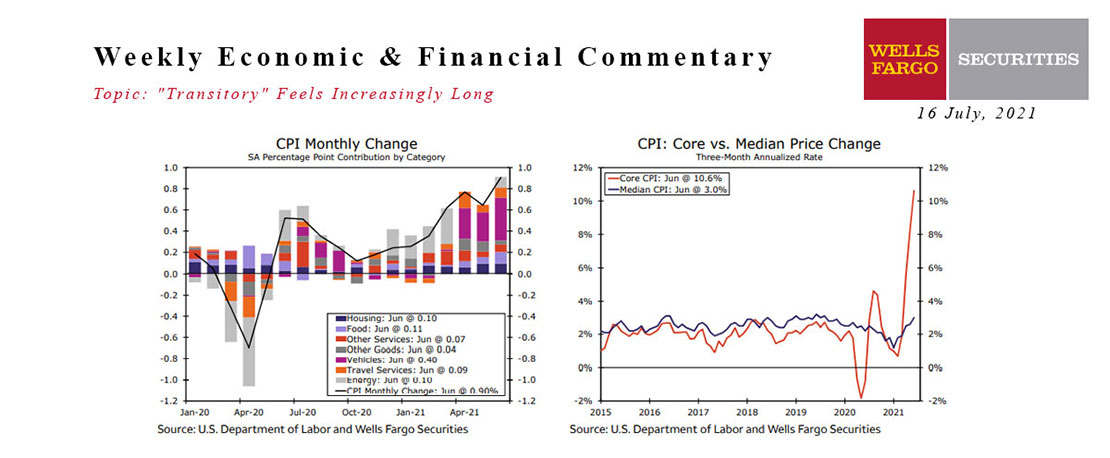

This Week's State Of The Economy - What Is Ahead? - 16 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

Visiting from Texas, it felt more like fall, which like the Texas cold-snap last February just goes to show that it’s a case of what you’re used to.

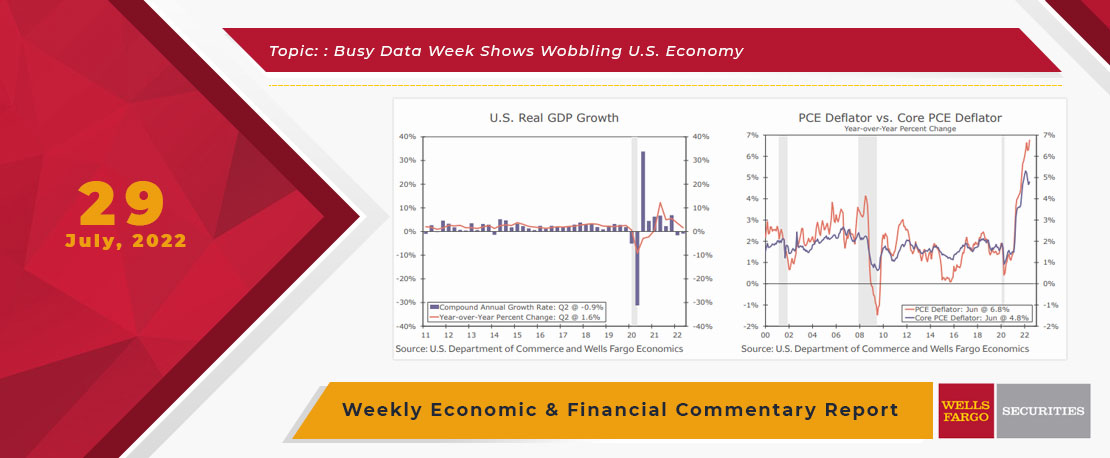

This Week's State Of The Economy - What Is Ahead? - 29 July 2022

Wells Fargo Economics & Financial Report / Jul 31, 2022

Unlike the local temperatures, data released this week showed U.S. economic growth modestly declined in Q2.

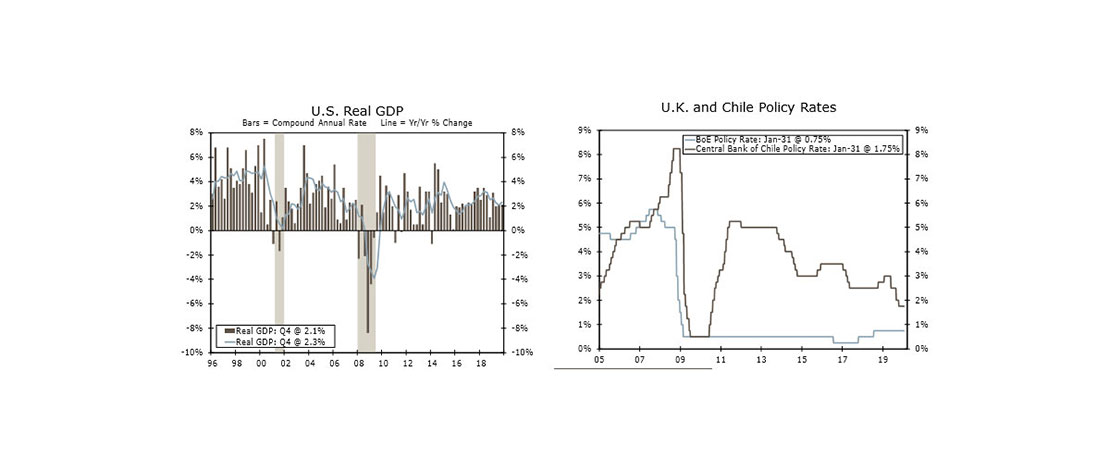

This Week's State Of The Economy - What Is Ahead? - 31 January 2020

Wells Fargo Economics & Financial Report / Feb 01, 2020

Mexico’s economy has slowed notably over the last year, with the economy contracting again in Q4, indicating a full-year contraction for 2019.

This Week's State Of The Economy - What Is Ahead? - 06 March 2020

Wells Fargo Economics & Financial Report / Mar 07, 2020

An inter-meeting rate cut by the FOMC did little to stem financial market volatility, as the number of confirmed COVID-19 cases continued to climb.

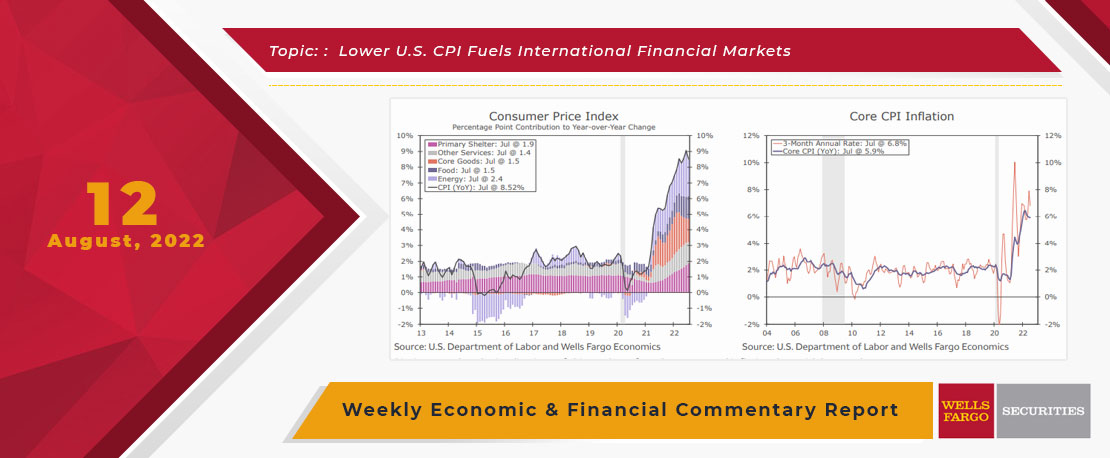

This Week's State Of The Economy - What Is Ahead? - 12 August 2022

Wells Fargo Economics & Financial Report / Aug 13, 2022

The FOMC has made it clear that it needs to see inflation slowing on a sustained basis before pivoting from its current stance. The data seems to be going in multiple directions all at once.

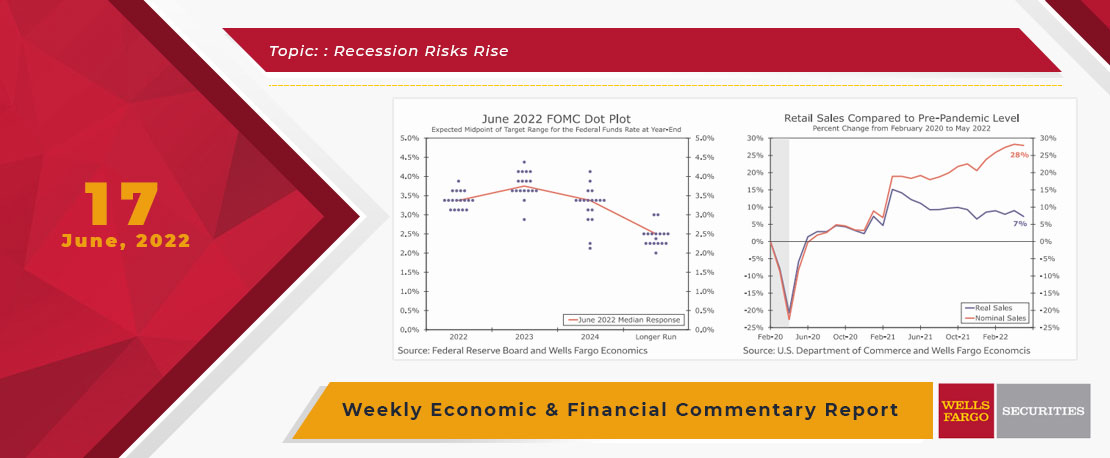

This Week's State Of The Economy - What Is Ahead? - 17 June 2022

Wells Fargo Economics & Financial Report / Jun 20, 2022

After last week\'s stronger-than-expected CPI, less surprising was the 75 point rate increase put forth by the Fed.

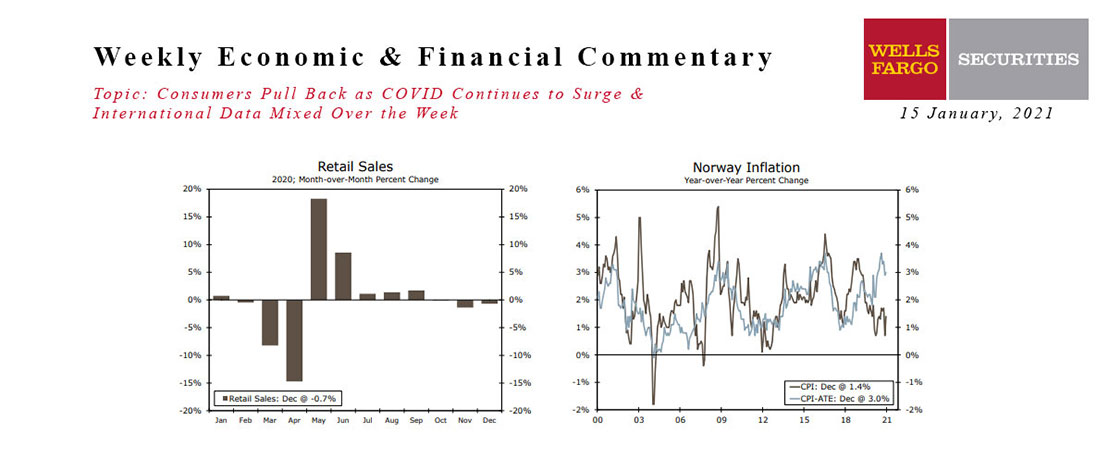

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

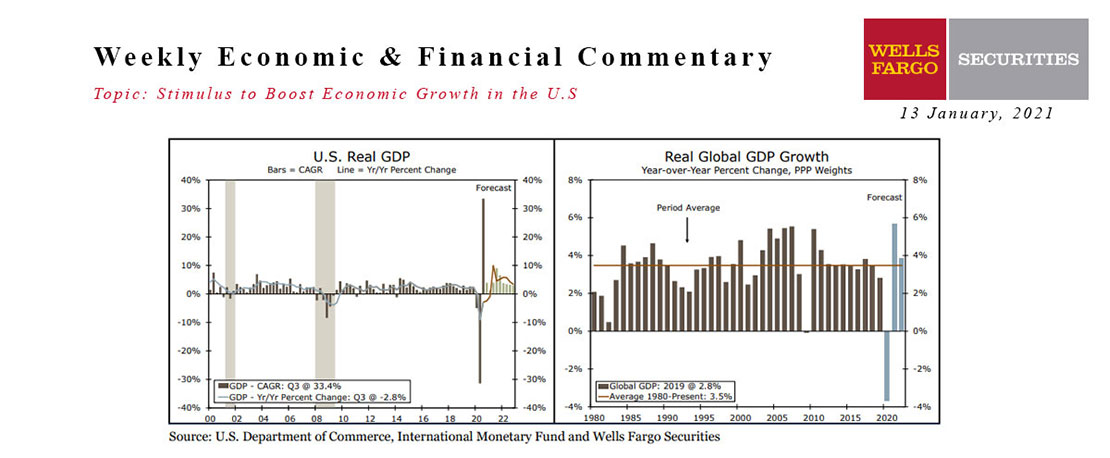

13 January 2021 Monthly Outlook Report

Wells Fargo Economics & Financial Report / Jan 19, 2021

The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate.