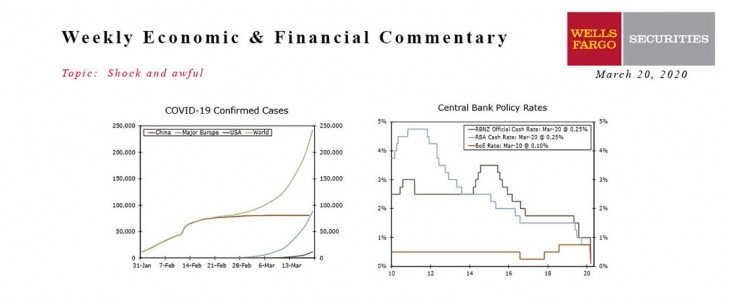

U.S - Shock and Awful

- Daily life came to a screeching halt this week as governments, businesses and consumers took drastic steps to halt the COVID-19 pandemic.

- Financial markets seized up as it became clear just how much, and for how long, economic activity could be interrupted.

- The situation has rapidly progressed beyond being either a “demand shock” or a “supply shock”; it is an unprecedented interruption and reorganization of economic life.

- We still have very few clues on how sharply spending will fall, but the incoming data will be unprecedented. Jobless claims will be in the millions next week.

Global - Easing Everywhere

- It was a wild week for the global economy as concerns continued to mount surrounding the negative consequences of the coronavirus outbreak. Many central banks across the globe opted to cut interest rates this week, including the Reserve Bank of New Zealand. The central bank cut its policy rate 75 bps to 0.25%, while the Reserve Bank of Australia also cut interest rates 25 bps to 0.25%, and introduced quantitative easing measures. In a surprise move, the BoE cut rates 15 bps and increased its bond purchase program. Among other central banks to ease monetary policy include the central banks of Korea, Chile, Brazil, Turkey and Japan, as well as the ECB.

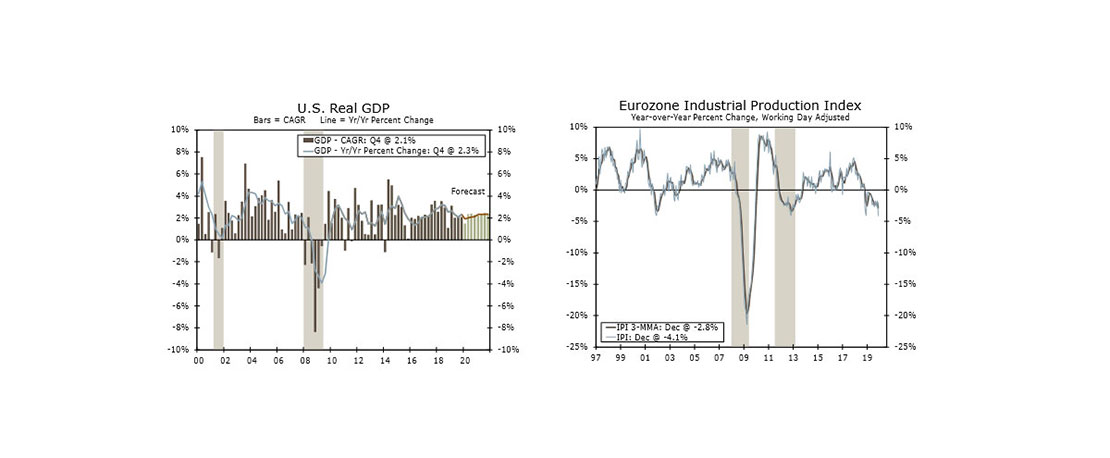

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

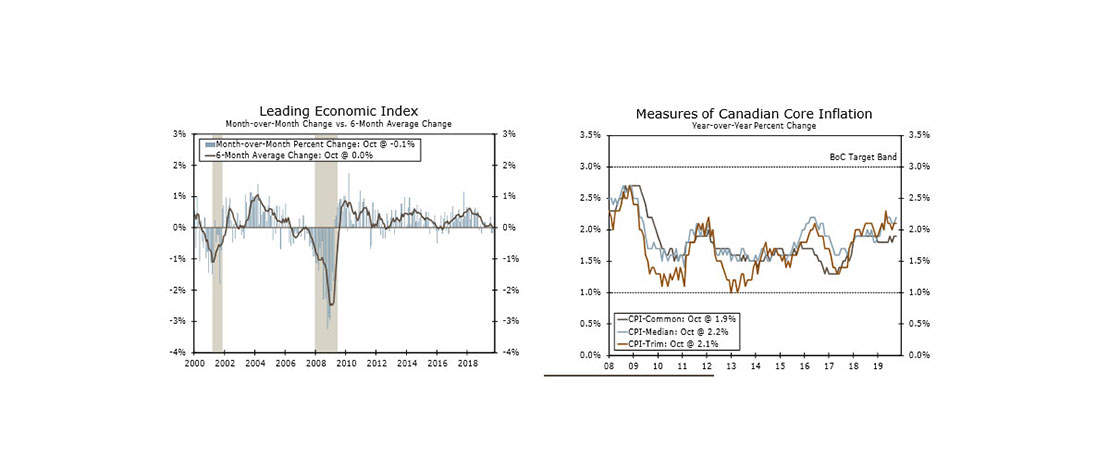

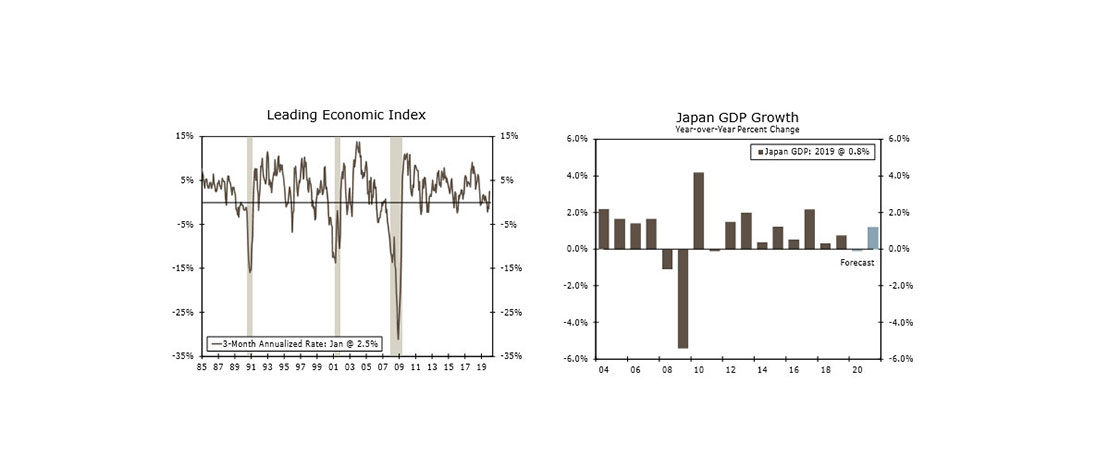

This Week's State Of The Economy - What Is Ahead? - 22 November 2019

Wells Fargo Economics & Financial Report / Nov 23, 2019

Minutes from the October FOMC meeting indicated the Fed is content to remain on the sidelines for the rest of this year as the looser financial conditions resulting from rate cuts at three consecutive meetings feed through to the economy.

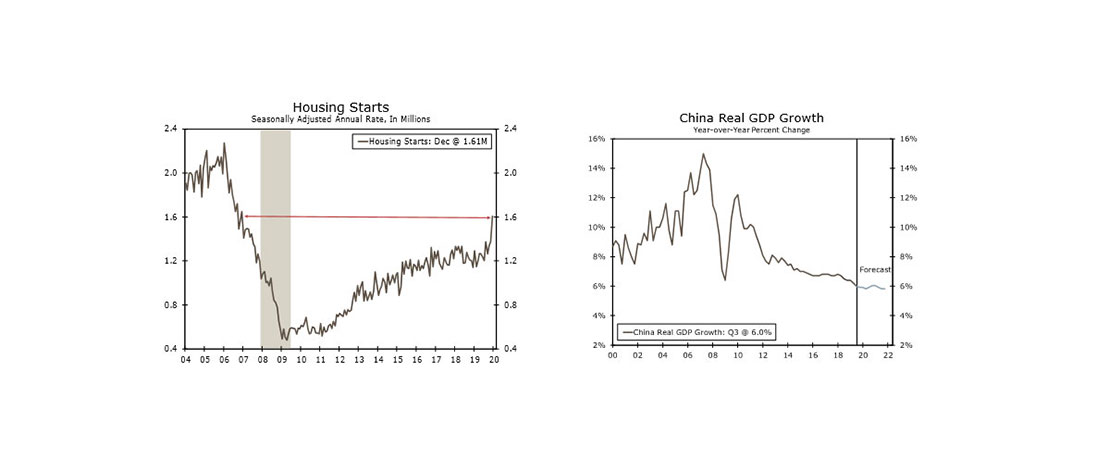

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

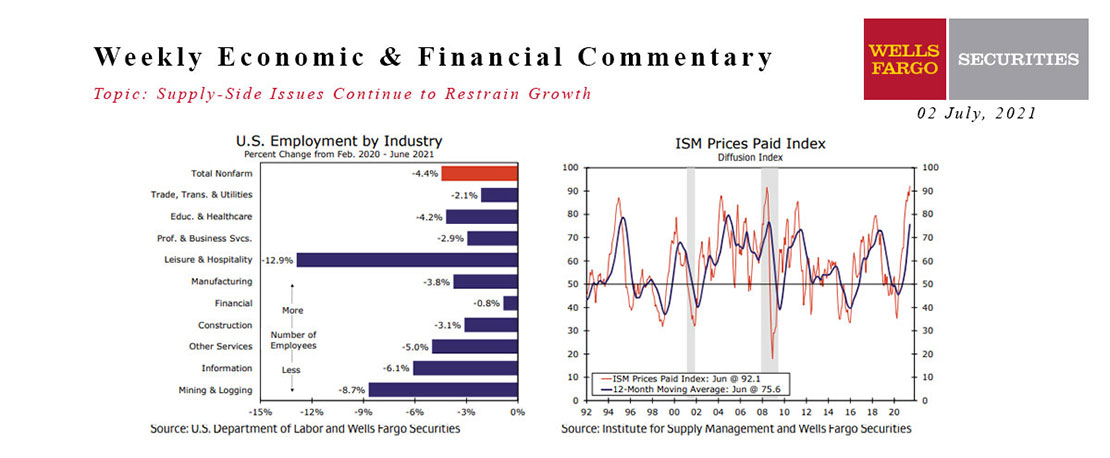

This Week's State Of The Economy - What Is Ahead? - 02 July 2021

Wells Fargo Economics & Financial Report / Jul 13, 2021

We added 850,00 jobs in June, but much of that was State governments school districts in some parts of the Country reopening just in time for summer break.

This Week's State Of The Economy - What Is Ahead? - 21 February 2020

Wells Fargo Economics & Financial Report / Feb 22, 2020

Minutes from the January 28-29 FOMC meeting indicate the coronavirus will not push the Fed to cut interest rates, and for the most part housing and manufacturing survey data this week supported that view.

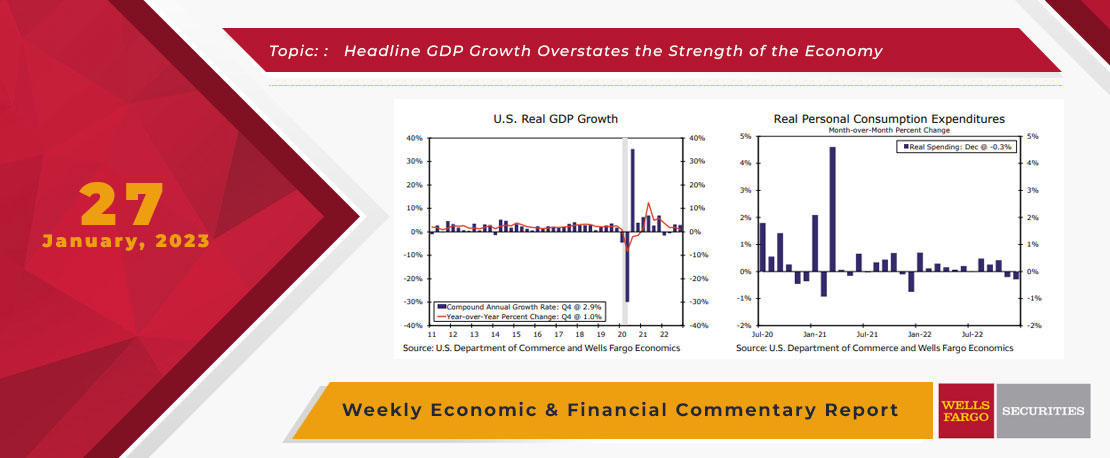

This Week's State Of The Economy - What Is Ahead? - 27 January 2023

Wells Fargo Economics & Financial Report / Jan 28, 2023

Real GDP expanded at a 2.9% annualized pace in Q4. While beating expectations, the underlying details were not as encouraging. Moreover, the weakening monthly indicator performances to end the year suggest the decelerating trend will continue in Q1.

This Week's State Of The Economy - What Is Ahead? - 17 January 2020

Wells Fargo Economics & Financial Report / Jan 18, 2020

Mild weather helped housing starts surge 16.9% in December to a 1.61 million-unit pace, the highest in 13 years. Manufacturing surveys from the New York Fed and Philadelphia Fed both rose more than expected in December.

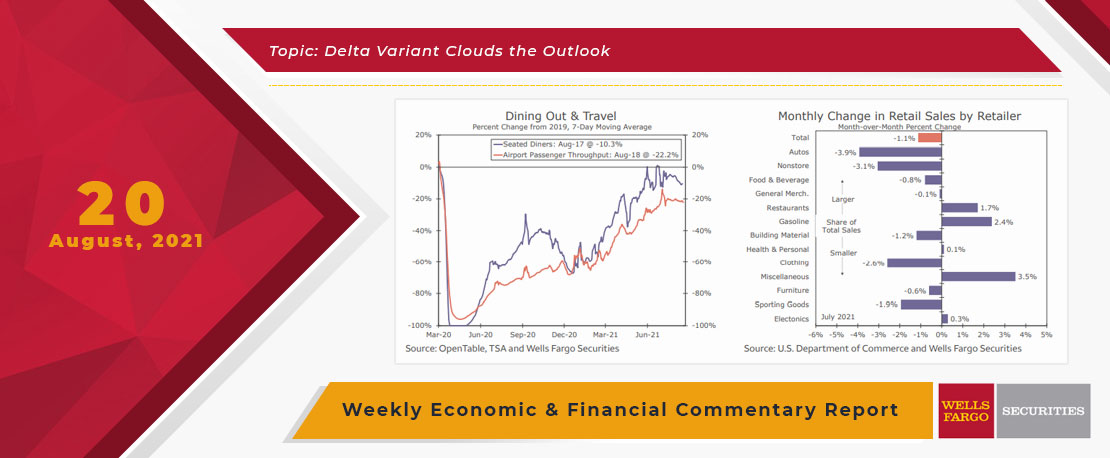

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

This Week's State Of The Economy - What Is Ahead? - 13 May 2022

Wells Fargo Economics & Financial Report / May 18, 2022

While small business enthusiasm appears to have stalled, as owners are concerned about their ability to continue to pass on higher costs to consumers, cautious enthusiasm around rookie Jeremy Pena’s start persists.

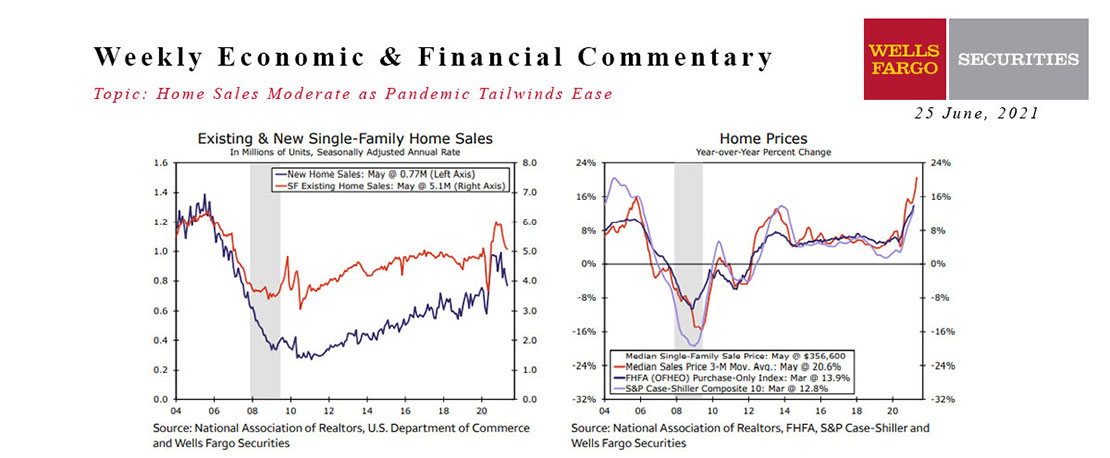

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.