U.S. Review - 2020 Is Off to a Good Start

- Most of this week’s economic reports showed the economy ended 2019 with strong momentum, while the Senate passage of the USMCA and the signing of Phase I of the China trade deal reduce some of the uncertainty hanging over the outlook.

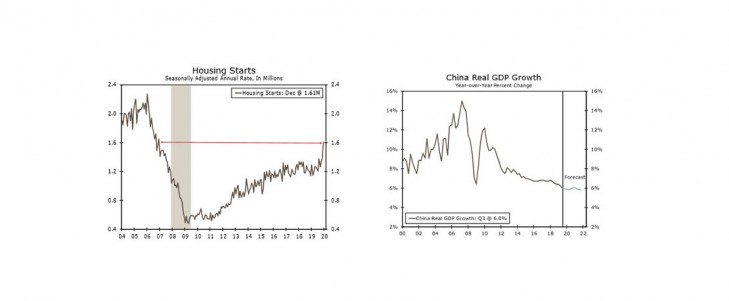

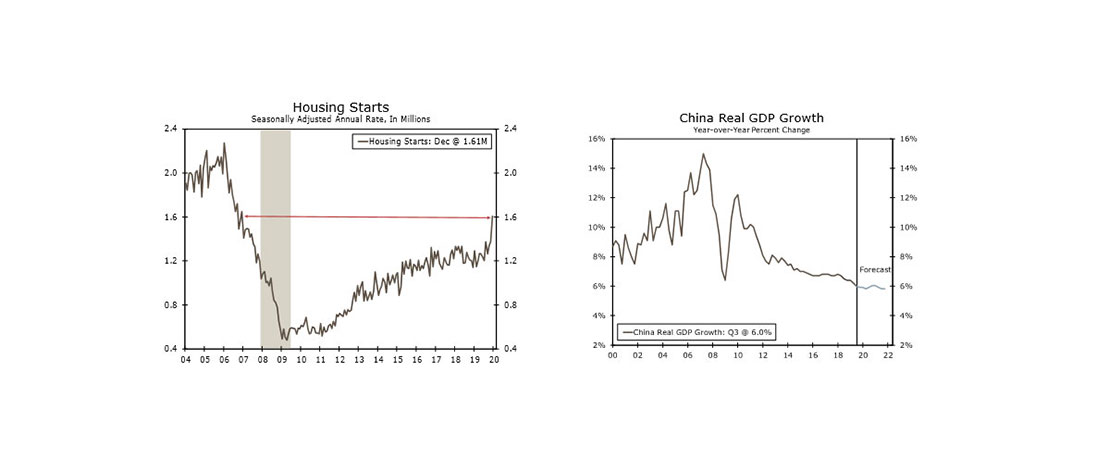

- Mild weather helped housing starts surge 16.9% in December to a 1.61 million-unit pace, the highest in 13 years.

- Manufacturing surveys from the New York Fed and Philadelphia Fed both rose more than expected in December.

- December retail sales were soft, with a 0.5% gain in core retail sales offset by downward revisions to the prior two months.

Global Review - Central Banks Keeping It Easy?

- Data this week continued to point to further easing from the Bank of England, while dovish commentary from policymakers remains consistent with that narrative. We acknowledge that the case for a BoE rate cut has risen dramatically over the past week, and although our official call is for no change in January, we nonetheless agree that a rate cut is a distinct possibility.

- In emerging markets, both Turkey and South Africa’s central banks cut interest rates this week, given subdued GDP growth in each country. Elsewhere, Chinese GDP growth held steady in the fourth quarter, and December activity data exceeded expectations, adding to signs of a stabilizing Chinese economy.

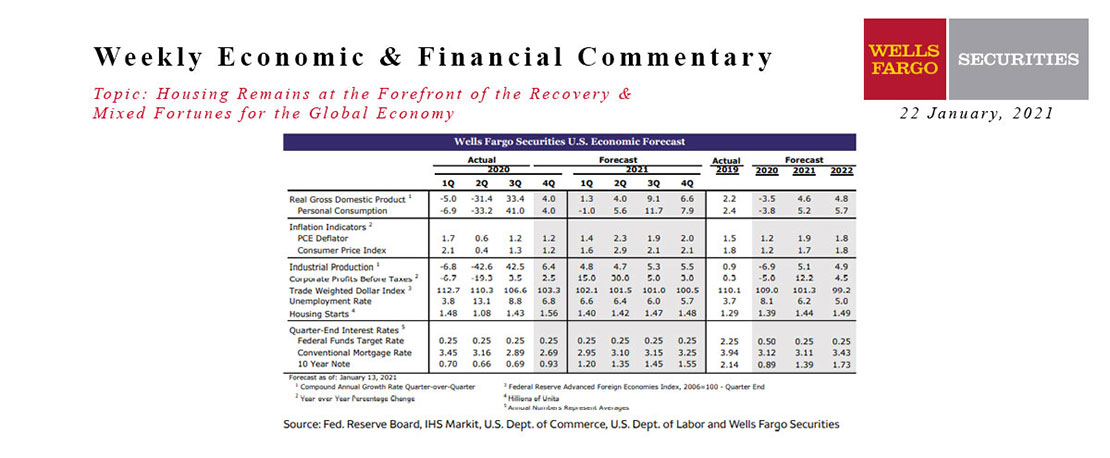

This Week's State Of The Economy - What Is Ahead? - 22 January 2021

Wells Fargo Economics & Financial Report / Jan 23, 2021

Housing starts jumped 5.8% during December. Single-family starts soared 12%, while multifamily starts dropped 13.6%.

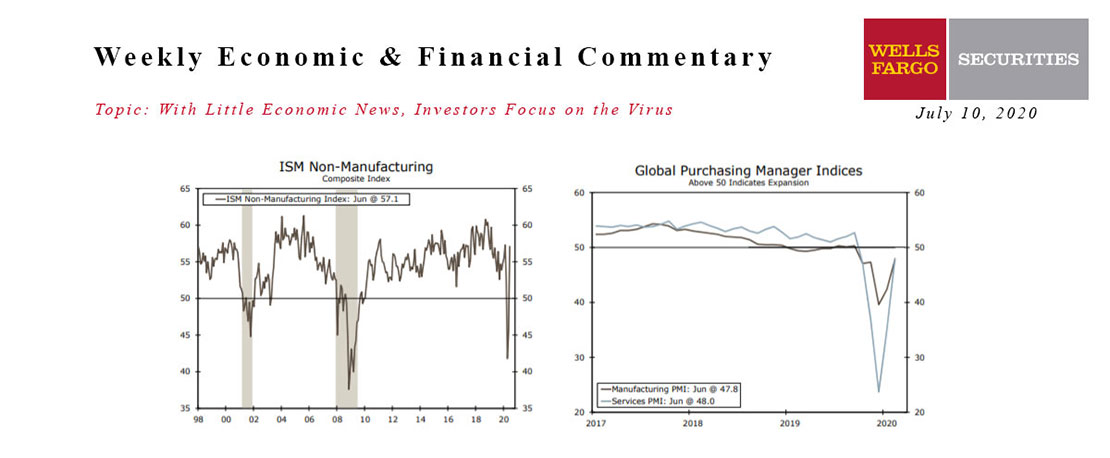

This Week's State Of The Economy - What Is Ahead? - 10 July 2020

Wells Fargo Economics & Financial Report / Jul 13, 2020

The ISM non-manufacturing index jumped 11.7 points to 57.1, reflecting the broadening re-opening of the economy.

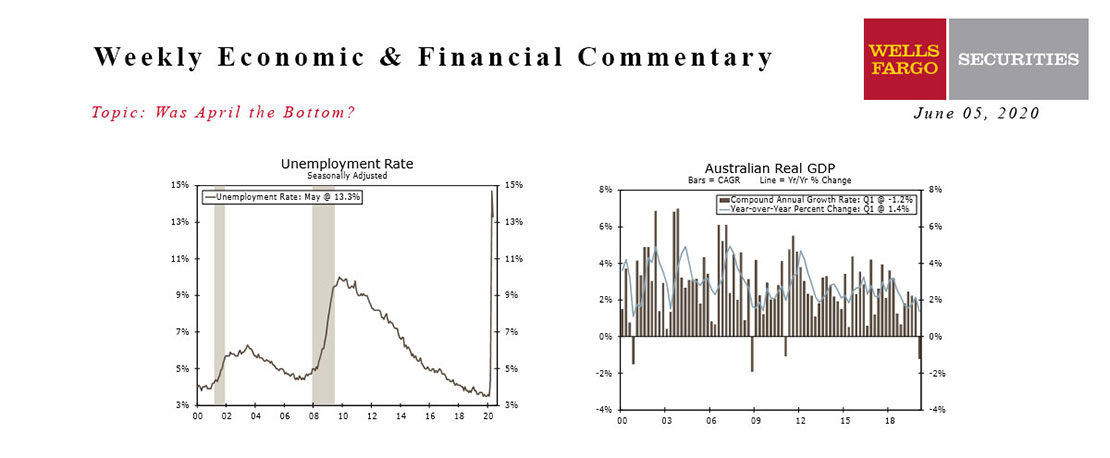

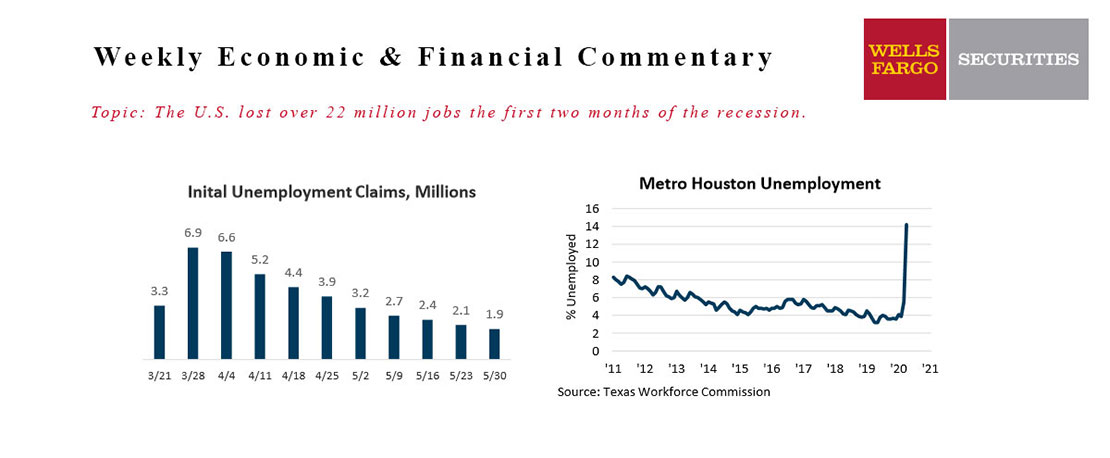

This Week's State Of The Economy - What Is Ahead? - 05 June 2020

Wells Fargo Economics & Financial Report / Jun 09, 2020

Data this week continued to suggest the U.S. economy hit rock bottom in April. Still, it is a long road to recovery and the pickup in economic activity will be gradual.

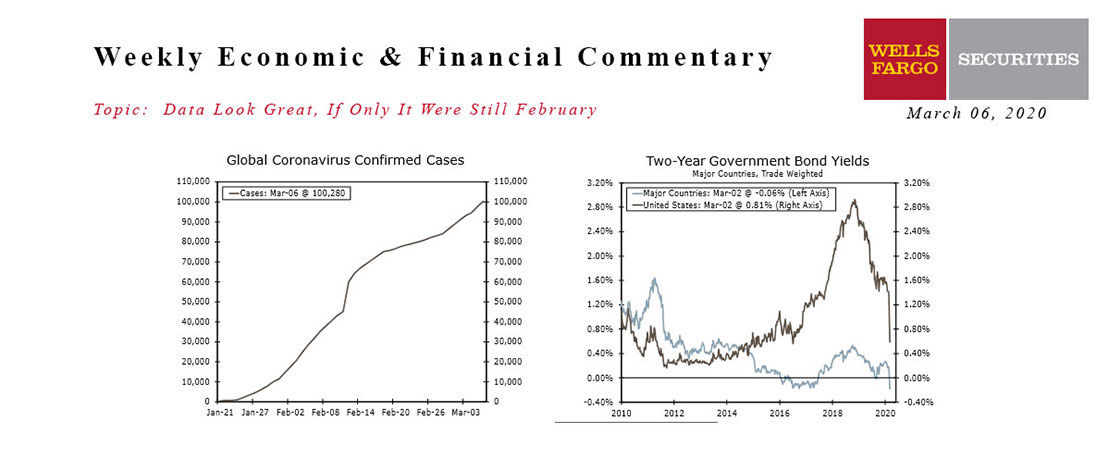

This Week's State Of The Economy - What Is Ahead? - 06 March 2020

Wells Fargo Economics & Financial Report / Mar 07, 2020

An inter-meeting rate cut by the FOMC did little to stem financial market volatility, as the number of confirmed COVID-19 cases continued to climb.

2021 Annual Economic Outlook

Wells Fargo Economics & Financial Report / Dec 16, 2020

The longest U.S. economic expansion since the end of the Second World War came to an abrupt end earlier this year as the COVID pandemic essentially shut down the economy.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

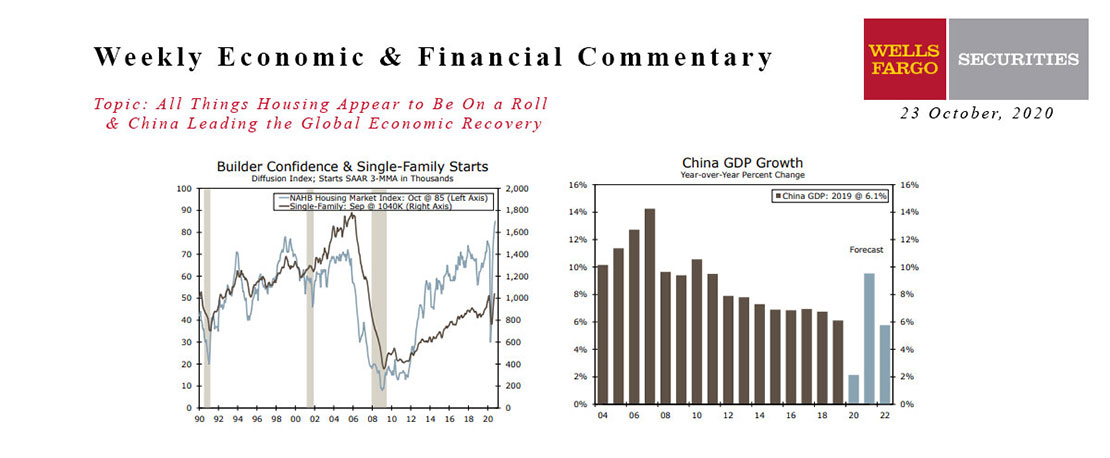

This Week's State Of The Economy - What Is Ahead? - 23 October 2020

Wells Fargo Economics & Financial Report / Oct 24, 2020

A recent strong report from the National Association of Homebuilders set the tone for another round of strong housing data. The NAHB index rose two points to a record high 85.

This Week's State Of The Economy - What Is Ahead? - 10 January 2020

Wells Fargo Economics & Financial Report / Jan 11, 2020

The week began amid rising tensions carrying over from the U.S. killing of Iranian General Qasem Soleimani last Friday.

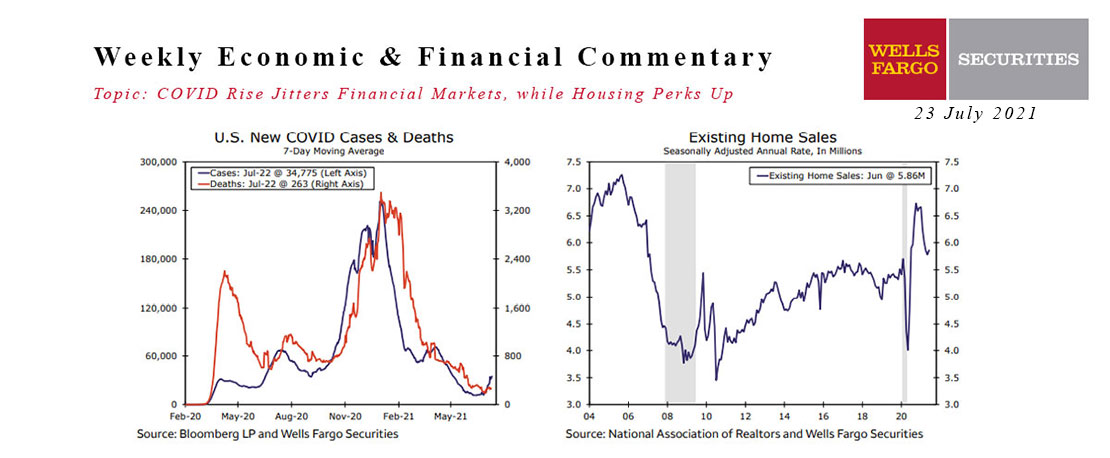

This Week's State Of The Economy - What Is Ahead? - 23 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

In the biggest financial news this week not connected to college football conference realignment, July\'s NAHB Housing Market Index slipped one point to 80.

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.